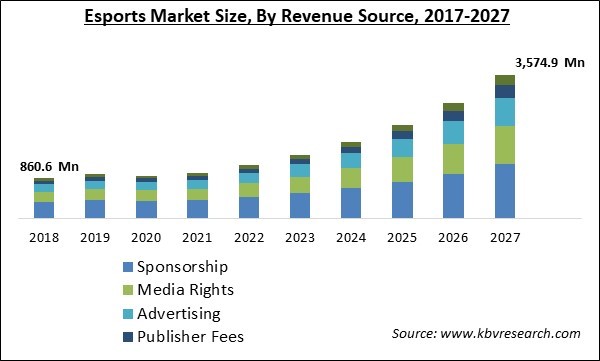

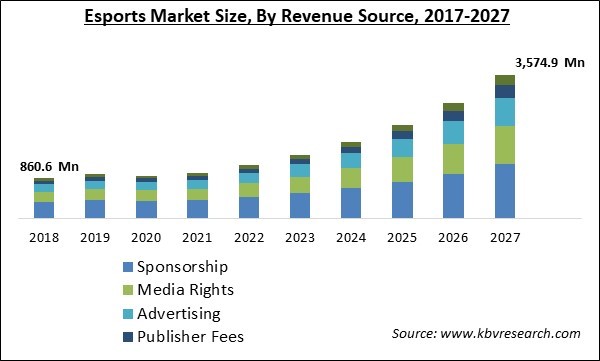

The Global Esports Market size is expected to reach $3,574.9 million by 2027, rising at a market growth of 21.3% CAGR during the forecast period.

Esports refers to electronic sports, in which digital mediums are used among competitors and spectators like PC, tablets, or mobile. Esports is available in the form of video games, which are played in leisure time as well as professionally by any traditional sportsperson. There is the growing popularity of esports due to the increasing digitalization across the world and the reduced cost of advanced gaming technologies.

Moreover, Esports has shifted online video gaming towards a spectator sport. In esports events, spectators experience watching a professional gaming event just like any other traditional sports event; however, instead of watching a physical competition, the audience watches video gamers competing with each other through the digital medium.

There is a huge base of participants prevailing in the video game industry, which is more than the combined viewers & participants of the music & entertainment sectors, and this base is constantly growing across the globe. The high popularity of video games like PUBG, Counter-Strike, Call of Duty, and others is estimated to augment the revenue share of the esports market.

COVID-19 Impact Analysis

The outbreak of the COVID-19 pandemic has positively impacted the growth of the esports market. The imposition of lockdown and social distancing norms has compelled people to engage with one another through digital as well as virtual platforms and mediums. In addition, digital transformation in the online gaming sector has contributed to the emergence of Esports. However, the deployment of esports was affected by the restricted supply of auxiliary tools like gaming setup, joypad, and console sensors & screens. However, with the relaxations in the lockdown norms and regulations, the growth of the esports market would surge in the coming years.

During the lockdown, people were compelled to follow the stay-at-home orders and could not move outside to play sports on grounds, which has shifted their focus on esports events and thus, augmented the demand for online video games. Several end-users have created online tournaments of famous or popular games, which has fueled the demand for these games in the market.

Market Growth Factors:

Rise in popularity of video games due to the influence of technology

The constant technological advancements across the world have compelled people to depend on smartphones, several high-tech gadgets, and the internet. As a large number of people are engaged in playing video games, the vendors have introduced a recurring revenue model in the past few years. In addition, virtual reality products, video game tournaments, and consumer spending on video content are experiencing high growth around the world due to the consistent technological advancement.

The growing number of esports events with huge prize pools

The Esports industry is getting monetized due to the high popularity of these esports events among gamers and spectators. Several universities and colleges are also offering scholarships and even esport courses just like any other traditional sports, which are creating opportunities for the gamers to choose it as a professional career. This would accelerate the growth of the esports market across the globe in the coming years.

