“Global Digital Twin in Telecom Market to reach a market value of USD 1.6 Trillion by 2031 growing at a CAGR of 22.0%”

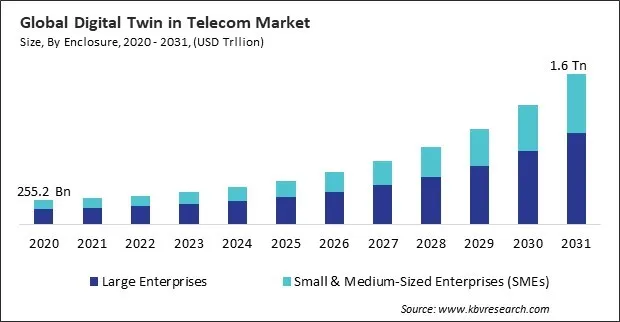

The Global Digital Twin in Telecom Market size is expected to reach $1.6 Trillion by 2031, rising at a market growth of 22.0% CAGR during the forecast period.

Europe is a leader in deploying advanced technologies like 5G, and the demand for digital twins is growing rapidly due to the region’s focus on improving network efficiency and enabling new services such as smart cities, Industry 4.0, and IoT-based applications. Hence, the Europe segment procured 32% revenue share in the market in 2023. Europe's telecom operators and service providers increasingly use digital twins to model complex network systems, manage resource allocation, and enhance operational efficiency. Additionally, the European Union’s push towards digitalization and smart infrastructure projects has driven the adoption of digital twin technology.

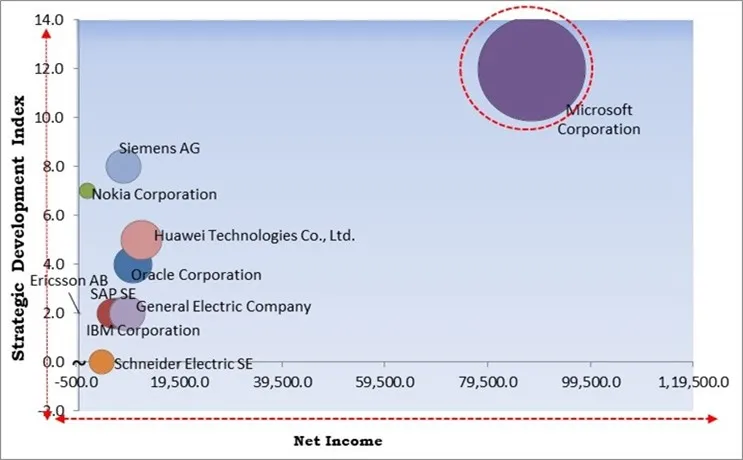

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In September, 2024, Huawei Technologies (Malaysia) partnered with CelcomDigi, a leading Malaysian telecom operator, to enhance CelcomDigi's network with intelligent capabilities through Huawei's IntelligentRAN solution. Additionally, in October, 2023, SAP SE partnered with Accenture, an Irish technology company, to integrate generative AI into organizations' core business processes, leveraging SAP technology like SAP S/4HANA Cloud. This partnership would enhance business performance, employee productivity, and decision-making by developing AI-enabled solutions and use cases across various industries, including supply chain management, finance, and digital twin applications.

Based on the Analysis presented in the KBV Cardinal matrix; Microsoft Corporation is the forerunner in the Market. In April, 2024, Microsoft Corporation partnered with Hexagon, a global leader in digital reality solutions, to redefine manufacturing through cloud technology. The collaboration will integrate Hexagon's digital twin technologies with Microsoft Azure and Microsoft 365, creating agile workflows and enhancing productivity in engineering. Companies such as Huawei Technologies Co., Ltd., Oracle Corporation, General Electric Company are some of the key innovators in Digital Twin in Telecom Market.

As 5G networks are designed to support many connected devices, ultra-low latency, and high-speed services, they require an adaptive and dynamic management approach. Digital twins provide telecom operators with the tools to continuously monitor and optimize network performance in real-time. By simulating how the network will respond to changing conditions, digital twins enable operators to adjust their infrastructure and resource management, accordingly, ensuring that 5G services meet the high expectations of users and businesses. Hence, digital twins are essential for the successful virtualization and deployment of 5G networks, the growth of which is propelling the expansion of the market.

This customer-centric approach also facilitates more proactive engagement. With the ability to model real-world scenarios and predict potential disruptions or service needs, telecom providers can offer anticipatory services. Instead of waiting for customers to report an issue, operators can proactively address potential service gaps or offer targeted promotions before customers even realize a need. This level of foresight builds trust and loyalty, positioning telecom providers as more responsive and attentive to customer needs. Thus, integrating digital twins into the telecom industry helps providers shift from a reactive service model to a proactive and customer-centric one, driving the market's growth.

The high costs extend beyond just hardware and software. Recruitment, training, and ongoing support are all necessary components of the investment in competent personnel by telecom operators to manage and maintain these systems. For many companies, this combination of capital expenditure and operational expenses makes adopting digital twin technology challenging, especially when short-term financial pressures and a slow ROI are factored in. Thus, the high cost may hamper the growth of the market.

