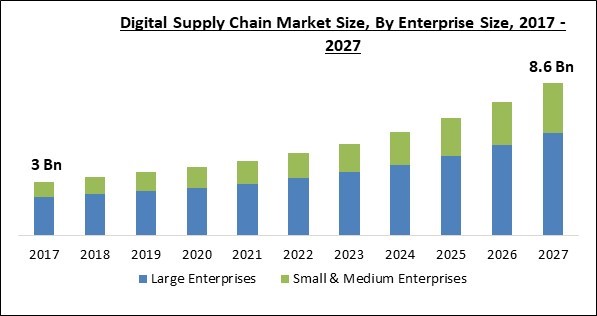

The Global Digital Supply Chain Market size is expected to reach $8.6 billion by 2027, rising at a market growth of 12.8% CAGR during the forecast period.

The digital supply chain is the end-to-end delivery chain for digital media like video, audio, electronic document & other data by certain stages. The digital supply chain market has gained immense popularity among consumers with the increasing digitalization of technology across the world. Moreover, the data supply chain solutions include copyright, data privacy, & intellectual property right preservation. The digital supply chain market widely serves the media & entertainment sector along with many other business domains.

The supply chain operations of organizations have shifted to an independent supply chain management function which is managed by the chief supply chain officer. The supply chain management function is focused on advanced planning processes like integrated sales & operation and demand planning. The integrated functions take care of all the unified operations from the consumers to suppliers.

Industry 4.0 along with the introduction of various new technologies has improved the companies’ traditional way of working and enabled them to re-design their supply chains. Additionally, megatrends & consumer expectations also play an important role in this process. Businesses have an opportunity of adopting digital supply chains which may lead to improving their operational effectiveness.

The continuous growth of the rural areas coupled with the wealth shifting into regions has majorly affected the supply chains. The trend of customization & individualization is changing the portfolio of the stock-keeping unit as well as driving the growth of the digital supply chain market. The transparency of online distribution channels & easy availability of multiple options is resulting in a more competitive supply chain platform. To cope up with these changing needs, the supply chains are required to be more granular, faster, and precise.

The outbreak of the COVID-19 pandemic has affected the economy of world brutally. Various industries could not able to maintain the traditionally used complex supply chains due to COVID. Most of the companies have faced disruptions in supply chains due to various restrictions imposed over the import & export by the government of many countries along with the complete lockdown to curb the effect of COVID-19. This has led to the increased adoption of digital supply chains by many companies.

Moreover, consumers’ preference has also shifted to purchase from the online distribution channels instead of stepping out for shopping. The rising trend of digitalization and growing demand for online shopping is enforcing the manufacturing, food & beverage and other companies to invest in automation of operations which further includes the digitalization of supply chains. These all factors are expected to contribute to the growth of the digital supply chain market during the post-pandemic period.

The changing lifestyle and the rising disposable incomes of the people is changing the preferences of the consumers in various regions. Due to the hectic lifestyle of working-class consumers and shortage of time, most of the consumers prefer to shop through various e-commerce channels and the online stores. By shopping from such distribution channels, consumers not only save time but also can avail the discounts vouchers offered by such stores. This changing preference of consumers arises the need of adoption of ecommerce channels by the companies.

The trend of digital transformation of various activities is leading to next generation of supply chain management. The digital supply chain brings up the supplier with consumer in a unique manner overcoming the issues occurred in traditional supply chains. The disruptions caused by the pandemic have led most of the industries to shift toward digital technology contributing to the growth of digital supply chain market.

The use cloud-based security supply chain involves the risk of security & privacy. The organizations have a large amount of confidential information which is required to be protected from data breaches & theft, as such breaches may lead to any kind to the organization & also ruin the image of the organization. In addition, it also involves the high risk of leaking the data on the internet which can be used by any unauthorized people which is becoming the main concern of the business organization.

