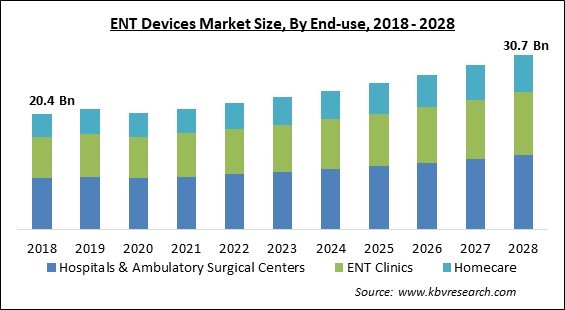

The Global ENT Devices Market size is expected to reach $30.7 billion by 2028, rising at a market growth of 5.5% CAGR during the forecast period.

ENT refers to the ear, nose, and throat, and the term "ENT devices" refers to the equipment used to treat these organs. Doctors use these tools to treat illnesses affecting the ear, nose, and throat. There are several ENT products in the market that are made to treat issues with the ear, nose, and throat, as well as other head and neck structures.

Aural forceps, speculums, tongue depressors, nasal forceps, and laryngoscopes are a few of the more common devices utilized. Otolaryngology is the treatment and diagnosis of disorders of the sinuses, larynx, oral cavity, upper pharynx (mouth and throat), and associated tissues of the head and neck in both adults and children.

The ears, nose, throat, face, and neck are typically examined as part of a comprehensive ENT examination. Audiometric testing is carried out when a person has symptoms such as ringing in the ears, hearing loss, or balance issues. It is conducted using an audiometer in a soundproof room.

An audiometer is a device that assesses hearing acuity and includes a hardware unit attached to a set of headphones and a feedback button for the patient to record their comments. The quietest noises one can hear at every frequency, in each ear, are recorded by an audiologist and plotted as an "audiogram" on a graph. Tests using audiometry can determine if the patient has conductive or sensorineural hearing loss (injury to the nerve or cochlea).

The COVID-19 outbreak has caused delays in clinical operations. This may have a limited detrimental effect on the market expansion. For instance, leading ENT device manufacturers have reported delays in clinical trials. While the ENT device industry was negatively impacted by COVID-19 due to postponed or canceled operations. Cases with benign diseases, orthopedic conditions, or ENT issues were the ones that were most likely to be delayed or postponed. The hearing care sector depends heavily on close client interaction. In clinics and audiology shops, close human contact was discouraged or necessitated additional precautions as a result of the government's strict preventive measures.

For market players in ENT devices, emerging economies like Latin America, China, India, and nations provide considerable growth prospects. People in developing nations are now capable to buy ENT devices with cutting-edge technology, which is boosting the market's expansion. In addition, a number of prospects for the expansion of this market exist in emerging nations due to factors like laxer regulatory standards, growing urbanization, better healthcare facilities, increasing disposable income, and an ageing older population.

Technology improvements in ENT devices and hearing aids will drive the market's expansion. Modern hearing aids come in small sizes and are attached to the ear through thin, invisible tubes. Miniaturization reduces the social stigma associated with hearing loss in adults and teenagers, which is beneficial for the market's growth. Additionally, some hearing aids have artificial intelligence (AI) built in that gives users access to a deep neural network for sound processing

Over the past few years, healthcare systems have made cost containment one of their top goals. Price regulations, bidding, competitive rates, tender processes, insurance and payment policies, comparative efficacy assessments of medications, technology reviews, and managed-care agreements are all used to achieve this. In response to a growing desire to cut healthcare costs, healthcare providers have partnered with group purchasing organizations and integrated medical networks that negotiate for the bulk purchase of medical equipment.

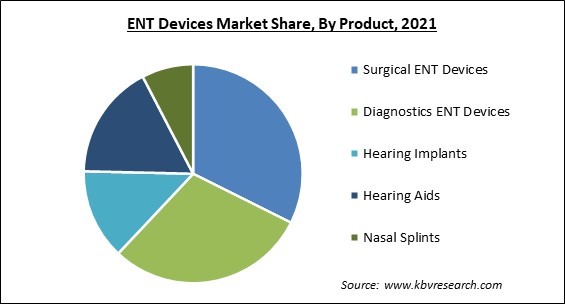

Based on product, the ENT Devices market is segmented into diagnostic ENT devices, surgical ENT devices, hearing aids, hearing implants and nasal splints. In 2021, the hearing aids segment procured a promising growth rate in the ENT Devices market. Most people who are 65 and older experience some degree of hearing loss due to aging. Many people do not become aware of this sort of hearing loss until it becomes a major issue since it occurs so gradually. Hearing aids cannot reverse hearing loss due to nerve damage or aging or stop the course of these conditions.

By end-use, the ENT device market is classified into hospitals & ambulatory surgical centers, ENT Clinics and homecare. In 2021, the hospitals & ambulatory surgical centers segment witnessed largest revenue share in the ENT device market. The market is expending in this segment due to the rising spending in healthcare industry to improve healthcare infrastructure. Furthermore, the ENT devices are in high demand in hospitals due to rising preference of people to visit hospitals directly and the quality care offered by these centers.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 21.3 Billion |

| Market size forecast in 2028 | USD 30.7 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 5.5% from 2022 to 2028 |

| Number of Pages | 379 |

| Number of Tables | 675 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Product, End-use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the ENT Devices market is analyzed across the North America, Europe, Asia Pacific and LAMEA. In 2021, the North America region led the ENT devices market by generating maximum revenue share. This is due to a number of factors, including the region's high prevalence of ENT-related illnesses, increasing preference for hearing care equipment, the presence of major hospital chains, well-equipped ambulatory facilities, and a sizable target market.

Free Valuable Insights: Global ENT Devices Market size to reach USD 30.7 Billion by 2028

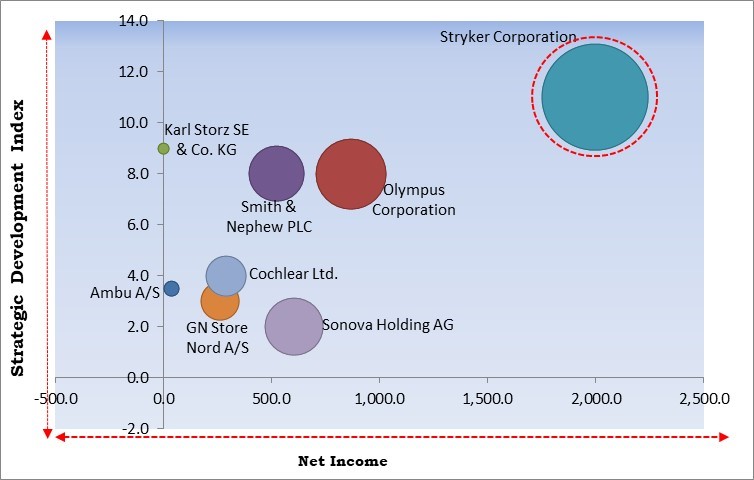

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Stryker Corporation is the major forerunner in the ENT Devices Market. Companies such as Olympus Corporation, Sonova Holding AG and Smith & Nephew PLC are some of the key innovators in ENT Devices Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Smith & Nephew PLC, Sonova Holding AG, GN Store Nord A/S, Ambu A/S, Stryker Corporation, Karl Storz SE & Co. KG, Olympus Corporation, Richard Wolf GmbH, Cochlear, Ltd., and Starkey Laboratories, Inc.

By End-use

By Product

By Geography

The global ENT Devices Market size is expected to reach $30.7 billion by 2028.

Growth Opportunities In Developing Nations are driving the market in coming years, however, Rising Pricing Pressure An Obstacle To Market Growth restraints the growth of the market.

Smith & Nephew PLC, Sonova Holding AG, GN Store Nord A/S, Ambu A/S, Stryker Corporation, Karl Storz SE & Co. KG, Olympus Corporation, Richard Wolf GmbH, Cochlear, Ltd., and Starkey Laboratories, Inc.

The Surgical ENT Devices segment acquired maximum revenue share in the Global ENT Devices Market by Product in 2021 thereby, achieving a market value of $9.6 billion by 2028.

The North America market dominated the Global ENT Devices Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $11.1 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.