Global Epigenetics Market Size, Share & Industry Trends Analysis Report By Application (Oncology and Non-Oncology), By Product, By End User, By Regional Outlook and Forecast, 2022 - 2028

Published Date : 31-May-2022 |

Pages: 212 |

Formats: PDF |

COVID-19 Impact on the Epigenetics Market

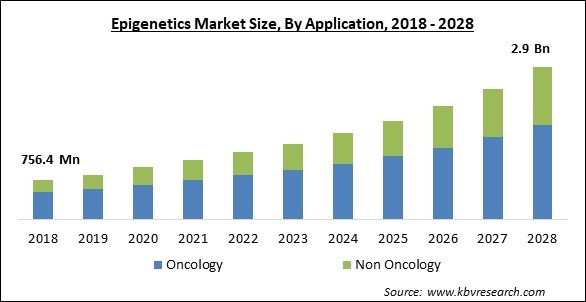

The Global Epigenetics Market size is expected to reach $2.9 billion by 2028, rising at a market growth of 14.6% CAGR during the forecast period.

Epigenetics is a field of genetics that examines cellular and physiological feature changes produced by environmental or environmental variables that switch genes on and off and alter the cellular capacity to read genes without being influenced by genotype changes. Although the underlying DNA or RNA sequence stays unchanged, epigenetics produces changes in an organism's phenotype rather than genotype. Epigenetic alterations are important for development because they are dynamic and change in response to environmental stimuli.

Epigenetics is a cutting-edge field that focuses on discovering and tracking phenotypic changes in genes caused by chromosomal modifications without affecting the DNA sequence. Although other uses are growing, this field is most commonly associated with cancer research. Rising institutional and governmental collaboration, as well as financing for the development of innovative methods for disease detection and treatment, are expected to boost demand for epigenetics, hence propelling the market forward. For example, the University of Southampton and University Hospitals Southampton NHS Foundation Trust (UK) got USD 1.57 million (GBP 1 million) in February 2016 for cancer and infectious disease genetics and genomics research.

The growing global prevalence of cancer, as well as the growing use of epigenetics in non-oncology diseases, are two important factors driving the global epigenetics market. The number of cancer patients is expected to climb from 14.1 million in 2012 to 19.3 million by 2025, according to WHO projections. The number of new cancer cases in the United States grew to 1,688,780 in 2017 from 1,685,210 in 2016, according to the American Cancer Society.

Moreover, factors like growing cancer prevalence increased funding for healthcare research and development, and rising applications of non-oncological epigenetics would help the market to flourish more. According to Globocan 2020, there were 19, 292, 789 new cancer cases of various sorts recorded worldwide in 2020, with 9,958,133 cancer-related deaths. This global and widespread threat of cancer continues to be a significant driving force behind the development of new cancer therapies that aid in risk assessment, early diagnosis, and successful treatment monitoring.

COVID-19 Impact Analysis

Due to the importance of epigenetics in the COVID-19 research, Covid has had a substantial impact on epigenetics market growth. According to research published in Clinical Epigenetics in October 2020 titled "The epigenetic implication in coronavirus infection and therapy," epigenetic changes may play a key role in the emergence of coronavirus illness outcomes. Despite the fact that a variety of therapy alternatives are being examined, more research is urgently needed to find a viable vaccine or safer chemotherapeutic drugs, including epigenetic treatments, to combat this viral pandemic and develop pre-and post-exposure COVID-19 prophylaxis.

Market Growth Factors:

Increased demand for DNA Methylation

The epigenetics market is driven by DNA methylation, which is the covalent attachment of a methyl group to the cytosine ring, which inhibits transcription. Methylation-sensitive PCR is defined as sensitive bisulfite modification followed by PCR (MSP). Variations of MSP include real-time PCR for methylation detection, methyl light, and quantitative analysis of methylated alleles. Quantitative methods for DNA methylation are currently available, including allele-specific bisulphite sequencing, southern-based approach, bisulphite pyrosequencing, and bisulphite PCR followed by MALDI - TOF MS. Technological improvements are making it easier to assess locus-specific DNA methylation on a genome-wide scale, which is boosting market expansion.

Increasing incidences of cancer

The number of persons diagnosed with cancer has risen dramatically all around the world. The number of cancer patients is expected to climb from 14.1 million in 2012 to 19.3 million by 2025, according to WHO projections. Cancer is the second most common cause of mortality in the United States, accounting for approximately one out of every four deaths. According to the American Cancer Society, the number of new cancer cases in the United States is predicted to rise to 1,688,780 in 2017 from 1,685,210 in 2016, while the total number of cancer-related deaths is expected to rise to 600,920 from 595,690 in the same time period.

Marketing Restraining Factor:

The massive cost of Instruments and the high need for standardization and clinical validation

Epigenetics research instruments are expensive due to their extensive features and functions. Illumina's NovaSeq 5000 and 6000 sequencers, for example, were released in January 2017 and cost USD 850,000 and USD 985,000, respectively. The total cost of ownership is increased by maintenance and a range of other indirect expenditures, such as samples and consumables. Hence, many healthcare institutions are not prompt to embrace these instruments. Pharmaceutical companies and research institutes require several of these systems. As a result, large sums of money will be needed to purchase a number of high-priced genomic devices. End users with tight budgets, like academic research labs, have a hard time affording such systems.

Application Outlook

Based on Application, the market is segmented into Oncology and Non-Oncology. In 2021, the Oncology segment acquired the maximum revenue share of the Epigenetics Market. This is due to a huge increase in cancer cases. The segment is expected to grow as the global prevalence of cancer rises, as well as the number of cancer-related deaths. Furthermore, the market is expected to grow due to the launch of new products and the potential commercialization of products already in the pipeline in the near future. Epimutations are epigenetic alterations that result in hypermethylation and epigenetic silencing. Epimutations have long been suspected of playing a role in cancer aetiology. Epimutations, specifically related to the silencing of tumor suppressor genes and the activation of oncogenes, are the subject of extensive research and development. Epimutations, unlike ordinary mutations, are reversible in nature.

Product Outlook

Based on Product, the market is segmented into Kits, Reagents, Enzymes, and Instruments.The Reagents segment procured a significant revenue share of the Epigenetics Market in 2021. The most commonly utilized epigenetic reagents are histone and DNA modifiers. Antibodies, PCR reagents, primers, histones, electrophoresis reagents, nucleic acid analysis reagents, and buffers are some of the most common epigenetic reagents. PyroMark Q24 is a sophisticated reagent that uses advanced pyrosequencing chemistry to deliver much better real-time sequence-based detection and quantification than previously possible. The existence of a number of technology platforms makes gene, protein, and cellular analysis easier, which fosters worldwide market innovation.

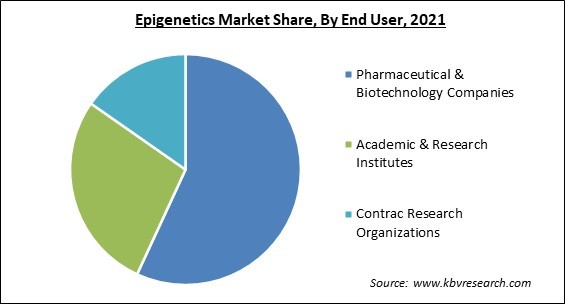

End User Outlook

Based on End User, the market is segmented into Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, and Contract Research Organizations. In 2021, the Pharmaceutical & Biotechnology Companies segment acquired the biggest revenue share of the Epigenetics Market. This can be attributed to the R & D activities for drug resistance developed by microorganisms, oncology, molecular aspects of cancer, and drug discovery for non-oncology applications. Moreover, the growth of the segment would further be driven by the increased research in the fields of genetics with a strong focus on customized treatment.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 1.1 Billion |

| Market size forecast in 2028 | USD 2.9 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 14.6% from 2022 to 2028 |

| Number of Pages | 212 |

| Number of Tables | 353 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Product, Application, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Regional Outlook

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2021, North America emerged as the leading region in the overall Epigenetics Market by collecting the maximum revenue share. This can be due to well-developed healthcare infrastructure, a wide range of modern epigenetics products, a big number of significant players, and well-trained medical personnel.

