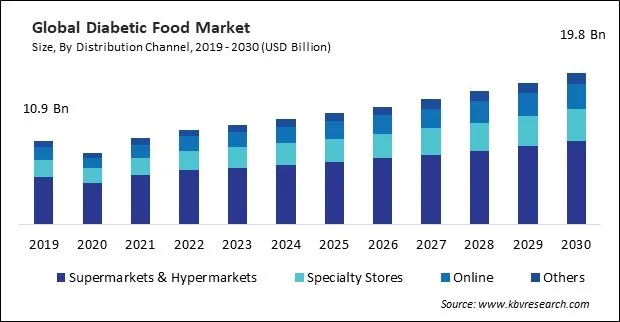

“Global Diabetic Food Market to reach a market value of USD 19.8 Billion by 2030 growing at a CAGR of 6.1%”

The Global Diabetic Food Market size is expected to reach $19.8 billion by 2030, rising at a market growth of 6.1% CAGR during the forecast period.

The high prevalence of diabetes in North America is a primary driver for the rising demand for diabetic food. Therefore, the North America region captured $4,545.9 million revenue in the market in 2022. Diabetes is among the most prevalent chronic illnesses that impact the Canadian population. According to the Government of Canada, approximately 3.7 million Canadians aged one year and older have been diagnosed with diabetes, representing 9.4% of the population. Additionally, prediabetes affects more than 6% of the adult population in Canada, increasing their risk of developing type 2 diabetes.

As more people are diagnosed with diabetes, there is an increasing demand for food products specifically designed to meet the dietary needs of individuals managing this condition. The global demographic landscape is changing, including an aging population. The elderly demographic is more susceptible to developing diabetes, contributing to the overall increase in diabetes cases. This demographic shift further fuels the demand for diabetic-friendly foods. Additionally, Food technology allows for the identification and incorporation of low-glycemic index ingredients. These ingredients have a slower impact on blood sugar levels, making them suitable for diabetic diets. Formulations that leverage such ingredients contribute to the production of diabetic-friendly products. Advances in food processing techniques have led to the development of alternative flours and grains with lower carbohydrate content and improved nutritional profiles. These innovations enable the creation of diabetic-friendly baked goods and snacks that align with dietary restrictions. advancements in food preservation techniques contribute to the availability of diabetic-friendly foods with extended shelf life. This is especially important for ready-to-eat and convenience products, ensuring that individuals managing diabetes have access to convenient and safe food options. Food technology advancements allow for the improvement of textures and mouthfeel in diabetic-friendly products. Therefore, the advancements in food technology are propelling the growth of the market.

However, Individuals with diabetes may have diverse nutritional needs based on factors such as age, gender, weight, activity level, and the presence of other health conditions. Creating a one-size-fits-all diabetic food product becomes challenging, as formulations must consider a broad spectrum of individual requirements. Personal dietary preferences and cultural differences add to the complexity. What may be suitable for one person with diabetes may not align with the preferences of another. Creating diabetic-friendly foods that cater to diverse taste preferences and cultural dietary habits requires careful consideration and customization. The nutritional needs of individuals with diabetes can vary based on the stage of the condition. Those with newly diagnosed diabetes may have different requirements than those managing the condition for an extended period. Creating products that accommodate the changing needs at different stages adds complexity. Therefore, the complexity of nutritional requirements hinders the market's growth.

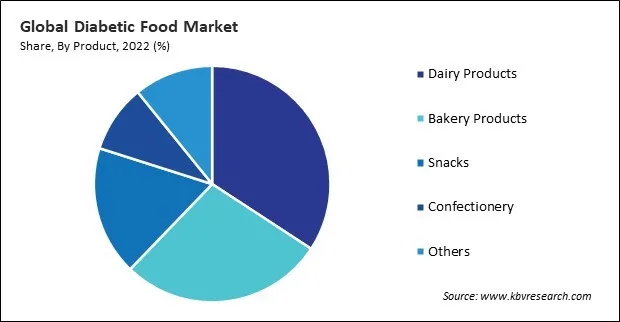

Based on product, the market is divided into snacks, dairy products, confectionery, bakery products, and others. The confectionery segment attained a considerable revenue share in the market in 2022. Sugar-free chocolate is a popular diabetic confectionery item. It uses sugar alternatives or natural sweeteners to provide a sweet taste without impacting blood sugar levels. Diabetic-friendly chocolate bars, truffles, and chocolate-covered nuts are common applications. Furthermore, diabetic-friendly candy is formulated without traditional sugars. Sugar alternatives such as stevia, xylitol, or erythritol are often used to sweeten these treats. Various fruit-flavored, hard, and gummy candies fall into this category.

On the basis of distribution channel, the market is segmented into hypermarkets & supermarkets, specialty stores, online, and others. The hypermarkets & supermarkets segment recorded the largest revenue share in the market in 2022. Hypermarkets and supermarkets contribute to the accessibility of its products. These large retail outlets typically offer a diverse range of diabetic-friendly options, including sugar-free, low-carb, and other products for individuals managing diabetes. This accessibility enhances the convenience for consumers seeking specialized food items. Hypermarkets and supermarkets' expansive space and inventory capabilities allow for a wide variety and range of products.

Free Valuable Insights: Global Diabetic Food Market size to reach USD 19.8 Billion by 2030

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific region generated a substantial revenue share in the market in 2022. Rapid urbanization and westernization of diets in many Asia-Pacific countries have led to shifts in dietary patterns. Increased consumption of processed foods, sugary snacks, and high-carbohydrate diets contributes to a higher risk of diabetes. The demand for reflects a response to the need for healthier dietary choices. Furthermore, Asia Pacific is experiencing an aging population. Older individuals are more prone to diabetes, and there is a growing demand for food products that address the nutritional requirements of seniors managing diabetes. This demographic shift contributes to the increasing demand for diabetic-friendly options.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 12.4 Billion |

| Market size forecast in 2030 | USD 19.8 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 6.1% from 2023 to 2030 |

| Number of Pages | 200 |

| Number of Tables | 290 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Product, Distribution Channel, Region |

| Country scope |

|

| Companies Included | Unilever PLC, Nestle S.A., The Coca Cola Company, PepsiCo, Inc. (Frito-Lay North America Inc.), Kellogg Company, Danone, S.A., Conagra Brands, Inc., Mars Inc., Tyson Foods, Inc., The Hershey Company (Hershey Trust Company) |

By Distribution Channel

By Product

By Geography

This Market size is expected to reach $19.8 billion by 2030.

Rising global prevalence of diabetes are driving the Market in coming years, however, Complexity of nutritional requirements restraints the growth of the Market.

Unilever PLC, Nestle S.A., The Coca Cola Company, PepsiCo, Inc. (Frito-Lay North America Inc.), Kellogg Company, Danone, S.A., Conagra Brands, Inc., Mars Inc., Tyson Foods, Inc., The Hershey Company (Hershey Trust Company)

The expected CAGR of this Market is 6.1% from 2023 to 2030.

The Dairy Products segment is leading the Market, by Product in 2022; there by, achieving a market value of $6.4 billion by 2030.

The North America region dominated the Market, by region in 2022, and would continue to be a dominant market till 2030; there by, achieving a market value of $6.8 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges