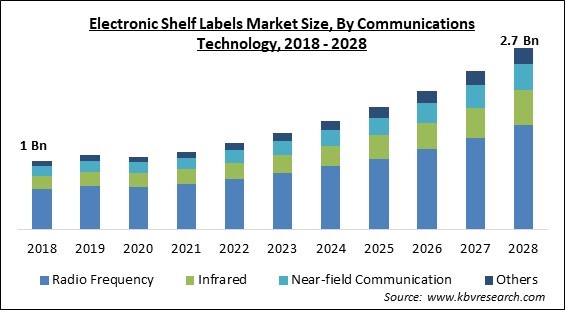

The Global Electronic Shelf Labels Market size is expected to reach $2.7 billion by 2028, rising at a market growth of 13.1% CAGR during the forecast period.

The market for electronic shelf labels is expanding due to the retail sector's trend toward automation. Also, the need for less time-consuming, more affordable alternatives to paper labels drives the market's expansion. In addition, using electronic shelf labels has boosted operating efficiency and enabled real-time product placement, all driving the growth of the electronic shelf label market. Moreover, it is anticipated that poor return on investment would restrain the expansion of the electronic shelf label market.

The growth of supermarkets and hypermarkets has significantly impacted the retail sector, driving increased demand for retail equipment and gadgets like computerized shelf labels. Moreover, real-time product placement, pricing optimization for retail outlets, retail automation trends under its digitization, and improved operational efficiency are often important market drivers.

Internet of Things (IoT) proliferation and rising retail sector digitalization continue to impact market expansion. Supermarkets and hypermarkets have seen a rapid increase thanks to the retail sector's ongoing rise in established and developing nations throughout the globe. In addition, self-checkout terminals, self-checking robots, electronic shelf labeling, and other related technology enabled merchants to increase their profit margins in the retail sector.

The need for electronic shelf labels is anticipated to be fueled by the direct association between several macroeconomic variables, most notably growing urbanization, GDP per capita and economic growth increases, and total sales of products and commodities. Also, in the following years, developing retail infrastructure will provide opportunities for the development of producers of electronic shelf labels.

The COVID-19 pandemic outbreak has had a significant negative influence on the market for electronic shelf labels. In addition, several countries have imposed and extended lockdowns, which has caused industry and manufacturing facilities worldwide to shut down due to crises and a lack of labor. As a result, it is determined that the market experienced a decline between 2019 and 2020 after taking into consideration the opinions of numerous industry experts from different segments of the value chain, including OEMs, integrators, suppliers, end users, and distributors, as well as the financial results of other businesses in the electronic shelf label ecosystem.

Consumers are growing more price-sensitive and price-aware, increasing the need for smooth price changes and fueling demand for retail automation solutions like ESLs. Furthermore, in the next five years, there will likely be a significant increase in demand for ESLs due to retailers' propensity to save operating expenses by eliminating manual tasks in shops. Also, rising consumer spending power and developing economies like China, South Korea, Italy, etc. are encouraging greater worldwide use of retail automation technologies.

Product labels were traditionally produced for each item at a retail business. They might be printed and tagged onto the item, put on windows or other bigger displays, or fastened on the shelf above or below the product display. But, technology is advancing, and electronic shelf labels provide several significant advantages. Recent years have seen many technological advancements in the retail sector due to the development of artificial intelligence. Among these modifications, ESL has replaced conventional paper labels and become the go-to option for fresh retail ventures.

There is a considerable barrier to entry presented by the ready availability of cheap labor in nations like India, China, South Korea, and South Africa, which is preventing the implementation of innovative retail solutions. The availability of large and low-cost labor in these places is anticipated to limit the economic value of modern retail solutions. In addition, the implementation of retail automation solutions in retail establishments, such as the use of ESLs, necessitates the modernization of the infrastructure already in place, which substantially adds to the overall cost of installation. This is because there is an abundance of low-priced labor available.

By component, the electronic shelf labels market is segmented into displays, batteries, transceivers, microprocessors, and others. In 2021, the batteries segment projected a prominent revenue share in the electronic shelf labels market. This is because battery-operated electronic shelf labels are adaptable, simple to use, and can be mounted on shelves or peg wall hooks in close-fitting spaces.