Free Valuable Insights: Global Epigenetics Market size to reach USD 2.9 Billion by 2028

KBV Cardinal Matrix - Epigenetics Market Competition Analysis

The major strategies followed by the market participants are Partnership. Based on the Analysis presented in the Cardinal matrix; Thermo Fisher Scientific, Inc. is the major forerunner in the Epigenetics Market. Companies such as PerkinElmer, Inc., Agilent Technologies, Inc. and Active Motif, Inc. are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Abcam plc, Agilent Technologies, Inc., Hologic, Inc., Illumina, Inc., Merck Group, PerkinElmer, Inc., Qiagen N.V., Thermo Fisher Scientific, Inc., Zymo Research, and Active Motif, Inc.

Recent Strategies Deployed in Epigenetics Market

» Partnerships, Collaborations and Agreements:

- Dec-2021: Qiagen formed a partnership with Denovo Biopharma, a biotech company providing a novel biomarker solution. Through this partnership, the companies aimed to develop a blood-based companion diagnostic test to recognize patients convey Denovo Genomic Marker 1 likely to acknowledge Denovo’s investigational cancer drug DB102TM for treatment of diffuse large B-cell lymphoma, one of the most usual lymphoid cancers.

- Dec-2021: Agilent Technologies formed a partnership with Lonza, a leading global cell and gene therapy manufacturer. Through this partnership, the companies aimed to convert the way customized cell therapies are realized and manufactured.

- Oct-2021: Abcam took over with BioVision, distributor of life science research tools. Through this acquisition, BioVision would improve Abcam's in-house innovation and compute scale to support the biochemical assay and cellular assay markets. Additionally, Acquisition would bring BioVision's product offerings, abilities, and 70-strong professional development and producing teams within Abcam.

- Aug-2021: Illumina joined hands with Next Generation Genomic, Southeast Asian Nations leaders in laboratory services and reproductive science. Through this collaboration, the companies aimed to introduce VeriSeq NIPT Solution v2 in Thailand, a CE-IVD, next-generation sequencing-based access to noninvasive prenatal testing.

- Jun-2021: Illumina partnered with Microba Life Sciences, world-leading technology for measuring the human gut microbiome. Together, the companies aimed to provide Illumina’s subversive NGS tools and Microba’s high-quality exclusive gut microbiome analysis platform to create the precise metagenomic data that researchers need to boost new inventions.

- Feb-2021: Active Motif came into a partnership with Arima Genomics, a biotechnology company. Together, the companies aimed to boost the awareness of genome structure and sequence to examine the three-dimensional folding patterns of the genome, delivering investigators with greater access to powerful technology and enhancing their research.

- Mar-2020: Zymo Research formed a partnership with Tecan, a provider of laboratory instruments and solutions in biopharmaceuticals. Through this partnership, the companies aimed to introduce a ready-to-go processing solution to simplify viral DNA/RNA extraction from oropharyngeal swabs, nasopharyngeal swabs, sputum, saliva, serum, and plasma.

» Acquisitions and Mergers:

- Jan-2022: Active Motif completed the acquisition of Amaryllis Nucleics, a Bay Area-based start-up company. Through this acquisition, the company aimed to employ novel synthesis chemistry that is twice as quick from RNA to library prep correlated to other methods is less costly and shows bigger than 99% fiber specificity.

- Sep-2021: PerkinElmer completed the acquisition of BioLegend, a leading provider of life science antibodies and reagents. Through this acquisition, the companies aimed to deliver new innovative solutions to scientists, assisting in propelling novel therapeutic development and discovery.

- Apr-2021: Agilent took over Resolution Bioscience, a leader in the development and commercialization of next-generation sequencing-based accuracy oncology solutions. This acquisition aimed to expand Agilent’s abilities in NGS-based cancer diagnostics and delivers the enterprise with innovative technology to further provide the demands of the rapidly growing accurate medicine market.

- Mar-2021: Hologic took over Diagenode, an international life sciences enterprise. This acquisition aimed to concentrate on creative instruments and reagents systems for life science research, to bolster our molecular diagnostics enterprise by expanding international abilities, enhancing regional time-to-market, and enabling us to provide a wide, more comprehend test menu.

- Dec-2020: PerkinElmer completed the acquisition of Horizon Discovery, a gene editing company. Through this acquisition, the company aimed to provide entire workflow solutions to life science consumer employed on drug development and discovery.

- Oct-2020: Abcam completed the acquisition of the Marker Gene Technologies, a developer of innovative new products for the biotechnology and medical organization. This acquisition aimed to expand the range of observation tools, such as cell assays & health kits, substrates, and biological probes. Additionally, Abcam aimed to launch a new range of pCambia plant vectors.

» Product Launches and Product Expansions:

- Oct-2021: PerkinElmer introduced Signals Image Artist. The software delivers next generation image investigation and administration platform for drug discovery analysis.

Scope of the Study

Market Segments Covered in the Report:

By Application

- Oncology

- Non-Oncology

By Product

- Kits

- Reagents

- Enzymes

- Instruments

By End User

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Contract Research Organizations

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Abcam plc

- Agilent Technologies, Inc.

- Hologic, Inc.

- Illumina, Inc.

- Merck Group

- PerkinElmer, Inc.

- Qiagen N.V.

- Thermo Fisher Scientific, Inc.

- Zymo Research

- Active Motif, Inc.

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Global Epigenetics Market, by Application