Marketing Restraining Factor:

Absence of standardization in the esports market

As the esports industry is still an emerging market, there are several challenges faced by companies as well as gamers. There are many participants and gamers who face difficulties in checking out the authenticity of tournaments. Along with the increasing number of tournaments, the number of scams and fraudulent is also rising, which is creating problems for the authentic and real esports tournament organizers. The absence of standardization of the esports industry also indicates the consistent issues that are faced by the players, tournaments, teams, and their advertising, sponsorships, or contracts.

Revenue Source Outlook

The esports market is divided into media rights, sponsorship, game publisher fee, digital advertisement, and tickets & merchandise. The sponsorship segment is expected to exhibit a promising growth rate during the forecasting period.

Esports Market Report Coverage | Report Attribute | Details |

| Market size value in 2020 | USD 1.06 Billion |

| Market size forecast in 2027 | USD 3.57 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 21.3% from 2021 to 2027 |

| Number of Pages | 310 |

| Number of Tables | 554 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Revenue Source, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers | - Rise in popularity of video games due to the influence of technology

- The growing number of esports events with huge prize pools

|

| Restraints | |

Regional Outlook

The esports market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific emerged as the leading region of the esports market in 2020. It is due to the high usage of esport service across this region and the huge population of the region which consist of a large pool of mobile subscribers for esport companies. In addition, as the region is the biggest contributor of internet subscribers, the popularity and adoption of esports are high in this region.

Free Valuable Insights: Global Esports Market size to reach USD 3,574.9 million by 2027

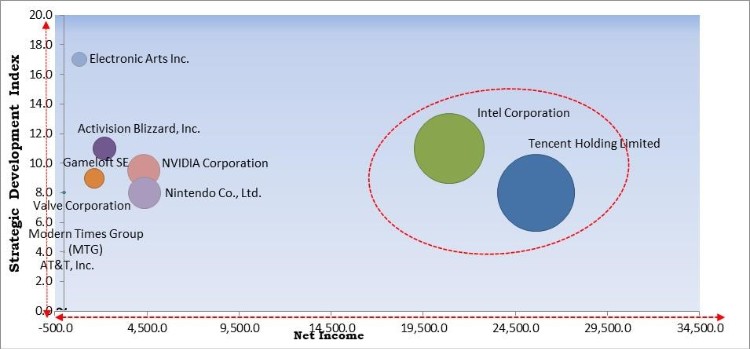

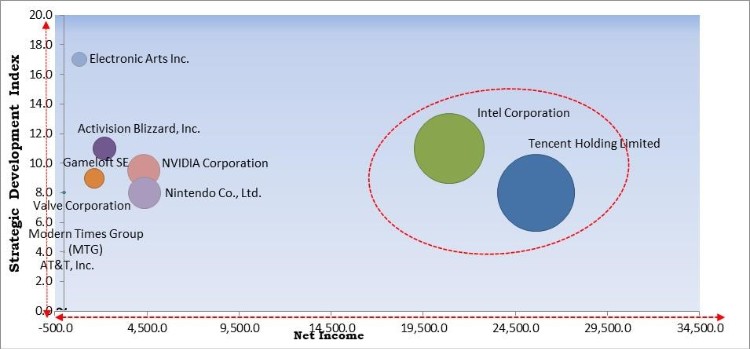

KBV Cardinal Matrix - Esports Market Competition Analysis

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Intel Corporation and Tencent Holding Limited are the forerunners in the Esports Market. Companies such as Nintendo Co., Ltd., NVIDIA Corporation, and Activision Blizzard, Inc. are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Intel Corporation, NVIDIA Corporation, Nintendo Co., Ltd., Activision Blizzard, Inc., Valve Corporation, Modern Times Group MTG AB, Electronic Arts, Inc., Tencent Holdings Ltd., Gameloft SE (Vivendi), and AT&T, Inc.

Recent Strategies Deployed in Esports Market

» Partnerships, Collaborations and Agreements:

- Sep-2021: NVIDIA Corporation formed a partnership with Electronic Arts, an American video game company. This partnership aimed to bring hit Games to GeForce NOW cloud gaming service, starting with Battlefield Revolution, Mirror's Edge Catalyst, Unravel Two, Dragon Age: Inquisition, and Apex Legends.

- Sep-2021: Valve formed a partnership with Fallen’s Gaming company. This partnership aimed to produce and distribute official Valve products in Latin America.

- Sep-2021: Nintendo U.K. partnered with Digital Schoolhouse and Outright Games. The partnership aimed to expand Nintendo's esports ecosystem in the country with the latest national tournament focused on primary school students between the ages of eight and 11 with the objective to introduce them to careers like computing, and the blossoming esports scene.

- Aug-2021: Gameloft came into a partnership with ESL Gaming, a German esports organizer and production company. This partnership aimed to level up mobile esports-native sponsoring solutions.

- Jul-2021: Activision Blizzard came into a partnership with ONE Esports, the esports venture of a sports media company, along with foodpanda Thailand. This deal aimed to continue the build and scale’ Call of Duty’s community in Southeast Asia.

- Jul-2021: Intel partnered with the International Olympic Committee. This partnership aimed to host one of the biggest virtual tournaments as a run-up to the Games. The esports event was primarily planned to be held in Katowice, a city of roughly 300,000 people located in Poland, a month before the Olympic Games.

- Jul-2021: Tencent Esports partnered with Hong Kong-based luxury hotel group Shangri-La, Canadian coffee chain Tim Hortons, and Swedish furniture retailer IKEA. These partnerships aimed to co-build a new solid economic engine.

- Jun-2021: Gameloft formed a partnership with Epik Prime, an NFT platform working with AAA gaming companies and giant entertainment IP and brands. This partnership aimed to launch a racing-themed set of collectibles within the mobile racing title Asphalt 9.

- Jun-2020: Activision Blizzard joined hands with Excel, a British esports organization. This collaboration aimed to detect new commercial opportunities in segments that are not customary in esports. In addition, Excel planned to leverage its prevailing sales experience in conventional sports to find brands that are seeking to embrace the crossover between major sports leagues and esports.

- May-2021: Nintendo came into a partnership with PlayVS, a leading amateur esports platform in the United States. This partnership aimed to expand its esports efforts by moving into high schools.

- Apr-2021: Tencent Sports, Tencent Esports, and EA Sports joined hands with The Premier League, English soccer's top-flight. This partnership aimed to introduce a new esports series on the FIFA title China. The ePremier League China tournament would deepen the Premier League’s digital portfolios in the country, in which it already has more than eight million followers across its digital and social platforms.

- Dec-2020: Gameloft entered into a partnership with AIS, Thailand's largest mobile operator. This partnership aimed to release Blacknut by Gameloft, a new cloud gaming subscription service.

- Aug-2020: Electronic Arts came into a partnership with KLab, a leader in online mobile games. Together, the companies would work on the game development of a new online mobile title.

- Aug-2020: Tencent entered into a partnership with Barcelona, the Spanish soccer giant. This partnership aimed to see the La Liga club engage in deep communication with Tencent regarding the esports presence that sees them compete on Konami’s eFootball PES and Psyonix’s Rocket League titles.

- Jul-2020: Electronic Arts formed a partnership with Turner Sports’ esports and gaming entertainment brand ELEAGUE and Buzzfeed Multiplayer. This partnership aimed to introduce a first-of-its-kind reality competition series centered on EA’s popular life simulation franchise, The Sims.

» Acquisitions and Mergers:

- Nov-2021: Intel completed the acquisition of RemoteMyApp, a Szczecin, Poland-based startup. This acquisition aimed to add RemoteMyApp's?team to Intel.

- Oct-2021: Activision Blizzard took over Digital Legends, a video game developer. This acquisition aimed to add Digital Legends' team with years of expertise in high-quality mobile titles for mobile composed by veterans and emerging talent would only boost Activision’s increasing mobile talent pool.

- Sep-2021: Electronic Arts (EA) acquired Warner Bros. Games’ Playdemic. This acquisition would add an incredible Playdemic team that would strengthen EA's mobile teams globally. In addition, EA would bring more amazing and innovative mobile games to various audiences across the globe.

- Jul-2021: Modern Times Group took over PlaySimple, a rapidly growing and highly profitable games studio. This acquisition aimed to expand and strengthen the company's position in the casual gaming sector.

- Apr-2021: Electronic Arts took over Glu Mobile, an American developer, and publisher of video games. This acquisition aimed to expand EA’s mobile portfolio growth and would improve new experiences in mobile, the largest gaming platform in the world.

- Jan-2021: Nintendo took over Next Level Games, a Vancouver-based video game development company. This acquisition aimed to secure the accessibility of Next Level Games development resources for Nintendo that include development expertise, and facilitate an anticipated advancement in development speed & quality by allowing closer communication and exchange of staff with the Nintendo development team.

- Sep-2020: NVIDIA Corporation acquired Arm Limited from SBG and the SoftBank Vision Fund. This acquisition aimed to bring together NVIDIA’s AI computing platform with Arm’s vast ecosystem to develop the premier computing company for the age of artificial intelligence, boosting innovation along with expanding into large, and high-growth markets.

» Product Launches and Product Expansions:

- Oct-2021: NVIDIA unveiled its next-generation cloud gaming platform providing GeForce RTX 3080-class gaming on GeForce NOW. This platform is available exclusively in a new, high-performance membership tier.

- Oct-2021: Intel introduced the 12th Gen Intel Core processor family with the launch of six new unlocked desktop processors, the 12th Gen Intel Core i9-12900K. This processor has a max turbo boost of up to 5.2 GHz and as many as 16 cores and 24 threads, this processor has opened many opportunities for multi-threaded performance for enthusiast gamers and professional creators.

- Sep-2021: Electronic Arts along with Fédération Internationale de Football Association (FIFA) introduced a new EA SPORTS FIFA 22 esports program. This program is estimated to encourage tens of millions of players and viewers. Additionally, this program has featured both 1v1 and 2v2 competitions, wherein players would represent themselves, worldwide recognized esports organizations, real-world football clubs, and their nation in a wide range of FIFA esports events.

- Jan-2020: Activision Blizzard introduced league for Call of Duty, the best-selling first-person-shooter game. This launch would make Activision the biggest operator of professional esports leagues, in which video-game players square off in front of large audiences.

Scope of the Study

Market Segments Covered in the Report:

By Revenue Source

- Sponsorship

- Media Rights

- Advertising

- Publisher Fees

- Merchandise & Tickets

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Intel Corporation

- NVIDIA Corporation

- Nintendo Co., Ltd.

- Activision Blizzard, Inc.

- Valve Corporation

- Modern Times Group MTG AB

- Electronic Arts, Inc.

- Tencent Holdings Ltd.

- Gameloft SE (Vivendi)

- AT&T, Inc.

TABLE 1 Global Esports Market, 2017 - 2020, USD Million

TABLE 2 Global Esports Market, 2021 - 2027, USD Million

TABLE 3 Partnerships, Collaborations and Agreements– Esports Market

TABLE 4 Product Launches And Product Expansions– Esports Market

TABLE 5 Acquisition and Mergers– Esports Market

TABLE 6 Geographical Expansions– Esports Market

TABLE 7 Global Esports Market by Revenue Source, 2017 - 2020, USD Million

TABLE 8 Global Esports Market by Revenue Source, 2021 - 2027, USD Million

TABLE 9 Global Sponsorship Market by Region, 2017 - 2020, USD Million

TABLE 10 Global Sponsorship Market by Region, 2021 - 2027, USD Million

TABLE 11 Global Media Rights Market by Region, 2017 - 2020, USD Million

TABLE 12 Global Media Rights Market by Region, 2021 - 2027, USD Million

TABLE 13 Global Advertising Market by Region, 2017 - 2020, USD Million

TABLE 14 Global Advertising Market by Region, 2021 - 2027, USD Million

TABLE 15 Global Publisher Fees Market by Region, 2017 - 2020, USD Million

TABLE 16 Global Publisher Fees Market by Region, 2021 - 2027, USD Million

TABLE 17 Global Merchandise & Tickets Revenue Source Market by Region, 2017 - 2020, USD Million

TABLE 18 Global Merchandise & Tickets Revenue Source Market by Region, 2021 - 2027, USD Million

