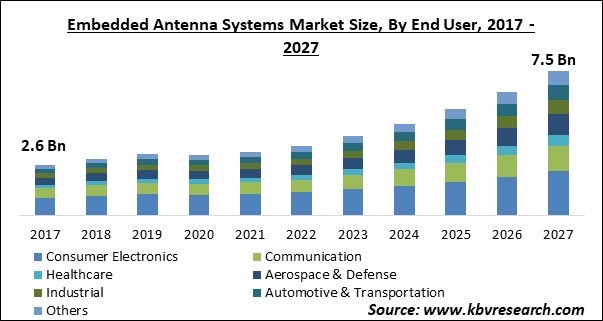

The Global Embedded Antenna Systems Market size is expected to reach $7.5 billion by 2027, rising at a market growth of 14.7% CAGR during the forecast period.

Embedded antennas are a type of antenna that makes use of metamaterials to boost the performance of small antenna systems. The goal of these antennas, like any other electromagnetic antenna, is to introduce energy into space. Furthermore, metamaterials are materials created with unique, typically microscopic patterns to provide strange physical characteristics, which are used in this kind of antenna.

Metamaterials in antenna designs can increase the antenna's radiated power. The majority of the signal is reflected back to the source by conventional antennas, which are quite tiny in comparison to the wavelength. Due to its innovative construction, a metamaterial antenna seems to be much larger because it retains and re-radiates energy.

The outbreak of the COVID-19 pandemic has significantly impacted various domains of business. COVID-19 had an influence not only on the operations of industries that provide diverse embedded components and solutions, but also on businesses that use these goods and solutions. Lockdown has a worldwide impact on the semiconductor sector because of the reduced demand for consumer electronics.

The continued decline in worldwide sales and export shipments for automobiles is projected to have a negative impact on the semiconductor market. The healthcare industry, on the other hand, is projected to gain from the COVID-19 pandemic, as the need for ventilators and other modern medical equipment grows globally.

Due to the availability of numerous smart goods for home and industrial uses, the Internet of Things (IoT) ecosystem is rapidly expanding. Smart homes, industrial internet, smart grids, and linked autos are just a few of the IoT application areas. Embedded antennas are compact, making them the optimum choice for low-frequency applications and IoT solutions with smaller designs. As a result, integrated antennas are in great demand from a variety of IoT applications. By leveraging the widespread deployment of cellular networks, cellular IoT gives the quickest approach to develop an IoT system internationally.

The wireless communication industrial innovations, like long-term evolution (LTE), greater usage of smart devices, enhanced mobility, and rapid rise in mobile data traffic, are driving demand for embedded antennas. New wireless technologies like LTE and 5G, that are the rapidly growing mobile technologies and are expected to continue to advance in the future, which would require more spectrum and energy. High-speed internet access has become one of the most critical characteristics in digitally sophisticated workplaces as the volume of connected devices grows.

OEMs are forced to develop numerous SKUs of the same IoT devices linked to wide area network (WAN) technology due to differences in spectrum allotment between countries. As 2G and 3G networks are faded out and devices shift to LTE and 5G, a technology with far more than 40 frequency bands, is projected to continue. The number of spectral bands that OEMs must consider for antenna design is growing with 5G.

Using active antenna tuning, smartphone makers may reduce the requirement for various SKUs. Even yet, distinct product SKUs are required for different locations by these firms. Although it is becoming more common, IoT devices are less complicated and seldom incorporate active antenna adjustment.

Based on End User, the market is segmented into Consumer Electronics, Communication, Healthcare, Aerospace & Defense, Industrial, Automotive & Transportation and Others. Communication segment acquired a substantial revenue share in embedded antenna systems market in 2020. In a communication system, an antenna is critical. It's utilised for both transmitting and receiving radio frequency signals. An antenna, in reality, is a structure capable of radiating or receiving electromagnetic waves, depending on the situation.

