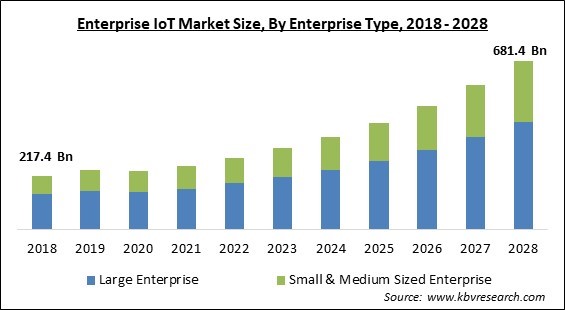

The Global Enterprise IoT Market size is expected to reach $681.4 billion by 2028, rising at a market growth of 15.4% CAGR during the forecast period.

The Internet of Things is evolving, and the next stage is called "Enterprise IoT," where businesses are progressively investing in linked physical objects with embedded computing devices to increase operational efficiency, lessen human labor, and speed up business operations.

Businesses can collect and send real-time data to make better business decisions and offer more value to their consumers by connecting physical things to the internet via enterprise IoT investments.

One use case for IoT devices in the healthcare industry is remote patient monitoring. Healthcare practitioners can swiftly identify whether patients require therapy or intervention by keeping track of their vital signs from a distance, improving health outcomes.

Organizations in various industries, including energy, telecom, manufacturing, government, retail, and industrial, expect to profit from business IoT projects because of the technology's potent capabilities.

The market is expected to grow because of the development of technologies like Wi-Fi, Bluetooth, Insteon, ZigBee, and others. Launching cutting-edge IoT solutions is prioritized by major industry players like Google LLC, IBM Corporation, and Amazon Web Services to generate good market demand.

To investigate the possibilities of the digital transformation brought on by 5G, wireless networking, and edge computing, for instance, AT&T and IBM Corporation teamed up in February 2022. The cooperation wants to provide industry clients with an engaging environment where they may encounter hybrid cloud technology, physical clouds, and AT.

The COVID-19 pandemic profoundly impacted the global economy. The outbreak caused the significant destruction of several enterprises. The supply chain for IoT systems was significantly impacted by the COVID-19 outbreak as well. A number of IoT initiatives were put on hold, and professional services were postponed. Because some firms' operations were disrupted during the early phases of the outbreak, few connected devices were used. As people become more tech-savvy and utilize technology when working from home, the pandemic increased the adoption of several technologies. These technologies include the Internet of Things, the Internet of Everything, machine learning, artificial intelligence, machine learning, and others.

The adoption of IoT technology among businesses across multiple business sectors is being accelerated by exposed to multiple data analytics and data processing tools such as massive data analytics, data science, and Hadoop. Data analytics is a technique used to examine both large and small data sets with various data attributes in order to produce valuable findings and useful insights. Moreover, awareness about real-time data & product lifecycle data in business is increasing, which is expected to bolster the growth of the Enterprise IoT market.

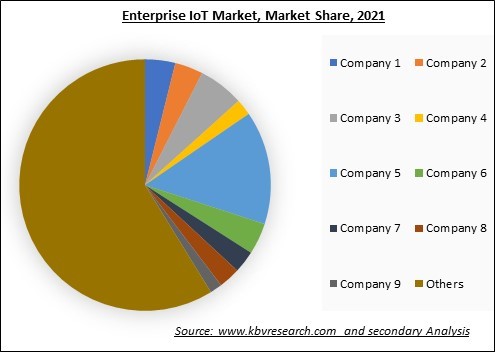

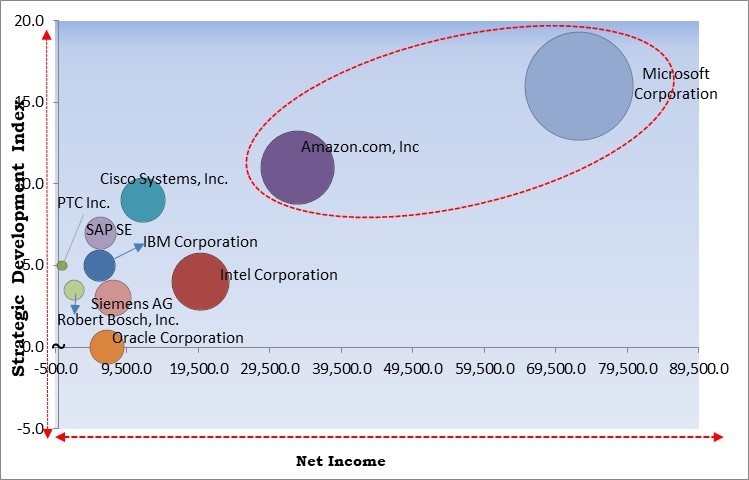

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The below illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

As the world shift towards urbanization, the increasing number of smart city projects and growing government investment for the digital ecosystem will raise IoT devices’ demand. The platform and devices are utilized for a close check on mobility, infrastructures, and air & water quality to enhance infrastructure, public services, and utilities. Thus, all these factors are driving the growth of Enterprise IoT Market.

