“Global Ethylene Copolymers Market to reach a market value of USD 75.56 Billion by 2031 growing at a CAGR of 5.6%”

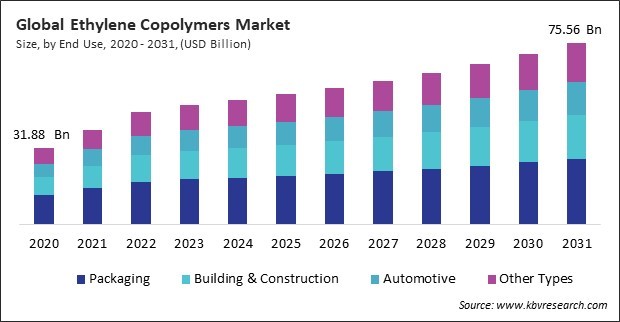

The Global Ethylene Copolymers Market size is expected to reach $75.56 billion by 2031, rising at a market growth of 5.6% CAGR during the forecast period. In the year 2023, the market attained a volume of 25,100.0 kilo tonnes, experiencing a growth of 23.2% (2020-2023).

North America’s growth is fueled by the strong adoption of ethylene copolymers in advanced packaging, automotive, and healthcare industries. The region's focus on sustainability and renewable energy applications, such as solar panel encapsulation, drives demand for high-performance materials. Hence, the North America segment acquired 27% revenue share in the market in 2023. In terms of volume, 8,994.3 kilo tonnes of Ethylene Copolymers are expected to be utilized by the year 2031. Additionally, investments in the construction sector and consumer preferences for eco-friendly and recyclable packaging further enhance the market’s prospects. North America's emphasis on technological innovation and infrastructure development solidifies its position as a significant contributor to the market.

The global focus on sustainable construction has also amplified the adoption of ethylene copolymers. These materials are compatible with eco-friendly practices, such as energy-efficient insulation systems and green building designs. Ethylene copolymers are used in photovoltaic encapsulants for solar panels, which are increasingly integrated into sustainable structures. Additionally, the construction and automotive industries also benefit from advancements in sustainable ethylene copolymers. In construction, these materials are used in green building solutions like energy-efficient insulation and moisture-resistant membranes, promoting eco-friendly practices. In the automotive sector, lightweight and recyclable ethylene copolymers are integrated into components to reduce vehicle emissions. Therefore, these developments will drive the expansion of the market.

However, the inconsistency in raw material prices creates additional challenges for businesses in downstream industries such as packaging, automotive, and construction. Companies relying on ethylene copolymers for their products must account for these unpredictable cost variations, which can lead to higher pricing for end-users or reduced demand. Thus, the fluctuating prices of petrochemical raw materials significantly hinder the growth and stability of the ethylene copolymers market.

Based on application, the market is classified into hot melt adhesives, asphalt modifications, thermo-adhesive films, and others. The hot melt adhesives segment garnered 46% revenue share in the market in 2023. In terms of volume, 16,641.8 kilo tonnes of ethylene copolymers are expected to be utilized in hot melt adhesives by the year 2031. The increasing demand for efficient, versatile, and rapid bonding solutions across packaging, woodworking, and automotive industries drives the hot melt adhesives segment. Ethylene copolymers are widely favored in this segment due to their excellent adhesion properties, flexibility, and ability to bond with various materials, including paper, plastics, and metals.

On the basis of end use, the market is divided into packaging, building & construction, automotive, and others. The building and construction segment recorded 24% revenue share in the market in 2023. In terms of volume, 9,193.9 kilo tonnes of ethylene copolymers are expected to be utilized in building and construction by the year 2031. In this sector, the demand for ethylene copolymers is fueled by their superior performance in applications such as waterproofing membranes, adhesives, sealants, and thermal insulation. Their flexibility, chemical resistance, and ability to enhance durability and weatherproofing make them indispensable in modern construction projects.

By type, the market is segmented into ethylene vinyl acetate, ethylene ethyl acrylate, ethylene butyl acrylate, ethylene propylene, and others. The ethylene vinyl acetate segment witnessed 45% revenue share in the market in 2023. In terms of volume, 15,365.3 kilo tonnes of ethylene vinyl acetate is expected to be utilized by the year 2031. The ethylene vinyl acetate (EVA) segment is driven by its versatile applications in solar energy, footwear, packaging, and adhesives. EVA’s superior flexibility, impact resistance, and lightweight properties make it ideal for encapsulating solar panels and manufacturing durable consumer goods. The increasing demand for sustainable and energy-efficient solutions, coupled with its role in renewable energy systems, contributes significantly to the growth of the EVA segment.

Free Valuable Insights: Global Ethylene Copolymers Market size to reach USD 75.56 Billion by 2031

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment procured 43% revenue share in the market in 2023. In terms of volume, 18,354.3 kilo tonnes of ethylene copolymers are expected to be utilized in this region by the year 2031. The Asia Pacific segment is driven by rapid industrialization, urbanization, and infrastructure development in China, India, and Southeast Asia. The region's thriving packaging, automotive, and construction industries fuel demand for ethylene copolymers due to their flexibility, durability, and chemical resistance.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 49.57 Billion |

| Market size forecast in 2031 | USD 75.56 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 5.6% from 2024 to 2031 |

| Quantitative Data | Volume in Kilo Tonnes, Revenue in USD Billion, and CAGR from 2020 to 2031 |

| Number of Pages | 390 |

| Number of Tables | 770 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Type, Application, End Use, Region |

| Country scope |

|

| Companies Included | BASF SE, The Dow Chemical Company, DuPont de Nemours, Inc., Sumitomo Electric Industries, Ltd., Saudi Basic Industries Corporation (SABIC), Exxon Mobil Corporation, Arkema S.A., Celanese Corporation, LyondellBasell Industries Holdings B.V., INEOS Group Holdings S.A. |

By Application (Volume, Kilo Tonnes, USD Billion, 2020-2031)

By End Use (Volume, Kilo Tonnes, USD Billion, 2020-2031)

By Type (Volume, Kilo Tonnes, USD Billion, 2020-2031)

By Geography (Volume, Kilo Tonnes, USD Billion, 2020-2031)

The Market size is projected to reach USD 75.56 billion by 2031.

Increasing Demand from the Packaging Industry are driving the Market in coming years, however, Fluctuating Raw Material Prices restraints the growth of the Market.

BASF SE, The Dow Chemical Company, DuPont de Nemours, Inc., Sumitomo Electric Industries, Ltd., Saudi Basic Industries Corporation (SABIC), Exxon Mobil Corporation, Arkema S.A., Celanese Corporation, LyondellBasell Industries Holdings B.V., INEOS Group Holdings S.A.

In the year 2023, the market attained a volume of 25,100.0 kilo tonnes, experiencing a growth of 23.2% (2020-2023).

The Packaging segment is leading the Market by End Use in 2023; thereby, achieving a market value of $27.27 billion by 2031.

The Asia Pacific region dominated the Market by Region in 2023; thereby, achieving a market value of $32.86 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges