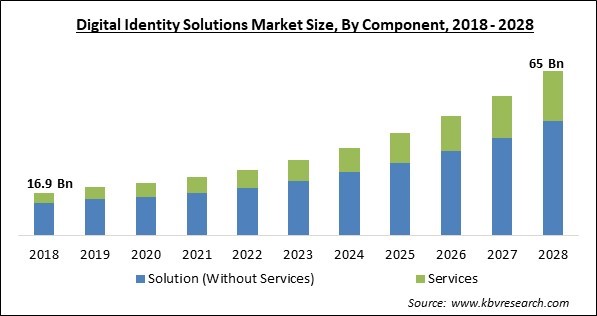

The Global Digital Identity Solutions Market size is expected to reach $65 billion by 2028, rising at a Market growth of 16.6% CAGR during the forecast period.

Organizations is a digital identification system which is designed in order to collect biographical data, such as name, gender, age, gender, and address, and biometric data, such as thumb impression, in an electronic format. Information about an entity used by a computer system to identify an external agent is referred as digital identity. Accessing computers and delivering services to clients is achievable through digital identity systems. The compliance of personal information that appears in a digital form, including everything from an individual's date of birth to all behaviors on social media platforms, is referred to as a digital identity solution. These solutions provide several benefits, including increased accuracy and compliance, lower operational costs, improved customer experience, and improved security.

Biometric authentication, which includes fingerprint, facial recognition, handprint, voice recognition, retina, or eye scan, is included in digital identification systems. Biometric features and digital identities are unique to each individual. It authenticates the user and grants them access to a limited set of services using lock-and-capture mechanisms. In addition, traditional identity verification systems, which rely on static certifications, are less secure than digital identity solutions. Traditionally, identity verification has been accomplished by direct social interaction and physical examination of government-issued documents.

Because this solution provides significant benefits for individuals and organizations, the Market for digital identity solutions is expected to increase over the forecast period. Several organizations benefit from digital identification solutions because they have a large staff and associated networking equipment that are vulnerable to identity-related hazards. Since organizations have offices all over the world, they are encouraged to give deploy these solutions for their employees via real-time data access.

Since the worldwide COVID-19 pandemic broke out, automobile demand has dropped dramatically. It's because of government-imposed restrictions on firms, such as temporary bans on raw material imports and exports, plant closures, and entire or partial lockdowns. The pandemic has had a significant impact on various end-user industries of digital identity solutions including hospitality, manufacturing, and entertainment.

However, worldwide governments and federal bodies have mandated both public and commercial enterprises to leverage new strategies for working remotely and maintaining social distance amid the COVID-19 pandemic. Since then, digital business practices have become the new Business Continuity Plan (BCP) for various businesses. Individuals are more attracted to adopt digital technologies such as cloud solutions as a result of the widespread usage of BYOD devices, the WFH trend, and internet saturation throughout the world, necessitating the need for cybersecurity measures to protect against cyber-attacks.

The number of smartphone users worldwide has surged as a result of rapid technology breakthroughs, and the world has become more connected than ever before. Traditionally, the only secure method of authentication was through the use of a password key mechanism. These password security measures are becoming easier to exploit as technology advances. Passwords are not as secure as digital identity-based security, such as biometrics and multi-factor authentication. Most smartphones across the Market include a camera as well as identification features such as fingerprint and face recognition. More smartphone manufacturers are incorporating fingerprints and face recognition technologies into devices.

While modern and reasonably safe, today's urban enclaves are beyond smart. In terms of traffic and junk architecture, management, wireless access, and other sectors, there are still several problems and needs for development. The Internet of Things (IoT) would allow several technological breakthroughs that would enhance these features, but the individual experience will be highly diverse. The majority of the world's population now lives in cities, and current projections indicate that this number would rise. Due to sudden increase in urban population, increased services and a great and gratifying citizen experience are critical to smart city success. Digital identity is significantly important in order to allow project participants and government officials to access these projects.

Organizations across all industries are concerned about the growing risks of cyberattacks and identity-related scams and thefts. To address these security concerns, organizations have started to install identity management solutions for identification and authentication. However, one of the factors impeding the development of the online identity solutions Market is the cost involved with deploying such solutions. Implementing digital identity systems requires significant upfront expenditures and costs. Due to limited resources, SMEs usually focus on security after a violation already happened. Enterprises focus on the protection of just critical servers, ignoring the data held in databases, which becomes subject to cyber-attacks.

Based on Component, the Market is segmented into Solution (Without Services), (Biometrics and Non-Biometrics) and Services. The service segment recorded the significant revenue share in in the Digital Identity Solutions Market in 2021. As the number of connected devices grows, the demand for managed services automatically increases, which allows businesses to focus on their core operations. The major benefit of management services is its experience, which consumers can leverage. Moreover, the services segment is being driven by an increased demand for installation and training services. In addition, the suppliers offer a mix of management services, training, and support to businesses to enable effective device management and secure corporate data shared over endpoints. These factors are augmenting the growth of this segment.

Based on Authentication Type, the Market is segmented into Single-factor Authentication and Multi-factor Authentication. The single factor Authentication segment garnered the largest revenue share in the Digital Identity Solutions Market in 2021. Single-Factor Authentication is an identity verification procedure that involves the access-requesting party to produce a single identifier or factor that is linked to its identification with the authenticating party. Many systems utilize Single factor authentication, or SFA, by default since it is simple and inexpensive to deploy. Password is the most widely used single-factor identification. Other often-used identifiers are SMS codes sent to an enrolled mobile device, one-time passwords created by a physical device or software on a mobile device or computer. This factor would propel the growth of the segment.

