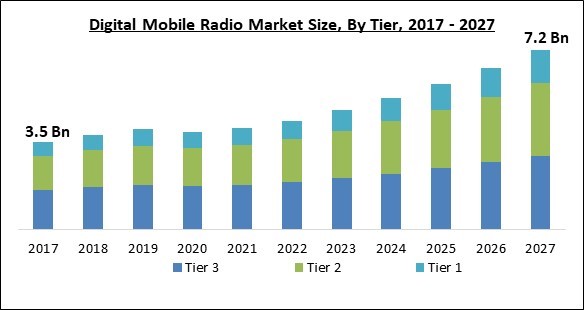

The Global Digital Mobile Radio Market size is expected to reach $7.2 billion by 2027, rising at a market growth of 10.0% CAGR during the forecast period.

Digital mobile radio is basically an international digital two-way radio standard introduced by the European Telecommunications Standards Institute with the primary goal of replacing conventional analog standards with twice the channel capacity and assisting professional mobile users by ensuring superior voice quality, functionality, and security. This standard is based on Time Division Multiple Access (TDMA) technology, and because it is an open standard, it makes it difficult for manufacturers to outperform their competitors.

DMR is a TDMA (Time Division Multiple Access) modes, which means it divides the signal into distinct time slots to allow multiple users to utilize the same frequency channel. Each frequency has two slots: slot 1 and slot 2, and each slot is used by several people. Every user sends a series of messages in quick succession, each in its own time slot. Multiple stations can share the very same frequency channel yet only use a portion of the channel's bandwidth.

Also, the market is being driven by the demand for upgrades in the radio communication infrastructure. The DMR is a brand-new communication system with a wide range of capabilities. The usage of these DMR is widespread, from industries to businesses. These areas are boosting demand for better communication. This DMR consists of standards with lesser disruptions. They can also provide end-users with an affordable choice of communication services.

The demand for digital mobile radio market is increasing as the requirement of an efficient communication system in various public security operations is emerging. DMR allows these public safety organizations to stream video, access data, and collaborate with their staff in real-time. Also, an increase in crime, terrorism, and natural disasters is encouraging the adoption of the digital mobile radio technology across the public safety sector

Moreover, the digital mobile radio technology is widely being employed in mining activities due to fact that these devices are capable of locating labors that are involved in the main mining activities such as coal mining and extracting minerals from the surface of ground.

The COVID-19 pandemic emerged as one of the biggest infections of the century. Additionally, it majorly affected economies of all countries as well as various industries irrespective of their sizes. The worldwide lockdown that was enforced by governments across the world in order to encourage the containment of the novel coronavirus caused a halt in production, causing a nuisance in the overall supply chain of electrical components.

Moreover, China, as the world's largest buyer and provider of electronic goods, suffered a demand slump caused by the pandemic. Due to a lack of items induced by the halt in production during the lockdown scenario, prices of contemporary digital technology components substantially increased. Both customers and the economy have been harmed by COVID-19. To minimize the spread of COVID-19 among staff, electronic manufacturing hubs were temporarily shut down.

While there are several advantages of DMR over Analogue, sophisticated control functions are one of the most important features among them. DMR makes use of TDMA's second time-slot technology to enable reverse-channel communication. The instructions are provided over the second channel when the first channel is engaged in a call. This provides capabilities such as transmitting radio control from a distance, priority call control, and emergency call preemption, among others.

The majority of analog transceivers used to be big and heavy. However, as technology advances, any discomfort in such traditional gadgets would be eliminated. DMRs are lighter and have a smaller footprint. In areas such as security and hospitality, radio's small size and discreetness are critical. DMRs that are ultra-light and ultra-thin offers a wider plethora of features to the user and are easier to use.

The growing number of errors in digital mobile radio is a key challenge in the market. In this sector, the frequency and noise difficulties are more prevalent. More obstacles are arising as a result of the market's developing technological issues. A small business's demand for the industry may be reduced due to technical challenges. Additionally, the digital mobile radio business is hampered by a lack of awareness. There are numerous alternatives to digital mobile radio, which resulted in less exposure of the digital mobile radio market.

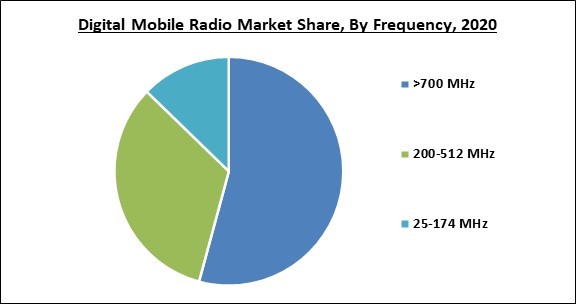

Based on the Frequency, the Digital Mobile Radio Market is segmented into 25-174 MHz, 200-512 MHz, and >700 MHz. In 2020, the 200-512 MHz segment held a substantial revenue share of the digital mobile radio market. The growth of this segment is attributed to the expanded range of the DMR devices that are comprised with this frequency. In addition, 200-512 MHz frequency devices are very affordable that also cover a long or a mid-range at a lesser cost. These factors are driving the growth of this segment over the forecast period.

