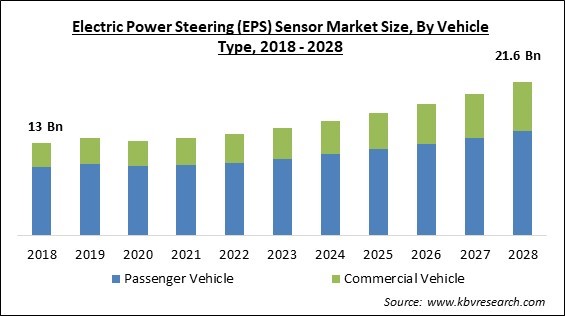

The Global Electric Power Steering (EPS) Sensor Market size is expected to reach $21.6 billion by 2028, rising at a market growth of 7.2% CAGR during the forecast period.

One essential component of highly automated driving is electric power steering (EPS). The steering of the vehicle is managed by the EPS' electric motor. With the use of an electric motor, the EPS manages and aids in vehicle steering and offers a satisfying and ideal steering sensation. The most recent control devices also offer security in case of mistakes.

The electronic interface enables SAE-Level 4 highly autonomous driving with the highest level of security. Due to a decrease in parasitic losses, EPS enhances vehicle handling, gives the driver directional control, and marginally boosts fuel efficiency. Another benefit of EPS is that a design can be software-modified for different automobile types or driving modes (e.g., sport vs. luxury.)

Although it is less expensive to construct EPS than conventional hydraulic systems, most vehicles still have a mechanical connection as a backup, such as a rack and a pinion steering. In the automotive industry, EPS is taking the place of hydraulic steering and is expected to eventually replace it as the standard steering method. With the use of an intelligent electric motor, electric power steering sensors control and aid in steering.

Based on the steering input from torque sensors, the control unit inside the EPS determines the appropriate steering support and sends the information to the electric motor to provide the necessary assistance. Before EPS, hydraulic power steering was frequently utilized. It required a pump, hoses, fluid, drive belt, and pulley to function. Since the EPS does not have these components, it is lighter and smaller than hydraulic steering systems. These components required space and added weight to the vehicle.

Manufacturing facilities all over the world were either shut down entirely or operated with limited constraints. As a result, during the pandemic, vehicle production eventually came to an end. Additionally, buyers were hesitant to buy cars and instead focused on their everyday requirements. As a result, a lack of demand for Electric Power Steering (EPS) Sensors contributed to the market downturn during the pandemic. However, the market opened with a boom in all regions due to the need for private automobiles and the recovery of the economy.

Motor, sensor, and steering column are a few of the parts that make up electric power steering (EPS), which is utilized in automobiles. In contrast to hydraulic power steering (HPS), which runs on engine power, electric power steering (EPS) employs an electric motor to help the driver guide the vehicle. Thus, reducing engine stress improves the engine's fuel economy. The Electric Power Steering (EPS) sensor continuously observes how the driver steers, accelerates, speeds, and moves the tires.

Both the manufacturing of cars and the demand for them are rising. Due to the increasing number of automobiles in various developing nations, the production of automotive balancing shafts for fuel efficiency has increased. Additionally, because consumers view automobiles as a necessity in their lives, the number of vehicles is steadily rising in many growing nations. Manufacturers of automobiles are also coming up with and creating models that are affordable while keeping the vehicle's performance and quality.

Exposure to extreme heat, the electric motor positioned on the steering column could cause the electric power steering to malfunction. It is also possible for a circuit to break or for moving parts to operate improperly when dirt, water, or other pollutants are introduced into the system. The incorrect performance of the sensor to detect the torque and other parameters will result from sensor failure brought on by heat or other reasons. Failure of the system results in problems like heavy or extremely difficult steering and the inability to steer or move the wheel in any direction.

On the basis of Type, the Electric Power Steering (EPS) Sensor Market is divided into Speed sensors, Steering Torque sensors, and Steering Wheel Position Sensor. The Steering Wheel Position Sensor segment acquired the highest revenue share in the Electric Power Steering (EPS) Sensor Market in 2021. It is because the steering shaft is home to the steering wheel position sensor, which measures the driver's input in steering motion.

Based on the Vehicle Type, the Electric Power Steering (EPS) Sensor Market is segmented into Passenger vehicles and Commercial Vehicle. The Passenger Vehicle segment garnered the largest revenue share in the Electric Power Steering (EPS) Sensor Market in 2021. It is because this technology is anticipated to be deployed in low-cost passenger cars. Because of these changes, the passenger car sub-segment now dominates the vehicle type sector and is expected to increase rapidly over the next few years.

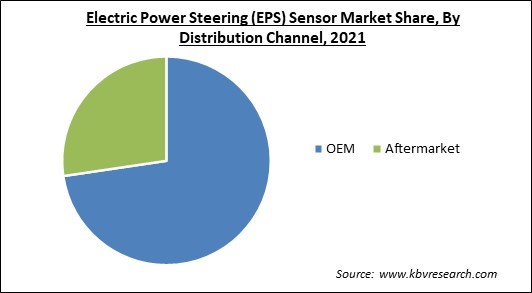

By Distribution Channel, Electric Power Steering (EPS) Sensor Market is classified into OEM, and Aftermarket. The Aftermarket segment recorded a significant revenue share in the Electric Power Steering (EPS) Sensor Market in 2021. It is due to the rising demand for updates to current vehicle electronics systems, which include EPS sensors. In contrast, the EPS-Motor Control Unit is increasingly being equipped with software updates that enable seamless integration of the unit with the vehicle after installation at the manufacturing facility.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 13.7 Billion |

| Market size forecast in 2028 | USD 21.6 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 7.2% from 2022 to 2028 |

| Number of Pages | 209 |

| Number of Tables | 330 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Vehicle Type, Distribution Channel, Type, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the Electric Power Steering (EPS) Sensor Market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific region acquired the largest revenue share in the Electric Power Steering (EPS) Sensor Market in 2021. Due to China's status as the largest car manufacturer in the world, Japan's and South Korea's status as the leading auto exporters, large-scale production, and considerable investments made in new vehicle technologies in the area, the EPS sensor market is predicted to increase over the projected period.

Free Valuable Insights: Global Electric Power Steering (EPS) Sensor Market size to reach USD 21.6 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Continental AG, Robert Bosch GmbH, NXP Semiconductors N.V., Infineon Technologies AG, TT electronics Plc, Denso Corporation, HELLA GmbH & Co. KGaA, Valeo SA, Sensata Technologies Holdings PLC, and Methode Electronics Inc.

By Vehicle Type

By Distribution Channel

By Type

By Geography

The Electric Power Steering (EPS) Sensor Market size is projected to reach USD 21.6 billion by 2028.

Electric Power Steering Sensor's Ability To Increase Fuel Efficiency are rising are driving the market in coming years, however, The Failure Of Electronic Power Steering restraints the growth of the market.

Continental AG, Robert Bosch GmbH, NXP Semiconductors N.V., Infineon Technologies AG, TT electronics Plc, Denso Corporation, HELLA GmbH & Co. KGaA, Valeo SA, Sensata Technologies Holdings PLC, and Methode Electronics Inc.

The expected CAGR of the Electric Power Steering (EPS) Sensor Market is 7.2% from 2022 to 2028.

The OEM segment acquired maximum revenue share in the Global Electric Power Steering (EPS) Sensor Market by Distribution Channel in 2021 thereby, achieving a market value of $15.1 billion by 2028.

The Asia Pacific market dominated the Global Electric Power Steering (EPS) Sensor Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $8.1 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.