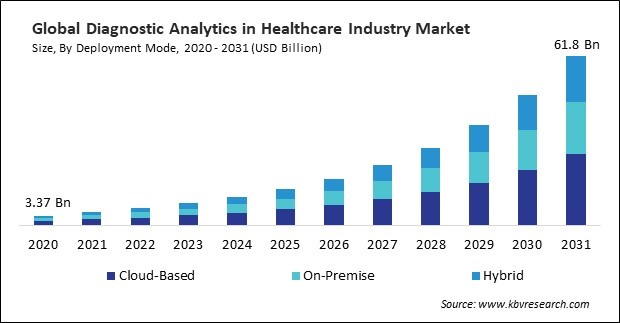

“Global Diagnostic Analytics in Healthcare Industry Market to reach a market value of USD 61.8 Billion by 2031 growing at a CAGR of 29.0%”

The Global Diagnostic Analytics In Healthcare Industry Market size is expected to reach $61.8 billion by 2031, rising at a market growth of 29.0% CAGR during the forecast period.

The North America segment garnered 39% revenue share in the market in 2023. This supremacy is explained by the region's substantial investments in healthcare analytics, strong adoption of cutting-edge technologies, and well-established healthcare infrastructure. Growth has been further accelerated by the existence of significant market participants and robust government measures to support healthcare IT.

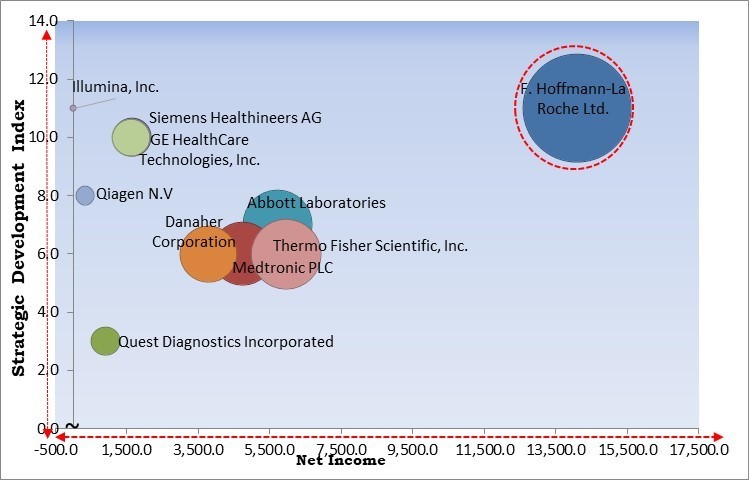

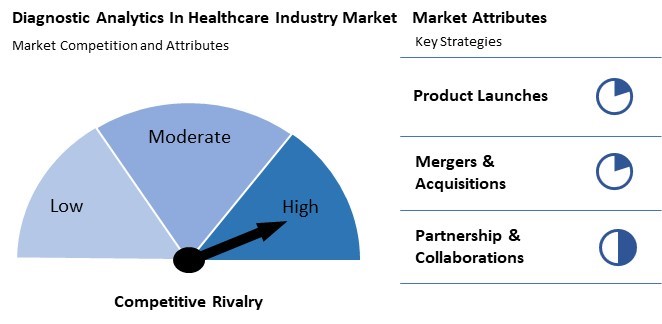

The major strategies followed by the market participants are Partnership as the key developmental strategy to keep pace with the changing demands of end users. For instance, In March, 2023, Siemens Healthineers AG entered into a 7-year strategic partnership with Aster DM Healthcare, aiming to advance healthcare innovation across the UAE and GCC. The collaboration focuses on technology upgrades, digital optimization, workflow improvements, and continuous education to enhance operational efficiency and patient care delivery. Moreover, In August, 2024, QIAGEN expanded its partnership with AstraZeneca to develop companion diagnostics for chronic diseases using the QIAstat-Dx platform. This syndromic testing system enables rapid genotyping, supporting precision medicine by tailoring treatments to patients’ genetic profiles during routine clinical exams.

Based on the Analysis presented in the KBV Cardinal matrix; F. Hoffmann-La Roche Ltd. is the forerunners in the Diagnostic Analytics in Healthcare Industry Market. In February, 2024, F. Hoffmann-La Roche Ltd. partnered with PathAI to develop AI-powered digital pathology algorithms for companion diagnostics. The collaboration will integrate these algorithms into Roche's navify Digital Pathology platform, advancing precision medicine and enhancing targeted treatments through seamless laboratory integration. Companies such as Illumina Inc., Siemens Healthineers AG and GE HealthCare Technologies, Inc. are some of the key innovators in Diagnostic Analytics in Healthcare Industry Market.

The COVID-19 pandemic significantly disrupted the adoption and growth of diagnostic analytics in the healthcare industry. One of the primary challenges was the overwhelming burden placed on healthcare systems, which redirected resources and attention away from long-term projects like analytics implementation toward immediate pandemic response. The sudden influx of COVID-19-related data from multiple, often incompatible sources created significant integration challenges, further complicating efforts to analyze and derive actionable insights. Thus, the pandemic had an overall negative impact on the market.

The rising demand for personalized medicine transforms healthcare by enabling tailored treatment plans based on patient-specific data. Diagnostic analytics is vital in this transformation, leveraging tools like Foundation Medicine and Caris Life Sciences to analyze genetic, clinical, and behavioral data for precise medical solutions. For instance, Foundation Medicine’s genomic profiling tools help oncologists identify tumor-specific genetic mutations, enabling targeted therapies that significantly improve treatment outcomes. Hence, these examples illustrate the transformative impact of diagnostic analytics in personalized medicine.

Additionally, In medical imaging, AI-powered tools developed by companies like Google Health and Zebra Medical Vision analyze X-rays, MRIs, and CT scans with exceptional precision. These tools can detect conditions such as lung and breast cancer as well as brain abnormalities, often surpassing human radiologists in accuracy. Accelerating the review process enables quicker diagnoses and interventions, particularly in critical cases. Thus, the development of these technologies will also drive the expansion of the market.

However, The adoption of diagnostic analytics solutions in the healthcare industry often comes with a substantial upfront investment. This cost encompasses various components such as purchasing or licensing advanced software, upgrading or acquiring compatible hardware, and ensuring the necessary training for healthcare professionals to use these tools effectively. Many organizations may find these cost constraints burdensome, particularly small-to-medium-sized healthcare facilities.

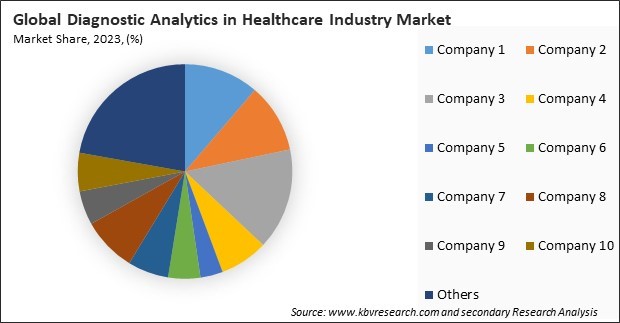

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships, Collaborations & Agreements.

Based on deployment mode, the market is classified into cloud-based, on-premise, and hybrid. The on-premise segment procured 30% revenue share in the market in 2023. Many healthcare providers prefer on-premise solutions to maintain direct control over sensitive patient data and ensure adherence to stringent healthcare regulations like HIPAA. Furthermore, on-premise systems are often tailored to meet the specific requirements of an organization’s infrastructure and workflows, providing a sense of reliability and governance that cloud-based models may not fully address.

On the basis of data source, the market is divided into clinical data, medical imaging data, wearables & IoT data, lab test data, and genomic data. The medical imaging data segment recorded 24% revenue share in the market in 2023. Improvements in imaging technology and the combination of machine learning and artificial intelligence (AI) have led to a notable expansion of the segment. These innovations have enhanced diagnostic accuracy and enabled personalized treatment plans by analyzing complex imaging datasets.

By end-user, the market is segmented into hospitals, diagnostic laboratories, clinics & physician practices, research & academic institutes, insurance companies, and others. The diagnostic laboratories segment procured 19% revenue share in the market in 2023. These laboratories leverage analytics tools to manage high volumes of test data, reduce turnaround times, and ensure accuracy in reporting. The adoption of analytics solutions has been further supported by the rising incidence of infectious and chronic diseases as well as a growing dependence on laboratory-based diagnostics.

