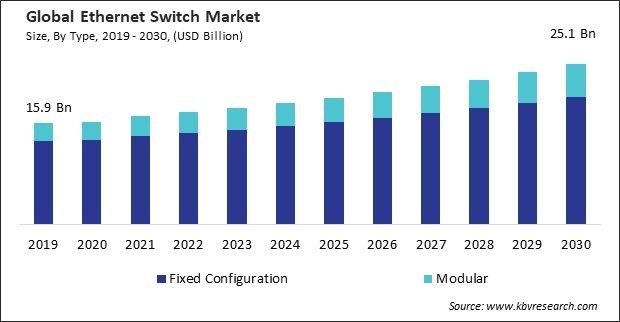

“Global Ethernet Switch Market to reach a market value of USD 25.1 Billion by 2030 growing at a CAGR of 4.6%”

The Global Ethernet Switch Market size is expected to reach $25.1 billion by 2030, rising at a market growth of 4.6% CAGR during the forecast period.

Managed Layer 2 (L2) switches are known for their ability to operate at the data link layer of the OSI model, offering features such as VLAN (Virtual Local Area Network) support, link aggregation, and Quality of Service (QoS). Thus, the Managed Layer 2 (L2) switches segment acquired $5,379.0 million in 2022. These switches provide more control and configurability than unmanaged switches, making them suitable for businesses with complex networking needs.

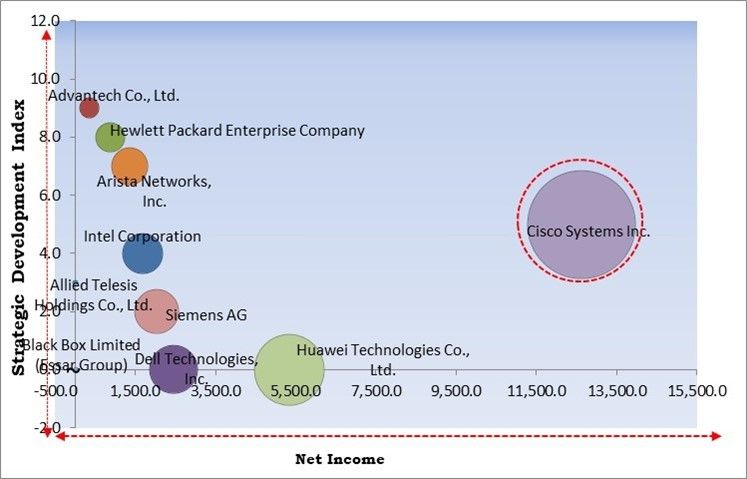

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In July 2023, Allied Telesis Holdings Co., Ltd. Introduced IE220 Series, The IE220 Series switches provide robust Gigabit connectivity to IoT devices, boasting dual 10 Gigabit fiber uplinks and PoE++ Gigabit interfaces for uncompromised performance and throughput. Additionally, In December 2022, Arista Networks, Inc. launched 7050X4 Series, the latest 7050X4 systems elevate industry-standard, high-volume SFP interfaces by introducing the new 100G SFP-DD and DSFP, offering 'quad-speed' support, alongside QSFP-DD supporting 40G to 400G.

Based on the Analysis presented in the KBV Cardinal matrix; Cisco Systems Inc. is the forerunner in the Ethernet Switch Market. In January 2022, Cisco Systems Inc. introduced Catalyst IE9300, a high-performance industrial Ethernet switch designed for rugged environments, offering advanced features for reliable connectivity. The IE9300 features a sensor for transmitting data to Cyber Vision software, facilitating inventorying and tracking of connected IoT devices, even those unable to comply with contemporary device identity standards, with Cyber Vision also monitoring software versions on the devices. Companies such as Intel Corporation, Siemens AG, and Huawei Technologies Co., Ltd. are some of the key innovators in Market.

Data centers require high-speed, reliable connectivity to facilitate seamless communication between servers, storage systems, and other network devices. Ethernet switches, especially those supporting high data rates such as 10 Gigabit Ethernet (GbE), 25GbE, 40GbE, and 100GbE, provide the necessary bandwidth for efficient data transfer within the data center network. Thus, these factors can help in the expansion of the market.

Additionally, With the proliferation of data-intensive applications, video conferencing, multimedia content, and other bandwidth-hungry services, enterprises require higher network bandwidth. Ethernet switches, especially those supporting higher data rates like 10 Gigabit Ethernet (GbE) and beyond, address the need for increased capacity. Thus, these factors will assist in the growth of the market.

The relentless pace of technological advancements, especially in the realm of networking and communications, demands agility from Ethernet switch manufacturers. Addressing compatibility issues and fostering interoperability become critical factors in product development and market acceptance. Thus, these factors can lead to a downturn in the demand for Ethernet switches in the upcoming years.

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

On the basis of speed, the market is divided into 1G, 10 G, 25 G, 40 G, 100 G, and others. In 2022, the 100 G segment witnessed a substantial 22.3% revenue share in the market. The 100G Ethernet switches address this demand by providing significantly higher data transfer rates compared to lower-speed alternatives. Hence, these factors will assist in the growth of the segment.

Based on configuration, the market is divided into unmanaged, smart, managed L2, managed L3, and divided. The unmanaged segment procured a 6% revenue in the Ethe in 2022. Small and medium-sized businesses (SMBs) and home offices often prefer unmanaged switches due to their simplicity and cost-effectiveness.

Based on type, the market is bifurcated into modular and fixed configuration. The fixed configuration segment held the largest 82% revenue share in the market in 2022. Fixed configuration switches are pre-configured, which makes them simple to install and manage, especially for small to medium-sized enterprises (SMEs) that may not have dedicated IT staff.

Free Valuable Insights: Global Ethernet Switch Market size to reach USD 25.1 Billion by 2030

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. The North America segment procured 40% revenue share in the market in 2022. The migration of organizations to cloud-based infrastructure and the increasing prevalence of cloud services frequently necessitates resilient and high-performing networking solutions, such as Ethernet switches.

The Ethernet switch market is highly competitive, with several key players vying for market share. Companies like Cisco Systems, Huawei Technologies, Arista Networks, Hewlett Packard Enterprise (HPE), and Dell Technologies are among the major competitors in this space. Competition in the Ethernet switch market is driven by factors such as product performance, reliability, feature set, pricing, and customer support.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 17.6 Billion |

| Market size forecast in 2030 | USD 25.1 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 4.6% from 2023 to 2030 |

| Number of Pages | 255 |

| Number of Tables | 393 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Type, Speed, Configuration, Region |

| Country scope |

|

| Companies Included | Dell Technologies, Inc., Allied Telesis Holdings Co., Ltd., Intel Corporation, Advantech Co., Ltd., Black Box Limited (Essar Group), Arista Networks, Inc., Cisco Systems Inc., Siemens AG, Hewlett Packard Enterprise Company, Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.) |

By Type

By Speed

By Configuration

By Geography

The Market size is projected to reach USD 25.1 billion by 2030.

Increasing expansion of data centers in various sectors are driving the Market in coming years, however, Challenges regarding technological obsolescence and evolution restraints the growth of the Market.

Dell Technologies, Inc., Allied Telesis Holdings Co., Ltd., Intel Corporation, Advantech Co., Ltd., Black Box Limited (Essar Group), Arista Networks, Inc., Cisco Systems Inc., Siemens AG, Hewlett Packard Enterprise Company, Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.)

The expected CAGR of this Market is 4.6% from 2023 to 2030.

The 1G segment is leading the Market by Speed in 2022; there by, achieving a market value of $10 billion by 2030.

The North America region dominated the Market by Region in 2022, and would continue to be a dominant market till 2030; there by, achieving a market value of $9.4 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges