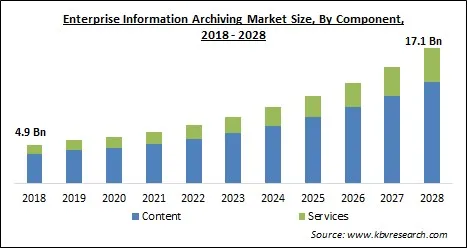

The Global Enterprise Information Archiving Market size is expected to reach $17.1 billion by 2028, rising at a Market growth of 15.1% CAGR during the forecast period.

Enterprise information archiving refers to the application of new ways for storing both structured and unstructured business data, in contrast to prior methods that solely focused on storing structured data. Enterprise information archiving (EIA) software incorporates products and solutions for archiving user communications content such as SMS, email, instant messaging, and public and business social media data. Other types of information, such as data in enterprise file synchronization and sharing (EFSS) platforms, files, website content, and audio, are also included. The majority of EIA spending goes into email compliance and retention, but there is growing interest in archiving other types of communications data. Data reduction across information types, retention management, content indexing, and e-discovery and categorization technologies are all included in EIA solutions.

In addition, enterprise information archiving is critical for any business to be protected against lawsuits alleging fraud or the leaking of personal information about customers. With the improvements of advanced computing and communication networks, new regulations are being enacted on a regular basis to protect the personal information of customers and promote ethical corporate practices. Enterprise information archiving has also aided enterprises all over the world in improving company efficiency by separating obsolete and less usable data on tertiary storage and maintaining useful data on secondary storage for faster access and processing. Market vendors offer a single platform for archiving and managing a broader range of company data, ranging from standard office files to enterprise communication media contents including email, social media, instant messaging, and mobile communication. Datacenters with cloud support have been constructed, allowing for scalable archiving at a reasonable cost.

For example, Cisco also predicts that the volume of Big Data in data center storage would grow to 403 exabytes by 2021, up from 179 exabytes in 2019. Furthermore, the growing use of the cloud has aided data generation across all end-user verticals. Information archiving solutions make use of public and private cloud platforms to provide enterprises with the agility and scalability they require at a cheaper cost. As a result, Market participants are progressively offering cloud-based data management solutions. With enhanced threat security, tamper-proof archiving, and data protection, the Barracuda Essentials cloud-based service, for example, makes e-mail safe for organizations.

The worldwide digital transition has been accelerated through COVID-19. Businesses must now overcome new complicated barriers as a result of the expansion of remote work settings. It has led to a rise in the number of people working from home or from remote places, as well as a shift in how employees connect to corporate networks. Collaboration platforms such as Slack, Microsoft Teams, Google Meet, and Zoom have become popular among businesses. As a result, firms will have to preserve higher volumes of digital conversations, including difficult file types like huge video files from virtual meetings. Companies are investing in technology that enables cognitive data and analytics capabilities as a result of increased cybersecurity concerns and the necessity for secure remote access.

The massive volume of enterprise data generated by the exponential increase in data from emails, instant messaging, databases, social media, mobile communication files, web, and enterprise file synchronization sharing is posing a serious challenge for businesses, resulting in a greater demand for enterprise information archiving solutions and services. Capturing, preserving, and producing records of corporate decisions and communications across a variety of content, sources, and data kinds are tough.

To improve operational efficiency, businesses use disruptive technologies such as the cloud, communication channels, IoT, and AI. Enterprises must use digital strategies and technology to operate efficiently in the age of digital transformation. Disruptive technologies generate and access enormous amounts of data. AI is expected to be used everywhere, from the edge to the core to the cloud. Businesses can leverage AI platforms and apps to use machine learning (ML) capabilities to increase accuracy and speed up processing for business-critical analysis.

Given the vast pool of digital enterprise information available to them, large enterprises have started implementing a variety of innovative solutions to manage their enterprise information. However, due to budget constraints and a lack of understanding about corporate information preservation, many businesses continue to use traditional and time-consuming approaches, such as manually managing digital company information. As a result, a variety of SMEs still relies on manual and other traditional approaches or tactical system archiving to maintain their business data.

Based on Component, the Market is segmented into Content and Services. Based on Content Type, the Market is segmented into Email & Web, Database, Social Media, Instant Messaging, File, Enterprise file synchronization & sharing, and Others. The services segment procured a significant revenue share in the enterprise information archiving Market in 2021. External assistance is needed for a variety of reasons, and there are five main drivers for establishing business archives programs: creating order out of chaos; closing or transferring custody of the Archives; establishing corporate memory; due diligence/verification requirements; and assistance for existing archives/records programs or functions.