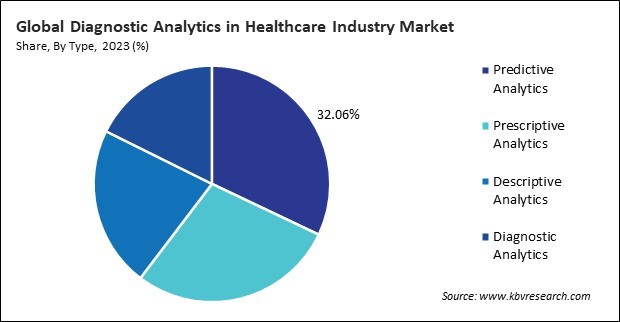

Based on type, the market is classified into predictive analytics, prescriptive analytics, descriptive analytics, and diagnostic analytics. The prescriptive analytics segment witnessed 28% revenue share in the market in 2023. This type of analytics recommends specific actions to improve outcomes, such as suggesting optimal treatment plans, resource utilization, or scheduling adjustments. The demand for precision medicine and the increasing complexity of healthcare delivery have made prescriptive analytics more crucial than ever.

On the basis of technology, the market is divided into artificial intelligence (AI) & machine learning (ML), Big Data analytics, cloud-based analytics, natural language processing (NLP), and others. The Big Data analytics segment procured 24% revenue share in the market in 2023. Big data analytics solutions are necessary for processing and evaluating the enormous amount of data generated by the healthcare industry every day. By utilizing big data analytics, healthcare organizations can identify trends, optimize resource allocation, and enhance patient outcomes.

By application, the market is segmented into disease detection & diagnosis, clinical decision support, personalized treatment, radiology & medical imaging, patient monitoring & remote diagnostics, and others. The clinical decision support segment recorded 19% revenue share in the market in 2023. This segment is propelled by the growing adoption of data-driven healthcare practices to improve care quality and reduce medical errors. These systems leverage real-time patient data, evidence-based guidelines, and predictive analytics to assist clinicians in making informed decisions.

Free Valuable Insights: Global Diagnostic Analytics in Healthcare Industry Market size to reach USD 61.8 Billion by 2031

The competition in the Diagnostic Analytics in Healthcare industry market, excluding top players, is marked by the presence of emerging firms and niche players offering innovative solutions. These companies focus on advanced analytics, AI-driven tools, and specialized services to cater to unmet needs. Intense rivalry exists as they strive to differentiate themselves through innovation, cost-efficiency, and tailored customer experiences.

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Europe segment procured 30% revenue share in the market in 2023. The region's robust regulatory framework, aimed at improving data security and patient care, has encouraged the adoption of diagnostic analytics solutions. Additionally, increasing investments in healthcare research and the growing use of artificial intelligence and big data analytics have strengthened the European market.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 8.16 Billion |

| Market size forecast in 2031 | USD 61.8 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 29.0% from 2024 to 2031 |

| Number of Pages | 515 |

| Number of Tables | 723 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Deployment Mode, Data Source, End-User, Type, Technology, Application, Region |

| Country scope |

|

| Companies Included | Siemens Healthineers AG (Siemens AG), Abbott Laboratories, F. Hoffmann-La Roche Ltd., Danaher Corporation, Qiagen N.V, Medtronic PLC, Illumina, Inc., Thermo Fisher Scientific, Inc., Quest Diagnostics Incorporated, and GE HealthCare Technologies, Inc. |

By Deployment Mode

By Data Source

By End-User

By Type

By Technology

By Application

By Geography

This Market size is expected to reach $61.8 billion by 2031.

Rising Demand For Personalized Medicine are driving the Market in coming years, however, Substantially High Implementation Costs restraints the growth of the Market.

Siemens Healthineers AG (Siemens AG), Abbott Laboratories, F. Hoffmann-La Roche Ltd., Danaher Corporation, Qiagen N.V, Medtronic PLC, Illumina, Inc., Thermo Fisher Scientific, Inc., Quest Diagnostics Incorporated, and GE HealthCare Technologies, Inc.

The expected CAGR of this Market is 29.0% from 2024 to 2031.

The Hospitals segment captured the maximum revenue in the Market by End-User in 2023, thereby, achieving a market value of $25.3 billion by 2031.

The North America region dominated the Market by Region in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $22.7 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges