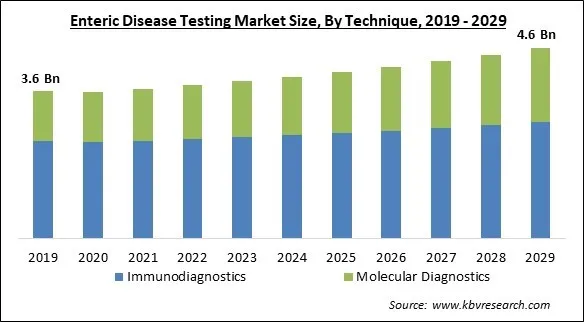

The Global Enteric Disease Testing Market size is expected to reach $4.6 billion by 2029, rising at a market growth of 3.2% CAGR during the forecast period.

Infections of the gastrointestinal tract, encompassing the small intestine, large intestine, and stomach, are known as enteric diseases. Bacteria, viruses, and parasites are just a few of the microorganisms that might cause these diseases. Salmonellosis, shigellosis, norovirus, rotavirus, amebiasis, cryptosporidiosis, and giardiasis are typical examples of enteric diseases. Others include cholera, Clostridium difficile (C. difficile), Escherichia coli (E. coli), shigellosis, and Helicobacter pylori (H. pylori).

To determine the exact pathogen triggering an enteric disease and to diagnose enteric diseases, numerous laboratory tests are employed. These tests often entail checking samples of blood, feces, or other fluids from the body for the presence of viruses, bacteria, and parasites known as enteric pathogens.

Enteric disorders are caused by bacterial, viral, and parasitic microorganisms that affect the intestines. Many of these illnesses can be spread from person to person and are typically brought on by consuming tainted food or drink. The symptoms of enteric infections include nausea, stomach pain, chills, fever, diarrhea, and loss of appetite.

One of the primary agents behind many water- and food-borne illnesses has been shown to be enteric bacteria. Diarrhea and hemolytic uremic syndrome (HUS) are becoming more common worldwide. Enteric bacterial infections are the most frequent cause. The enteric disease testing market is expected to expand throughout the forecast period due to factors such as rising rates of diarrhea, rising rates in emerging nations, higher government awareness, and various government and public sector initiatives.

COVID-19 testing and treatment took precedence over enteric illness testing as a result of the pandemic's impact on healthcare priorities. The COVID-19 pandemic required a massive redirection of resources towards COVID-19 testing, treatment, and vaccination efforts. This led to a diversion of resources away from other areas of healthcare, including enteric disease testing. This was due to a combination of factors, including reduced healthcare capacity, and social distancing measures. The COVID-19 pandemic disrupted many research projects related to enteric diseases, with resources and personnel being diverted towards COVID-19 research. The demand for enteric disease testing kits decreased during the pandemic, which negatively impacted market growth.

The rise in the prevalence of several other enteric diseases such as clostridium difficile (C. difficile), shigellosis, Escherichia coli (E. coli), cholera, and salmonellosis-all of which can result in severe diarrhea or even death-also contributes to the increasing demand for these tests. Rising Millions of people contract enteric infections every year worldwide, but they are particularly prevalent in underdeveloped nations with subpar sanitation. Hence, the rising prevalence of enteric disease will propel the growth of the market throughout the forecast period.

The demand for enteric disease testing may benefit from the growing technological developments and improvements in enteric disease testing equipment and methods. Testing efficiency gains, cost-effective testing, and quick test results may contribute to product development. Additionally, the healthcare business is embracing the growing trend of more efficient, effective, and affordable computing hardware connected to greater network connectivity, improved software, and advanced sensors. In light of this, the market may benefit financially from these variables in the years to come.

Automated enteric disease testing instruments are priced higher than their manual counterparts due to their advanced features and functions. The calculated cost of the media, instrument, and labor may be perceived as prohibitively expensive by certain end users. In addition, implementing numerous systems in testing laboratories has significantly increased the total capital cost investment. Utilizing molecular diagnostic techniques, particularly multiplexed assays, is a recent development in the healthcare industry compared to singleplex assays. However, the cost of multiplexed assay equipment is comparatively high, and the initial investment required for instrument installation is higher. This factor will impede the market's growth until cost-effective alternatives become available.

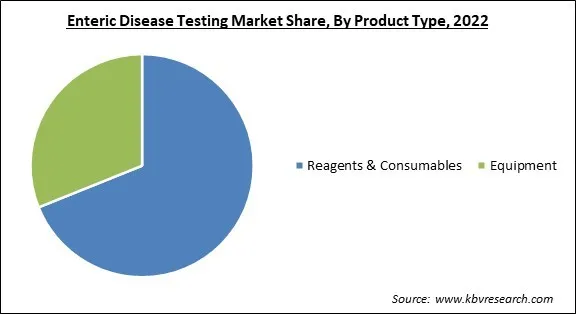

Based on product type, the enteric disease testing market is characterized into reagents & consumables and equipment. The equipment segment procured a considerable growth rate in the enteric disease testing market in 2022. Different types of enteric disease testing are used in the process, which is propelling the growth of the segment. Automated analyzers are used to perform rapid tests for enteric diseases. These tests can detect the presence of specific antigens or genetic material from the pathogen in a sample.

On the basis of technique, the enteric disease testing market is classified into molecular diagnostics and immunodiagnostics. The immunodiagnostics segment acquired the largest revenue share in the enteric disease testing market in 2022. Immunodiagnostic tests can provide results quickly, sometimes in as little as a few hours, which allows for earlier diagnosis and treatment of enteric diseases. Immunodiagnostic tests can detect even small amounts of pathogens or antibodies, making them highly sensitive and specific. This means they can accurately identify the presence of a specific pathogen and rule out other potential causes of the patient's symptoms.

By disease type, the enteric disease testing market is divided into bacterial, viral, and parasitic. The high prevalence of bacterial enteric diseases such as salmonellosis, cholera, E. coli, and Helicobacter pylori, as well as the widespread utilization of enteric disease testing products for the diagnosis, are driving the growth of this market segment. In addition, due to increased knowledge of bacterial enteric disease diagnosis and a rising incidence of bacterial enteric diseases globally, the category is anticipated to experience rapid growth.

Based on end user, the enteric disease testing market is segmented into academic & research institutes, hospital laboratories, and pharmaceutical & biotechnology companies. The academic & research institutes segment acquired a substantial revenue share in the enteric disease testing market in 2022. Academic and research institutes play a vital role in public health surveillance for enteric diseases. Testing and monitoring of enteric diseases in populations can help in identifying outbreaks, developing response plans, and implementing prevention and control strategies. Research institutes play a crucial role in identifying new pathogens responsible for enteric diseases.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 3.7 Billion |

| Market size forecast in 2029 | USD 4.6 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2029 |

| Revenue Growth Rate | CAGR of 3.2% from 2023 to 2029 |

| Number of Pages | 251 |

| Number of Table | 423 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Disease Type, Product Type, Technique, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the enteric disease testing market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment recorded the largest revenue share in the enteric disease testing market in 2022. The presence of a number of significant players as well as improvements in the manufacturing technology of enteric disease testing products in the region is what is driving the market's expansion. This is mostly due to an increase in the number of patients with enteric diseases, increased government support for research into the diagnosis of enteric diseases, and a sizable increase in capital income in industrialized nations.

Free Valuable Insights: Global Enteric Disease Testing Market size to reach USD 4.6 Billion by 2029

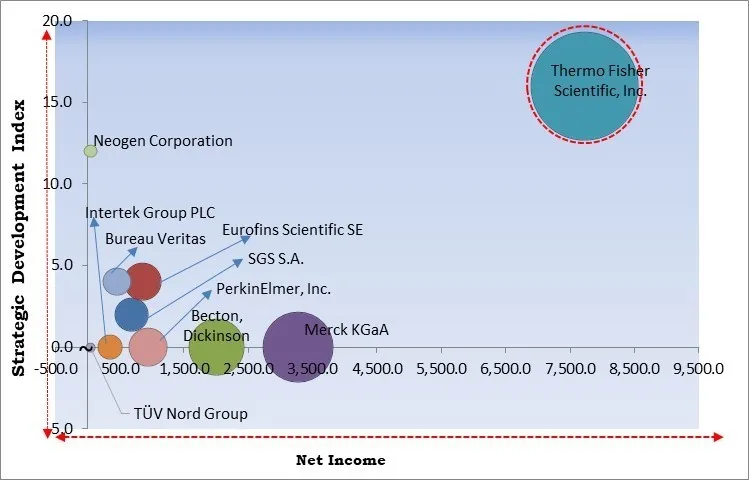

The major strategies followed by the market participants are Acquisitions. Based on the Analysis presented in the Cardinal matrix; Thermo Fisher Scientific, Inc. is the forerunner in the Enteric Disease Testing Market. Companies such as Neogen Corporation, Bureau Veritas S.A., and Eurofins Scientific SE are some of the key innovators in Enteric Disease Testing Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Merck KGaA, Thermo Fisher Scientific, Inc., SGS S.A., Eurofins Scientific SE, Bureau Veritas S.A., Intertek Group PLC, TÜV Nord Group, PerkinElmer, Inc., Becton, Dickinson and Company and Neogen Corporation.

By End User

By Disease Type

By Product Type

By Technique

By Geography

The Market size is projected to reach USD 4.6 billion by 2029.

Increasing prevalence of enteric disease worldwide are driving the Market in coming years, however, High cost of testing and sampling restraints the growth of the Market.

Merck KGaA, Thermo Fisher Scientific, Inc., SGS S.A., Eurofins Scientific SE, Bureau Veritas S.A., Intertek Group PLC, TÜV Nord Group, PerkinElmer, Inc., Becton, Dickinson and Company and Neogen Corporation.

The Reagents & Consumables segment is generating highest revenue share in the Global Enteric Disease Testing Market by Product Type 2022 thereby, achieving a market value of $3 billion by 2029.

The Hospital Laboratories segment is leading the Market by End User 2022 thereby, achieving a market value of $3.4 billion by 2029.

The North America market dominated the Market by Region 2022, and would continue to be a dominant market till 2029; thereby, achieving a market value of $1.8 billion by 2029.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.