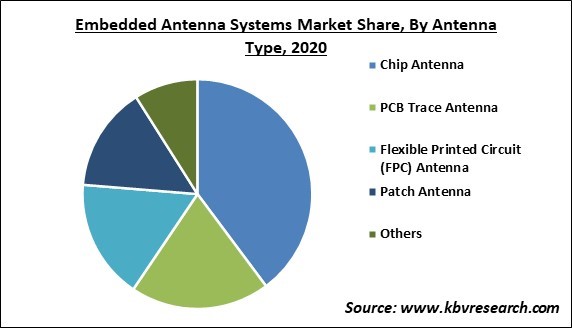

Based on Antenna Type, the market is segmented into Chip Antenna, PCB Trace Antenna, Flexible Printed Circuit (FPC) Antenna, Patch Antenna, and Others. PCB Trace Antenna segment procured a significant revenue share in the embedded antenna systems market in 2020. The Embedded PCB antennas are meant to be quickly connected to the inside of the enclosure via an adhesive pad, providing stable performance and the flexibility of fitting away from other RF-prone components. Due to this, the demand for PCB trace antenna would witness a spike over the forecast period.

Based on Connectivity, the market is segmented into LPWAn, Cellular, RFID, GNSS/GPS, Wi-Fi/Bluetooth and Others. The cellular segment garnered a significant revenue share in embedded antenna systems market in 2020. Antennas are a critical component of every wireless system, including cellular phones. An antenna in a wireless system converts guided radio wave energy into energy that is emitted or radiated into free space. Due to this increasing usage of antenna in cellular network, the demand for these systems would witness a rise during the forecast period.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 3.1 Billion |

| Market size forecast in 2027 | USD 7.5 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 14.7% from 2021 to 2027 |

| Number of Pages | 266 |

| Number of Tables | 443 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Antenna Type, Connectivity, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. Asia Pacific emerged as the leading region. It is owing to the factors like strong manufacturing sector and high advancements in the various telecom and IT technologies.

Free Valuable Insights: Global Embedded Antenna Systems Market size to reach USD 7.5 Billion by 2027

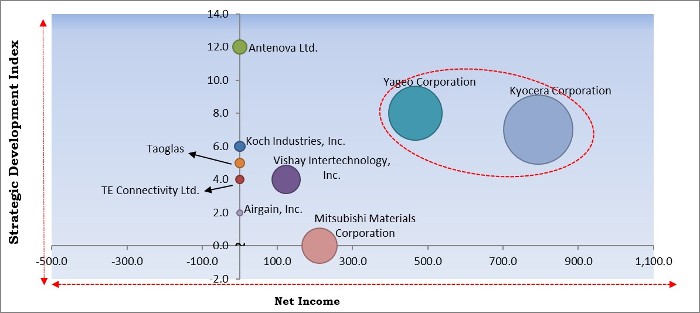

The major strategies followed by the market participants are Acquisitions. Based on the Analysis presented in the Cardinal matrix; Yageo Corporation and Kyocera Corporation are the forerunners in the Embedded Antenna Systems Market. Companies such as Vishay Intertechnology, Inc., Koch Industries, Inc. and Antenova Ltd. are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Vishay Intertechnology, Inc., Yageo Corporation, Koch Industries, Inc. (Molex LLC), Kyocera Corporation, Taoglas, Airgain, Inc., Mitsubishi Materials Corporation, Antenova Ltd., Walsin Technology Corporation, and TE Connectivity Ltd.

By End User

By Antenna Type

By Connectivity

By Geography

The embedded antenna systems market size is projected to reach USD 7.5 billion by 2027.

Rising application of embedded antenna in Internet of Things (IOT) devices are driving the market in coming years, however, requirement for reduction of stock-keeping units (SKUs) limited the growth of the market.

Vishay Intertechnology, Inc., Yageo Corporation, Koch Industries, Inc. (Molex LLC), Kyocera Corporation, Taoglas, Airgain, Inc., Mitsubishi Materials Corporation, Antenova Ltd., Walsin Technology Corporation, and TE Connectivity Ltd.

The Chip Antenna market shows high market share in the Global Embedded Antenna Systems Market by Antenna Type 2020, and would continue to be a dominant market till 2027.

The LPWAn market generating high revenue the Global Embedded Antenna Systems Market by Connectivity 2020, and would continue to be a dominant market till 2027.

The Asia Pacific market region shows high market in the Global Embedded Antenna Systems Market by Region 2020, and would continue to be a dominant market till 2027.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.