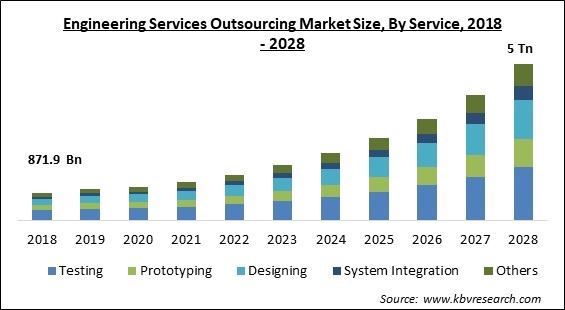

The Global Engineering Services Outsourcing Market size is expected to reach $5 trillion by 2028, rising at a market growth of 22.8% CAGR during the forecast period.

Engineering services outsourcing is the approach of hiring intangible engineering functions from an external source, like design, system integration, prototyping, and testing. These services are needed from the beginning of the product design and development process, and they make use of a variety of IT-based tools and databases. ESO is used to hire geospatial data analytics, network design services, and inventory management in the network and communications sector, for example. Apart from that, it has a lot of uses in supply chain and product cycle management, industrial automation, and device remote monitoring.

New product development, also known as R&D, is one of the most commonly outsourced design services. Companies that use expert engineering services for product development and design can get their product to market considerably faster. Bringing the idea to a pool of highly-skilled engineers and enabling them to turn it into useful end products is what R&D is all about. Another of the most widely outsourced engineering services is CAD, or computer-aided design, and Drafting. CAD software can be used to create electronic blueprints, assemble drawings, and manufacture detailed drawings. The models can then be readily edited, shared, and archived by converting them between 2D and 3D drawing formats. If not executed properly, design services can be a very time-consuming procedure.

In a nutshell, reverse engineering is the act of dismantling a finished object and determining how it functions. Data is collected from the finished result, which may subsequently be utilized to duplicate the object or provide more insight into the creation of a new one. In reverse engineering, the engineer creates a CAD model of the product and extracts data from it, which can then be utilized to modify or improve the object. Reverse engineering can aid in improving production efficiency, updating a product, or redesigning specific aspects of it.

Because of the temporary shutdown of businesses, production facilities, and everyday operational logistics, the aircraft industry has suffered the most among the industry verticals. The healthcare industry, on the other hand, has remained essentially stable, with healthcare companies focusing on providing advanced and tailored Personal Protective Equipment kits. As a result, as part of their attempts to conserve intellectual property, manufacturers are taking preventative steps, such as arranging network operations, conserving vital information with access codes, and including the basic arrangements of the layout or the original code. Nonetheless, as individuals prefer to avoid public transportation in the midst of the COVID-19 outbreak, private car sales are expected to rise in the near future.

The development of innovative and new technologies and solutions necessitates extensive research and development efforts as well as significant financial commitments. Leading industry players are incorporating delivery systems into their individual company strategies as a result of the rapid widespread of research and development. Due to this, increasing research and development efforts would drive more developments in the ESO sector in the coming years. In addition, engineering services outsourcing has developed in order to give creative solutions to clients or end-users. As a result, there has been a shift in the engineering services outsourcing market away from core engineers and toward integrated engineering solutions, such as the internet of things.

Software development companies are frequently encountering the necessity to expedite product delivery. To take advantage of a new commercial opportunity, a corporation may need to supply specific functionality within a strict deadline or cure a technical issue right away. This mandates the engineering team being propelled effectively and quickly. Forming a new in-house department or restructuring internal resources, on the other hand, takes a lot of time and work. Outsourcing, on the other hand, provides a flexible resource pool along with measurable services, allowing projects to be developed quickly.

Small and medium-sized businesses lack the financial resources to outsource engineering services. Firms in developing nations also lack the resources to outsource business processes. As a result, the reason for this is the high cost of services, which no corporation can afford to pay engineering services outsourcing companies. As a result, high service costs pose a significant barrier to the engineering services outsourcing market's expansion. Moreover, the risk of losing sensitive data and privacy is a fundamental disadvantage of outsourcing engineering services. When it comes to negotiating outsourced contracts, having seamless protocols and checks in place for data loss and confidentiality agreements is essential.

Based on Service, the market is segmented into Testing, Prototyping, Designing, System Integration, and Others. In 2021, the testing segment acquired the largest revenue share of the engineering services outsourcing market. The growing importance of testing has been fueled by the need to produce and remodel product prototypes featuring higher optimization along with error-free processes in recent years. OEMs are enlisting the help of ESPs for software testing in order to ensure user-friendliness and error-free software.

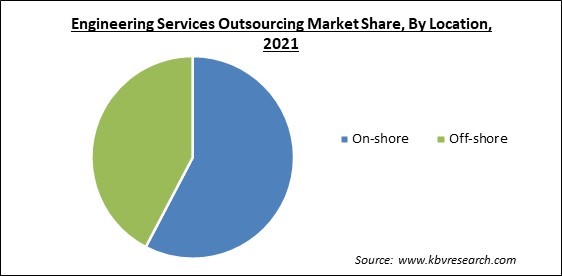

Based on Location, the market is segmented into On-shore and Off-shore. In 2021, the off-shore segment recorded a substantial revenue share of the engineering services outsourcing market. The growth of the segment is rising due to foreign inflation rates, high mix rates, training expenses, and an increasing preference for outsourcing to on-shore partners. Furthermore, while catering to customers in different countries, ESPs must accept a variety of rules in outsourcing contracts.

Based on Application, the market is segmented into Industrial, Automotive, Semiconductors, Telecom, Aerospace, Healthcare, Consumer Electronics, and Others. In 2021, the industrial segment witnessed the largest revenue share of the engineering services outsourcing market. Drilling, blasting, crushing, and tunneling activities are among the many probe services that are progressively adopting digitalization. Through the implementation of private, public, and hybrid clouds, industrial products manufacturing organizations are significantly embracing cloud infrastructure to modernize their information technology-driven infrastructure, streamline inheritance processes, and drive automation.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 1.3 Trillion |

| Market size forecast in 2028 | USD 5 Trillion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 22.8% from 2022 to 2028 |

| Number of Pages | 268 |

| Number of Tables | 412 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Service, Location, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2021, the Asia-Pacific segment accounted for the largest revenue share of the engineering services outsourcing market. The surging growth of the regional market is owing to the prevalence of a robust product manufacturing industry in the region. The region is known for its industrial products manufacture and low-cost hiring services provided by highly skilled engineering personnel. In addition, the location serves as the nerve center for major software outsourcing service providers.

Free Valuable Insights: Global Engineering Services Outsourcing Market size to reach USD 5 Trillion by 2028

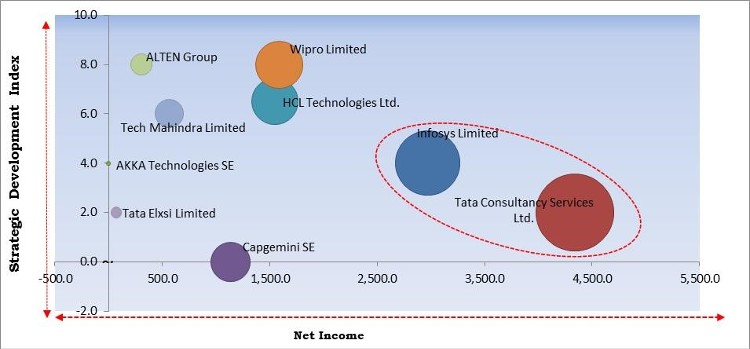

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Infosys Limited and Tata Consultancy Services Ltd. is the forerunners in the Engineering Services Outsourcing Market. Companies such as HCL Technologies Ltd., Wipro Limited, Capgemini SE are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Wipro Limited, HCL Technologies Ltd. (HCL Enterprises), Capgemini SE, Infosys Limited, Tata Consultancy Services Ltd., Tech Mahindra Limited, Tata Elxsi Limited, Entelect Software (Pty) Ltd., AKKA Technologies SE, and ALTEN.

By Service

By Location

By Application

By Geography

The global engineering services outsourcing market size is expected to reach $5 trillion by 2028.

A growing number of R&D activities and technological advancements are driving the market in coming years, however, High service cost and privacy risks limited the growth of the market.

Wipro Limited, HCL Technologies Ltd. (HCL Enterprises), Capgemini SE, Infosys Limited, Tata Consultancy Services Ltd., Tech Mahindra Limited, Tata Elxsi Limited, Entelect Software (Pty) Ltd., AKKA Technologies SE, and ALTEN.

The expected CAGR of the engineering services outsourcing market is 22.8% from 2022 to 2028.

The On-shore segment acquired maximum revenue share in the Global Engineering Services Outsourcing Market by Location in 2021, thereby, achieving a market value of $2.69 Trillion by 2028.

The Asia Pacific market dominated the Global Engineering Services Outsourcing Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $2.1 Trillion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.