TABLE 19 Global Esports Market by Region, 2017 - 2020, USD Million

TABLE 20 Global Esports Market by Region, 2021 - 2027, USD Million

TABLE 21 North America Esports Market, 2017 - 2020, USD Million

TABLE 22 North America Esports Market, 2021 - 2027, USD Million

TABLE 23 North America Esports Market by Revenue Source, 2017 - 2020, USD Million

TABLE 24 North America Esports Market by Revenue Source, 2021 - 2027, USD Million

TABLE 25 North America Sponsorship Market by Country, 2017 - 2020, USD Million

TABLE 26 North America Sponsorship Market by Country, 2021 - 2027, USD Million

TABLE 27 North America Media Rights Market by Country, 2017 - 2020, USD Million

TABLE 28 North America Media Rights Market by Country, 2021 - 2027, USD Million

TABLE 29 North America Advertising Market by Country, 2017 - 2020, USD Million

TABLE 30 North America Advertising Market by Country, 2021 - 2027, USD Million

TABLE 31 North America Publisher Fees Market by Country, 2017 - 2020, USD Million

TABLE 32 North America Publisher Fees Market by Country, 2021 - 2027, USD Million

TABLE 33 North America Merchandise & Tickets Revenue Source Market by Country, 2017 - 2020, USD Million

TABLE 34 North America Merchandise & Tickets Revenue Source Market by Country, 2021 - 2027, USD Million

TABLE 35 North America Esports Market by Country, 2017 - 2020, USD Million

TABLE 36 North America Esports Market by Country, 2021 - 2027, USD Million

TABLE 37 US Esports Market, 2017 - 2020, USD Million

TABLE 38 US Esports Market, 2021 - 2027, USD Million

TABLE 39 US Esports Market by Revenue Source, 2017 - 2020, USD Million

TABLE 40 US Esports Market by Revenue Source, 2021 - 2027, USD Million

TABLE 41 Canada Esports Market, 2017 - 2020, USD Million

TABLE 42 Canada Esports Market, 2021 - 2027, USD Million

TABLE 43 Canada Esports Market by Revenue Source, 2017 - 2020, USD Million

TABLE 44 Canada Esports Market by Revenue Source, 2021 - 2027, USD Million

TABLE 45 Mexico Esports Market, 2017 - 2020, USD Million

TABLE 46 Mexico Esports Market, 2021 - 2027, USD Million

TABLE 47 Mexico Esports Market by Revenue Source, 2017 - 2020, USD Million

TABLE 48 Mexico Esports Market by Revenue Source, 2021 - 2027, USD Million

TABLE 49 Rest of North America Esports Market, 2017 - 2020, USD Million

TABLE 50 Rest of North America Esports Market, 2021 - 2027, USD Million

TABLE 51 Rest of North America Esports Market by Revenue Source, 2017 - 2020, USD Million

TABLE 52 Rest of North America Esports Market by Revenue Source, 2021 - 2027, USD Million

TABLE 53 Europe Esports Market, 2017 - 2020, USD Million

TABLE 54 Europe Esports Market, 2021 - 2027, USD Million

TABLE 55 Europe Esports Market by Revenue Source, 2017 - 2020, USD Million

TABLE 56 Europe Esports Market by Revenue Source, 2021 - 2027, USD Million

TABLE 57 Europe Sponsorship Market by Country, 2017 - 2020, USD Million

TABLE 58 Europe Sponsorship Market by Country, 2021 - 2027, USD Million

TABLE 59 Europe Media Rights Market by Country, 2017 - 2020, USD Million

TABLE 60 Europe Media Rights Market by Country, 2021 - 2027, USD Million

TABLE 61 Europe Advertising Market by Country, 2017 - 2020, USD Million

TABLE 62 Europe Advertising Market by Country, 2021 - 2027, USD Million

TABLE 63 Europe Publisher Fees Market by Country, 2017 - 2020, USD Million

TABLE 64 Europe Publisher Fees Market by Country, 2021 - 2027, USD Million

TABLE 65 Europe Merchandise & Tickets Revenue Source Market by Country, 2017 - 2020, USD Million

