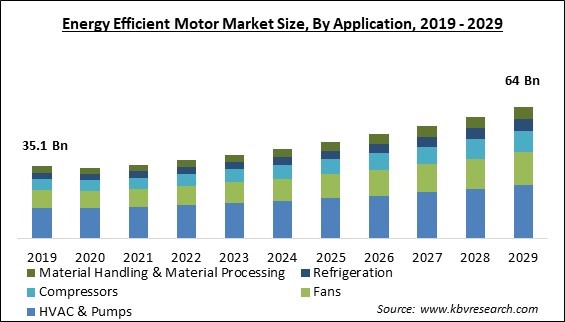

The Global Energy Efficient Motor Market size is expected to reach $64 billion by 2029, rising at a market growth of 7.8% CAGR during the forecast period.

IE1 is one of the standard efficiency levels of Energy Efficient Motor because low Voltage motors with the IE1 standard are primarily used in the metallurgical, hydrocarbon, chemical, cement, and paper industries; they can be combined with pumps, fans, and compressors. Therefore, IE1 accounted for $5,553 million revenue of the market in 2022. The range of capacity for IE1 motors is between 0.75kW and 355kW. Two, four, six, eight, ten, and twelve poles are featured on the IE1 motors. The IE1 motors operate between 500 and 3600 revolutions per minute and have an rpm frequency of 50Hz or 60Hz. Thus, these factors are expected to surge the segment's expansion.

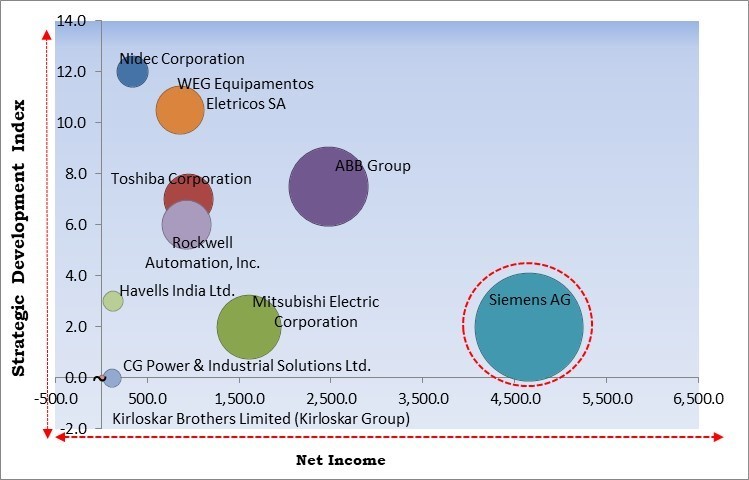

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In October 2022, WEG announced the addition of a new assembly line facility for its WEG IE3 electric motors this new facility enhances flexibility in WEG's electric motor supply chain and makes sure of prompt delivery times for customers. Moreover, In June, 2023, Nidec Drive Technology Corporation introduced FLEXWAVE, a precision-control reducer, and a motor. The FLEXWAVE consists of better energy density and low backlash on their reducers, the actuators would suppress the shock generated at start-up.

Based on the Analysis presented in the KBV Cardinal matrix; Siemens AG is the major forerunner in the Market. In February, 2021, Siemens announced a collaboration with Turboden S.p.A., a Mitsubishi Heavy Industries Group Company, to broaden and decarbonize Egypt's transmission network of natural gas. Moreover, Siemens supports the government in the adoption of energy efficiency and sustainable solutions and business models to sustain Siemens energy infrastructure. Companies such as ABB Group, Nidec Corporation and WEG Equipamentos Eletricos SA are some of the key innovators in the Market.

Governments can create energy efficiency programs through these that offer resources and technical support to organizations and people wishing to adopt energy-efficient technologies. In addition, these programs offer advice on choosing the best motor for a specific application, which can help uncover energy-saving opportunities and provide financing choices to aid with the initial expenditures of new equipment. Thus, the government's ongoing efforts to promote the use and understanding of energy-efficient motors will support market growth during the projected period.

Energy-efficient motors play a critical role in accomplishing these objectives by lowering the energy consumption and carbon footprint of industrial operations. A crucial component in making the energy transition, which entails moving away from fossil fuels and toward renewable energy sources, is the usage of energy-efficient motors. The increasing industrialization and decarbonization programs have established an advantageous market for energy-efficient motors. As more sectors embrace energy-efficient practices and the push toward decarbonization intensifies, the market is anticipated to expand.

To assure their efficacy, energy-efficient motors typically require additional certification and testing, higher-quality components, more sophisticated production techniques, and more testing. This can result in increased production costs for manufacturers and a higher price for the end user. Generally, energy-efficient motors are more expensive than conventional motors. In addition, there is a possibility that some buyers are not aware of the benefits of energy-efficient motors, and as a result, they are unwilling to pay higher prices for a technology that they do not fully understand. Thus, the price of energy-efficient motors, particularly the IE4, will restrict the market growth.

