The Global Dermal Fillers Market size is expected to reach $10.3 billion by 2029, rising at a market growth of 8.1% CAGR during the forecast period.

The purpose of dermal fillers is to impart volume and fullness to the skin through injection. A mineral-like substance found in bones called calcium hydroxylapatite, polyalkylimide, hyaluronic acid, polylactic acid, and polymethyl-methacrylate microspheres is among the ingredients utilized in dermal fillers (PMMA).

In addition, the deep dermis, depth of implantation (superficial midterms and upper and subcutaneous levels), the longevity of correction (temporary and permanent), allergenicity, the agent's composition (allografts, semi/fully synthetic, xenografts, or autologous), and stimulatory behavior (physiologic processes of endogenous tissue proliferation) versus replacement fillers are some of the criteria that can be used to classify dermal fillers (space-replacing effect).

HA and collagen are two examples of temporary dermal fillers that are biodegradable and have a lifespan of between four and nine months. Both dissatisfaction and the possibility of detrimental effects are temporary occurrences.

Therefore, in order to save long-lasting fillers for subsequent patient visits, temporary fillers are always employed as the initial line of treatment. Permanent fillers are mostly utilized to treat deep skin wrinkles and furrows that go beyond the scope of typical face creases. They are considered a top choice for face rejuvenation, particularly in HIV lipodystrophy. PMMA is generally employed for effects that are effective, long-lasting, and safe.

The medical cosmetics industry experienced supply chain delays due to the COVID-19-imposed lockdowns, which included restrictions on import and export, flight cancellations, decreased production, and disrupted supply lines. Moreover, nonsurgical procedures involving hyaluronic acid and botulinum toxin saw a decline in total usage. Thus, the drop in product demand during the pandemic further impacted the market expansion. The market for dermal fillers has been affected by the COVID-19 pandemic. However, the market for dermal fillers will be driven by the relaxation of regulatory regulations after the decreasing cases of COVID-19, thereby aiding the market to recover after the losses during the pandemic.

One of the most pervasive trends in the market is that practically all demographic groups have demonstrated a desire or predisposition for these minimally invasive or non-invasive procedures. For the male demographic, who are increasingly using these operations to improve their appearance, this is especially important. For instance, a growing number of men are discovering that gravity and aging can have a detrimental effect on the way their facial features look. As a result, males choose facial filler procedures due to their success in reversing the early gravitational aging of the face. Also, it offers the extra benefit of requiring no downtime for recuperation.

A scope for seeing and surgical instruments with specialized equipment are used in minimally invasive surgery. It reduces volume, shape, and undesirable fat while concentrating on the abnormalities of the face, such as wrinkles and fine lines. Minimally invasive techniques are becoming more popular because they have almost no risk of significant adverse outcomes and need few or no cuts with quick recovery. There is a huge demand for energy-based, minimally invasive procedures for wrinkle reduction, skin tightening, face contouring, and rejuvenation. These mentioned factors are expected to propel the market's expansion.

The growth of the market is anticipated to be constrained throughout the forecast period, despite the wide range of aesthetic applications. One of the main barriers hindering the slowdown in the expansion of the market is the high price tag attached to these products. Dermal filler prices can vary depending on a variety of variables, including the type of procedure performed, the experience and credentials of the practitioner, and the amount of time and effort necessary to complete the surgery or treatment. Thus, the high cost associated with dermal fillers is expected to hinder the market's growth.

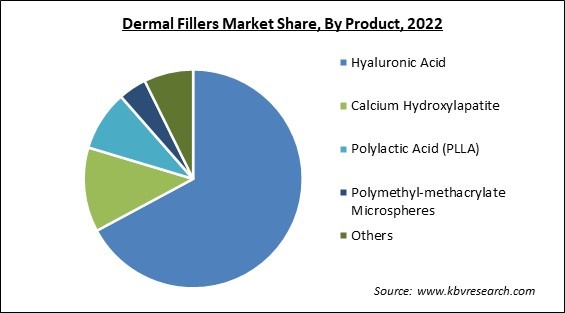

Based on product, the Dermal Fillers Market is segmented into hyaluronic acid, calcium hydroxylapatite, polylactic acid (PLLA), polymethyl-methacrylate microspheres and others. The calcium hydroxylapatite segment acquired a significant revenue share in the dermal fillers market in 2022. The growth is attributed to its safety characteristics. Key players' launches of new goods in this market also contribute to the segment's expansion. Calcium hydroxylapatite (CaHA), which stimulates collagen over time, is an active constituent in the injectable dermal filler. Without treating the area around the tear trough, one can lift sagging soft tissues, lessen lower eyelid lag, and decrease the tear trough.

On the basis of type, the dermal fillers market is divided into biodegradable and non-biodegradable. The biodegradable segment witnessed the largest revenue share in the dermal fillers market in 2022. This is due to the presence of more product options in this segment than in the non-biodegradable category and because biodegradable products have more varied aesthetic uses. The segment's expansion is also anticipated to be aided by the goods' higher level of safety and solid regulatory approval.

By application, the dermal fillers market is classified into wrinkle correction, facial contouring, scar treatment, lip enhancement and others. The lip enhancement segment garnered a prominent revenue share in the dermal fillers market in 2022. This is due to the strong volume of lip procedures. The category is anticipated to be driven by the increased demand for cosmetic enhancements of the lips, fueled by the advent of minimally invasive procedures. Lip fillers are a cosmetic treatment that can enhance the volume of lips.

Based on the end-use, the dermal fillers market is bifurcated into MedSpa, cosmetic surgery clinics and hospitals. The hospital segment recorded a promising growth rate in the dermal fillers market in 2022. This is owing to the widespread use of aesthetic procedures like face injectables carried out in hospitals. In addition, the presence of high-tech equipment, staff and other facilities increased their popularity among patients who trust hospitals for various types of filler surgeries, and thus further providing growth opportunities for the segment.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 6 Billion |

| Market size forecast in 2029 | USD 10.3 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2029 |

| Revenue Growth Rate | CAGR of 8.1% from 2023 to 2029 |

| Number of Pages | 254 |

| Number of Table | 470 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Product, End-use, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the dermal fillers market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region generated the highest revenue share in the dermal fillers market in 2022. This is due to the region's developing trend of ageless beauty, increased popularity among men, and rising desire for non-surgical aesthetic procedures. In North America, people care a lot about their looks and beauty standards. Due to this, there is a significant demand for dermal fillers to improve face characteristics and lessen aging symptoms.

Free Valuable Insights: Global Dermal Fillers Market size to reach USD 10.3 Billion by 2029

The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Bioplus Co. Ltd, Bioxis pharmaceuticals, Suneva Medical, Inc., Galderma S.A., Allergan PLC (AbbVie, Inc.), Sinclair Pharma Ltd. (Huadong Medicine Co., Ltd.), Revance Therapeutics, Inc., Medytox Inc., Merz Pharma GmbH & Co. KGaA and Prollenium Medical Technologies Inc.

By Type

By Product

By End-use

By Application

By Geography

The Market size is projected to reach USD 10.3 billion by 2029.

The rising popularity of injectable fillers among men are driving the Market in coming years, however, The high cost associated with dermal fillers restraints the growth of the Market.

Bioplus Co. Ltd, Bioxis pharmaceuticals, Suneva Medical, Inc., Galderma S.A., Allergan PLC (AbbVie, Inc.), Sinclair Pharma Ltd. (Huadong Medicine Co., Ltd.), Revance Therapeutics, Inc., Medytox Inc., Merz Pharma GmbH & Co. KGaA and Prollenium Medical Technologies Inc.

The Hyaluronic Acid segment acquired maximum revenue share in the Global Dermal Fillers Market by Product in 2022 thereby, achieving a market value of $6.7 billion by 2029.

The Wrinkle Correction segment is leading the Global Dermal Fillers Market by Application in 2022 thereby, achieving a market value of $3.1 billion by 2029.

The North America market dominated the Market by Region in 2022, and would continue to be a dominant market till 2029; thereby, achieving a market value of $4.1 billion by 2029.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.