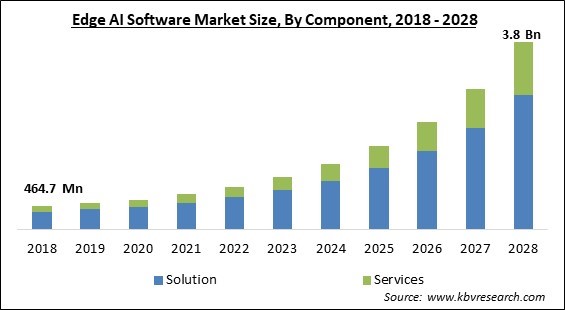

The Global Edge AI Software Market size is expected to reach $3.8 billion by 2028, rising at a market growth of 27.8% CAGR during the forecast period.

Edge AI software consists of numerous machine-learning algorithms which are executed on physical hardware. Running AI algorithms on a local machine or device is the premise. Because Edge AI software can connect to consumers without the usage of other systems or the internet, users may access data instantly. Artificial intelligence combined with edge computing is known as edge AI.

The machine learning methods used in Edge AI are executed right at the edge. Edge computing is the direct processing of data and information at the IoT unit or device or the edge. Because of its intrinsic benefits, such as real-time analytics, high speed, reduced latency, etc., edge computing is expanding quickly.

The machine learning techniques used in Edge AI systems can be run on current CPUs or even less powerful microcontrollers (MCUs) in edge devices. Edge AI offers higher performance while also consuming less power as compared to other applications that make use of highly effective AI devices.

Edge computing is the phrase for processing that considers a particular point of view. It brings data nearer to the equipment or point of information where it is most frequently required. Instead of being transported over vast distances to data centers or the cloud, edge computing enables IoT data to be handled close to its source. It relates to managing persistent data close to the data source, which is referred to as the association's "edge." It is linked to active applications as nearby as is practical to the location where the data is created rather than a cloud or data collection area.

The COVID-19 outbreak has significantly impacted sectors like aerospace, transportation, manufacturing, and food and beverage. The Covid-19 pandemic epidemic has had a devastating effect on a number of sectors, but it has had a favorable effect on the market for edge AI software. Numerous businesses and organizations had to close their doors in order to stop the deadly coronavirus from spreading. Many firms made the switch to adopting cutting-edge AI software during this time in order to fully automate work processes and to easily and remotely monitor the workflow. These elements have accelerated the market's vertical growth during the crisis.

Due to the quick uptake of cloud computing, everyday data transfers to the cloud are expected to result in an increase in cloud workloads. Organizations can store and retrieve data on edge nodes and devices that require a real-time reaction and are needed for a brief period of time, thanks to edge AI software solutions. With the rise of multiple applications across numerous industries, AI is expanding significantly. For tasks like real-time data processing and data capture, these apps need a lot of computational power to deliver effective and useful results.

The development of a 5G network will unite IT and telecom. With regard to delivering ultra-low latency throughout edge devices like drones, telesurgery equipment, self-driving cars, IoT gateways, etc., 5G is anticipated to emerge as a powerful technology enabler. Next-generation edge devices will proliferate as a result of the deployment and adoption of 5G, revolutionizing workload and productivity across several industries.

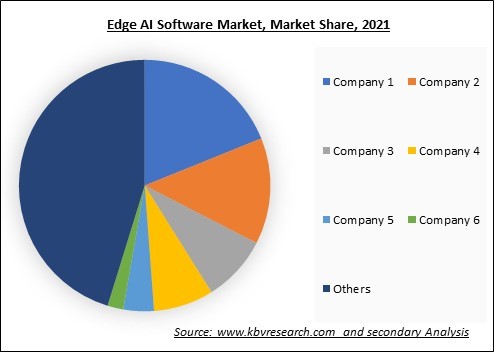

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The below illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

AI systems must be created, managed, and implemented by qualified professionals. The use of technologies like machine learning, cognitive computing, image recognition, and deep learning should be understood by everyone working with AI systems. Additionally, integrating AI technologies with current systems is a challenging undertaking that needs a lot of data processing. Even slight mistakes can cause a system to malfunction or fail, which can have an impact on how a process turns out. To modify an existing ML-enabled AI service, qualified data scientists and developers are needed.

On the basis of components, the market is divided into Solutions and Services. The Solutions category attained the highest market share in 2021. Edge AI software solutions help businesses automate administrative procedures, boost productivity, and cut expenses. In addition to training and consultation, system integration and testing, support and maintenance are among the services offered by Edge AI software solutions, which comprise both integrated and standalone solutions.

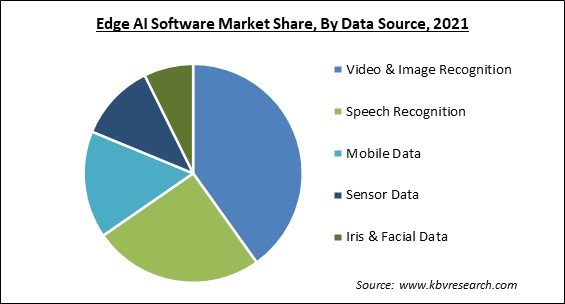

On the basis of data source, the market is divided into categories for video and image recognition, iris and facial data, mobile data, sensor data, and speech recognition. Mobile data is expected to have the highest CAGR in 2021 out of all the forecasted segments. As computing becomes more pervasive in all facets of life, phones, tablets, and wearable technology are able to do new tasks. To support the need for computationally intensive applications among mobile users, such as virtual reality and real-time online gaming, computing requirements for mobile applications are fast rising.

