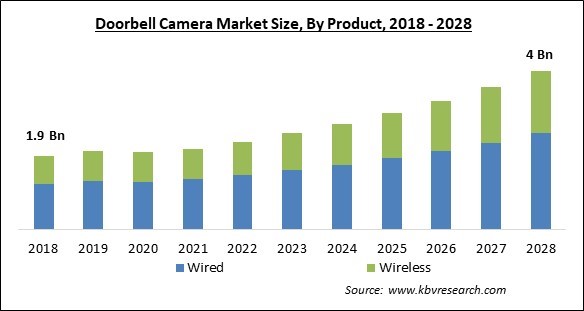

The Global Doorbell Camera Market size is expected to reach $4.1 billion by 2028, rising at a market growth of 10.3% CAGR during the forecast period.

An Internet connection can be made between a smartphone and a doorbell camera, which is an integrated camera with a doorbell. This product contains a dual-way audio system that allows communication between the user and the visitor. Motion detection devices are also included with some doorbell cameras. A doorbell camera can also permit a live or recorded video with the help of the attached camera in the device and give video interaction between the guest and the host. The smartphone and doorbell camera connection let the host see and speak with the visitor.

Doorbell cameras just require a minimal amount of wiring and tools to install. It is anticipated that increased concerns for people's safety, security, and well-being would be a major factor in expanding the use of doorbell cameras. The public's rising understanding of the benefits of incorporating artificial intelligence (AI) into daily activities for comfort and luxury is another factor supporting the industry's expansion. Produced by tech hardware businesses, these items have been updated and modified to meet the changing needs of consumers by utilizing AI characteristics. For example, most doorbell cameras now include a two-way audio system to help customers communicate with visitors more effectively.

Globally, the crime rate has been steadily increasing in recent years. The FBI's 2017 Crime Statistics show that there were 382.9 violent crimes for every 100,000 people. Non-negligent manslaughter, murder, robbery, assault, and severe assaults are examples of violent crimes. Additionally, the recorded rate of property crime, which includes burglary, larceny-theft, motor vehicle theft, and arson, was 2,362.2 offenses per 100,000 people. The rest of the world's condition is not much different.

The construction of homes, apartments, office buildings, and social complexes was in full swing before the implementation of COVID. This resulted in the need for doorbell cameras in large volumes and various configurations. The expansion of the doorbell camera is influenced by the sales of new residences, changes in lifestyle, high disposable income, fast urbanization, and improvements in the standard of living. Construction was suspended after the pandemic, eliminating the requirement for doorbell cameras in newly built homes. Customers are more focused on getting their fundamental requirements met than on buying a high-tech doorbell camera. Customers demand a lock and an advanced gadget to protect their homes as the frequency of burglary, theft, and personal invasion is rising.

Security equipment is now a must to maintain the protection of one's home and to keep oneself protected and awake. With a rise in theft and robbery, home security tools like doorbell cameras have become more commonplace. In the United States, there are around three burglaries per minute, making them the second-most frequent crime behind larceny-theft, according to FBI crime figures from 2017. Due to the large number of crimes committed, people's attention has been drawn to enhancing the security system in their homes. An essential security component for controlling and observing access into a home is a doorbell camera.

An internet-connected gadget is used in an intelligent home to provide remote monitoring and administration of systems and appliances like heating, lighting, and security equipment. Through apps on their cellphones and other network devices, such as tablets and personal laptops, homeowners may operate these appliances. Modern home automation technology is used in these homes to provide safety, comfort, efficiency, and fuel efficiency. The popularity of smart homes has increased over the past few years on a scale. Due to its effectiveness and high level of security, this has increased the use of security tools in these homes, such as doorbell cameras.