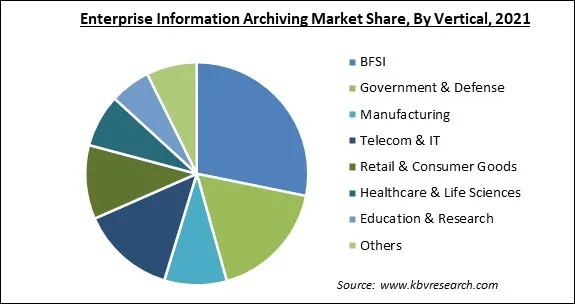

Based on Vertical, the Market is segmented into BFSI, Government & Defense, Manufacturing, Telecom & IT, Retail & Consumer Goods, Healthcare & Life Sciences, Education & Research, and Others. The BFSI segment acquired the largest revenue share in the enterprise information archiving Market in 2021. The Financial Industry Regulatory Authority (FINRA), the Securities and Exchange Commission (SEC), the Federal Financial Institutions Examination Council (FFIEC), the Federal Deposit Insurance Corporation (FDIC), and the Dodd-Frank Act all have regulatory compliance requirements that financial service institutions and businesses must meet. These regulations ensure that financial service businesses adhere to industry standards and conduct fair business with their customers. This aids financial service firms in successfully communicating with customers, as well as monitoring and archiving all conversations sent by email, social media, or mobile devices.

Based on Deployment Type, the Market is segmented into On-premise and Cloud. The cloud segment garnered a substantial revenue share in the enterprise information archiving Market in 2021. A cloud archive is a storage as a service (SaaS) solution for long-term data archiving. The archive stores data that is rarely accessed and can be optimized for security and compliance with data privacy regulations. In addition to lowering storage costs, removing idle data from primary storage improves application performance. It also makes it easier to reduce the backup window. With a smaller working set of data, applications execute faster.

Based on Organization Size, the Market is segmented into Large Enterprises and Small & Medium Enterprises. The large enterprise segment acquired the largest revenue share in the enterprise information archiving Market in 2021. Due to the vast volumes of data to be maintained, large organizations are likely to embrace enterprise information archiving solutions in the future. Large corporations have numerous offices and divisions located all over the world. These companies use centralized, cloud-based enterprise information archiving solutions to keep track of their offices and divisions from corporate headquarters. The introduction of cloud-based enterprise information archiving systems has enabled incident storage in the cloud. To improve and evaluate company information archiving, large enterprises are eager to invest in innovative and cutting-edge technologies such as AI, cloud, and 5G. Another element driving enterprise information archiving adoption around the world is huge corporations' enormous spending power.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 6.5 Billion |

| Market size forecast in 2028 | USD 17.1 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 15.1% from 2022 to 2028 |

| Number of Pages | 345 |

| Number of Tables | 580 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Deployment Type, Organization Size, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the Market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. North America acquired the largest revenue share in the enterprise information archiving Market in 2021. Due to the increased adoption of new technologies, high investments in digital transformation, quick expansion of domestic firms, broad infrastructure development, and increasing GDP of various nations. To safeguard and achieve enterprise information, rapidly rising economies such as China, Japan, Singapore, and India are deploying enterprise information archiving solutions across numerous business processes. Asia is the center of the IT industry, and it is expanding at a quicker rate. The growing demand for business process optimization and monitoring has necessitated the usage of the enterprise information archiving solutions to minimize policy and regulatory violations.

Free Valuable Insights: Global Enterprise Information Archiving Market size to reach USD 17.1 Billion by 2028

The Market research report covers the analysis of key stake holders of the Market . Key companies profiled in the report include Microsoft Corporation, Hewlett-Packard Enterprise Company, IBM Corporation, Google LLC, Dell Technologies, Inc., Barracuda Networks, Inc. (Thoma Bravo), Veritas Technologies LLC (The Carlyle Group), Proofpoint, Inc., Mimecast Limited, and Smarsh, Inc.

By Component

By Vertical

By Geography

The enterprise information archiving market size is projected to reach USD 17.1 billion by 2028.

Increasing amount of data being created each year are increasing are driving the market in coming years, however, Ignorance regarding enterprise information archiving solutions growth of the market.

Microsoft Corporation, Hewlett-Packard Enterprise Company, IBM Corporation, Google LLC, Dell Technologies, Inc., Barracuda Networks, Inc. (Thoma Bravo), Veritas Technologies LLC (The Carlyle Group), Proofpoint, Inc., Mimecast Limited, and Smarsh, Inc.

The expected CAGR of the enterprise information archiving market is 15.1% from 2022 to 2028.

The Content segment acquired maximum revenue share in the Global Enterprise Information Archiving Market by Component 2021, thereby, achieving a Market value of $12.8 billion by 2028.

The North America is the fastest growing region in the dominated the Global Enterprise Information Archiving Market by Region 2021, and would continue to be a dominant Market till 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.