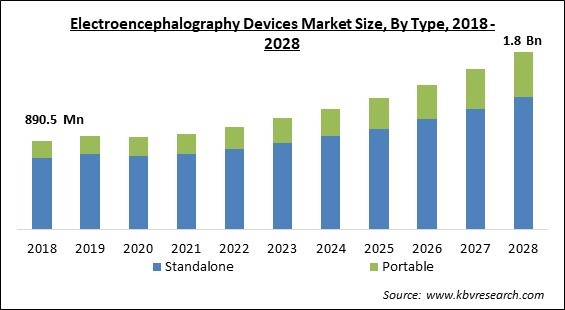

The Global Electroencephalography Devices Market size is expected to reach $1.8 billion by 2028, rising at a market growth of 9.5% CAGR during the forecast period.

Electroencephalography devices are utilized in monitoring and reviewing the electrical signals generated by the brain. These devices have electrodes that are attached to the scalp to register electrical activity. The outcomes from these devices are used in monitoring patients under anesthesia and those suffering from sleep disorders. The devices also aid in diagnosing various neurodegenerative brain disorders.

These devices are mainly used in diagnostic laboratories, hospitals, and ambulatory surgery centers and include EEG biofeedback machines or EEG neurofeedback machines. During the electroencephalography (EEG) of the brain, the electrogram recording the electrical activity is generated. The brain waves detected by the EEG device represent the pyramidal neurons’ postsynaptic potentials in the allocortex and neocortex. The EEG method is non-invasive as it involves attaching the electrodes all along the scalp with some adhesive.

The placement of these electrodes is governed by the 10-20 system or the international 10-20 system. The interpretation of brain wave recordings for clinical use is commonly done by quantitative or visual analysis of EEG recordings. The electrical activity in the brain produces minute voltages that are picked by the EEG devices.

Most EEG equipment comes with amplifiers, which help in the easy recognition of minute voltages and thus, help in producing accurate recordings. The transmission of ionic currents, which occur when the brain receives and processes information, from and among neurons brings changes in the voltages. These are then captured by the EEG devices. Besides amplifiers, EEG devices also contain filters, electrodes, and a converter that converts signals from analog to digital.

During the pandemic, an increase in the number of people suffering from sleep disorders and problems was recorded. This increase was because the pandemic worsened the working situation with most people working beyond the standard office hours. The lockdown restricted the hospitals and other healthcare facilities for admission of uninfected cases. This caused high cancellation rates of appointments and surgeries. Most infected patients with underlying brain disorders needed EEG devices for regular monitoring and thus, this maintained the demand of these devices in hospital and homecare settings. But other than that, the overall demand for the devices suffered negatively. Therefore, the COVID-19 pandemic had a negative impact on the electroencephalography devices market.

Lifestyle habits, genetic disorders, and certain chronic conditions propagate the incidences of neurovascular diseases. These are the diseases that are related to the brain, spine, and connecting nerves, and significantly impair and hinder their functioning. In the past few years, these diseases have become dominant. The most commonly found neurovascular diseases include stroke, brain tumors, and ischemic strokes. Sedentary lifestyles and a lack of exercise hinder the optimal intake of oxygen.

Most recent research has extrapolated the population numbers from countries and the world to quantify the rise of the aging population. Subsequently, the outcomes have established this age group to be one of the most prominent social transformations. As per the WHO, one in six people in the world will be over 60 years of age by 2030, and the population would increase to around 1.4 billion. And in 2050, the aging population would be almost double of what it was in 2020.

While EEGs offer a high temporal resolution, they deliver subpar results for spatial resolution. Even the data produced through the temporal resolution is inaccurate oftentimes and as such, can be considered less meaningful. Other techniques are able to display the active regions of the brain, while EEG necessitates the need for intense interpretation that would conclude and hypothesize the active regions for a specific response.

On the basis of type, the electroencephalography devices market is bifurcated into standalone devices and portable devices. The standalone segment acquired the largest revenue share in the electroencephalography devices market in 2021. Standalone EEG devices are implanted or fixed at a specific place and are mainly used in hospital settings. These systems include more software and hardware peripherals that allow the proper diagnosis of brain disorders. The applications of standalone EEG devices in critical care and intensive care units have made them the most common EEG device usage.

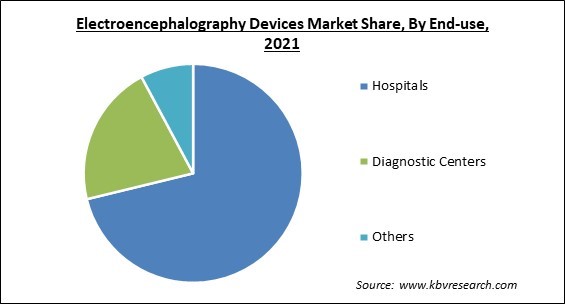

Based on end-use, the electroencephalography devices market is divided into hospitals, diagnostics centers, and others. The diagnostics segment garnered a prominent revenue share in the electroencephalography devices market in 2021. The growing awareness of people towards the impact of cognitive inactivity and brain disorders in daily life has increased the adoption of diagnostic services. As a consequence, the density of diagnostics centers has increased in most developed nations which in turn is propelling the demand for EEG devices and systems.

Based on product, the electroencephalography devices market is categorized into 8-channel EEG, 21-channel EEG, 25-channel EEG, 32-channel EEG, 40-channel EEG, and multi-channel EEG. The 32-channel EEG segment procured the highest revenue share in the electroencephalography devices market in 2021. The growth of the segment is attributable to the dominant use of 32-channel EEG in the diagnosis of various brain disorders. The increased efficiency of this product with 32 channels has made it an ideal EEG device, and as such many healthcare practitioners prefer the machine for regular monitoring and studies.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 965.6 Million |

| Market size forecast in 2028 | USD 1.8 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 9.5% from 2022 to 2028 |

| Number of Pages | 209 |

| Number of Tables | 368 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Product, End-use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

On the basis of region, the electroencephalography devices market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment procured the highest revenue share in the electroencephalography devices market in 2021. The growing incidence of neurodegenerative disorders and various other sleep and brain disorders is advancing the use of EEG devices in the region, which is thereby boosting the growth of the segment. The availability of advanced healthcare infrastructure and convenient diagnostic facilities have influenced more individuals to increase their efforts in taking care of themselves.

Free Valuable Insights: Global Electroencephalography Devices Market size to reach USD 1.8 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Medtronic PLC, Compumedics Limited, Natus Medical Incorporated (Archimed SAS), Nihon Kohden Corporation, Cadwell Industries, Inc., Neurowave Systems, Inc., Magstim EGI (Magstim, Inc.) and Noraxon U.S.A., Inc.

By Type

By End User

By Product

By Geography

The global Electroencephalography Devices Market size is expected to reach $1.8 billion by 2028.

Rising prevalence of neurovascular disorders are driving the market in coming years, however, Low spatial resolution and less meaningful results restraints the growth of the market.

Medtronic PLC, Compumedics Limited, Natus Medical Incorporated (Archimed SAS), Nihon Kohden Corporation, Cadwell Industries, Inc., Neurowave Systems, Inc., Magstim EGI (Magstim, Inc.) and Noraxon U.S.A., Inc.

The expected CAGR of the Electroencephalography Devices Market is 9.5% from 2022 to 2028.

The Hospitals market is leading the Global Electroencephalography Devices Market by End-use in 2021; thereby, achieving a market value of $1.2 billion by 2028.

The North America market dominated the Global Electroencephalography Devices Market by Region in 2021; thereby, achieving a market value of $695.2 million by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.