“Global Electronic Manufacturing Services (EMS) Market to reach a market value of USD 796.3 Billion by 2030 growing at a CAGR of 7.1%”

The Global Electronic Manufacturing Services (EMS) Market size is expected to reach $796.3 billion by 2030, rising at a market growth of 7.1% CAGR during the forecast period.

Modern vehicles have an ever-increasing array of electronic components, from advanced driver assistance systems (ADAS) and infotainment systems to engine control units (ECUs) and sensors. The proliferation of electronic content in vehicles has led to a higher demand for EMS services as automotive manufacturers seek specialized expertise in producing these sophisticated components. Consequently, the automotive segment would attain nearly 17% of the total market share by 2030. EMS providers collaborate closely with automotive manufacturers to optimize supply chain logistics, ensuring the timely and efficient delivery of electronic components. Therefore, these factors will help expand the segment.

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, in February, 2023, Compal Electronics, Inc. signed a partnership with Lanner Electronics. The solution features Compal’s O-RAN inline acceleration card and Lanner’s DU/CU network appliances and would deliver a fully separated and programmable 5G RAN platform with high efficiency in power consumption and data transfer. Moreover, in January, 2020, Benchmark Electronics, Inc. signed a partnership with Rohde & Schwarz. Under the partnership, Benchmark Electronics would use its manufacturing expertise to help Rohde & Schwarz meet the growing demand for its products.

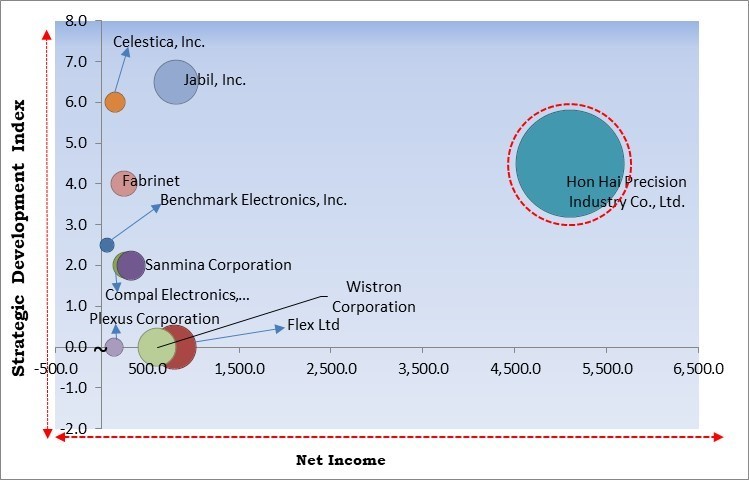

Based on the Analysis presented in the KBV Cardinal matrix; Hon Hai Precision Industry Co., Ltd. is the forerunner in the Market. Companies such as Jabil, Inc., Fabrinet and Sanmina Corporation are some of the key innovators in Market. In February, 2023, Jabil, Inc. partnered with Mavenir, a cloud-native network software provider. Under the partnership, Jabil would manufacture MIMO (mMIMO) radios for Mavenir.

OEMs are able to focus on their fundamental competencies, including product design, research and development, marketing, and customer service, by delegating manufacturing to EMS providers. By offloading the manufacturing process, OEMs can allocate more resources to activities directly contributing to their competitive advantage. In addition, EMS providers offer flexibility in terms of production volume and can quickly scale up or down based on changes in demand. This is especially beneficial for OEMs operating in industries with dynamic market conditions and rapidly changing customer preferences. Thus, these aspects will boost the demand for these services.

EMS providers typically invest in staying abreast of the latest technological advancements. This includes expertise in emerging manufacturing technologies, materials, and processes. OEMs benefit from partnering with EMS providers that can seamlessly integrate these advancements into their production processes. In addition to engineering and design expertise, the electronics industry also demands assembly and quality control proficiency. EMS providers often have a skilled workforce with expertise in various technical domains, enabling them to handle the complexities of manufacturing increasingly sophisticated electronic products. Thus, these factors will assist in the expansion of the market.

