“Global Enterprise Firewall Market to reach a market value of USD 19.01 Billion by 2031 growing at a CAGR of 7.6%”

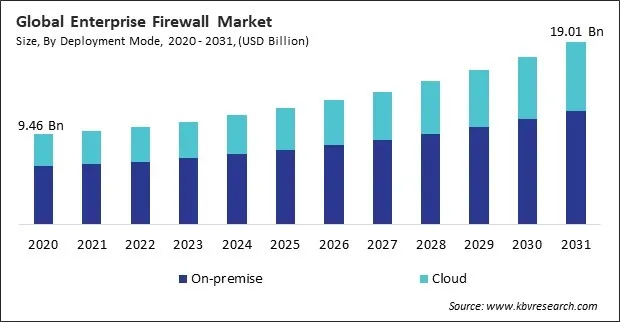

The Global Enterprise Firewall Market size is expected to reach $19.01 billion by 2031, rising at a market growth of 7.6% CAGR during the forecast period.

The North America segment witnessed 37% revenue share in the market in 2023. The region is home to several leading cybersecurity vendors and technology innovators, which fosters early adoption of next-generation firewalls (NGFWs) and advanced threat protection systems. Stringent regulatory frameworks such as HIPAA, PCI DSS, and GDPR (for international operations), particularly in industries like banking, healthcare, and government, mandate the deployment of robust security measures, further fueling the demand for enterprise firewall solutions.

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In February, 2025, Sophos Group PLC teamed up with Pax8, a software company to offer a comprehensive cybersecurity portfolio to Pax8's network of managed service providers (MSPs). This collaboration simplifies security management by providing MSPs with streamlined operations, billing, and integrated cybersecurity solutions, including Sophos Managed Detection and Response, Endpoint Protection, and Firewalls. Moreover, In December, 2024, Palo Alto Networks, Inc. announced the partnership with Bell Canada, a telecommunication company to enhance cybersecurity for Canadian businesses. Bell will offer a full suite of services across Palo Alto's AI-powered security platforms, including Next-Generation Firewalls, Zero Trust Network Access, and cloud security. This partnership strengthens Bell's position as a leading Managed Security Services Provider in Canada.

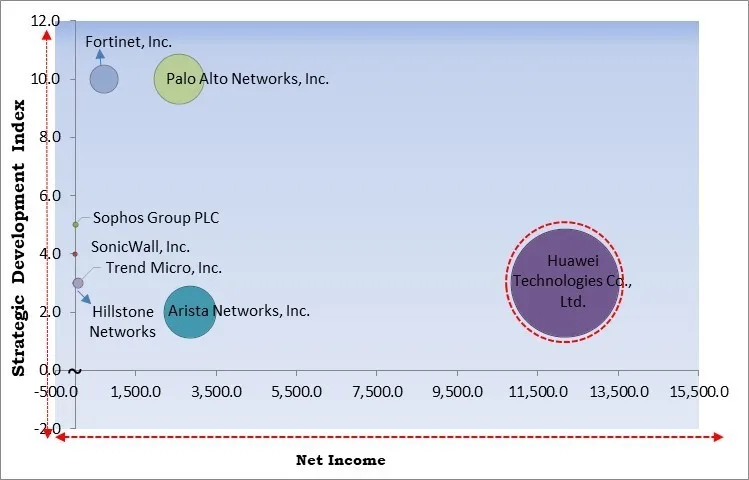

Based on the Analysis presented in the KBV Cardinal matrix; Huawei Technologies Co., Ltd. is the forerunner in the Enterprise Firewall Market. Companies such as Arista Networks, Inc., Palo Alto Networks, Inc., and Fortinet, Inc. are some of the key innovators in Enterprise Firewall Market. In February, 2025, Palo Alto Networks, Inc. announced the partnership with Zero Networks, a software company to deliver comprehensive zero-trust microsegmentation as part of a hybrid mesh firewall platform. This partnership combines automated microsegmentation and next-generation firewalls (NGFWs), enhancing network security, minimizing lateral movement, and simplifying policy enforcement for a more robust and streamlined defense strategy.

Cybersecurity threats have become more prevalent, sophisticated, and damaging than ever in the current digital landscape. Regardless of size or industry, enterprises face a constant onslaught of cyberattacks that target sensitive data, financial assets, and operational infrastructure. Malicious actors leverage advanced hacking techniques, AI-powered attacks, and automated botnets to breach enterprise networks, steal critical information, or disrupt essential services. Hence, these factors are propelling the market's growth.

Additionally, Governments and regulatory bodies worldwide enforce strict data protection laws to ensure the privacy and security of sensitive information. Prominent regulations such as the General Data Protection Regulation (GDPR) in Europe, the Health Insurance Portability and Accountability Act (HIPAA) in the United States, and the Payment Card Industry Data Security Standard (PCI DSS) globally, mandate organizations to implement comprehensive security measures to protect personal, financial, and health-related data. Therefore, in order to guarantee regulatory compliance, safeguard sensitive data, and guarantee business continuity, enterprises must prioritize investments in comprehensive firewall technologies as cyber threats continue to develop.

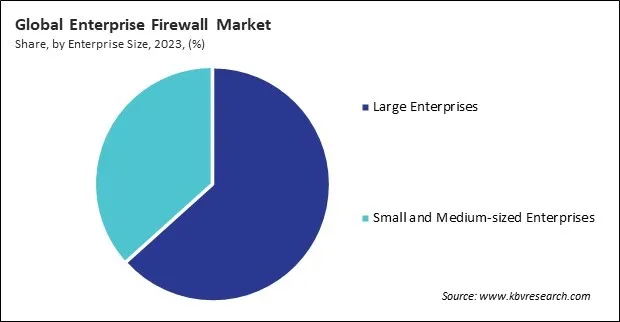

However, Enterprise-grade firewalls, particularly next-generation firewalls (NGFWs), require a substantial upfront investment. These firewalls incorporate advanced security features such as deep packet inspection (DPI), intrusion prevention systems (IPS), threat intelligence, and AI-driven analytics, making them more expensive than traditional firewall solutions. Large enterprises with dedicated IT security budgets can afford such high-end solutions, but small and medium-sized enterprises (SMEs) often struggle to allocate the necessary funds for these critical security investments. Hence, the financial strain associated with high-end firewalls limits market adoption among SMEs and affects larger organizations that operate on tight IT budgets.

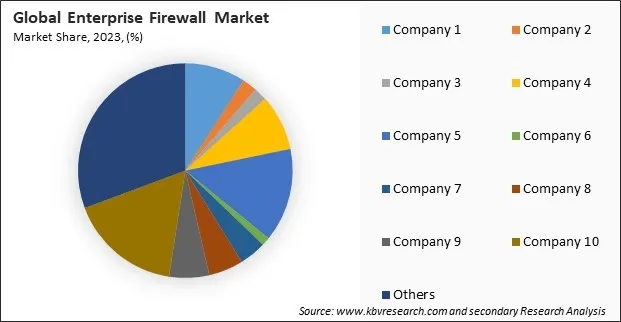

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships, Collaborations & Agreements.

Free Valuable Insights: Global Enterprise Firewall Market size to reach USD 19.01 Billion by 2031

On the basis of deployment mode, the market is bifurcated into on-premise and cloud. The cloud segment recorded 35% revenue share in the market in 2023. Cloud-based firewalls offer the advantage of easy deployment, centralized management, and rapid scalability without requiring heavy capital investments in physical infrastructure. They facilitate the rapid adaptation of businesses to evolving security requirements and the provision of real-time updates and threat intelligence, which is essential for the defense against evolving cyber threats.

