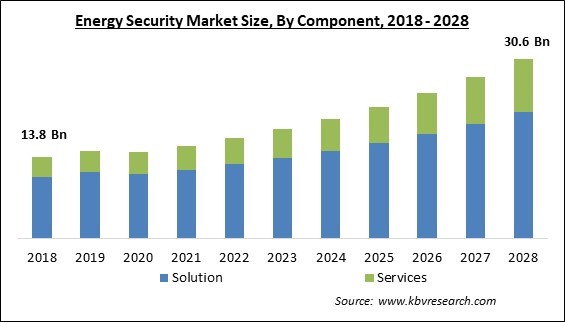

The Global Energy Security Market size is expected to reach $30.6 billion by 2028, rising at a market growth of 10.2% CAGR during the forecast period.

Energy security refers to the protection of power plants and the sources of energy generation from physical and cyber-attacks to ensure the uninterrupted operation of the power plants for energy generation. Additionally, rapid deployment of renewable energy, diversification of energy sources, enhanced energy efficiency, energy depots, and machine-usable energy types result in substantial energy security and economic benefits. Increasing pressure from the government and security compliance and regulation, as well as rising terrorism and cyber-attack threats, are driving the expansion of the energy security market.

In addition, the expansion of the energy security market is positively impacted by the rise of physical attacks and insider threats. The emergence of a new energy sector in emerging economies would create lucrative expansion prospects for the energy security market. The energy supply is vital for households and businesses. In addition, the energy supply must be inexpensive, sustainable, reliable, and secure, making energy systems a difficult task.

Digital energy systems are an evolving area that employs potent digital tools and diverse digital models to solve and manage the increasingly complex energy systems of the twenty-first century. Within the field, digital tools and models like blockchain technology and artificial intelligence are used to analyze data from various energy systems and sources to drive new control and operational strategies and business models and support critical goals such as achieving Net Zero emissions.

In addition, cloud computing enables energy applications to request access to a common pool of computing resources. It consists of social and networked enhancements to corporate intranets and other traditional software platforms large corporations use to organize communication. In contrast to conventional enterprise software, which imposes structure before encouraging usage, enterprise social software tends to encourage use before imposing structure.

The effects of COVID-19 have also emphasized the need for improved risk management, increased preparedness, and higher resilience. The pandemic was a significant disruptor that provided both obstacles and possibilities for the industry. As a result of containment measures, the electricity demand decreased rapidly in numerous places. Hence, the decline in electricity demand in the initial phase of the pandemic negatively impacted the market due to the reduced utilization of the energy security solutions, but it is expected to increase with ease in restriction and demand for electricity increasing.

Several government authorities and power plant owners are implementing network and physical solutions such as a perimeter, microwave intrusion detection, secured communications, surveillance systems, access control systems, and detectors. These solutions are intended to thwart potential threats. In addition, network systems such as antivirus, firewall, SCADA systems, and IPS/IDS systems are implemented to prevent cybercriminals from attacking the network power plant network. The government's effort to implement security solutions to safeguard power plants from threats is projected to propel energy security adoption and market growth.

Security professionals view reputable energy security suppliers as important partners that can assist them with crucial energy security choices. When sensitive content is identified in or leading up to the cloud, energy security allows IT teams to manage potential violations on their local networks for more investigation. In addition, an extensive study on threat observations supports a business in recognizing and halting harmful conduct before it worsens. These reasons are driving the market for energy security forward.

The lack of financial resources hinders the adoption of new technologies and corporate security solutions by these organizations, resulting in an inadequate IT security architecture. In addition, small firms are burdened with the management of budgeted finances for a variety of operational issues and business continuity planning, leaving them with less time and resources to implement security solutions. Thus, due to the lack of capital among SMBs and startups, the market for security solutions in the energy sector may suffer slowed growth throughout the projected period.

Based on component, the energy security market is segmented into solution and service. The solution segment held the highest revenue share in the energy security market in 2021. This is because preserving and enhancing the energy sector's resilience in the face of both man-made and natural disasters is an ongoing process that involves continued vigilance, contingency planning, and training which can be attained with an energy security solution. Many programs funded by governmental and private groups support the energy sector's security vision and objectives.

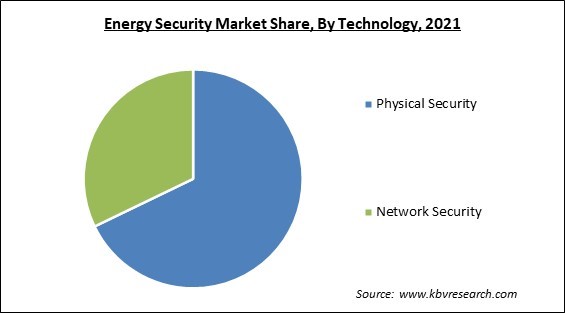

On the basis of technology, the energy security market is divided into physical security and network security. The network security segment procured a significant revenue share in the energy security market in 2021. This is owing to the weaknesses in the IT systems, OT infrastructure, and supply chain partners, which exposes energy firms to cyber risk. IT systems consist of the software, hardware, and technologies used to collect and process data for the enterprise's business operations. OT infrastructure comprises the software, hardware, and technologies necessary to control physical equipment like pumps, motors, valves, and switches.

By power plant, the energy security market is classified into thermal & hydro, nuclear, oil & gas and renewable energy. The thermal & hydro segment registered the highest revenue share in the energy security market in 2021. This is due to the fact that hydropower plays a crucial role in the transition to clean energy, not just because it generates vast quantities of low-carbon electricity. Also, it has unparalleled flexibility and storage capacity. Compared to nuclear, coal, and natural gas power plants, many hydropower plants can quickly scale up and down their electricity production.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 15.7 Billion |

| Market size forecast in 2028 | USD 30.6 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 10.2% from 2022 to 2028 |

| Number of Pages | 203 |

| Number of Table | 340 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Technology, Power Plant, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the energy security market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region led the energy security market by generating the maximum revenue share in 2021. This is due to the rising industrialization and urbanization, which are anticipated to fuel the North American power industry. In addition, throughout North America, the installation of renewable energy facilities has increased as a result of the rules for reducing countries' carbon footprints. This element will give rise to the more renewable energy sources which in turn will increase the demand for energy security solutions, providing future prospects for the energy security market in North America in the projected period.

Free Valuable Insights: Global Energy Security Market size to reach USD 30.6 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Siemens AG, Teledyne FLIR LLC (Teledyne Technologies Incorporated), ABB Ltd., Honeywell International, Inc., BAE Systems PLC, Elbit Systems Ltd., Thales Group S.A., Hexagon AB, Lockheed Martin Corporation and AEGIS Security & Investigations Inc.

By Component

By Technology

By Power Plant

By Geography

The global Energy Security Market size is expected to reach $30.6 billion by 2028.

Accelerated threat of terrorists and cyber attacks are driving the market in coming years, however, Lack of sufficient funding among SMEs restraints the growth of the market.

Siemens AG, Teledyne FLIR LLC (Teledyne Technologies Incorporated), ABB Ltd., Honeywell International, Inc., BAE Systems PLC, Elbit Systems Ltd., Thales Group S.A., Hexagon AB, Lockheed Martin Corporation and AEGIS Security & Investigations Inc.

The Physical Security segment acquired maximum revenue share in the Global Energy Security Market by Technology in 2021 thereby, achieving a market value of $19.9 billion by 2028.

The North America market dominated the Global Energy Security Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $11 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.