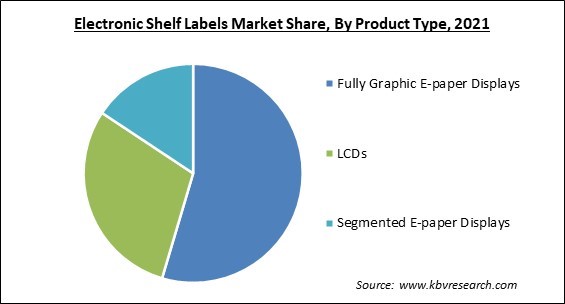

Based on product type, the electronic shelf labels market is categorized into LCDs, segmented e-paper displays, and fully graphic e-paper displays. The full graphics e-paper displays segment held the highest revenue share in the electronic shelf labels market in 2021. This sector has seen significant development by offering pricing changes at any time, facilitating stock management, and streamlining customer interactions, reassignments, and firmware upgrades by a simple touch on an NFC-enabled smartphone. In addition, label tags with these ESLs often include promotional advertising, special typefaces, barcodes, and QR codes.

On the basis of communications technology, the electronic shelf labels market is fragmented into radio frequency, infrared, near-field communication and others. The near-field segment acquired a substantial revenue share in the electronic shelf labels market in 2021. Electronic shelf labels with near-field communication (NFC) capabilities are expected to become the most popular technology among consumers and businesses. By providing dynamic product pricing and promotional updates and streamlining consumer interactions with NFC-enabled devices, NFC technology supports enhanced stock management.

By display size, the electronic shelf labels market is bifurcated into less than 3 inches, 3 to 7 inches, 7 to 10 inches, and more than 10 inches. The less than 3 inches segment dominated the electronic shelf labels market in 2021 with the maximum revenue share. The rise in demand for price automation from tier I and tier II retailers, which heavily relies on labels of such sizes because to the abundance of retail goods and SKUs in the shops, may be contributed to the segment's rise.

Based on application, the electronic shelf labels market is classified into retail and industrial. The industrial segment recorded a remarkable revenue share in the electronic shelf labels market in 2021. The use of electronic labels for shelf labeling will be influenced by the growing use of Internet of Things (IoT) technology in industrial facilities to enhance asset tracking. A single platform may now be used to remotely operate an increasing number of linked devices due to Industry 4.0. Electronic rack labels are significant in achieving an excellent inventory control and management system.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 1.2 Billion |

| Market size forecast in 2028 | USD 2.7 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 13.1% from 2022 to 2028 |

| Number of Pages | 302 |

| Number of Table | 560 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Product Type, Communications Technology, Application, Display Size, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the electronic shelf labels market is analyzed across North America, Europe, Asia Pacific and LAMEA. In 2021, the Europe region led the electronic shelf labels market by generating maximum revenue share. Early adopters of ESLs for retail and industrial applications include Europe. Also, multiple major market companies that provide ESLs and the rising cost of living in the area are additional factors fostering market expansion. European retailers are putting much effort into using automated retail solutions like ESLs to drastically save operating expenses in their establishments.

Free Valuable Insights: Global Electronic Shelf Labels Market size to reach USD 2.7 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include SES-Imagotag (BOE Technology Group Co., Ltd.), Opticon Sensors Europe B.V., Pricer AB, Displaydata Limited, M2Comm, Rainus Co., Ltd., Shanghai Sunmi Technology Co., Ltd., Hanshow Technology Co. Ltd., Solum Co., Ltd, and Teraoka Seika Co., Ltd.

By Component

By Product Type

By Communications Technology

By Application

By Display Size

By Geography

The global Electronic Shelf Labels Market size is expected to reach $2.7 billion by 2028.

Rising inclination of retail automation are driving the market in coming years, however, Low labour costs in developing economies are a constraint restraints the growth of the market.

SES-Imagotag (BOE Technology Group Co., Ltd.), Opticon Sensors Europe B.V., Pricer AB, Displaydata Limited, M2Comm, Rainus Co., Ltd., Shanghai Sunmi Technology Co., Ltd., Hanshow Technology Co. Ltd., Solum Co., Ltd, and Teraoka Seika Co., Ltd.

The Radio Frequency segment acquired maximum revenue share in the Global Electronic Shelf Labels Market by Communications Technology in 2021 thereby, achieving a market value of $1.6 billion by 2028.

The Display segment is leading the Global Electronic Shelf Labels Market by Component in 2021 thereby, achieving a market value of $951.6 Million by 2028.

The Europe market dominated the Global Electronic Shelf Labels Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $915.4 Million by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.