1.4.2 Global Epigenetics Market, by Product

1.4.3 Global Epigenetics Market, by End User

1.4.4 Global Epigenetics Market, by Geography

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

Chapter 3. Competition Analysis - Global

3.1 KBV Cardinal Matrix

3.2 Recent Industry Wide Strategic Developments

3.2.1 Partnerships, Collaborations and Agreements

3.2.2 Product Launches and Product Expansions

3.2.3 Acquisition and Mergers

3.3 Top Winning Strategies

3.3.1 Key Leading Strategies: Percentage Distribution (2018-2022)

3.3.2 Key Strategic Move: (Partnerships, Collaborations and Agreements: 2018, Apr – 2021, Dec) Leading Players

Chapter 4. Global Epigenetics Market by Application

4.1 Global Oncology Market by Region

4.2 Global Non Oncology Market by Region

Chapter 5. Global Epigenetics Market by Product

5.1 Global Kits Market by Region

5.2 Global Reagents Market by Region

5.3 Global Enzymes Market by Region

5.4 Global Instruments Market by Region

Chapter 6. Global Epigenetics Market by End User

6.1 Global Pharmaceutical & Biotechnology Companies Market by Region

6.2 Global Academic & Research Institutes Market by Region

6.3 Global Contract Research Organizations Market by Region

Chapter 7. Global Epigenetics Market by Region

7.1 North America Epigenetics Market

7.1.1 North America Epigenetics Market by Application

7.1.1.1 North America Oncology Market by Country

7.1.1.2 North America Non Oncology Market by Country

7.1.2 North America Epigenetics Market by Product

7.1.2.1 North America Kits Market by Country

7.1.2.2 North America Reagents Market by Country

7.1.2.3 North America Enzymes Market by Country

7.1.2.4 North America Instruments Market by Country

7.1.3 North America Epigenetics Market by End User

7.1.3.1 North America Pharmaceutical & Biotechnology Companies Market by Country

7.1.3.2 North America Academic & Research Institutes Market by Country

7.1.3.3 North America Contract Research Organizations Market by Country

7.1.4 North America Epigenetics Market by Country

7.1.4.1 US Epigenetics Market

7.1.4.1.1 US Epigenetics Market by Application

7.1.4.1.2 US Epigenetics Market by Product

7.1.4.1.3 US Epigenetics Market by End User

7.1.4.2 Canada Epigenetics Market

7.1.4.2.1 Canada Epigenetics Market by Application

7.1.4.2.2 Canada Epigenetics Market by Product

7.1.4.2.3 Canada Epigenetics Market by End User

7.1.4.3 Mexico Epigenetics Market

7.1.4.3.1 Mexico Epigenetics Market by Application

7.1.4.3.2 Mexico Epigenetics Market by Product

7.1.4.3.3 Mexico Epigenetics Market by End User

7.1.4.4 Rest of North America Epigenetics Market

7.1.4.4.1 Rest of North America Epigenetics Market by Application

7.1.4.4.2 Rest of North America Epigenetics Market by Product

7.1.4.4.3 Rest of North America Epigenetics Market by End User

7.2 Europe Epigenetics Market

7.2.1 Europe Epigenetics Market by Application

7.2.1.1 Europe Oncology Market by Country

7.2.1.2 Europe Non Oncology Market by Country

7.2.2 Europe Epigenetics Market by Product

7.2.2.1 Europe Kits Market by Country

7.2.2.2 Europe Reagents Market by Country

7.2.2.3 Europe Enzymes Market by Country

7.2.2.4 Europe Instruments Market by Country

7.2.3 Europe Epigenetics Market by End User

7.2.3.1 Europe Pharmaceutical & Biotechnology Companies Market by Country

7.2.3.2 Europe Academic & Research Institutes Market by Country

7.2.3.3 Europe Contract Research Organizations Market by Country

7.2.4 Europe Epigenetics Market by Country

7.2.4.1 Germany Epigenetics Market

7.2.4.1.1 Germany Epigenetics Market by Application

7.2.4.1.2 Germany Epigenetics Market by Product

7.2.4.1.3 Germany Epigenetics Market by End User

7.2.4.2 UK Epigenetics Market

7.2.4.2.1 UK Epigenetics Market by Application

7.2.4.2.2 UK Epigenetics Market by Product

7.2.4.2.3 UK Epigenetics Market by End User

7.2.4.3 France Epigenetics Market

7.2.4.3.1 France Epigenetics Market by Application

7.2.4.3.2 France Epigenetics Market by Product

7.2.4.3.3 France Epigenetics Market by End User

7.2.4.4 Russia Epigenetics Market

7.2.4.4.1 Russia Epigenetics Market by Application

7.2.4.4.2 Russia Epigenetics Market by Product

7.2.4.4.3 Russia Epigenetics Market by End User

7.2.4.5 Spain Epigenetics Market

7.2.4.5.1 Spain Epigenetics Market by Application

7.2.4.5.2 Spain Epigenetics Market by Product

7.2.4.5.3 Spain Epigenetics Market by End User

7.2.4.6 Italy Epigenetics Market

7.2.4.6.1 Italy Epigenetics Market by Application

7.2.4.6.2 Italy Epigenetics Market by Product

7.2.4.6.3 Italy Epigenetics Market by End User

7.2.4.7 Rest of Europe Epigenetics Market

7.2.4.7.1 Rest of Europe Epigenetics Market by Application

7.2.4.7.2 Rest of Europe Epigenetics Market by Product

7.2.4.7.3 Rest of Europe Epigenetics Market by End User

7.3 Asia Pacific Epigenetics Market

7.3.1 Asia Pacific Epigenetics Market by Application

7.3.1.1 Asia Pacific Oncology Market by Country

7.3.1.2 Asia Pacific Non Oncology Market by Country

7.3.2 Asia Pacific Epigenetics Market by Product

7.3.2.1 Asia Pacific Kits Market by Country

7.3.2.2 Asia Pacific Reagents Market by Country

7.3.2.3 Asia Pacific Enzymes Market by Country

7.3.2.4 Asia Pacific Instruments Market by Country

7.3.3 Asia Pacific Epigenetics Market by End User

7.3.3.1 Asia Pacific Pharmaceutical & Biotechnology Companies Market by Country

7.3.3.2 Asia Pacific Academic & Research Institutes Market by Country

7.3.3.3 Asia Pacific Contract Research Organizations Market by Country

7.3.4 Asia Pacific Epigenetics Market by Country

7.3.4.1 China Epigenetics Market

7.3.4.1.1 China Epigenetics Market by Application

7.3.4.1.2 China Epigenetics Market by Product

7.3.4.1.3 China Epigenetics Market by End User

7.3.4.2 Japan Epigenetics Market

7.3.4.2.1 Japan Epigenetics Market by Application

7.3.4.2.2 Japan Epigenetics Market by Product

7.3.4.2.3 Japan Epigenetics Market by End User

7.3.4.3 India Epigenetics Market

7.3.4.3.1 India Epigenetics Market by Application

7.3.4.3.2 India Epigenetics Market by Product

7.3.4.3.3 India Epigenetics Market by End User

7.3.4.4 South Korea Epigenetics Market

7.3.4.4.1 South Korea Epigenetics Market by Application

7.3.4.4.2 South Korea Epigenetics Market by Product

7.3.4.4.3 South Korea Epigenetics Market by End User

7.3.4.5 Singapore Epigenetics Market

7.3.4.5.1 Singapore Epigenetics Market by Application

7.3.4.5.2 Singapore Epigenetics Market by Product

7.3.4.5.3 Singapore Epigenetics Market by End User

7.3.4.6 Malaysia Epigenetics Market

7.3.4.6.1 Malaysia Epigenetics Market by Application

7.3.4.6.2 Malaysia Epigenetics Market by Product

7.3.4.6.3 Malaysia Epigenetics Market by End User

7.3.4.7 Rest of Asia Pacific Epigenetics Market

7.3.4.7.1 Rest of Asia Pacific Epigenetics Market by Application

7.3.4.7.2 Rest of Asia Pacific Epigenetics Market by Product

7.3.4.7.3 Rest of Asia Pacific Epigenetics Market by End User

7.4 LAMEA Epigenetics Market

7.4.1 LAMEA Epigenetics Market by Application

7.4.1.1 LAMEA Oncology Market by Country

7.4.1.2 LAMEA Non Oncology Market by Country

7.4.2 LAMEA Epigenetics Market by Product

7.4.2.1 LAMEA Kits Market by Country

7.4.2.2 LAMEA Reagents Market by Country

7.4.2.3 LAMEA Enzymes Market by Country

7.4.2.4 LAMEA Instruments Market by Country

7.4.3 LAMEA Epigenetics Market by End User

7.4.3.1 LAMEA Pharmaceutical & Biotechnology Companies Market by Country

7.4.3.2 LAMEA Academic & Research Institutes Market by Country

7.4.3.3 LAMEA Contract Research Organizations Market by Country

7.4.4 LAMEA Epigenetics Market by Country

7.4.4.1 Brazil Epigenetics Market

7.4.4.1.1 Brazil Epigenetics Market by Application

7.4.4.1.2 Brazil Epigenetics Market by Product

7.4.4.1.3 Brazil Epigenetics Market by End User

7.4.4.2 Argentina Epigenetics Market

7.4.4.2.1 Argentina Epigenetics Market by Application

7.4.4.2.2 Argentina Epigenetics Market by Product

7.4.4.2.3 Argentina Epigenetics Market by End User

7.4.4.3 UAE Epigenetics Market

7.4.4.3.1 UAE Epigenetics Market by Application

7.4.4.3.2 UAE Epigenetics Market by Product

7.4.4.3.3 UAE Epigenetics Market by End User

7.4.4.4 Saudi Arabia Epigenetics Market

7.4.4.4.1 Saudi Arabia Epigenetics Market by Application

7.4.4.4.2 Saudi Arabia Epigenetics Market by Product

7.4.4.4.3 Saudi Arabia Epigenetics Market by End User

7.4.4.5 South Africa Epigenetics Market

7.4.4.5.1 South Africa Epigenetics Market by Application

7.4.4.5.2 South Africa Epigenetics Market by Product

7.4.4.5.3 South Africa Epigenetics Market by End User

7.4.4.6 Nigeria Epigenetics Market

7.4.4.6.1 Nigeria Epigenetics Market by Application

7.4.4.6.2 Nigeria Epigenetics Market by Product

7.4.4.6.3 Nigeria Epigenetics Market by End User

7.4.4.7 Rest of LAMEA Epigenetics Market

7.4.4.7.1 Rest of LAMEA Epigenetics Market by Application

7.4.4.7.2 Rest of LAMEA Epigenetics Market by Product

7.4.4.7.3 Rest of LAMEA Epigenetics Market by End User

Chapter 8. Company Profiles

8.1 Abcam plc

8.1.1 Company Overview

8.1.2 Financial Analysis

8.1.3 Segmental and Regional Analysis

8.1.4 Research & Development Expenses

8.1.5 Recent strategies and developments:

8.1.5.1 Partnerships, Collaborations, and Agreements:

8.1.5.2 Acquisition and Mergers:

8.2 Agilent Technologies, Inc.

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Segmental and Regional Analysis

8.2.4 Research & Development Expense

8.2.5 Recent strategies and developments:

8.2.5.1 Partnerships, Collaborations, and Agreements:

8.2.5.2 Acquisition and Mergers:

8.3 Hologic, Inc.

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Segmental and Regional Analysis

8.3.4 Research & Development Expense

8.3.5 Recent strategies and developments:

8.3.5.1 Acquisition and Mergers:

8.4 Illumina, Inc.

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Regional Analysis

8.4.4 Research & Development Expense

8.4.5 Recent strategies and developments:

8.4.5.1 Partnerships, Collaborations, and Agreements:

8.5 Merck Group (Merck Millipore)

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Segmental and Regional Analysis

8.5.4 Research & Development Expense

8.6 PerkinElmer, Inc.

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Segmental and Regional Analysis

8.6.4 Research & Development Expense

8.6.5 Recent strategies and developments:

8.6.5.1 Partnerships, Collaborations, and Agreements:

8.6.5.2 Product Launches and Product Expansions:

8.6.5.3 Acquisition and Mergers:

8.7 Qiagen N.V.

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Regional Analysis

8.7.4 Research & Development Expense

8.7.5 Recent strategies and developments:

8.7.5.1 Partnerships, Collaborations, and Agreements:

8.8 Thermo Fisher Scientific, Inc.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Segmental and Regional Analysis

8.8.4 Research & Development Expense

8.8.5 Recent strategies and developments:

8.8.5.1 Partnerships, Collaborations, and Agreements:

8.9 Zymo Research

8.9.1 Company Overview

8.9.2 Recent strategies and developments:

8.9.2.1 Partnerships, Collaborations, and Agreements:

8.10. Active Motif, Inc.

8.10.1 Company Overview

8.10.2 Recent strategies and developments:

8.10.2.1 Partnerships, Collaborations, and Agreements:

8.10.2.2 Acquisition and Mergers:

TABLE 2 Global Epigenetics Market, 2022 - 2028, USD Million

TABLE 3 Partnerships, Collaborations and Agreements – Epigenetics Market

TABLE 4 Product Launches And Product Expansions – Epigenetics Market

TABLE 5 Acquisition and Mergers – Epigenetics Market

TABLE 6 Global Epigenetics Market by Application, 2018 - 2021, USD Million

TABLE 7 Global Epigenetics Market by Application, 2022 - 2028, USD Million

TABLE 8 Global Oncology Market by Region, 2018 - 2021, USD Million

TABLE 9 Global Oncology Market by Region, 2022 - 2028, USD Million

TABLE 10 Global Non Oncology Market by Region, 2018 - 2021, USD Million

TABLE 11 Global Non Oncology Market by Region, 2022 - 2028, USD Million

TABLE 12 Global Epigenetics Market by Product, 2018 - 2021, USD Million

TABLE 13 Global Epigenetics Market by Product, 2022 - 2028, USD Million

TABLE 14 Global Kits Market by Region, 2018 - 2021, USD Million

TABLE 15 Global Kits Market by Region, 2022 - 2028, USD Million

TABLE 16 Global Reagents Market by Region, 2018 - 2021, USD Million

TABLE 17 Global Reagents Market by Region, 2022 - 2028, USD Million

TABLE 18 Global Enzymes Market by Region, 2018 - 2021, USD Million

TABLE 19 Global Enzymes Market by Region, 2022 - 2028, USD Million

TABLE 20 Global Instruments Market by Region, 2018 - 2021, USD Million

TABLE 21 Global Instruments Market by Region, 2022 - 2028, USD Million

TABLE 22 Global Epigenetics Market by End User, 2018 - 2021, USD Million

TABLE 23 Global Epigenetics Market by End User, 2022 - 2028, USD Million

TABLE 24 Global Pharmaceutical & Biotechnology Companies Market by Region, 2018 - 2021, USD Million

TABLE 25 Global Pharmaceutical & Biotechnology Companies Market by Region, 2022 - 2028, USD Million

TABLE 26 Global Academic & Research Institutes Market by Region, 2018 - 2021, USD Million

TABLE 27 Global Academic & Research Institutes Market by Region, 2022 - 2028, USD Million

TABLE 28 Global Contract Research Organizations Market by Region, 2018 - 2021, USD Million

TABLE 29 Global Contract Research Organizations Market by Region, 2022 - 2028, USD Million

TABLE 30 Global Epigenetics Market by Region, 2018 - 2021, USD Million

TABLE 31 Global Epigenetics Market by Region, 2022 - 2028, USD Million

TABLE 32 North America Epigenetics Market, 2018 - 2021, USD Million

TABLE 33 North America Epigenetics Market, 2022 - 2028, USD Million

TABLE 34 North America Epigenetics Market by Application, 2018 - 2021, USD Million

TABLE 35 North America Epigenetics Market by Application, 2022 - 2028, USD Million