TABLE 66 Europe Merchandise & Tickets Revenue Source Market by Country, 2021 - 2027, USD Million

TABLE 67 Europe Esports Market by Country, 2017 - 2020, USD Million

TABLE 68 Europe Esports Market by Country, 2021 - 2027, USD Million

TABLE 69 Germany Esports Market, 2017 - 2020, USD Million

TABLE 70 Germany Esports Market, 2021 - 2027, USD Million

TABLE 71 Germany Esports Market by Revenue Source, 2017 - 2020, USD Million

TABLE 72 Germany Esports Market by Revenue Source, 2021 - 2027, USD Million

TABLE 73 UK Esports Market, 2017 - 2020, USD Million

TABLE 74 UK Esports Market, 2021 - 2027, USD Million

TABLE 75 UK Esports Market by Revenue Source, 2017 - 2020, USD Million

TABLE 76 UK Esports Market by Revenue Source, 2021 - 2027, USD Million

TABLE 77 France Esports Market, 2017 - 2020, USD Million

TABLE 78 France Esports Market, 2021 - 2027, USD Million

TABLE 79 France Esports Market by Revenue Source, 2017 - 2020, USD Million

TABLE 80 France Esports Market by Revenue Source, 2021 - 2027, USD Million

TABLE 81 Russia Esports Market, 2017 - 2020, USD Million

TABLE 82 Russia Esports Market, 2021 - 2027, USD Million

TABLE 83 Russia Esports Market by Revenue Source, 2017 - 2020, USD Million

TABLE 84 Russia Esports Market by Revenue Source, 2021 - 2027, USD Million

TABLE 85 Spain Esports Market, 2017 - 2020, USD Million

TABLE 86 Spain Esports Market, 2021 - 2027, USD Million

TABLE 87 Spain Esports Market by Revenue Source, 2017 - 2020, USD Million

TABLE 88 Spain Esports Market by Revenue Source, 2021 - 2027, USD Million

TABLE 89 Italy Esports Market, 2017 - 2020, USD Million

TABLE 90 Italy Esports Market, 2021 - 2027, USD Million

TABLE 91 Italy Esports Market by Revenue Source, 2017 - 2020, USD Million

TABLE 92 Italy Esports Market by Revenue Source, 2021 - 2027, USD Million

TABLE 93 Rest of Europe Esports Market, 2017 - 2020, USD Million

TABLE 94 Rest of Europe Esports Market, 2021 - 2027, USD Million

TABLE 95 Rest of Europe Esports Market by Revenue Source, 2017 - 2020, USD Million

TABLE 96 Rest of Europe Esports Market by Revenue Source, 2021 - 2027, USD Million

TABLE 97 Asia Pacific Esports Market, 2017 - 2020, USD Million

TABLE 98 Asia Pacific Esports Market, 2021 - 2027, USD Million

TABLE 99 Asia Pacific Esports Market by Revenue Source, 2017 - 2020, USD Million

TABLE 100 Asia Pacific Esports Market by Revenue Source, 2021 - 2027, USD Million

TABLE 101 Asia Pacific Sponsorship Market by Country, 2017 - 2020, USD Million

TABLE 102 Asia Pacific Sponsorship Market by Country, 2021 - 2027, USD Million

TABLE 103 Asia Pacific Media Rights Market by Country, 2017 - 2020, USD Million

TABLE 104 Asia Pacific Media Rights Market by Country, 2021 - 2027, USD Million

TABLE 105 Asia Pacific Advertising Market by Country, 2017 - 2020, USD Million

TABLE 106 Asia Pacific Advertising Market by Country, 2021 - 2027, USD Million

TABLE 107 Asia Pacific Publisher Fees Market by Country, 2017 - 2020, USD Million

TABLE 108 Asia Pacific Publisher Fees Market by Country, 2021 - 2027, USD Million

TABLE 109 Asia Pacific Merchandise & Tickets Revenue Source Market by Country, 2017 - 2020, USD Million

TABLE 110 Asia Pacific Merchandise & Tickets Revenue Source Market by Country, 2021 - 2027, USD Million