IoT technology can be used for a huge variety of things, including collecting biometric data via communication networks and cloud technologies. To communicate and exchange data both internally and with other machines, these devices have individual IP addresses. However, as deployment becomes more advanced, data security and privacy for smart devices, connected devices, mobile devices, and platforms are also expanding. Thus, all these factors are hampering the growth of Enterprise IoT Market.

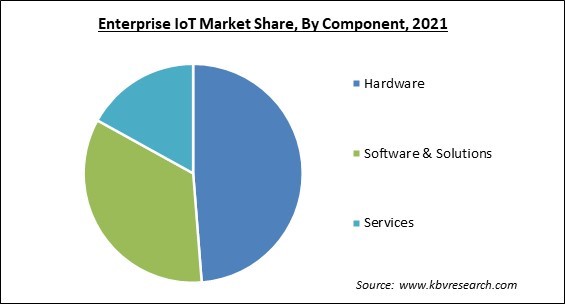

Based on Component, the Enterprise IoT Market is classified into Hardware, Software & Solutions, and Services. The software & solutions segment generated a significant revenue share in 2021. One of the key reasons influencing the market growth is the increased adoption of professional IoT services by businesses, including deployment and integration services, consultancy services, and maintenance and support services. Managed service providers have made it possible for IoT technology to be widely used through service-based solutions for managing front-end deployment, manufacturing operations, and choosing the appropriate parts for specific business needs.

Based on enterprise type, the market is classified into large enterprise and small & medium sized enterprise. In 2021, the large enterprise segment will account for a largest portion of sales. The increased usage of big data and the opportunistic market for major corporations can be credited with this segment's growth. Additionally, IoT service providers are concentrating on improving products and services through enhanced offerings like business process integration and service management to cater the requirements of multi-regional and multinational enterprises, which is anticipated to benefit the enterprise IoT industry in the long run.

Based in end-use, the market is categorized into manufacturing, Utilities, Oil & Gas, Transport, IT & Telecomm, BFSI, Healthcare, and Others. In 2021, the transport segment was responsible for a sizeable portion of revenue. The rising utilization of online fleet management systems in the enterprise IoT application is anticipated to alter logistics and transportation. Accessibility to onboard connectivity and real-time data is made possible by the online fleet management system, which ultimately increases transportation effectiveness and security

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 254.6 Billion |

| Market size forecast in 2028 | USD 681.4 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 15.4% from 2022 to 2028 |

| Number of Pages | 324 |

| Number of Tables | 504 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Market Share Analysis, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Enterprise Type, Component, End-use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on the geography, the Enterprise IoT Market is classified into North America, Europe, Asia Pacific, and LAMEA. The North America registered the highest market share in 2021. The region's early embrace of cutting-edge technologies including big data, IoT, ML, AI, cloud, and mobility, is anticipated to drive market expansion. Additionally, firms in the area are eager to integrate IoT technologies into their procedures to boost operational effectiveness. Additionally, the US government is working to raise the use of immersive technology and hence the area's market share.

Free Valuable Insights: Global Enterprise IoT Market size to reach USD 681.4 Billion by 2028

The major strategies followed by the market participants are Partnership. Based on the Analysis presented in the Cardinal matrix; Microsoft Corporation and Amazon.com, Inc. are the forerunners in the Enterprise IoT Market. Companies such as Cisco Systems, Inc., SAP SE, Intel Corporation are some of the key innovators in Enterprise IoT Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Amazon.com, Inc., Cisco Systems, Inc., IBM Corporation, Intel Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, Siemens AG, Robert Bosch GmbH, and PTC, Inc.

By Enterprise Type

By Component

By End-use

By Geography

The global Enterprise IoT Market size is expected to reach $681.4 billion by 2028.

Increasing Use Of Cutting-Edge Data Analytics And Processing Technologies are driving the market in coming years, however, IoT Ecosystem Limitations Related To Data Integrity, Security, And Privacy restraints the growth of the market.

Amazon.com, Inc., Cisco Systems, Inc., IBM Corporation, Intel Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, Siemens AG, Robert Bosch GmbH, and PTC, Inc.

The expected CAGR of the Enterprise IoT Market is 15.4% from 2022 to 2028.

The Hardware segment acquired maximum revenue share in the Global Enterprise IoT Market by Component in 2021 thereby, achieving a market value of $323.8 billion by 2028.

The North America market dominated the Global Enterprise IoT Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $225.5 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.