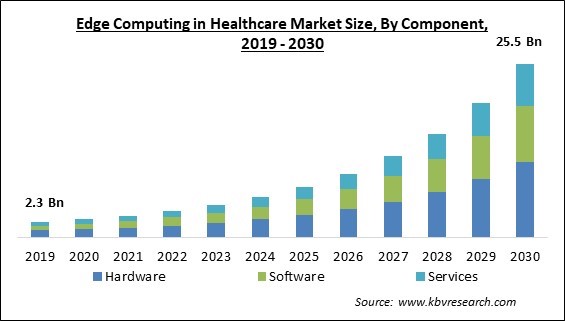

The Global Edge Computing in Healthcare Market size is expected to reach $25.5 billion by 2030, rising at a market growth of 26.9% CAGR during the forecast period.

Asia Pacific region has increased its focus on advancing networking technology during the COVID-19 outbreak, thereby APAC is expected to acquire more than 1/4th share of the market by 2030. A robust computing infrastructure is required due to the region's tremendous growth of the connected device ecosystem, which creates a lot of data. The use of 5G across the healthcare sector is also significantly increasing in regional countries, supporting the market expansion.

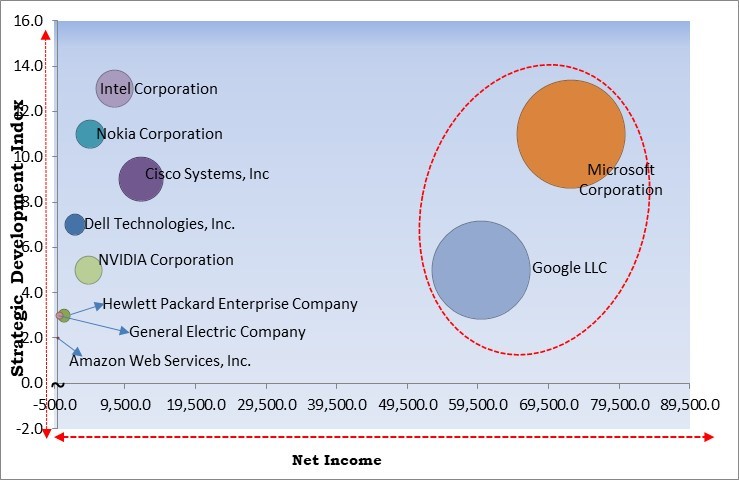

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For example, In May, 2023, Cisco Systems, Inc. teamed up with NTT Ltd. to develop solutions for operational efficiencies for their joint customers. The two companies would serve their joint customers with IoT services to accelerate their operational efficiencies. Additionally, In March, 2023, NVIDIA Corporation entered into a partnership with Medtronic to develop AI-powered patient care solutions. The partnership would provide the joint customers of the two companies with AI-powered solutions for better patient outcomes.

Based on the Analysis presented in the KBV Cardinal matrix; Microsoft Corporation and Google LLC are the forerunners in the Market. In April, 2023, Microsoft Corporation expanded its partnership with Cognizant to provide IoT solutions across the healthcare industry. The partnership would allow the two companies to provide their customers with interoperability solutions and claims management. Companies such as Intel Corporation, Nokia Corporation, Cisco Systems, Inc are some of the key innovators in the Market.

Healthcare businesses have begun to rely on centralized cloud computing & storage solutions because of the proliferation of IoT devices and the large rise in data that has resulted. There are latency and financial viability challenges when moving every aspect of IT to the cloud. Organizations utilizing IoT sensors, actuators, and other IoT devices are thus progressively seeking edge computing solutions, including edge nodes, devices, and hyper-localized data centers. Edge computing enhances the cloud paradigm by enabling data processing near the data source, enabling businesses to accelerate decision-making. The market is predicted to expand because of the increasing deployment of IoT medical devices.

Companies must reduce the time it takes to get connected to a service and the quantity of data they transfer to the cloud in the present business environment. The length of time a data packet needs to travel between two sites is referred to as a network's latency. Less latency leads to an increase in the data transfer rate. Remote patient monitoring is one example of a time-sensitive application that demands computation in real time. As a result, the market will grow in the approaching years.