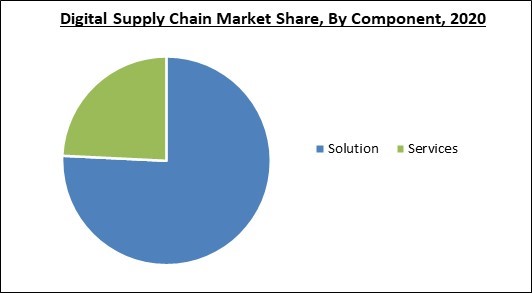

Based on components, the digital supply chain market is segmented into service and solution. The service segment accounted a significant share in the digital supply chain market in 2020. It is due to the fact that many companies would outsource these activities and get the services by experts who can optimize the process. Owing to which, companies would adopt digital supply chain services in order to ensure effective functioning of solutions, software & platforms.

On the basis of enterprise size, the digital supply chain market is divided into large enterprise & small and medium sized enterprises. The large enterprise segment led the digital supply chain market with the highest revenue share in 2020. Because of the broad customer base, the large amount of data is collected in large-sized enterprises which are required to be kept secured for analyzing the consumer demand. By digitalizing the supply chain, the large enterprise can easily get the information related to actual needs & supply chain activities which would enable them to make better decisions on time.

By end user, the digital supply chain market is categorized into retail & consumer goods, healthcare & pharmaceuticals, manufacturing, food & beverages, transportation & logistics and automotive. The food and beverage segment recorded a significant revenue share in digital supply chain market in 2020. The consumers nowadays are demanding to have updated information regarding the food they are consuming which can be done through the digital media. Therefore, the rising awareness among consumers is resulting in growth of digital supply chain market.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 3.8 Billion |

| Market size forecast in 2027 | USD 8.6 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 12.8% from 2021 to 2027 |

| Number of Pages | 232 |

| Number of Tables | 373 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Enterprise Size, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the digital supply chain market is analyzed in North America, Europe, Asia Pacific and LAMEA. In 2020, North America emerged as the leading region in the digital supply chain market with the largest revenue share. It is due to rising investments in developing technologies like artificial intelligence (AI), Internet of Things (IoT), robotics & automation, autonomous cars, augmented & virtual reality, digital twin, and 5G networking.

Free Valuable Insights: Global Digital Supply Chain Market size to reach USD 8.6 Billion by 2027

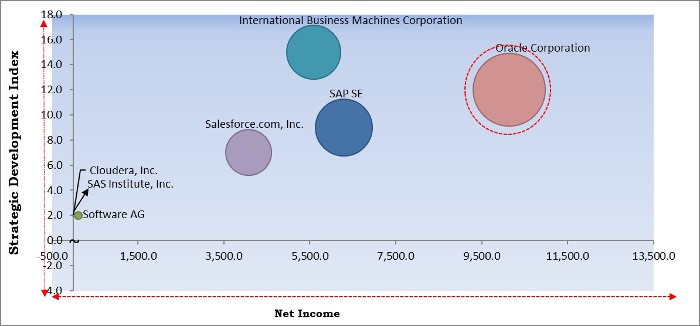

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Oracle Corporation is the major forerunner in the Digital Supply Chain Market. Companies such as International Business Machines Corporation, SAP SE and Salesforce.com, Inc. are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Cloudera, Inc., IBM Corporation, SAP SE, MicroStrategy, Inc., TIBCO Software, Inc., SAS Institute, Inc., Salesforce.com, Inc., Oracle Corporation, Software AG, and Infor, Inc.

By Component

By Enterprise Size

By End User

By Geography

The global digital supply chain market size is expected to reach $8.6 billion by 2027.

Growing shoppers at e-commerce platforms are driving the market in coming years, however, the rise in cases of security and privacy breaches among companies limited the growth of the market.

Cloudera, Inc., IBM Corporation, SAP SE, MicroStrategy, Inc., TIBCO Software, Inc., SAS Institute, Inc., Salesforce.com, Inc., Oracle Corporation, Software AG, and Infor, Inc.

The Solution market is generating high revenue in the Global Digital Supply Chain Market by Component 2020, thereby, achieving a market value of $6.1 billion by 2027.

The Small & Medium Enterprises market shows high growth rate of 14.5% during (2021 - 2027).

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.