Based on Organization size, the Market is segmented into Large Enterprises and Small & Medium-sized Enterprises (SMEs). The small and medium enterprise segment recorded the significant revenue share in the Digital Identity Solutions Market in 2021. Small business identity access software suite builds a comprehensive database of user information at one location, allowing the company to keep track of user records and roles more easily. It can unify all of directory systems with the correct identity and access management software for business, ensuring that no system, new or old, is left behind.

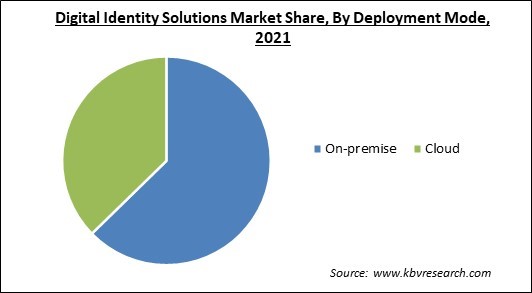

Based on Deployment Mode, the Market is segmented into On-premise and Cloud. The On-premise segment acquired the highest revenue share in the Digital Identity Solutions Market in 2021. Organizations are likely to indulge in on-premise solutions because they provide complete control of the data, particularly in security-related solutions. These solutions are used by the government and the military to address identity-related concerns, which is driving up demand for on premise solutions.

Based on Vertical, the Market is segmented into BFSI, IT, ITeS & Telecom, Government & Defense, Healthcare, Energy & Utilities, Retail & eCommerce, and Others. The retail and e-commerce segment registered the substantial revenue share in the Digital Identity Solutions Market in 2021. The retail and e-commerce industries have become one of the most data-sensitive industries. Escalating digital payments have been accompanied by a rise in individual data storage, potentially resulting in data leakages in the face of rising cyber-crime. As data systems become more complex as a result of growing digitalization, enhanced authentication is required. Adopting a digital identification solution can assist shops in preventing intruders from entering internal access, resulting in data loss reduction. As a result, the growth of the segment is being boosted.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 23 Billion |

| Market size forecast in 2028 | USD 65 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 16.6% from 2022 to 2028 |

| Number of Pages | 354 |

| Number of Tables | 614 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Authentication Type, Organization Size, Deployment Mode, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the Market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. The North America segment acquired the highest revenue share in the Digital Identity Solutions Market in 2021. Partnerships, strategic investments, and major R&D operations, in addition to geographical presence, are all contributing to the widespread adoption of digital identification systems. Due to reasons such as the rise in identification and authentication frauds and the presence of significant suppliers in the region, North America is regarded as the most advanced Market in terms of incorporating technological identity solutions.

Free Valuable Insights: Global Digital Identity Solutions Market Size to reach USD 65 Billion by 2028

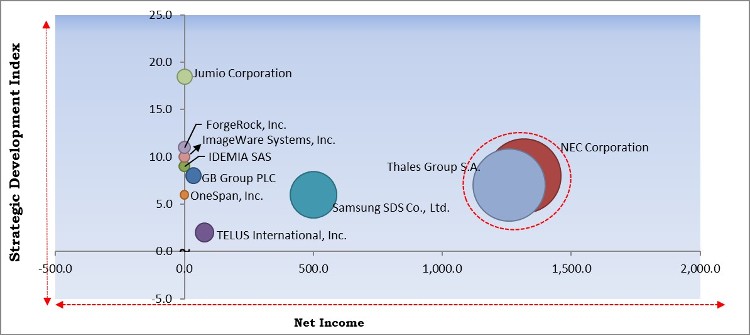

The major strategies followed by the Market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; NEC Corporation and Thales Group S.A. are the forerunners in the Digital Identity Solutions Market . Companies such as Samsung SDS Co., Ltd., Jumio Corporation and ForgeRock, Inc. are some of the key innovators in the Market .

The Market research report covers the analysis of key stake holders of the Market . Key companies profiled in the report include TELUS International, Inc., Samsung SDS Co., Ltd., GB Group PLC, NEC Corporation, Thales Group S.A., OneSpan, Inc., ForgeRock, Inc., ImageWare Systems, Inc., IDEMIA SAS, and Jumio Corporation.

By Component

By Authentication Type

By Organization size

By Deployment Mode

By Vertical

By Geography

The digital identity solutions market size is projected to reach USD 65 billion by 2028.

Integration of the biometrics into smartphones are increasing are driving the market in coming years, however, the increased expense of implementing digital identity solutions growth of the market.

TELUS International, Inc., Samsung SDS Co., Ltd., GB Group PLC, NEC Corporation, Thales Group S.A., OneSpan, Inc., ForgeRock, Inc., ImageWare Systems, Inc., IDEMIA SAS, and Jumio Corporation.

Due to COVID-19 individuals are more attracted to adopt digital technologies such as cloud solutions as a result of the widespread usage of BYOD devices, the WFH trend, and internet saturation throughout the world.

The Solution (Without Services) segment dominated the Global Digital Identity Solutions Market by Component 2021; thereby, achieving a Market value of $45.1 billion by 2028.

The North America is the fastest growing region in the Global Digital Identity Solutions Market by Region 2021, and would continue to be a dominant Market till 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.