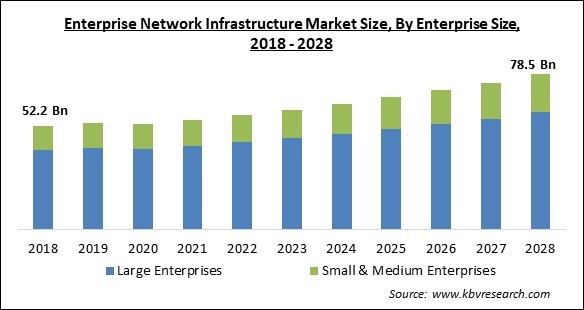

The Global Enterprise Network Infrastructure Market size is expected to reach $78.5 billion by 2028, rising at a market growth of 5.3% CAGR during the forecast period.

A network is a collection of interconnected computers, and an enterprise network is one built to meet the demands of a large-scale company. Local area networks (LANs) interact with wide area networks (WANs) as well as the cloud to make up enterprise networks. Data centers, public and private clouds, branch offices, Internet of Things devices, and individual employees all require reliable network connectivity in an organizational setting. These connections allow businesses to share data, perform business operations, and analyze network activity – in other words, the network allows them to operate their businesses.

Enterprise networks, unlike the Internet, are not open to anybody who wants to connect. Enterprise networks restrict access to certain individuals, devices, and locations. Virtual private networks or Transport Layer Security encryption are frequently used to encrypt data that goes across them. Because of its size, enterprise networking differs from other types of networking. The ordinary person may have connectivity to a home LAN, which uses a single router to link a few devices to the Internet. Internal networks, on the other hand, connect thousands of servers and devices to each other and the Internet.

Digital technology is being used by businesses to improve their operations. The relevance of network infrastructure is growing as the world becomes more digital. As a result, the demand for network infrastructure is increasing. Additionally, businesses are updating their networks to meet the increased bandwidth demands of wireless networks. The enterprise network infrastructure market is being driven by reasons such as the increased adoption of mobile devices, the growing requirement for bandwidth, and the migration to wireless technology. Furthermore, businesses are increasing their investments in network upgrades to improve speed, which would provide a reliable and cost-effective solution, increases performance, and saves energy.

The COVID-19 pandemic caused severe harm to several economies all over the world. The outbreak demolished various businesses all over the world irrespective of their sizes. In addition, to stop the spread of the infection, governments all over the world were compelled to impose stringent lockdown across their nations, which, eventually led to a temporary industrial shutdown. The temporary closure of companies and factories accompanied by worldwide travel restrictions caused a major disruption to the global supply chain. This concluded as a major supply chain gap.

Network management services companies allow businesses to focus on their principal objectives. To fuel business growth, they combine high-performance network availability along with enhanced speed and flexibility. Network service providers have the infrastructure in place to facilitate quick upgrades as well as installations. In this advanced network architecture, preventative and proactive maintenance inspections and modifications are performed on a regular basis. Moreover, managed network services give businesses access to cutting-edge technology that they might not be able to purchase otherwise.

Managed network services ensure that the entire data and voice network is secure. Most network service providers include anti-spam, anti-malware, anti-virus, anti-intrusion, and anti-inappropriate web content products. All transactions, business vital applications, as well as data are safe and secure in this policy-secured setup. MaxxSecure is an example of a network services solution that uses a fully-managed network security solution to reduce failures and prevent bottlenecks and intrusions. Improved voice quality, improved call routing, as well as better network management with built-in Quality of Service are some of the other advantages organizations can experience with the appropriate managed network services firm (QoS).

The dedicated IT team must understand the exact requirements for the intended IT configuration of the customer while working with their firm. However, they may lack the knowledge and experience that an IT Service Provider has. This causes a misunderstanding and lack of communication between the company-owned IT team and the consulting firm. It's critical that the enterprise's IT staff and IT services provider has a positive working relationship with the end aim of business expansion in mind. It is unwise to seek assistance from employed IT workers when the IT infrastructure has been set up and arranged by IT consulting service providers.

Based on Enterprise Size, the market is segmented into Large Enterprises and Small & Medium Enterprises. In 2021, the large enterprises segment procured the largest revenue share of the enterprise network infrastructure market. The increasing growth of this segment is attributed to the robust spending potential of large-sized enterprises. Large businesses are those with revenues in the billions of dollars and more than 1000 employees. These businesses with large finances can innovate and deploy new technology. Furthermore, businesses conduct their activities efficiently. As a result, the large corporation contributes more to market revenue.