By enterprise size, the market is divided into large enterprises and small & medium-sized enterprises. The small & medium-sized enterprises segment garnered 37% revenue share in the market in 2023. Cybercriminals are increasingly targeting SMEs due to their limited in-house security resources and perceived vulnerabilities, accelerating their adoption of cost-effective firewall solutions. The availability of cloud-based firewalls and Security-as-a-Service (SECaaS) models has made advanced security technologies accessible and scalable, allowing SMEs to protect their networks without significant upfront investments.

Based on component, the market is classified into hardware, software, and services. The software segment procured 29% revenue share in the market in 2023. Businesses are increasingly transitioning to hybrid and multi-cloud infrastructures, necessitating security solutions that are both scalable and adaptable and that can be readily deployed and managed across a variety of platforms. Software-based firewalls are appealing to small and medium-sized enterprises (SMEs) due to their cost-effective protection, which is achieved without the need for dedicated hardware.

Based on application, the market is segmented into BFSI, IT & telecom, healthcare, retail & e-commerce, government, and others. The IT & telecom segment acquired 22% revenue share in the market in 2023. The IT & telecom segment is driven by the exponential growth of data traffic, cloud computing, 5G networks, and IoT deployments, all of which have expanded the attack surface for cybercriminals. Telecom operators and IT service providers manage large-scale, distributed network infrastructures that require high-performance firewall solutions to protect against DDoS attacks, malware, and intrusions. The industry's focus on delivering uninterrupted services and data privacy for millions of users makes scalable, real-time threat monitoring and protection essential.

The Enterprise Firewall Market is experiencing growing competition driven by advancements in AI-powered automation, cloud-based migration tools, and real-time data processing. Innovations in machine learning algorithms are enhancing data mapping, transformation, and validation, reducing downtime and improving accuracy. The rise of hybrid and multi-cloud environments has led to the development of scalable, seamless migration solutions with minimal disruption. Additionally, advancements in data security, compliance automation, and zero-downtime migration techniques are addressing enterprise concerns. As organizations modernize IT infrastructure and transition to cloud platforms, competition is intensifying, driving continuous improvements in speed, efficiency, and risk mitigation.

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment garnered 27% revenue share in the market in 2023. Countries like China, India, Japan, and South Korea are witnessing a surge in internet penetration, cloud adoption, and e-commerce activities, increasing the need for reliable network security solutions. The necessity for organizations to implement comprehensive firewall solutions has been exacerbated by the increase in cybersecurity threats, such as data breaches and ransomware attacks.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 10.76 Billion |

| Market size forecast in 2031 | USD 19.01 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 7.6% from 2024 to 2031 |

| Number of Pages | 284 |

| Number of Tables | 453 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Deployment Mode, Enterprise Size, Component, Application, Region |

| Country scope |

|

| Companies Included | Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Arista Networks, Inc., Hillstone Networks, SonicWall, Inc., Fortinet, Inc., Forcepoint LLC (Francisco Partners), Trend Micro, Inc., McAfee Corp., Sophos Group PLC (Thoma Bravo), and Palo Alto Networks, Inc. |

By Deployment Mode

By Enterprise Size

By Component

By Application

By Geography

This Market size is expected to reach $19.01 billion by 2031.

Increasing Frequency and Sophistication of Cyberattacks are driving the Market in coming years, however, High Cost of Advanced Firewalls restraints the growth of the Market.

Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Arista Networks, Inc., Hillstone Networks, SonicWall, Inc., Fortinet, Inc., Forcepoint LLC (Francisco Partners), Trend Micro, Inc., McAfee Corp., Sophos Group PLC (Thoma Bravo), and Palo Alto Networks, Inc.

The expected CAGR of this Market is 7.6% from 2023 to 2031.

The On-premise segment captured the maximum revenue in the Market by Deployment Mode in 2023, thereby, achieving a market value of $11.9 billion by 2031.

The North America region dominated the Market by Region in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $6.8 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges