The Global Digital Transaction Management Market size is expected to reach $30.5 billion by 2027, rising at a market growth of 25.5% CAGR during the forecast period.

Digital Transaction Management (DTM) is the process of converting paper-based document procedures to totally digital ones so that transaction processes may be executed digitally. DTM include document transfer, eSignatures, certification, data and form integration and administration, as well as a number of meta-processes centred on administering electronic transactions and the papers that accompany them.

DTM usage is accelerating, and it is likely to consume a significant portion of paper documents in the near future. To boost income and profitability, most businesses are turning to digital platforms. Salesforce, for example, used digital transaction management and saw a USD 20 per-document savings and a 60 percent decrease in response times. The firm also used electronic signatures in their sales process, which reduced transaction closing time from an average of two days to about 90% of deals completing in one day and 71% of deals concluding in one hour.

The usage of cloud-based solutions is also increasing, that will have a favourable influence on the digital transaction management market growth. Workflows must be managed in some way by both small and large enterprises. Employees and management may be on multiple systems that make significant transfers, making interdepartmental and cross-agency processes difficult. The digital transaction management process will be more seamless and cost-effective if a cloud-based solution enables any team member to access the documents.

COVID-19 pandemic outbreak has originally had a beneficial influence on the market, owing to the growth in remote working and the expanding digital transformation of enterprises. Over the projection period, the breakout of the COVID-19 pandemic is projected to promote the use of digital transaction management systems. Businesses are looking for methods of doing business that are smooth and efficient and can be performed from anywhere. Businesses all around the world are putting a lot of effort towards paperless approvals for both financed transactions and guarantee issuances. As a result, DTM solutions are projected to acquire momentum across a wide range of sectors and verticals. Electronic signatures are becoming more widely accepted as part of corporate transactions, which bodes well for industry expansion.

The potential of the smartphone to accept transactions on the spot has been fully exploited by mobile point of sale. mPOS is a technology that allows all businesses to get rid of their in-store and brick-and-mortar transactions. As transactions are encrypted and card details is not saved on the mPOS device, liability is limited, reducing the risk of data breaches and making compliance easier and faster. Biometrics, such as fingerprint and face recognition, may be used with mPOS to verify customer credentials and threat intelligence throughout transactions, giving an extra layer of protection to digital transactions. Staff may view previous transactions, web browsing history, loyalty points, and other information that helps them understand the customer's needs using mPOS. These features have improved not just consumer happiness, but also employee performance.

They require an efficient system for handling digital transactions and keeping operations on schedule, whether they're onboarding new staff, issuing electronic purchase orders, providing financial records such as credit reports and payroll, or exchanging marketing content with the worldwide team. Business process simplification is a fundamental benefit of handling documents and related tasks through digital channels. You may save operating expenses, free up staff time to focus on more essential bottom-line-oriented company duties, and accomplish a faster time-to-revenue cycle by automating regular document-related operations like contracts and accounting functions.

Despite the fact that the Digital Transaction Management business has had tremendous growth over the years, various risks may hinder its advancement. When it comes to money, one of the most significant restrictions that may confront the DTM industry is digital fraudulence and cyber threats. Malware dangers are increasing, jeopardising network and system security, posing a danger to digital transactions. As a result, extra protection in digital transactions is constantly required. Digital Transaction Management cannot be depended on, despite the fact that almost all systems provide two-factor authentication and enhanced protection. The market would be hampered in the projected term by a lack of trust in Digital Transaction Management.

Based on Component, the market is segmented into Hardware, Software and Services. Over the projected period, the software category is expected to grow at the quickest rate. The increased need for different software, like Contract Lifecycle Management (CLM) software, which may assist in managing digital transactions, can be related to the segment's rise. Businesses may use digital transaction management software to capture legally acceptable electronic signatures, track and manage the flow of documents among contractual parties, and secure document-based transactions and data storage. Digital transaction management systems with cloud-based features can help customers manage their business operations more effectively.

Based on Vertical, the market is segmented into BFSI, IT & Telecom, Government, Retail, Healthcare, Real Estate, Utilities and others. Over the projected period, the government segment is expected to grow at the fast rate. As part of the digital governance efforts being pursued by many governments throughout the world, government agencies are anticipated to effortlessly embrace digital transaction management technologies. Governments have discovered that incorporating these technologies into their operations could provide advanced algorithms and an enhanced security for properly storing transaction records and ensuring efficient and appropriate governance. As a result, various governments throughout the world are pursuing suppliers to build digital transaction management systems for them.