The initial capital expense (CAPEX) needed for infrastructure is one of the main barriers to the adoption of edge computing solutions in healthcare settings. Healthcare firms with tight budgets are less likely to embrace edge computing systems because they need large investments in networking, hardware, and software. For instance, deploying edge computing systems for medical imaging necessitates significant investments in high-performance computing infrastructure, such as storage systems, servers, and networking tools. Medical imaging edge computing solutions with high performance are available from numerous vendors, although the initial CAPEX for these systems might be costly.

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

Based on component, the market is fragmented into hardware, software, and services. In 2022, the hardware segment dominated the market with maximum revenue share. When discussing edge computing in healthcare, the term "hardware" refers to the actual hardware utilized to make it possible. This comprises both networking or edge devices, like switches, routers, and gateways, as well as RFID sensors, tags, and gateways. Cloud infrastructure, including virtual machines, storage, and databases, can also be used with the market.

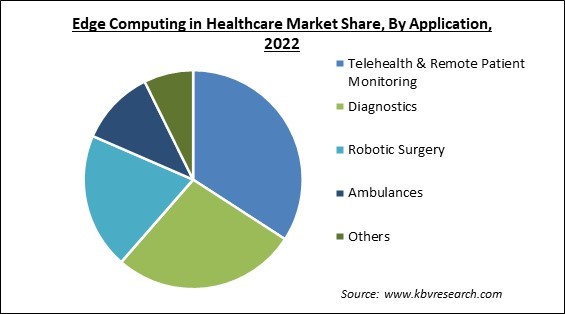

On the basis of application, the market is classified into diagnostics, telehealth & remote patient monitoring, robotic surgery, ambulances, and other applications. In 2022, the ambulances segment covered a considerable revenue share in the market. In the emergency care system, paramedics can only give emergency doctors a quick description of the patient. Therefore, these individuals can only obtain pertinent diagnostic procedures once the ambulance pulls up to the hospital. Due to its mobility, low latency, and data-processing capabilities, edge computing at the network edge can help local paramedics provide more effective and precise care and send more precise information on the state and location of patients arriving at the hospital.

By end user, the market is categorized into hospitals & clinics, long-term care centers & home care settings, ambulatory care centers, and others. The hospitals & clinics segment witnessed the largest revenue share in the market in 2022. This is due to their massive data production, which results from their large customer base and diverse geographic presence. Through faster, more effective decision-making and a reduction in the demand for IT infrastructure, edge computing is revolutionizing how hospitals & clinics manage their data. The effectiveness of healthcare systems as a whole is rising owing to this technology, which also helps enhance patient outcomes & patient satisfaction.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 3.9 Billion |

| Market size forecast in 2030 | USD 25.5 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 26.9% from 2023 to 2030 |

| Number of Pages | 284 |

| Number of Table | 383 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Market Share Analysis, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Application Type, Application, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region led the market by generating the highest revenue share in 2022. The region is witnessing growth due to factors like growing government or healthcare providers' investments in enhancing healthcare IT facilities, increasing cloud-based service adoption, and an increasing need for effective data management solutions. A further factor in the region's growth is the existence of significant edge computing providers.

Free Valuable Insights: Global Edge Computing in Healthcare Market size to reach USD 25.5 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Cisco Systems, Inc, Nokia Corporation, Dell Technologies, Inc., Amazon Web Services, Inc. (Amazon.com, Inc.), Google LLC (Alphabet Inc.), Microsoft Corporation, Intel Corporation, General Electric Company, Hewlett Packard Enterprise Company, and NVIDIA Corporation

By Component

By Application

By End User

By Geography

The Market size is projected to reach USD 25.5 billion by 2030.

Rising acceptance of IoT medical devices are driving the Market in coming years, however, Cost of CAPEX and OPEX associated with edge computing systems is expensive restraints the growth of the Market.

Cisco Systems, Inc, Nokia Corporation, Dell Technologies, Inc., Amazon Web Services, Inc. (Amazon.com, Inc.), Google LLC (Alphabet Inc.), Microsoft Corporation, Intel Corporation, General Electric Company, Hewlett Packard Enterprise Company, and NVIDIA Corporation

The Telehealth & Remote Patient Monitoring segment acquired the maximum revenue share in the Market by Application in 2022, thereby achieving a market value of $8.2 billion by 2030.

The North America region dominated the Market by Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $9.9 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.