Based on the Industry vertical, the Digital Mobile Radio Market is divided into Aerospace & Defense, Commercial, Transportation, Oil & Gas, Mining, Automotive, Industrial, and Others. In 2020, the Industrial segment garnered a promising revenue share in the digital mobile radio market. Digital mobile radio devices are being used across the industrial sector with the purpose of rapid transmission of information. DMR technology allows the operators to grow systems to enhance their businesses on fields and sites.

Based on the Product type, the Digital Mobile Radio Market is bifurcated into Hand Portable and In-Vehicle (Mobile). In 2020, the Mobile or In-vehicle segment acquired a significant revenue share of the digital mobile radio market. This growth is attributed to the increasing utilization of mobile DMR devices in defense and automotive. Moreover, In-vehicle DMR is substantially being utilized in the public service sector.

Based on the Tier, the Digital Mobile Radio Market is segregated into Tier 1, Tier 2, and Tier 3. In 2020, the Tier 3 segment acquired the largest revenue share of the digital mobile radio market. End-users have a stronger need for sophisticated tier 3. Tier 3 allows for smooth data service, voice quality, and communication. Telecommunications, aerospace, and defense are three domains where DMR is in high demand. DMR Tier III covers trunking operations in the 66-960 MHz frequency ranges.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 3.9 Billion |

| Market size forecast in 2027 | USD 7.2 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 10% from 2021 to 2027 |

| Number of Pages | 274 |

| Number of Tables | 483 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Frequency, Product Type, Tier, Industry Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on the Region, the Digital Mobile Radio Market is analyzed across North America, Europe, APAC, and LAMEA. In 2020, North America emerged as the leading region in the digital mobile radio market with the largest revenue share. The increasing demand for digital mobile radio devices is attributed to the rapidly growing businesses and industries across the region.. In addition, the increasing utilization of digital mobile radio technology in the transportation sector of this region is also encouraging prevailing market players to bring developments in the DMR standards and coverage.

Free Valuable Insights: Global Digital Mobile Radio Market size to reach USD 7.2 Billion by 2027

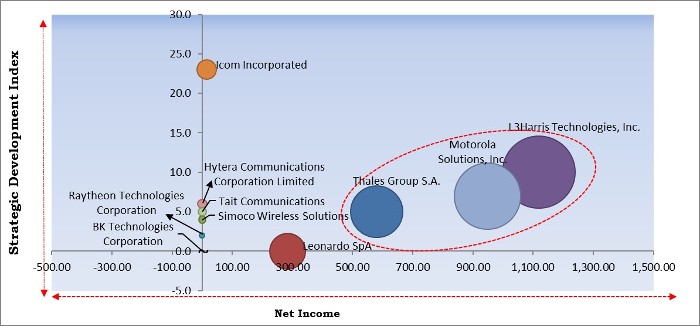

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Thales Group S.A., Motorola Solutions, Inc. and L3Harris Technologies, Inc. are the forerunners in the Digital Mobile Radio Market. Companies such as Leonardo SpA, BK Technologies Corporation and Hytera Communications Corporation Limited are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include L3Harris Technologies, Inc., Raytheon Technologies Corporation, Thales Group S.A., Leonardo SpA, Motorola Solutions, Inc., Icom Incorporated, BK Technologies Corporation, Hytera Communications Corporation Limited, Simoco Wireless Solutions, and Tait Communications.

By Frequency

By Industry Vertical

By Product Type

By Tier

By Geography

The global digital mobile radio market size is expected to reach $7.2 billion by 2027.

Increased capacities in a compact mechanism are driving the market in coming years, however, prevalence of technical issues and glitches limited the growth of the market.

L3Harris Technologies, Inc., Raytheon Technologies Corporation, Thales Group S.A., Leonardo SpA, Motorola Solutions, Inc., Icom Incorporated, BK Technologies Corporation, Hytera Communications Corporation Limited, Simoco Wireless Solutions, and Tait Communications.

The Hand Portable market is generating high revenue in the Global Digital Mobile Radio Market by Product Type 2020, achieving a market value of $5.3 billion by 2027.

The Tier 2 market shows high growth rate of 10.6% during (2021 - 2027).

The North America market acquired maximum revenue share in the Global Digital Mobile Radio Market by Region 2020, and would continue to be a dominant market till 2027.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.