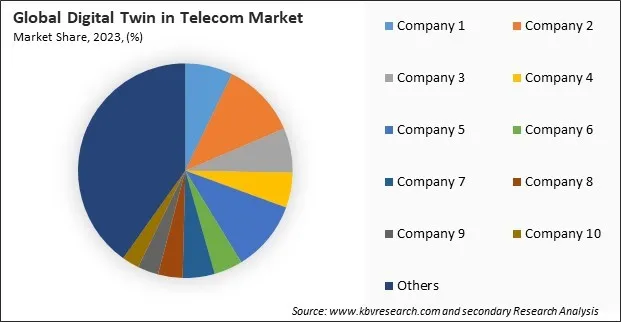

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

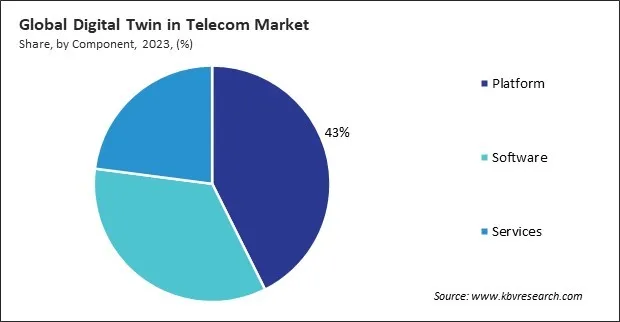

Based on component, the market is classified into platform, software, and services. The platform segment garnered 43% revenue share in the market in 2023. The complex, data-driven processes involved in the creation of virtual replicas of telecom networks can be attributed to the critical role of digital twin platforms in administering such processes. These platforms enable telecom operators to simulate, analyze, and optimize their networks in real-time. As telecom companies increasingly focus on network efficiency, resilience, and automation, platforms that offer comprehensive capabilities for monitoring and managing data have become essential.

On the basis of technology, the market is divided into the Internet of Things (IoT), artificial intelligence (AI), Big Data analytics, cloud computing, and others. The Internet of Things (IoT) segment acquired 31% revenue share in the market in 2023. Telecom operators can develop real-time, dynamic models of their networks by integrating digital twin technology with the vast amounts of data generated by IoT devices. These digital replicas allow operators to track and manage connected devices, predict potential failures, optimize network performance, and improve service delivery.

By deployment type, the market is segmented into cloud-based, on-premises, and hybrid. The cloud-based segment witnessed 48% revenue share in the market in 2023. Cloud-based deployment of digital twins has gained traction due to its scalability, flexibility, and cost-effectiveness. Telecom operators can leverage cloud infrastructure to store and process vast amounts of data in real-time, which is essential for the dynamic simulations required by digital twins.

Based on end user, the market is classified into telecom operators, communication service providers (CSPs), mobile network operators (MNOs), Internet service providers (ISPs), and others. The communication service providers (CSPs) segment acquired 29% revenue share in the market in 2023. CSPs deliver various communication services to businesses and consumers, including broadband, voice, data, and cloud services. Digital twin technology provides CSPs with a powerful tool to manage and optimize the vast infrastructure they support.

On the basis of organization size, the market is bifurcated into large enterprises and small & medium-sized enterprises (SMEs). The small & medium-sized enterprises (SMEs) segment witnessed 37% revenue share in the market in 2023. While SMEs typically operate on a smaller scale than large enterprises, they increasingly recognize the value of digital twin technology to improve network efficiency and performance. Adopting digital twins can offer SMEs a competitive advantage by streamlining network operations, reducing costs, and improving service reliability.

Free Valuable Insights: Global Digital Twin in Telecom Market size to reach USD 1.6 Trillion by 2031

The Digital Twin in Telecom Market is fiercely competitive, driven by the rising need for advanced network optimization, predictive maintenance, and real-time monitoring. Providers are focused on delivering digital twin solutions that replicate physical telecom infrastructure to enhance performance, reduce downtime, and streamline operations. As telecom operators increasingly adopt these technologies to manage 5G networks and improve service delivery, competition revolves around the ability to offer scalable, accurate, and AI-driven digital twin platforms. Innovation in analytics and simulation tools is key to staying competitive in this dynamic market.

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment garnered 35% revenue share in the market in 2023. North America is home to some of the world's largest telecom operators and communication service providers (CSPs), constantly seeking innovative ways to optimize network operations and improve customer experiences. Digital twins enable operators to simulate network behaviors, predict failures, and optimize service delivery in real-time, which is especially important as networks grow in complexity.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 335.8 Billion |

| Market size forecast in 2031 | USD 1.6 Trillion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 22.0% from 2024 to 2031 |

| Number of Pages | 350 |

| Number of Tables | 553 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Organization Size, Component, Technology, End User, Deployment Type, Region |

| Country scope |

|

| Companies Included | Microsoft Corporation, IBM Corporation, Oracle Corporation, SAP SE, Siemens AG, Schneider Electric SE, General Electric Company, Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Nokia Corporation, Ericsson AB |

By Organization Size

By Component

By Technology

By End User

By Deployment Type

By Geography

This Market size is expected to reach $1.6 Trillion by 2031.

Shift to Network Virtualization and 5G Deployment are driving the Market in coming years, however, Data Privacy and Security Concerns restraints the growth of the Market.

Microsoft Corporation, IBM Corporation, Oracle Corporation, SAP SE, Siemens AG, Schneider Electric SE, General Electric Company, Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Nokia Corporation, Ericsson AB

The expected CAGR of this Market is 22.0% from 2024 to 2031.

The Large Enterprises segment is leading the by Organization Size in 2023; thereby, achieving a market value of $959.4 Billion by 2031.

The North America region dominated the Market by Region in 2023; thereby, achieving a market value of $525.8 Billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges