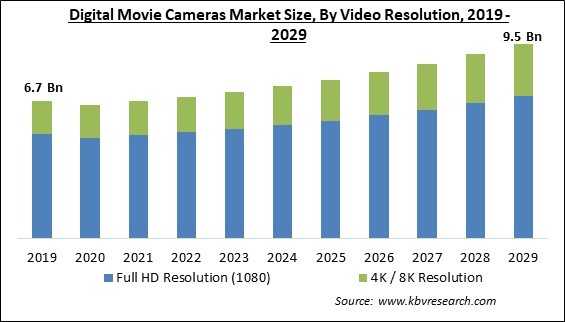

The Global Digital Movie Cameras Market size is expected to reach $9.5 billion by 2029, rising at a market growth of 4.8% CAGR during the forecast period.

High-resolution and high-quality videos are necessary in the professional world, where digital movie cameras are used. They come in a variety of resolutions, including 1K, 4K, 5K, 6K, and 8K, and they are in high demand from studios like Fox Studios, Walt Disney, and Red Chillies. In the world of cinema or movie creation, 1K cameras—often referred to as cameras with 1080p resolution—are beginning to mature. Independent media outlets and other newcomers to the film and television industries, such as amateur filmmakers, continue to have a high demand for 4K content.

4K cameras are currently maturing and set to go into expansion. Despite their expensive cost, professional users have a significant demand for 6K resolution movie cameras. The majority of modern web series and Hollywood films are shot using 6K cameras. Cameras with higher resolutions, such as 8K, are still in the development stage. Whether for movies, video games, or in the medical profession for CT scans and other material, these cameras are employed wherever high-end resolutions are necessary.

Digital movie cameras are in greater demand as a result of the tremendous growth of the entertainment sector. The development of this industry is being fueled by rising per capita income, shifting lifestyles, and the broad use of digitalization.

Since digital videos are a popular content format among social media users, multiple social media platforms, like Youtube, are also supporting market growth. The popularity of movies, online shows, and original content has increased recently, significantly expanding the range of the entertainment sector. The market for digital movie cameras is also being driven by an increase in the number of film schools, regional film industries, and supportive governmental regulations.

The creativity of its producers saved the market from serious harm. On several social media channels, they started by going online and providing free tutorials on how to utilize these cameras. Due to the high demand for entertainment during quarantine, this was quite successful. But as the lockdown gradually lifted, various filmmaking sectors began to shoot, which increased demand for cameras. Additionally, since they are readily available and help keep production costs in check, camera rental services are increasingly preferred by the film industry. In the upcoming years, there will be plenty of market chances due to the cameras' growing popularity and demand.

The 3D camera enables the perception of depth in images to mimic three dimensions. Viewers prefer it the most since it provides an in-depth experience. Digital video cameras are now a part of the technology revolution brought on by artificial intelligence (AI). Computational photography has greatly benefited from AI, spawning various innovative technologies such as face recognition and hardware function emulation. When used in conjunction with a digital movie camera, AI can significantly reduce the weight of the camera and the amount of time needed for post-processing the content by supplying extensive editing features in the camera. Therefore, the market is anticipated to develop due to ongoing technological advancements in digital camera design.

In the healthcare sector, to diagnose dental issues, digital movie cameras for digital photography can be used. Compared to print and slide films, digital cameras are far superior at capturing high-quality images. As a result, photographing the patient's teeth digitally, inside and outside the mouth, allows the dentist to see problems that could have gone unnoticed. The use of digital cameras in unmanned aerial vehicles (UAVs) for civic purposes like law enforcement, environmental monitoring, firefighting, and disaster assessment. Hence, all these elements are propelling the expansion of the digital movie cameras market in the coming years.

There has been a surge in demand for smartphones due to technological developments in the smartphone sector. Numerous cell phones offer features like high resolution, sensors, and increased frame rate (fps). Additionally, companies that produce DSLRs are working on creating compact DSLRs that offer the same features as cameras. Moreover, the introduction of several better camera photography capabilities in smartphones has revolutionized the workflow and quality of the details. These aforementioned elements could prevent the market from expanding.

Based on video resolution, the digital movie cameras market is characterized into 4K/8K resolution and full HD resolution (1080). The full HD resolution (1080) segment garnered the highest revenue share in the digital movie cameras market in 2022. A variety of features are available with full high-definition (HD) resolution cameras that are sold in the market. For example, many cameras include progressive shooting modes, while others have sensors with the full 1920x1080 resolution. Additionally, some HDV camcorders allow the use of premium interchangeable lenses in place of the fixed lenses that are standard on most prosumer cameras.