TABLE 36 North America Oncology Market by Country, 2018 - 2021, USD Million

TABLE 37 North America Oncology Market by Country, 2022 - 2028, USD Million

TABLE 38 North America Non Oncology Market by Country, 2018 - 2021, USD Million

TABLE 39 North America Non Oncology Market by Country, 2022 - 2028, USD Million

TABLE 40 North America Epigenetics Market by Product, 2018 - 2021, USD Million

TABLE 41 North America Epigenetics Market by Product, 2022 - 2028, USD Million

TABLE 42 North America Kits Market by Country, 2018 - 2021, USD Million

TABLE 43 North America Kits Market by Country, 2022 - 2028, USD Million

TABLE 44 North America Reagents Market by Country, 2018 - 2021, USD Million

TABLE 45 North America Reagents Market by Country, 2022 - 2028, USD Million

TABLE 46 North America Enzymes Market by Country, 2018 - 2021, USD Million

TABLE 47 North America Enzymes Market by Country, 2022 - 2028, USD Million

TABLE 48 North America Others Market by Country, 2018 - 2021, USD Million

TABLE 49 North America Instruments Market by Country, 2022 - 2028, USD Million

TABLE 50 North America Epigenetics Market by End User, 2018 - 2021, USD Million

TABLE 51 North America Epigenetics Market by End User, 2022 - 2028, USD Million

TABLE 52 North America Pharmaceutical & Biotechnology Companies Market by Country, 2018 - 2021, USD Million

TABLE 53 North America Pharmaceutical & Biotechnology Companies Market by Country, 2022 - 2028, USD Million

TABLE 54 North America Academic & Research Institutes Market by Country, 2018 - 2021, USD Million

TABLE 55 North America Academic & Research Institutes Market by Country, 2022 - 2028, USD Million

TABLE 56 North America Contract Research Organizations Market by Country, 2018 - 2021, USD Million

TABLE 57 North America Contract Research Organizations Market by Country, 2022 - 2028, USD Million

TABLE 58 North America Epigenetics Market by Country, 2018 - 2021, USD Million

TABLE 59 North America Epigenetics Market by Country, 2022 - 2028, USD Million

TABLE 60 US Epigenetics Market, 2018 - 2021, USD Million

TABLE 61 US Epigenetics Market, 2022 - 2028, USD Million

TABLE 62 US Epigenetics Market by Application, 2018 - 2021, USD Million

TABLE 63 US Epigenetics Market by Application, 2022 - 2028, USD Million

TABLE 64 US Epigenetics Market by Product, 2018 - 2021, USD Million

TABLE 65 US Epigenetics Market by Product, 2022 - 2028, USD Million

TABLE 66 US Epigenetics Market by End User, 2018 - 2021, USD Million

TABLE 67 US Epigenetics Market by End User, 2022 - 2028, USD Million

TABLE 68 Canada Epigenetics Market, 2018 - 2021, USD Million

TABLE 69 Canada Epigenetics Market, 2022 - 2028, USD Million

TABLE 70 Canada Epigenetics Market by Application, 2018 - 2021, USD Million

TABLE 71 Canada Epigenetics Market by Application, 2022 - 2028, USD Million

TABLE 72 Canada Epigenetics Market by Product, 2018 - 2021, USD Million

TABLE 73 Canada Epigenetics Market by Product, 2022 - 2028, USD Million

TABLE 74 Canada Epigenetics Market by End User, 2018 - 2021, USD Million

TABLE 75 Canada Epigenetics Market by End User, 2022 - 2028, USD Million

TABLE 76 Mexico Epigenetics Market, 2018 - 2021, USD Million

TABLE 77 Mexico Epigenetics Market, 2022 - 2028, USD Million

TABLE 78 Mexico Epigenetics Market by Application, 2018 - 2021, USD Million

TABLE 79 Mexico Epigenetics Market by Application, 2022 - 2028, USD Million

TABLE 80 Mexico Epigenetics Market by Product, 2018 - 2021, USD Million

TABLE 81 Mexico Epigenetics Market by Product, 2022 - 2028, USD Million

TABLE 82 Mexico Epigenetics Market by End User, 2018 - 2021, USD Million

TABLE 83 Mexico Epigenetics Market by End User, 2022 - 2028, USD Million

TABLE 84 Rest of North America Epigenetics Market, 2018 - 2021, USD Million

TABLE 85 Rest of North America Epigenetics Market, 2022 - 2028, USD Million

TABLE 86 Rest of North America Epigenetics Market by Application, 2018 - 2021, USD Million

TABLE 87 Rest of North America Epigenetics Market by Application, 2022 - 2028, USD Million

TABLE 88 Rest of North America Epigenetics Market by Product, 2018 - 2021, USD Million

TABLE 89 Rest of North America Epigenetics Market by Product, 2022 - 2028, USD Million

TABLE 90 Rest of North America Epigenetics Market by End User, 2018 - 2021, USD Million

TABLE 91 Rest of North America Epigenetics Market by End User, 2022 - 2028, USD Million

TABLE 92 Europe Epigenetics Market, 2018 - 2021, USD Million

TABLE 93 Europe Epigenetics Market, 2022 - 2028, USD Million

TABLE 94 Europe Epigenetics Market by Application, 2018 - 2021, USD Million

TABLE 95 Europe Epigenetics Market by Application, 2022 - 2028, USD Million

TABLE 96 Europe Oncology Market by Country, 2018 - 2021, USD Million

TABLE 97 Europe Oncology Market by Country, 2022 - 2028, USD Million

TABLE 98 Europe Non Oncology Market by Country, 2018 - 2021, USD Million

TABLE 99 Europe Non Oncology Market by Country, 2022 - 2028, USD Million

TABLE 100 Europe Epigenetics Market by Product, 2018 - 2021, USD Million

TABLE 101 Europe Epigenetics Market by Product, 2022 - 2028, USD Million

TABLE 102 Europe Kits Market by Country, 2018 - 2021, USD Million

TABLE 103 Europe Kits Market by Country, 2022 - 2028, USD Million

TABLE 104 Europe Reagents Market by Country, 2018 - 2021, USD Million

TABLE 105 Europe Reagents Market by Country, 2022 - 2028, USD Million

TABLE 106 Europe Enzymes Market by Country, 2018 - 2021, USD Million

TABLE 107 Europe Enzymes Market by Country, 2022 - 2028, USD Million

TABLE 108 Europe Instruments Market by Country, 2018 - 2021, USD Million

TABLE 109 Europe Instruments Market by Country, 2022 - 2028, USD Million

TABLE 110 Europe Epigenetics Market by End User, 2018 - 2021, USD Million

TABLE 111 Europe Epigenetics Market by End User, 2022 - 2028, USD Million

TABLE 112 Europe Pharmaceutical & Biotechnology Companies Market by Country, 2018 - 2021, USD Million

TABLE 113 Europe Pharmaceutical & Biotechnology Companies Market by Country, 2022 - 2028, USD Million

TABLE 114 Europe Academic & Research Institutes Market by Country, 2018 - 2021, USD Million

TABLE 115 Europe Academic & Research Institutes Market by Country, 2022 - 2028, USD Million

TABLE 116 Europe Contract Research Organizations Market by Country, 2018 - 2021, USD Million

TABLE 117 Europe Contract Research Organizations Market by Country, 2022 - 2028, USD Million