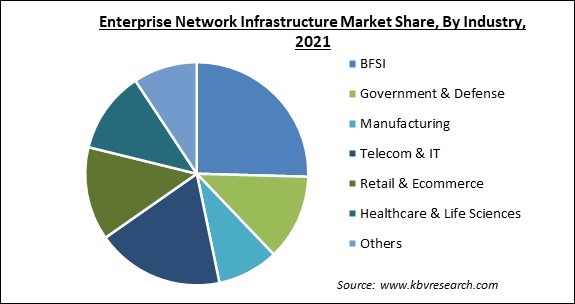

Based on Industry, the market is segmented into BFSI, Government & Defense, Manufacturing, Telecom & IT, Retail & Ecommerce, Healthcare & Life Sciences, and Others. In 2021, the healthcare & life sciences industry segment registered a substantial revenue share of the enterprise network infrastructure market. The growth of the segment is increasing because people are increasingly concerned about their health as health awareness grows. As a result, healthcare institutions and businesses are actively monitoring and tracking people's medical histories in order to provide better health treatments as well as services. As a result, healthcare institutions and businesses are adopting digital platforms and utilizing enterprise networks for communication and information exchange. It would boost their brand loyalty. As a result, health care organizations and businesses are investing in enterprise network infrastructure devices.

Based on Technology, the market is segmented into Routers & Switches, Enterprise Telephony, Wireless LAN, Storage Area Network, and Infrastructure Firewalls. In 2021, the routers & switches segment acquired the largest revenue share of the enterprise network infrastructure market. The increasing growth of the segment is owing to the fact that routers and switches are critical components of an enterprise network. Routers are devices that transport data packets across a network and are located at the intersection of two or more networks. Switches connect network devices and use packet switching in order to exchange data. This segment is also expected to be driven by a growth in the number of enterprise customers and enhanced broadband infrastructure.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 55.1 Billion |

| Market size forecast in 2028 | USD 78.5 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 5.3% from 2022 to 2028 |

| Number of Pages | 272 |

| Number of Tables | 402 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Enterprise Size, Technology, Industry, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2021, North America accounted for the largest revenue share of the enterprise network infrastructure market. In recent years, countries like the United states and Canada have served as industry hubs. Businesses are investing more money into this region in order to take advantage of the potential. These countries also have a large customer base. Digital technologies are being adopted by both governments and businesses. As a result, the region is likely to have a major increase in this market throughout the forecast period.

Free Valuable Insights: Global Enterprise Network Infrastructure Market size to reach USD 78.5 Billion by 2028

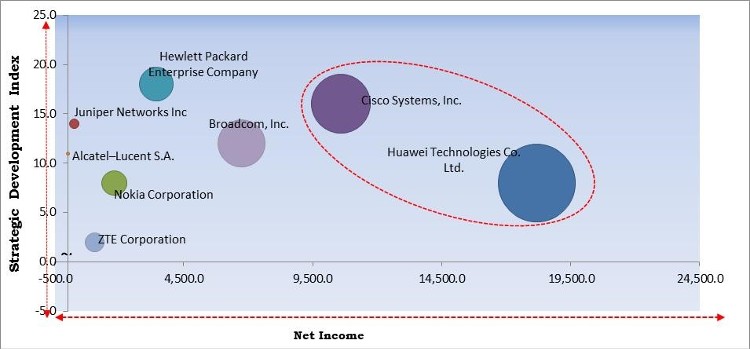

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Cisco Systems, Inc. and Huawei Technologies Co. Ltd. are the forerunners in the Enterprise Network Infrastructure Market. Companies such as Broadcom, Inc., Hewlett Packard Enterprise Company, Nokia Corporation are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Cisco Systems, Inc., Hewlett-Packard Enterprise Company, Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Juniper Networks, Inc., Broadcom, Inc. (Brocade Communications Systems, Inc.), Alcatel-Lucent Enterprise (China Huaxin Post and Telecom Technologies Co., Limited), Nokia Corporation, Avaya, Inc. (Avaya Holdings Corp.), and ZTE Corporation.

By Enterprise Size

By Industry

By Technology

By Geography

The global enterprise network infrastructure market size is expected to reach $78.5 billion by 2028.

Increased network security are increasing are driving the market in coming years, however, lack of reliability growth of the market.

Cisco Systems, Inc., Hewlett-Packard Enterprise Company, Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Juniper Networks, Inc., Broadcom, Inc. (Brocade Communications Systems, Inc.), Alcatel-Lucent Enterprise (China Huaxin Post and Telecom Technologies Co., Limited), Nokia Corporation, Avaya, Inc. (Avaya Holdings Corp.), and ZTE Corporation.

The expected CAGR of the enterprise network infrastructure market is 5.3% from 2022 to 2028.

The BFSI segment acquired maximum revenue share in the Global Enterprise Network Infrastructure Market by Industry in 2021, thereby, achieving a market value of $18.6 billion by 2028.

The North America market dominated the Global Enterprise Network Infrastructure Market by Region in 2021, and would continue to be a dominant market till 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.