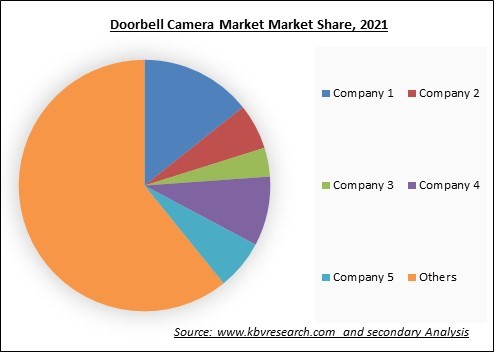

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The below illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

Many cameras don't change their exposure settings when taking a photo, thus they might not perform as well at night or in direct sunshine. Some models need the purchase of a whole system because they are not supplied separately. Not all home security footage is of the best caliber. Only 480p, a quite low and grainy resolution, is offered by some models. Some types of cameras frequently receive complaints about difficulties during setup. Some audio alternatives, such as a walkie-talkie rather than an open phone line, restrict the discussion to one speaker at a time. Surveillance camera systems can get very expensive very quickly, particularly if they require a monthly service charge.

Based on the product, the doorbell camera market is bifurcated into wired and wireless. The wired segment acquired the highest revenue share in the doorbell camera market in 2021. A hard-wired doorbell is already integrated into the majority of homes. The wiring that is now in place encourages people to install wired doorbells. Additionally, because these products come in a variety of stylish bodies, they can be used to complete the décor. The body might be made of polished wood or old metallic scrolls.

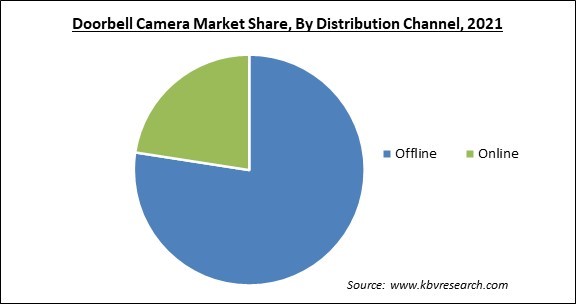

On the basis of distribution channel, the doorbell camera market is segmented into Offline and Online. The online segment recorded a substantial revenue share in the doorbell camera market in 2021. The vast majority of producers opt to sell their goods exclusively online since it offers them a higher profit margin and eliminates overhead expenses related to logistics, damaged products, and store maintenance. Customers have also been favoring online channels because the ratings and reviews left by past purchasers serve as unbiased validity for the performance of the product, assisting them in selecting the appropriate product.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 2 Billion |

| Market size forecast in 2028 | USD 4 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 10.3% from 2022 to 2028 |

| Number of Pages | 142 |

| Number of Tables | 240 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Market Share Analysis, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Product, Distribution Channel, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the doorbell camera market is analyzed across North America, Europe, Asia Pacific and LAMEA. The North America region garnered the highest revenue share in the doorbell camera market in 2021. The expansion of the regional doorbell camera industry can be due to Americans being more aware of the devices. The local cops and police also advised that people utilize video cameras because these tools not only serve to prevent criminals but also provide reliable proof of criminal activity. The majority of home builders include these cameras as a standard feature and install them before turning over the property.

Free Valuable Insights: Global Doorbell Camera Market size to reach USD 4 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Amazon.com, Inc., Panasonic Corporation, Legrand S.A., Vivint Smart Home, Inc., Napco Security Technologies, Inc., Raytheon Technologies Corporation, Assa Abloy AB, Hangzhou Hikvision Digital Technology Co., Ltd., Skybell Technologies, Inc., and Zmodo Technology Corporation, Ltd.

By Product

By Distribution Channel

By Geography

The global Doorbell Camera Market size is expected to reach $4.1 billion by 2028.

Rising Burglary And Crime Rates Which Led To A New Product Launch are driving the market in coming years, however, The Quality And Cost Of The Doorbell Camera Are A Major Concern restraints the growth of the market.

Amazon.com, Inc., Panasonic Corporation, Legrand S.A., Vivint Smart Home, Inc., Napco Security Technologies, Inc., Raytheon Technologies Corporation, Assa Abloy AB, Hangzhou Hikvision Digital Technology Co., Ltd., Skybell Technologies, Inc., and Zmodo Technology Corporation, Ltd.

The expected CAGR of the Doorbell Camera Market is 10.3% from 2022 to 2028.

The Offline segment acquired maximum revenue share in the Global Doorbell Camera Market by Distribution Channel in 2021 thereby, achieving a market value of $3 billion by 2028.

The North America market dominated the Global Doorbell Camera Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $1.3 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.