TABLE 118 Europe Epigenetics Market by Country, 2018 - 2021, USD Million

TABLE 119 Europe Epigenetics Market by Country, 2022 - 2028, USD Million

TABLE 120 Germany Epigenetics Market, 2018 - 2021, USD Million

TABLE 121 Germany Epigenetics Market, 2022 - 2028, USD Million

TABLE 122 Germany Epigenetics Market by Application, 2018 - 2021, USD Million

TABLE 123 Germany Epigenetics Market by Application, 2022 - 2028, USD Million

TABLE 124 Germany Epigenetics Market by Product, 2018 - 2021, USD Million

TABLE 125 Germany Epigenetics Market by Product, 2022 - 2028, USD Million

TABLE 126 Germany Epigenetics Market by End User, 2018 - 2021, USD Million

TABLE 127 Germany Epigenetics Market by End User, 2022 - 2028, USD Million

TABLE 128 UK Epigenetics Market, 2018 - 2021, USD Million

TABLE 129 UK Epigenetics Market, 2022 - 2028, USD Million

TABLE 130 UK Epigenetics Market by Application, 2018 - 2021, USD Million

TABLE 131 UK Epigenetics Market by Application, 2022 - 2028, USD Million

TABLE 132 UK Epigenetics Market by Product, 2018 - 2021, USD Million

TABLE 133 UK Epigenetics Market by Product, 2022 - 2028, USD Million

TABLE 134 UK Epigenetics Market by End User, 2018 - 2021, USD Million

TABLE 135 UK Epigenetics Market by End User, 2022 - 2028, USD Million

TABLE 136 France Epigenetics Market, 2018 - 2021, USD Million

TABLE 137 France Epigenetics Market, 2022 - 2028, USD Million

TABLE 138 France Epigenetics Market by Application, 2018 - 2021, USD Million

TABLE 139 France Epigenetics Market by Application, 2022 - 2028, USD Million

TABLE 140 France Epigenetics Market by Product, 2018 - 2021, USD Million

TABLE 141 France Epigenetics Market by Product, 2022 - 2028, USD Million

TABLE 142 France Epigenetics Market by End User, 2018 - 2021, USD Million

TABLE 143 France Epigenetics Market by End User, 2022 - 2028, USD Million

TABLE 144 Russia Epigenetics Market, 2018 - 2021, USD Million

TABLE 145 Russia Epigenetics Market, 2022 - 2028, USD Million

TABLE 146 Russia Epigenetics Market by Application, 2018 - 2021, USD Million

TABLE 147 Russia Epigenetics Market by Application, 2022 - 2028, USD Million

TABLE 148 Russia Epigenetics Market by Product, 2018 - 2021, USD Million

TABLE 149 Russia Epigenetics Market by Product, 2022 - 2028, USD Million

TABLE 150 Russia Epigenetics Market by End User, 2018 - 2021, USD Million

TABLE 151 Russia Epigenetics Market by End User, 2022 - 2028, USD Million

TABLE 152 Spain Epigenetics Market, 2018 - 2021, USD Million

TABLE 153 Spain Epigenetics Market, 2022 - 2028, USD Million

TABLE 154 Spain Epigenetics Market by Application, 2018 - 2021, USD Million

TABLE 155 Spain Epigenetics Market by Application, 2022 - 2028, USD Million

TABLE 156 Spain Epigenetics Market by Product, 2018 - 2021, USD Million

TABLE 157 Spain Epigenetics Market by Product, 2022 - 2028, USD Million

TABLE 158 Spain Epigenetics Market by End User, 2018 - 2021, USD Million

TABLE 159 Spain Epigenetics Market by End User, 2022 - 2028, USD Million

TABLE 160 Italy Epigenetics Market, 2018 - 2021, USD Million

TABLE 161 Italy Epigenetics Market, 2022 - 2028, USD Million

TABLE 162 Italy Epigenetics Market by Application, 2018 - 2021, USD Million

TABLE 163 Italy Epigenetics Market by Application, 2022 - 2028, USD Million

TABLE 164 Italy Epigenetics Market by Product, 2018 - 2021, USD Million

TABLE 165 Italy Epigenetics Market by Product, 2022 - 2028, USD Million

TABLE 166 Italy Epigenetics Market by End User, 2018 - 2021, USD Million

TABLE 167 Italy Epigenetics Market by End User, 2022 - 2028, USD Million

TABLE 168 Rest of Europe Epigenetics Market, 2018 - 2021, USD Million

TABLE 169 Rest of Europe Epigenetics Market, 2022 - 2028, USD Million

TABLE 170 Rest of Europe Epigenetics Market by Application, 2018 - 2021, USD Million

TABLE 171 Rest of Europe Epigenetics Market by Application, 2022 - 2028, USD Million

TABLE 172 Rest of Europe Epigenetics Market by Product, 2018 - 2021, USD Million

TABLE 173 Rest of Europe Epigenetics Market by Product, 2022 - 2028, USD Million

TABLE 174 Rest of Europe Epigenetics Market by End User, 2018 - 2021, USD Million

TABLE 175 Rest of Europe Epigenetics Market by End User, 2022 - 2028, USD Million

TABLE 176 Asia Pacific Epigenetics Market, 2018 - 2021, USD Million

TABLE 177 Asia Pacific Epigenetics Market, 2022 - 2028, USD Million

TABLE 178 Asia Pacific Epigenetics Market by Application, 2018 - 2021, USD Million

TABLE 179 Asia Pacific Epigenetics Market by Application, 2022 - 2028, USD Million

TABLE 180 Asia Pacific Oncology Market by Country, 2018 - 2021, USD Million

TABLE 181 Asia Pacific Oncology Market by Country, 2022 - 2028, USD Million

TABLE 182 Asia Pacific Non Oncology Market by Country, 2018 - 2021, USD Million

TABLE 183 Asia Pacific Non Oncology Market by Country, 2022 - 2028, USD Million

TABLE 184 Asia Pacific Epigenetics Market by Product, 2018 - 2021, USD Million

TABLE 185 Asia Pacific Epigenetics Market by Product, 2022 - 2028, USD Million

TABLE 186 Asia Pacific Kits Market by Country, 2018 - 2021, USD Million

TABLE 187 Asia Pacific Kits Market by Country, 2022 - 2028, USD Million

TABLE 188 Asia Pacific Reagents Market by Country, 2018 - 2021, USD Million

TABLE 189 Asia Pacific Reagents Market by Country, 2022 - 2028, USD Million

TABLE 190 Asia Pacific Enzymes Market by Country, 2018 - 2021, USD Million

TABLE 191 Asia Pacific Enzymes Market by Country, 2022 - 2028, USD Million

TABLE 192 Asia Pacific Instruments Market by Country, 2018 - 2021, USD Million

TABLE 193 Asia Pacific Instruments Market by Country, 2022 - 2028, USD Million

TABLE 194 Asia Pacific Epigenetics Market by End User, 2018 - 2021, USD Million

TABLE 195 Asia Pacific Epigenetics Market by End User, 2022 - 2028, USD Million

TABLE 196 Asia Pacific Pharmaceutical & Biotechnology Companies Market by Country, 2018 - 2021, USD Million

TABLE 197 Asia Pacific Pharmaceutical & Biotechnology Companies Market by Country, 2022 - 2028, USD Million

TABLE 198 Asia Pacific Academic & Research Institutes Market by Country, 2018 - 2021, USD Million

TABLE 199 Asia Pacific Academic & Research Institutes Market by Country, 2022 - 2028, USD Million

TABLE 200 Asia Pacific Contract Research Organizations Market by Country, 2018 - 2021, USD Million

TABLE 201 Asia Pacific Contract Research Organizations Market by Country, 2022 - 2028, USD Million