TABLE 111 Asia Pacific Esports Market by Country, 2017 - 2020, USD Million

TABLE 112 Asia Pacific Esports Market by Country, 2021 - 2027, USD Million

TABLE 113 China Esports Market, 2017 - 2020, USD Million

TABLE 114 China Esports Market, 2021 - 2027, USD Million

TABLE 115 China Esports Market by Revenue Source, 2017 - 2020, USD Million

TABLE 116 China Esports Market by Revenue Source, 2021 - 2027, USD Million

TABLE 117 Japan Esports Market, 2017 - 2020, USD Million

TABLE 118 Japan Esports Market, 2021 - 2027, USD Million

TABLE 119 Japan Esports Market by Revenue Source, 2017 - 2020, USD Million

TABLE 120 Japan Esports Market by Revenue Source, 2021 - 2027, USD Million

TABLE 121 India Esports Market, 2017 - 2020, USD Million

TABLE 122 India Esports Market, 2021 - 2027, USD Million

TABLE 123 India Esports Market by Revenue Source, 2017 - 2020, USD Million

TABLE 124 India Esports Market by Revenue Source, 2021 - 2027, USD Million

TABLE 125 South Korea Esports Market, 2017 - 2020, USD Million

TABLE 126 South Korea Esports Market, 2021 - 2027, USD Million

TABLE 127 South Korea Esports Market by Revenue Source, 2017 - 2020, USD Million

TABLE 128 South Korea Esports Market by Revenue Source, 2021 - 2027, USD Million

TABLE 129 Singapore Esports Market, 2017 - 2020, USD Million

TABLE 130 Singapore Esports Market, 2021 - 2027, USD Million

TABLE 131 Singapore Esports Market by Revenue Source, 2017 - 2020, USD Million

TABLE 132 Singapore Esports Market by Revenue Source, 2021 - 2027, USD Million

TABLE 133 Malaysia Esports Market, 2017 - 2020, USD Million

TABLE 134 Malaysia Esports Market, 2021 - 2027, USD Million

TABLE 135 Malaysia Esports Market by Revenue Source, 2017 - 2020, USD Million

TABLE 136 Malaysia Esports Market by Revenue Source, 2021 - 2027, USD Million

TABLE 137 Rest of Asia Pacific Esports Market, 2017 - 2020, USD Million

TABLE 138 Rest of Asia Pacific Esports Market, 2021 - 2027, USD Million

TABLE 139 Rest of Asia Pacific Esports Market by Revenue Source, 2017 - 2020, USD Million

TABLE 140 Rest of Asia Pacific Esports Market by Revenue Source, 2021 - 2027, USD Million

TABLE 141 LAMEA Esports Market, 2017 - 2020, USD Million

TABLE 142 LAMEA Esports Market, 2021 - 2027, USD Million

TABLE 143 LAMEA Esports Market by Revenue Source, 2017 - 2020, USD Million

TABLE 144 LAMEA Esports Market by Revenue Source, 2021 - 2027, USD Million

TABLE 145 LAMEA Sponsorship Market by Country, 2017 - 2020, USD Million

TABLE 146 LAMEA Sponsorship Market by Country, 2021 - 2027, USD Million

TABLE 147 LAMEA Media Rights Market by Country, 2017 - 2020, USD Million

TABLE 148 LAMEA Media Rights Market by Country, 2021 - 2027, USD Million

TABLE 149 LAMEA Advertising Market by Country, 2017 - 2020, USD Million

TABLE 150 LAMEA Advertising Market by Country, 2021 - 2027, USD Million

TABLE 151 LAMEA Publisher Fees Market by Country, 2017 - 2020, USD Million

TABLE 152 LAMEA Publisher Fees Market by Country, 2021 - 2027, USD Million

TABLE 153 LAMEA Merchandise & Tickets Revenue Source Market by Country, 2017 - 2020, USD Million

TABLE 154 LAMEA Merchandise & Tickets Revenue Source Market by Country, 2021 - 2027, USD Million