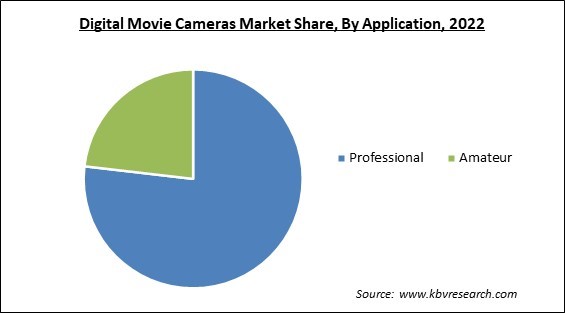

On the basis of application, the digital movie cameras market is classified into amateur and professional. The amateur segment recorded a significant revenue share in the digital movie cameras market in 2022. Amateur users are using digital cinema cameras more and more frequently. Divers, hikers, and swimmers who possess a video camera for taking videos while they perform their activities underwater make up the amateur users. Because the equipment is simple to use and produces high-quality images, digital cinema cameras are frequently used by amateur users.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 6.9 Billion |

| Market size forecast in 2029 | USD 9.5 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2029 |

| Revenue Growth Rate | CAGR of 4.8% from 2023 to 2029 |

| Number of Pages | 161 |

| Number of Table | 243 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Video Resolution, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the digital movie cameras market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment witnessed the maximum revenue share in the digital movie cameras market in 2022. The market in the region is expected to increase due to the film industry's transition toward unconventional production businesses like Netflix. In addition, regional acceptance of OTT (over-the-top) platforms has increased. An important element driving the growth of the regional market is the rise in demand for portable, high-quality digital cameras. Further, digital cameras are widely used in media, entertainment, and sports.

Free Valuable Insights: Global Digital Movie Cameras Market size to reach USD 9.5 Billion by 2029

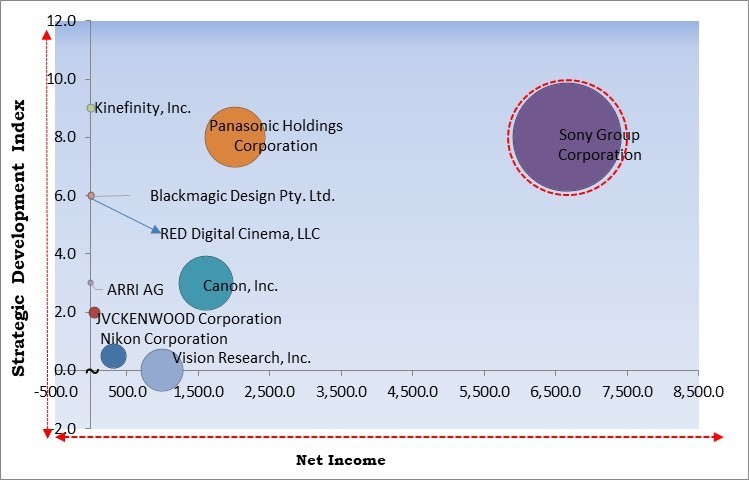

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix, Sony Group Corporation is the forerunner in the Digital Movie Cameras Market. Companies such as Panasonic Holdings Corporation, Kinefinity, Inc., and Canon, Inc. are some of the key innovators in the Digital Movie Cameras Market.

The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Sony Group Corporation, Canon, Inc., Nikon Corporation, JVCKENWOOD Corporation, Vision Research, Inc. (AMETEK, Inc.), Panasonic Holdings Corporation, ARRI AG, RED Digital Cinema, LLC, Blackmagic Design Pty. Ltd. And Kinefinity, Inc.

By Video Resolution

By Application

By Geography

The Market size is projected to reach USD 9.5 billion by 2029.

Growing usage of digital movie cameras in other fields are driving the Market in coming years, however, Increasing use of premium mobile cameras and compact DSLRs restraints the growth of the Market.

Sony Group Corporation, Canon, Inc., Nikon Corporation, JVCKENWOOD Corporation, Vision Research, Inc. (AMETEK, Inc.), Panasonic Holdings Corporation, ARRI AG, RED Digital Cinema, LLC, Blackmagic Design Pty. Ltd. And Kinefinity, Inc.

The Professional segment acquired maximum revenue share in the Global Digital Movie Cameras Market by Application in 2022 thereby, achieving a market value of $7 billion by 2029.

The North America market dominated the Market by Region in 2022, and would continue to be a dominant market till 2029; thereby, achieving a market value of $3.3 billion by 2029.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.