TABLE 202 Asia Pacific Epigenetics Market by Country, 2018 - 2021, USD Million

TABLE 203 Asia Pacific Epigenetics Market by Country, 2022 - 2028, USD Million

TABLE 204 China Epigenetics Market, 2018 - 2021, USD Million

TABLE 205 China Epigenetics Market, 2022 - 2028, USD Million

TABLE 206 China Epigenetics Market by Application, 2018 - 2021, USD Million

TABLE 207 China Epigenetics Market by Application, 2022 - 2028, USD Million

TABLE 208 China Epigenetics Market by Product, 2018 - 2021, USD Million

TABLE 209 China Epigenetics Market by Product, 2022 - 2028, USD Million

TABLE 210 China Epigenetics Market by End User, 2018 - 2021, USD Million

TABLE 211 China Epigenetics Market by End User, 2022 - 2028, USD Million

TABLE 212 Japan Epigenetics Market, 2018 - 2021, USD Million

TABLE 213 Japan Epigenetics Market, 2022 - 2028, USD Million

TABLE 214 Japan Epigenetics Market by Application, 2018 - 2021, USD Million

TABLE 215 Japan Epigenetics Market by Application, 2022 - 2028, USD Million

TABLE 216 Japan Epigenetics Market by Product, 2018 - 2021, USD Million

TABLE 217 Japan Epigenetics Market by Product, 2022 - 2028, USD Million

TABLE 218 Japan Epigenetics Market by End User, 2018 - 2021, USD Million

TABLE 219 Japan Epigenetics Market by End User, 2022 - 2028, USD Million

TABLE 220 India Epigenetics Market, 2018 - 2021, USD Million

TABLE 221 India Epigenetics Market, 2022 - 2028, USD Million

TABLE 222 India Epigenetics Market by Application, 2018 - 2021, USD Million

TABLE 223 India Epigenetics Market by Application, 2022 - 2028, USD Million

TABLE 224 India Epigenetics Market by Product, 2018 - 2021, USD Million

TABLE 225 India Epigenetics Market by Product, 2022 - 2028, USD Million

TABLE 226 India Epigenetics Market by End User, 2018 - 2021, USD Million

TABLE 227 India Epigenetics Market by End User, 2022 - 2028, USD Million

TABLE 228 South Korea Epigenetics Market, 2018 - 2021, USD Million

TABLE 229 South Korea Epigenetics Market, 2022 - 2028, USD Million

TABLE 230 South Korea Epigenetics Market by Application, 2018 - 2021, USD Million

TABLE 231 South Korea Epigenetics Market by Application, 2022 - 2028, USD Million

TABLE 232 South Korea Epigenetics Market by Product, 2018 - 2021, USD Million

TABLE 233 South Korea Epigenetics Market by Product, 2022 - 2028, USD Million

TABLE 234 South Korea Epigenetics Market by End User, 2018 - 2021, USD Million

TABLE 235 South Korea Epigenetics Market by End User, 2022 - 2028, USD Million

TABLE 236 Singapore Epigenetics Market, 2018 - 2021, USD Million

TABLE 237 Singapore Epigenetics Market, 2022 - 2028, USD Million

TABLE 238 Singapore Epigenetics Market by Application, 2018 - 2021, USD Million

TABLE 239 Singapore Epigenetics Market by Application, 2022 - 2028, USD Million

TABLE 240 Singapore Epigenetics Market by Product, 2018 - 2021, USD Million

TABLE 241 Singapore Epigenetics Market by Product, 2022 - 2028, USD Million

TABLE 242 Singapore Epigenetics Market by End User, 2018 - 2021, USD Million

TABLE 243 Singapore Epigenetics Market by End User, 2022 - 2028, USD Million

TABLE 244 Malaysia Epigenetics Market, 2018 - 2021, USD Million

TABLE 245 Malaysia Epigenetics Market, 2022 - 2028, USD Million

TABLE 246 Malaysia Epigenetics Market by Application, 2018 - 2021, USD Million

TABLE 247 Malaysia Epigenetics Market by Application, 2022 - 2028, USD Million

TABLE 248 Malaysia Epigenetics Market by Product, 2018 - 2021, USD Million

TABLE 249 Malaysia Epigenetics Market by Product, 2022 - 2028, USD Million

TABLE 250 Malaysia Epigenetics Market by End User, 2018 - 2021, USD Million

TABLE 251 Malaysia Epigenetics Market by End User, 2022 - 2028, USD Million

TABLE 252 Rest of Asia Pacific Epigenetics Market, 2018 - 2021, USD Million

TABLE 253 Rest of Asia Pacific Epigenetics Market, 2022 - 2028, USD Million

TABLE 254 Rest of Asia Pacific Epigenetics Market by Application, 2018 - 2021, USD Million

TABLE 255 Rest of Asia Pacific Epigenetics Market by Application, 2022 - 2028, USD Million

TABLE 256 Rest of Asia Pacific Epigenetics Market by Product, 2018 - 2021, USD Million

TABLE 257 Rest of Asia Pacific Epigenetics Market by Product, 2022 - 2028, USD Million

TABLE 258 Rest of Asia Pacific Epigenetics Market by End User, 2018 - 2021, USD Million

TABLE 259 Rest of Asia Pacific Epigenetics Market by End User, 2022 - 2028, USD Million

TABLE 260 LAMEA Epigenetics Market, 2018 - 2021, USD Million

TABLE 261 LAMEA Epigenetics Market, 2022 - 2028, USD Million

TABLE 262 LAMEA Epigenetics Market by Application, 2018 - 2021, USD Million

TABLE 263 LAMEA Epigenetics Market by Application, 2022 - 2028, USD Million

TABLE 264 LAMEA Oncology Market by Country, 2018 - 2021, USD Million

TABLE 265 LAMEA Oncology Market by Country, 2022 - 2028, USD Million

TABLE 266 LAMEA Non Oncology Market by Country, 2018 - 2021, USD Million

TABLE 267 LAMEA Non Oncology Market by Country, 2022 - 2028, USD Million

TABLE 268 LAMEA Epigenetics Market by Product, 2018 - 2021, USD Million

TABLE 269 LAMEA Epigenetics Market by Product, 2022 - 2028, USD Million

TABLE 270 LAMEA Kits Market by Country, 2018 - 2021, USD Million

TABLE 271 LAMEA Kits Market by Country, 2022 - 2028, USD Million

TABLE 272 LAMEA Reagents Market by Country, 2018 - 2021, USD Million

TABLE 273 LAMEA Reagents Market by Country, 2022 - 2028, USD Million

TABLE 274 LAMEA Enzymes Market by Country, 2018 - 2021, USD Million

TABLE 275 LAMEA Enzymes Market by Country, 2022 - 2028, USD Million

TABLE 276 LAMEA Instruments Market by Country, 2018 - 2021, USD Million

TABLE 277 LAMEA Instruments Market by Country, 2022 - 2028, USD Million

TABLE 278 LAMEA Epigenetics Market by End User, 2018 - 2021, USD Million

TABLE 279 LAMEA Epigenetics Market by End User, 2022 - 2028, USD Million

TABLE 280 LAMEA Pharmaceutical & Biotechnology Companies Market by Country, 2018 - 2021, USD Million

TABLE 281 LAMEA Pharmaceutical & Biotechnology Companies Market by Country, 2022 - 2028, USD Million

TABLE 282 LAMEA Academic & Research Institutes Market by Country, 2018 - 2021, USD Million

TABLE 283 LAMEA Academic & Research Institutes Market by Country, 2022 - 2028, USD Million

TABLE 284 LAMEA Contract Research Organizations Market by Country, 2018 - 2021, USD Million

TABLE 285 LAMEA Contract Research Organizations Market by Country, 2022 - 2028, USD Million

TABLE 286 LAMEA Epigenetics Market by Country, 2018 - 2021, USD Million

TABLE 287 LAMEA Epigenetics Market by Country, 2022 - 2028, USD Million

TABLE 288 Brazil Epigenetics Market, 2018 - 2021, USD Million

TABLE 289 Brazil Epigenetics Market, 2022 - 2028, USD Million

TABLE 290 Brazil Epigenetics Market by Application, 2018 - 2021, USD Million

TABLE 291 Brazil Epigenetics Market by Application, 2022 - 2028, USD Million

TABLE 292 Brazil Epigenetics Market by Product, 2018 - 2021, USD Million

TABLE 293 Brazil Epigenetics Market by Product, 2022 - 2028, USD Million

TABLE 294 Brazil Epigenetics Market by End User, 2018 - 2021, USD Million

TABLE 295 Brazil Epigenetics Market by End User, 2022 - 2028, USD Million

TABLE 296 Argentina Epigenetics Market, 2018 - 2021, USD Million

TABLE 297 Argentina Epigenetics Market, 2022 - 2028, USD Million

TABLE 298 Argentina Epigenetics Market by Application, 2018 - 2021, USD Million

TABLE 299 Argentina Epigenetics Market by Application, 2022 - 2028, USD Million

TABLE 300 Argentina Epigenetics Market by Product, 2018 - 2021, USD Million

TABLE 301 Argentina Epigenetics Market by Product, 2022 - 2028, USD Million

TABLE 302 Argentina Epigenetics Market by End User, 2018 - 2021, USD Million

TABLE 303 Argentina Epigenetics Market by End User, 2022 - 2028, USD Million

TABLE 304 UAE Epigenetics Market, 2018 - 2021, USD Million

TABLE 305 UAE Epigenetics Market, 2022 - 2028, USD Million

TABLE 306 UAE Epigenetics Market by Application, 2018 - 2021, USD Million

TABLE 307 UAE Epigenetics Market by Application, 2022 - 2028, USD Million

TABLE 308 UAE Epigenetics Market by Product, 2018 - 2021, USD Million

TABLE 309 UAE Epigenetics Market by Product, 2022 - 2028, USD Million

TABLE 310 UAE Epigenetics Market by End User, 2018 - 2021, USD Million

TABLE 311 UAE Epigenetics Market by End User, 2022 - 2028, USD Million

TABLE 312 Saudi Arabia Epigenetics Market, 2018 - 2021, USD Million

TABLE 313 Saudi Arabia Epigenetics Market, 2022 - 2028, USD Million

TABLE 314 Saudi Arabia Epigenetics Market by Application, 2018 - 2021, USD Million

TABLE 315 Saudi Arabia Epigenetics Market by Application, 2022 - 2028, USD Million

TABLE 316 Saudi Arabia Epigenetics Market by Product, 2018 - 2021, USD Million

TABLE 317 Saudi Arabia Epigenetics Market by Product, 2022 - 2028, USD Million

TABLE 318 Saudi Arabia Epigenetics Market by End User, 2018 - 2021, USD Million

TABLE 319 Saudi Arabia Epigenetics Market by End User, 2022 - 2028, USD Million

TABLE 320 South Africa Epigenetics Market, 2018 - 2021, USD Million

TABLE 321 South Africa Epigenetics Market, 2022 - 2028, USD Million

TABLE 322 South Africa Epigenetics Market by Application, 2018 - 2021, USD Million

TABLE 323 South Africa Epigenetics Market by Application, 2022 - 2028, USD Million

TABLE 324 South Africa Epigenetics Market by Product, 2018 - 2021, USD Million

TABLE 325 South Africa Epigenetics Market by Product, 2022 - 2028, USD Million

TABLE 326 South Africa Epigenetics Market by End User, 2018 - 2021, USD Million

TABLE 327 South Africa Epigenetics Market by End User, 2022 - 2028, USD Million

TABLE 328 Nigeria Epigenetics Market, 2018 - 2021, USD Million

TABLE 329 Nigeria Epigenetics Market, 2022 - 2028, USD Million

TABLE 330 Nigeria Epigenetics Market by Application, 2018 - 2021, USD Million

TABLE 331 Nigeria Epigenetics Market by Application, 2022 - 2028, USD Million

TABLE 332 Nigeria Epigenetics Market by Product, 2018 - 2021, USD Million

TABLE 333 Nigeria Epigenetics Market by Product, 2022 - 2028, USD Million

TABLE 334 Nigeria Epigenetics Market by End User, 2018 - 2021, USD Million

TABLE 335 Nigeria Epigenetics Market by End User, 2022 - 2028, USD Million

TABLE 336 Rest of LAMEA Epigenetics Market, 2018 - 2021, USD Million

TABLE 337 Rest of LAMEA Epigenetics Market, 2022 - 2028, USD Million

TABLE 338 Rest of LAMEA Epigenetics Market by Application, 2018 - 2021, USD Million

TABLE 339 Rest of LAMEA Epigenetics Market by Application, 2022 - 2028, USD Million

TABLE 340 Rest of LAMEA Epigenetics Market by Product, 2018 - 2021, USD Million

TABLE 341 Rest of LAMEA Epigenetics Market by Product, 2022 - 2028, USD Million

TABLE 342 Rest of LAMEA Epigenetics Market by End User, 2018 - 2021, USD Million

TABLE 343 Rest of LAMEA Epigenetics Market by End User, 2022 - 2028, USD Million

TABLE 344 key information – Abcam plc

TABLE 345 key Information – Agilent Technologies, Inc.

TABLE 346 Key information – Hologic, Inc.

TABLE 347 key information – Illumina, Inc.

TABLE 348 key Information – Merck GrouP

TABLE 349 key Information – PerkinElmer, Inc.

TABLE 350 Key Information – Qiagen N.V.

TABLE 351 Key Information – Thermo Fisher Scientific, Inc.

TABLE 352 Key Information – Zymo Research

TABLE 353 Key Information – Active Motif, Inc.

List of Figures

FIG 1 Methodology for the research

FIG 2 KBV Cardinal Matrix

FIG 3 Key Leading Strategies: Percentage Distribution (2018-2022)

FIG 4 Key Strategic Move: (Partnerships, Collaborations and Agreements: 2018, Apr – 2021, Dec) Leading Players

FIG 5 Global Epigenetics Market Share by Application, 2021

FIG 6 Global Epigenetics Market Share by Application, 2028

FIG 7 Global Epigenetics Market by Application, 2018 - 2028, USD Million

FIG 8 Global Epigenetics Market Share by Product, 2021

FIG 9 Global Epigenetics Market Share by Product, 2028

FIG 10 Global Epigenetics Market by Product, 2018 - 2028, USD Million

FIG 11 Global Epigenetics Market Share by End User, 2021

FIG 12 Global Epigenetics Market Share by End User, 2028

FIG 13 Global Epigenetics Market by End User, 2018 - 2028, USD Million

FIG 14 Global Epigenetics Market Share by Region, 2021

FIG 15 Global Epigenetics Market Share by Region, 2028

FIG 16 Global Epigenetics Market by Region, 2018 - 2028, USD Million

FIG 17 Recent strategies and developments: PerkinElmer, Inc.

FIG 18 Recent strategies and developments: Active Motif, Inc.