On the basis of organization size, the market is divided into large Enterprises and SMEs. During the anticipated timeframe, SMEs are showing encouraging growth. SMEs are businesses with between 1 and 1,000 employees, whereas large businesses have more than 1,000 employees. SMEs frequently lack the tools and resources necessary for efficient marketing orchestration in addition to having a small marketing budget. SMEs attempt to scale up their businesses on a tight budget using methods that maximize return on investment.

On the basis of deployment mode, the market is divided into On-premises and Cloud. In the market for edge AI software, the on-premises segment is displaying largest revenue share. There is a vast ecosystem of tools available that were created for on-site use and can operate with high levels of computational power, which is sometimes pricey in the cloud. Some clients believe that doing this on-site is more cost-effective, or they favor a capital expense model over an operational expense one.

On the basis of vertical, public and government sectors, manufacturing, healthcare and life sciences, energy and utilities, telecom, media and entertainment, transportation and logistics, and others. Healthcare & Life Sciences is projected to have a potential revenue share in 2021. By using more specific and precise real-time data processing, AI technology aids in the diagnosis and identification of a variety of ailments. A person's capacity to speak, move, engage, and react is limited by neurological illnesses. AI-based brain-computer interfaces can assist a person in carrying out basic tasks.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 716.9 Million |

| Market size forecast in 2028 | USD 3.8 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 27.8% from 2022 to 2028 |

| Number of Pages | 342 |

| Number of Tables | 574 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Data Source, Deployment Mode, Organization Size, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

On the basis of geography, the market is divided into North America, Europe, Asia Pacific, and LAMEA. During the anticipated time, North America's market will be the largest. Among all the geographical areas, North America has one of the highest rates of edge AI software use. The US and Canada are the top two nations fueling the expansion of the edge AI software market. Businesses in this region, particularly those in the US, have taken advantage of AI, ML, and deep learning technology to stay ahead of the competition.

Free Valuable Insights: Global Edge AI Software Market size to reach USD 3.8 Billion by 2028

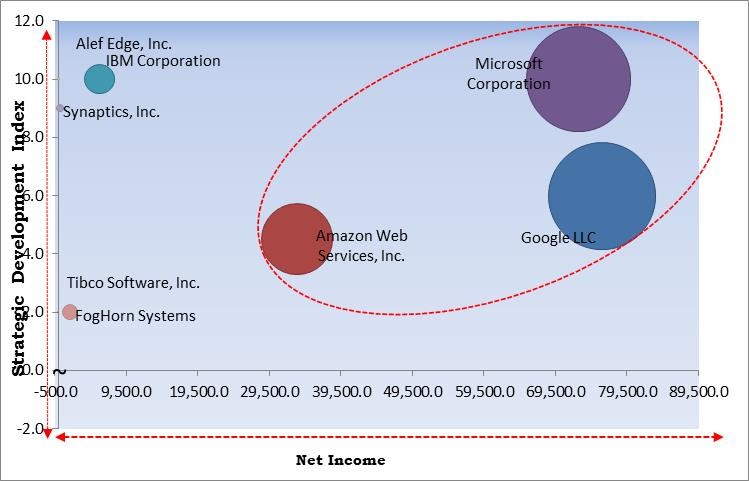

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Microsoft Corporation and Google LLC are the forerunners in the Edge AI Software Market. Companies such as Amazon Web Services, Inc., IBM Corporation, FogHorn Systems are some of the key innovators in Edge AI Software Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Microsoft Corporation, IBM Corporation, Google LLC, Amazon Web Services, Inc. (Amazon.com, Inc.), Nutanix, Inc., Tibco Software, Inc. (Vista Equity Partners), Synaptics, Inc., FogHorn Systems (Johnson Controls), Azion Technologies, Inc., and Alef Edge, Inc.

By Component

By Data Source

By Deployment Mode

By Organization Size

By Vertical

By Geography

The global Edge AI Software Market size is expected to reach $3.8 billion by 2028.

Enterprise Workloads Are Expanding Quickly In The Cloud are driving the market in coming years, however, Edge Ai Solutions Raise Privacy And Security Problems restraints the growth of the market.

Microsoft Corporation, IBM Corporation, Google LLC, Amazon Web Services, Inc. (Amazon.com, Inc.), Nutanix, Inc., Tibco Software, Inc. (Vista Equity Partners), Synaptics, Inc., FogHorn Systems (Johnson Controls), Azion Technologies, Inc., and Alef Edge, Inc.

The expected CAGR of the Edge AI Software Market is 27.8% from 2022 to 2028.

The Video & Image Recognition segment acquired maximum revenue share in the Global Edge AI Software Market by Data Source in 2021 thereby, achieving a market value of $1.5 billion by 2028.

The North America market dominated the Global Edge AI Software Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $1.5 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.