Based on Organization Size, the market is segmented into Large Enterprises and Small & Medium Enterprises. In 2021, the large enterprise sector dominated the market. Large businesses must continue to organise transaction workflows and ensure efficient and cost-effective business operations. As a result, major companies are more likely to use digital transaction management systems to handle their transactions and respective documentation efficiently. Large businesses use digital transaction management systems to accept timestamped updates, provide proper authentication, and cooperate with reviewers, all of which helps to speed up the whole business lifecycle.

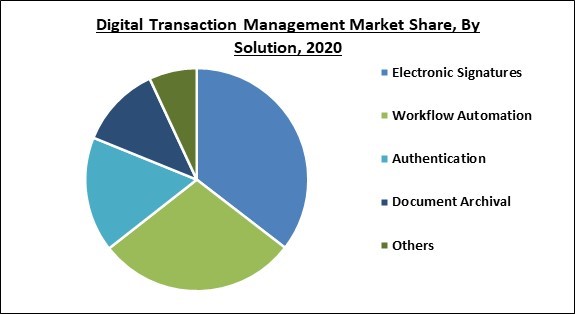

Based on Solution, the market is segmented into Electronic Signatures, Workflow Automation, Authentication, Document Archival and Others. Over the projected period, the workflow automation category is expected to grow at the quickest rate. Workflow automation saves time and money for organisations while also preventing mistakes in the procedures. Document and transaction errors might result in significant financial losses. Specifying criteria and rules as part of process automation systems, on the other hand, can assist firms in avoiding such blunders. As a result, businesses are increasingly choosing for workflow automation, which is likely to boost segment growth throughout the projection period.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 6.5 Billion |

| Market size forecast in 2027 | USD 30.5 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 25.5% from 2021 to 2027 |

| Number of Pages | 294 |

| Number of Tables | 503 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Solution, Organization Size, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2021, North America led the worldwide market. Several prominent industry incumbents, as well as new start-ups, provide digital transaction management solutions in North America. Furthermore, the region is noted for being one of the first to implement cutting-edge digital transaction management technologies. As a result of these reasons, the North American regional market now accounts for a significant portion of the worldwide market. Over the projection period, Asia Pacific is predicted to be the fastest-growing regional market.

Free Valuable Insights: Global Digital Transaction Management Market size to reach USD 30.5 Billion by 2027

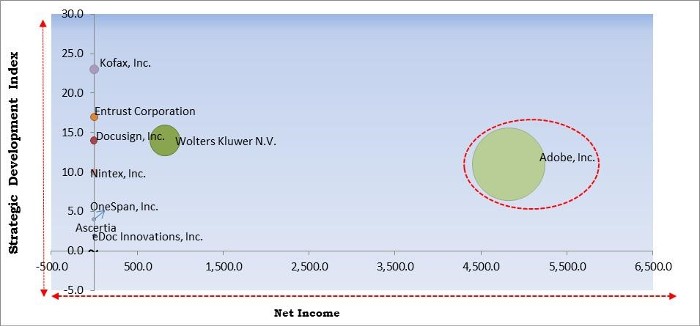

The major strategies followed by the market participants are Acquisitions. Based on the Analysis presented in the Cardinal matrix; Adobe, Inc. is the forerunners in the Digital Transaction Management Market. Companies such as Docusign, Inc., Wolters Kluwer N.V., Kofax, Inc. are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Ascertia, DocuFirst, eDoc Innovations, Inc., Docusign, Inc., OneSpan, Inc., Entrust Corporation, Kofax, Inc., Nintex, Inc., Wolters Kluwer N.V., and Adobe, Inc.

By Component

By Vertical

By Organization Size

By Solution

By Geography

The global digital transaction management market size is expected to reach $30.5 billion by 2027.

Rising Adoption of Mobile POS are driving the market in coming years, however, digital Transaction Management has a perception of having low level of trust limited the growth of the market.

Ascertia, DocuFirst, eDoc Innovations, Inc., Docusign, Inc., OneSpan, Inc., Entrust Corporation, Kofax, Inc., Nintex, Inc., Wolters Kluwer N.V., and Adobe, Inc.

The Hardware segment acquired maximum revenue share in the Global Digital Transaction Management Market by Component 2020, thereby, achieving a market value of $13.7 billion by 2027.

The BFSI market is generating high revenue in the Global Digital Transaction Management Market by Vertical 2020, and would continue to be a dominant market till 2027.

The North America is fastest growing region the Global Digital Transaction Management Market by Region 2020, and would continue to be a dominant market till 2027.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.