TABLE 155 LAMEA Esports Market by Country, 2017 - 2020, USD Million

TABLE 156 LAMEA Esports Market by Country, 2021 - 2027, USD Million

TABLE 157 Brazil Esports Market, 2017 - 2020, USD Million

TABLE 158 Brazil Esports Market, 2021 - 2027, USD Million

TABLE 159 Brazil Esports Market by Revenue Source, 2017 - 2020, USD Million

TABLE 160 Brazil Esports Market by Revenue Source, 2021 - 2027, USD Million

TABLE 161 Argentina Esports Market, 2017 - 2020, USD Million

TABLE 162 Argentina Esports Market, 2021 - 2027, USD Million

TABLE 163 Argentina Esports Market by Revenue Source, 2017 - 2020, USD Million

TABLE 164 Argentina Esports Market by Revenue Source, 2021 - 2027, USD Million

TABLE 165 UAE Esports Market, 2017 - 2020, USD Million

TABLE 166 UAE Esports Market, 2021 - 2027, USD Million

TABLE 167 UAE Esports Market by Revenue Source, 2017 - 2020, USD Million

TABLE 168 UAE Esports Market by Revenue Source, 2021 - 2027, USD Million

TABLE 169 Saudi Arabia Esports Market, 2017 - 2020, USD Million

TABLE 170 Saudi Arabia Esports Market, 2021 - 2027, USD Million

TABLE 171 Saudi Arabia Esports Market by Revenue Source, 2017 - 2020, USD Million

TABLE 172 Saudi Arabia Esports Market by Revenue Source, 2021 - 2027, USD Million

TABLE 173 South Africa Esports Market, 2017 - 2020, USD Million

TABLE 174 South Africa Esports Market, 2021 - 2027, USD Million

TABLE 175 South Africa Esports Market by Revenue Source, 2017 - 2020, USD Million

TABLE 176 South Africa Esports Market by Revenue Source, 2021 - 2027, USD Million

TABLE 177 Nigeria Esports Market, 2017 - 2020, USD Million

TABLE 178 Nigeria Esports Market, 2021 - 2027, USD Million

TABLE 179 Nigeria Esports Market by Revenue Source, 2017 - 2020, USD Million

TABLE 180 Nigeria Esports Market by Revenue Source, 2021 - 2027, USD Million

TABLE 181 Rest of LAMEA Esports Market, 2017 - 2020, USD Million

TABLE 182 Rest of LAMEA Esports Market, 2021 - 2027, USD Million

TABLE 183 Rest of LAMEA Esports Market by Revenue Source, 2017 - 2020, USD Million

TABLE 184 Rest of LAMEA Esports Market by Revenue Source, 2021 - 2027, USD Million

TABLE 185 Key Information – Intel Corporation

TABLE 186 Key Information – NVIDIA Corporation

TABLE 187 key information – Nintendo Co., Ltd.

TABLE 188 Key Information – Activision Blizzard, Inc.

TABLE 189 Key Information – Valve Corporation

TABLE 190 Key Information – Modern Times Group

TABLE 191 Key Information – Electronic Arts Inc.

TABLE 192 Key Information – Tencent Holdings Ltd.

TABLE 193 Key Information – Gameloft SE

TABLE 194 Key Information – AT&T, Inc.

List of Figures

FIG 1 Methodology for the research

FIG 2 KBV Cardinal Matrix

FIG 3 Key Leading Strategies: Percentage Distribution (2017-2021)

FIG 4 Key Strategic Move: (Product Launches and Product Expansions : 2017, Jun – 2021, Jun) Leading Players

FIG 5 Recent strategies and developments: Intel Corporation

FIG 6 SWOT analysis: Intel corporation

FIG 7 Recent strategies and developments: NVIDIA Corporation

FIG 8 SWOT Analysis: NVIDIA Corporation

FIG 9 Recent strategies and developments: Nintendo Co., Ltd.

FIG 10 Recent strategies and developments: Activision Blizzard, Inc.

FIG 11 Recent strategies and developments: Valve Corporation

FIG 12 Recent strategies and developments: Electronic Arts

FIG 13 Recent strategies and developments: Gameloft SE