Global demand and supply fluctuations for raw materials, such as semiconductors, metals, and specialized components, can lead to shortages. This scarcity can result from factors like increased demand, production issues, or geopolitical events affecting the sources of raw materials. Furthermore, ensuring the quality of components from various suppliers is crucial. Inconsistent quality standards across the supply chain can lead to defects, rework, and production delays. Depending on a single supplier for critical components poses a risk. Hence, these factors can lead to reduced demand for these services.

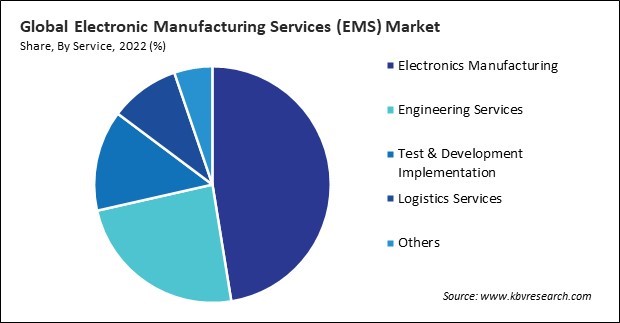

Based on service, the market is segmented into electronics manufacturing, engineering services, test & development implementation, logistics services, and others. The engineering services segment acquired a significant revenue share in the market in 2022. As electronic products become more sophisticated and technologically advanced, the complexity of their design and manufacturing processes has increased. OEMs often lack the in-house expertise or resources to handle intricate engineering tasks. EMS providers offering specialized engineering services bridge this gap, providing comprehensive support in designing complex electronic components and systems. These factors will boost the demand in the segment.

Based on industry, the market is divided into consumer electronics, automotive, heavy industrial manufacturing, aerospace & defense, healthcare, IT & telecom, and others. The aerospace and defense segment witnessed a substantial revenue share in the market in 2022. Growing geopolitical tensions and an increased focus on defense capabilities have led to a surge in demand for military electronics. This includes producing electronic components for communication systems, surveillance equipment, electronic warfare systems, and guided missile systems. EMS providers are instrumental in meeting the defense sector's stringent requirements regarding reliability, precision, and adherence to military standards. Thus, the segment will grow rapidly in the upcoming years.

Free Valuable Insights: Global Electronic Manufacturing Services (EMS) Market size to reach USD 796.3 Billion by 2030

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment procured the highest revenue share in the market in 2022. Asia Pacific has long been recognized as a global manufacturing hub, with countries like China, Japan, South Korea, and Taiwan at the forefront. The region's dominance in electronics manufacturing is attributed to its well-established infrastructure, skilled labor force, and the presence of major original equipment manufacturers. EMS providers in APAC have capitalized on this ecosystem, offering cost-effective and efficient manufacturing solutions. Hence, these factors will lead to increased growth in the segment.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 465.2 Billion |

| Market size forecast in 2030 | USD 796.3 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 7.1% from 2023 to 2030 |

| Number of Pages | 246 |

| Number of Tables | 323 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Service, Industry, Region |

| Country scope |

|

| Companies Included | Sanmina Corporation, Hon Hai Precision Industry Co., Ltd., Benchmark Electronics, Inc., Flex Ltd, Jabil, Inc., Celestica, Inc., Plexus Corporation, Fabrinet, Compal Electronics, Inc. and Wistron Corporation |

By Service

By Industry

By Geography

This Market size is expected to reach $796.3 billion by 2030.

Increasing trends among original equipment manufacturers to outsource are driving the Market in coming years, however, Concerns related to supply chain disruptions restraints the growth of the Market.

Sanmina Corporation, Hon Hai Precision Industry Co., Ltd., Benchmark Electronics, Inc., Flex Ltd, Jabil, Inc., Celestica, Inc., Plexus Corporation, Fabrinet, Compal Electronics, Inc. and Wistron Corporation

The expected CAGR of this Market is 7.1% from 2023 to 2030.

The Electronics Manufacturing segment led the Market by Service in 2022; there by, achieving a market value of $350.8 billion by 2030.

The Asia Pacific region dominated the Market by Region in 2022, and would continue to be a dominant market till 2030; there by, achieving a market value of $306.9 Billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges