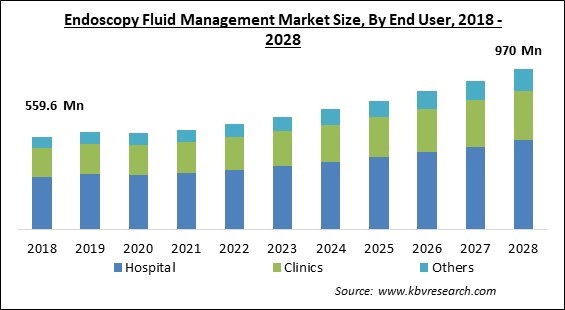

The Global Endoscopy Fluid Management Market size is expected to reach $970 Million by 2028, rising at a market growth of 7.2% CAGR during the forecast period.

Endoscopy fluid management is a medical device that assists in managing fluids during endoscopic procedures. These systems generally contain a suction device, a fluid collection unit, and a disposable fluid system. the fluid collection unit collects and stores fluid during endoscopic procedures. The suction device are used to remove fluids from the patient’s body and carry them to the fluid collection unit. The disposable fluid system treats and disposes of the collected fluids in a manner that is environment friendly.

An endoscopy fluid management system is required in all endoscopy procedures, including laparoscopy, arthroscopy, hysteroscopy, and urology. A laparoscopy is a surgical, diagnostic procedure conducted utilizing laparoscopy and aids in evaluating the organs inside the abdomen. It’s a minimally invasive procedure that needs only small incisions. In hysteroscopy, systemic absorption of the uterine distension fluid occurs majorly through disrupted endometrial and myometrial venous sinuses due to the pressure gradient between the uterine cavity and open vessels or sinuses.

The increased fluid absorption is linked with high intrauterine pressure, deep myometrial penetration, higher intrauterine pressure, and large uteri. Urology endoscopies are done to diagnose the issues related to the urinary tract. Endoscopies come in two forms one is ureteroscopy, and the other is cystoscopy. A cystoscopy utilizes a cystoscope to look inside the bladder and urethra, whereas a ureteroscopy utilizes a ureteroscopy to look inside the ureters and kidneys.

With technological advancements, it is possible to conduct invasive urological surgeries. Lower risk of complications and high efficiency characterizes them. For instance, the removal of kidney stones through the urethra. A medical pump is designed to deliver fluid under pressure to an operating area during endoscopy. Arthroscopy aids in treating anterior cruciate ligament (ACL) injury, a significant injury in professional sports. Fluid management system pressure is set as low as possible or per the requirement to obtain a view.

COVID-19 has put the healthcare system under stress around the world. The pandemic has altered how medical device manufacturers and healthcare providers approach endoscopy fluid management systems. The COVID-19 pandemic affected numerous sub-specialists and procedure-related fields such as gastroenterology. A considerable number of hospitals and clinics were restructured to raise their capacity for the patient diagnosed with COVID-19. In addition, a significant proportion of these endoscopic procedures were affected due to the lockdowns, which is expected to have a negative impact on the growth of the endoscopy fluid management market.

Surgeries which are minimally invasive are much less traumatic than conventional open surgeries. Surgeries performed with traditional laparoscopic instruments were traumatic and complex. But in minimally invasive surgeries, laparoscopic cameras are inserted through smaller incisions, and small specialized instruments are utilized to perform the operation. The recovery is also less painful, and patients recover faster. The popularity of these surgeries are increasing due to the quicker recovery, smaller incisions, high accuracy, shorter hospital stays, and less scarring & pain. In addition, these medical displays provide even the most negligible difference in cells and tissues, ensure superior visibility, and enable rapid and precise surgery. This supports the growth of the regional market.

It was seen that the burden of GI cancers has continued to shift towards economically developing nations which usually have fewer healthcare resources to manage the rising incidence. The number of new cases and death for each type of the five major types of GI cancers are expected to increase. This cancer is also associated with infection, tobacco smoking, diet, physical inactivity, alcohol consumption, and obesity. The increasing cases of GI cancers, especially in developing countries, will surge the utilization of endoscopy fluid management, boosting the market expansion in the projected period.

Patients undergoing endoscopy are generally provided with anesthetic or are mildly sedated as the procedure might be uncomfortable or painful to many patients, while almost all individuals undergoing a CT scan don’t require any sedation. In addition, CT scans can be done on people of nearly every age, while most endoscopy procedures are done on adults. The painlessness and the requirement of no type of sedatives in the CT scans might make them a better alternative to endoscopy; hence the market growth for endoscopy fluid management is expected to hinder.

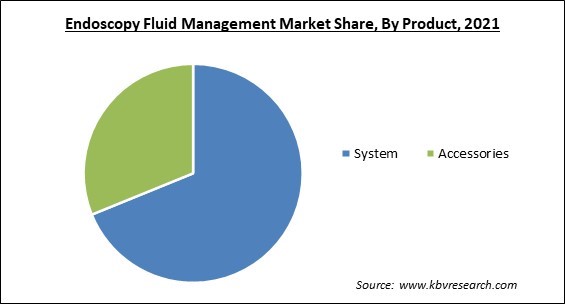

Based on product, the endoscopy fluid management market is segmented into system and accessories. The accessories segment acquired a substantial revenue share in the endoscopy fluid management market in 2021. This is due to the usage of these accessories to provide treatment or collect tissue samples. An endoscope has a channel through which the doctor can insert tools into the patient's body. These tools include flexible forceps, which take the tissue sample; biopsy forceps which are used to remove any suspicious growth; cytology brushes which take the cell sample and suture removal forceps, which are used to remove stitches inside the body.

On the basis of application, the endoscopy fluid management market is divided into laparoscopy, hysteroscopy and others. The laparoscopy segment held the highest revenue share in the endoscopy fluid management market in 2021. This is because of the increasing number of laparoscopy procedures. Many individuals are now opting for minimally invasive procedures for diagnosis and treatment. In addition, the rising geriatric population globally is further increasing the demand for endoscopy fluid management systems. These factors are anticipated to propel the segment’s growth during the projected period.

By end user, the endoscopy fluid management market is classified into hospital, clinics and others. The hospital segment led the endoscopy fluid management market by generating the maximum revenue share in 2021. This is due to the rising number of patient admissions for numerous surgical procedures in such healthcare settings. There is an increase in endoscopy procedures and the development of advanced hospitals. Also, many governmental bodies are now concentrating on enhancing the capacity for surgical procedures. These factors are anticipated to surge the expansion of the segment.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 601.4 Million |

| Market size forecast in 2028 | USD 970 Million |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 7.2% from 2022 to 2028 |

| Number of Pages | 198 |

| Number of Table | 344 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Product, Application, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the endoscopy fluid management market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region generated the highest revenue share in the endoscopy fluid management market in 2021. This is due to the assistance provided by these systems in maintaining precise pressure to decrease the bleeding in internal cavities during endoscopic procedures. Utilizing high-tech devices enhances treatment compliance. The region also has highly skilled medical professionals, high-tech technology, and a robust healthcare infrastructure. Also, many policies by the government to further enhance the sector is expected to increase their utilization and propel the market growth in the region.

Free Valuable Insights: Global Endoscopy Fluid Management Market size to reach USD 970 Million by 2028

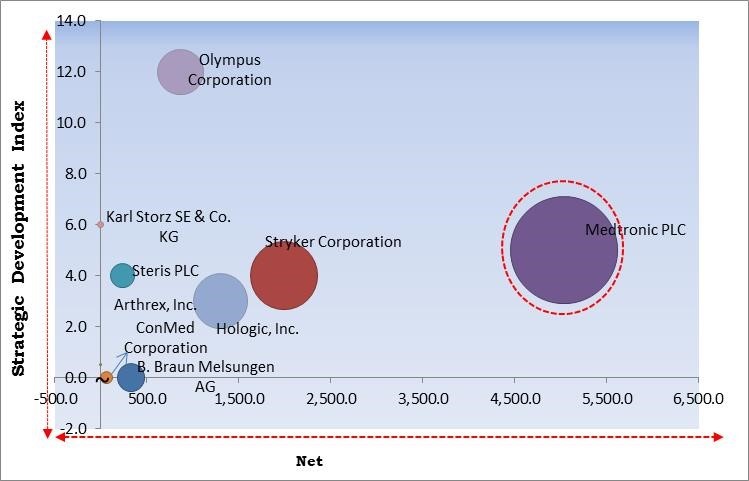

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Medtronic PLC is the forerunners in the Endoscopy Fluid Management Market. Companies such as Olympus Corporation, Stryker Corporation, Hologic, Inc. are some of the key innovators in Endoscopy Fluid Management Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Medtronic PLC, Olympus Corporation, Steris PLC, B. Braun Melsungen AG, Stryker Corporation, Hologic, Inc., ConMed Corporation, Karl Storz SE & Co. KG, Arthrex, Inc., and COMEG Medical Technologies (Acteon Group).

By Application

By Product

By End User

By Geography

The global Endoscopy Fluid Management Market size is expected to reach $970 Million by 2028.

The increasing number of minimally invasive surgeries are driving the market in coming years, however, Alternatives to endoscopy restraints the growth of the market.

Medtronic PLC, Olympus Corporation, Steris PLC, B. Braun Melsungen AG, Stryker Corporation, Hologic, Inc., ConMed Corporation, Karl Storz SE & Co. KG, Arthrex, Inc., and COMEG Medical Technologies (Acteon Group).

The expected CAGR of the Endoscopy Fluid Management Market is 7.2% from 2022 to 2028.

The System segment acquired maximum revenue share in the Global Endoscopy Fluid Management Market by Product in 2021 thereby, achieving a market value of $655.8 Million by 2028.

The North America market dominated the Global Endoscopy Fluid Management Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $349.5 Million by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.