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Based on type, the market is segmented into AC motors and DC motors. The DC motors segment acquired a substantial revenue share in the market in 2022. This is because DC motors are ideally adapted for use in vacuums, fabrication & manufacturing equipment, elevators, and material handling equipment due to their faster response times and more stable torque and speed levels. In addition, they offer easier installation and maintenance demands, increased starting power and torque, quicker response times for start/stop and acceleration, and a wider range of voltage options.

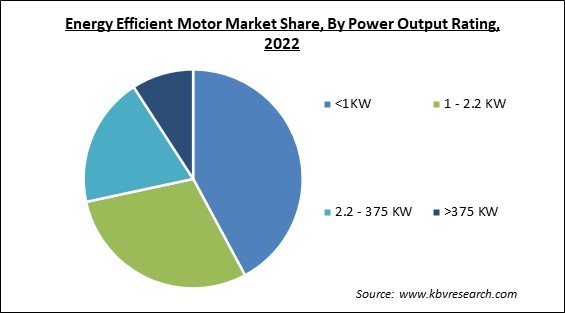

On the basis of power output rating, the market is divided into < 1 kW, 1–2.2 kW, 2.2–375 kW and > 375 kW. The < 1 kW segment held the highest revenue share in the market in 2022. This is due to the fact that these electric motors are utilized in various industrial, marine, and wind applications. For instance, fans and HVAC, pumps, shredders, and gears hydraulics, are common uses. Moreover, their energy efficiency and the increasing trend of low energy consumption further fuel their usage in various end-use industries, propelling the segment’s growth in the forecasted period.

By efficiency level, the market is classified into IE1, IE2, IE3, IE4 and IE5. The IE2 segment garnered a prominent revenue share in the market in 2022. This is due to the range of capacity for IE2 motors which is between 0.75kW and 355kW. It is an ideal replacement for Y and Y2 series motors in chemical, mining, and other relatively harsh environments where fans, pumps, machine tools, compressors, transportation machinery, etc., operate various general mechanical equipment. Two, four, or six poles are present in IE2 motors.

Based on the application, the market is bifurcated into HVAC, pumps, fans, compressors, refrigeration, material handling and material processing. The HVAC & pumps segment held the highest revenue share in the market in 2022. This is due to the fact that HVAC is utilized in a variety of technologies to regulate the temperature, humidity, and cleanliness of the air within an enclosed space. Using this technology, residential and commercial buildings are heated and chilled. Various structures, from single-family homes to submarines, contain HVAC systems that provide environmental comfort.

On the basis of end user, the market is segmented into residential, commercial, industrial, automotive, agriculture and aerospace & defense. The industrial segment led the market by generating the maximum revenue share in 2022. This is attributed to the fact that energy efficient motors are widely used for industrial applications; as industries become more automated, the demand increases; energy efficient motors enable industries to save on electricity consumed; and the government's focus on the industrial sector to reduce power consumption will contribute to the growth of the segment.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 38.3 Billion |

| Market size forecast in 2029 | USD 64 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2029 |

| Revenue Growth Rate | CAGR of 7.8% from 2023 to 2029 |

| Number of Pages | 353 |

| Number of Table | 604 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Market Share Analysis, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Efficiency Level, Power Output Rating, Type, Application, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific region generated the highest revenue share in the market in 2022. The regional growth is attributed to several Asian-Pacific governments that have enacted minimum energy performance standards or labeling programs for electric motors, increasing the demand for energy-efficient motors. Asia-Pacific is the world's most populous region and is projected to become the largest energy consumer globally.

Free Valuable Insights: Global Energy Efficient Motor Market size to reach USD 64 Billion by 2029

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include ABB Group, Siemens AG, Toshiba Corporation, Rockwell Automation, Inc., Nidec Corporation, WEG Equipamentos Eletricos SA, Mitsubishi Electric Corporation, Havells India Ltd., CG Power & Industrial Solutions Ltd. (Murugappa Group) and Kirloskar Brothers Limited (Kirloskar Group).

By Application

By Efficiency Level

By Power Output Rating

By Type

By End User

By Geography

The Market size is projected to reach USD 64 billion by 2029.

Measures to reduce carbon emissions and advance industrialization are driving the Market in coming years, however, The high production and net cost of energy-efficient motors restraints the growth of the Market.

ABB Group, Siemens AG, Toshiba Corporation, Rockwell Automation, Inc., Nidec Corporation, WEG Equipamentos Eletricos SA, Mitsubishi Electric Corporation, Havells India Ltd., CG Power & Industrial Solutions Ltd. (Murugappa Group) and Kirloskar Brothers Limited (Kirloskar Group).

The IE3 segment acquired maximum revenue share in the Market by Efficiency Level in 2022 thereby, achieving a market value of $22 Billion by 2029.

The AC Motors segment is leading the Market by Type in 2022 thereby, achieving a market value of $39.6 Billion by 2029.

The Asia Pacific market dominated the Market by Region in 2022 and would continue to be a dominant market till 2029; thereby, achieving a market value of $25.6 Billion by 2029.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.