The Europe Automation and Instrumentation In Power Market would witness market growth of 6.8% CAGR during the forecast period (2024-2031).

The Germany market dominated the Europe Automation and Instrumentation In Power Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $3,197 Million by 2031. The UK market is exhibiting a CAGR of 5.8% during (2024 - 2031). Additionally, The France market would experience a CAGR of 7.6% during (2024 - 2031).

EMS software integrates automation and instrumentation to optimize energy usage, reduce costs, and improve efficiency in industrial facilities, commercial buildings, and residential properties. EMS systems monitor energy consumption, analyze data, and automate control strategies to minimize peak demand, manage energy resources, and achieve sustainability goals. Automation and instrumentation enable predictive maintenance strategies in power generation and distribution infrastructure.

By continuously monitoring equipment conditions using sensors and data analytics, predictive maintenance systems predict equipment failures before they occur, allowing for timely repairs and preventing costly downtime. Automation and instrumentation technologies enable power companies to streamline operations, optimize processes, and reduce manual intervention. Businesses may increase production throughout the value chain, reduce downtime, and improve overall efficiency by automating repetitive operations and implementing sophisticated control systems.

Automation and instrumentation technologies enable real-time monitoring and control of the grid, helping to balance supply and demand, prevent outages, and maintain grid stability. During the 10 years from 2011 to 2021, the consumption of electricity by households increased in the EU by 6.2 %. European power generation and distribution systems must operate at peak efficiency to meet increasing electricity demand. Automation and instrumentation technologies enable precise control and optimization of energy production and distribution processes, reducing losses and improving overall efficiency. This optimization is particularly important in densely populated regions and industrial hubs where energy demand is highest. Hence, high electricity generation and rising electricity consumption are driving the market growth in Europe.

Free Valuable Insights: The Global Automation and Instrumentation In Power Market will Hit USD 51.7 Billion by 2031, at a CAGR of 7.0%

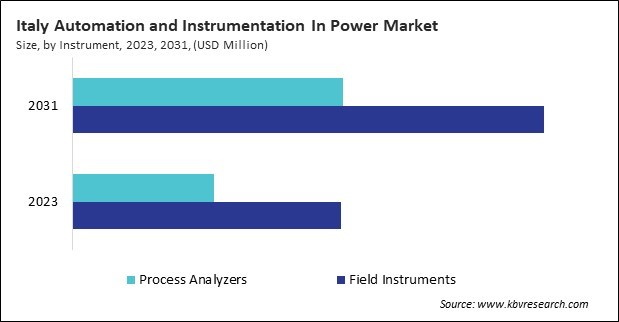

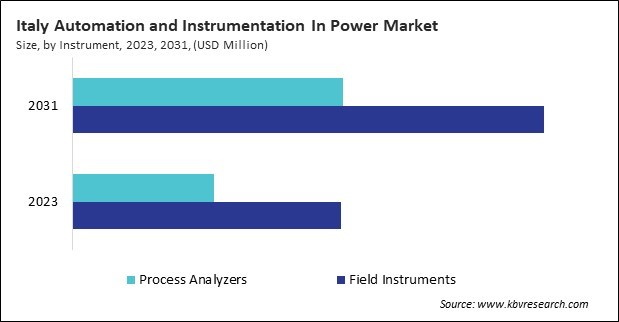

Based on Instrument, the market is segmented into Field Instruments, and Process Analyzers. Based on Solution, the market is segmented into Programmable Logic Controller (PLC), Distributed Control System (DCS), Safety Automation Supervisory Control and Data Acquisition (SCADA), Human Machine Interaction (HMI), Advanced Process Control (APC), and Manufacturing Execution System (MES). Based on countries, the market is segmented into Germany, UK, France, Russia, Spain, Italy, and Rest of Europe.

List of Key Companies Profiled

- Siemens AG

- ABB Group

- Emerson Electric Co.

- Rockwell Automation Inc.

- Omron Corporation

- Honeywell International, Inc.

- Schneider Electric SE

- Mitsubishi Electric Corporation

- Yokogawa Electric Corporation

- Danaher Corporation (Beckman Coulter, Inc.)

Europe Automation and Instrumentation In Power Market Report Segmentation

By Instrument

- Field Instruments

- Process Analyzers

By Solution

- Programmable Logic Controller (PLC)

- Distributed Control System (DCS)

- Safety Automation Supervisory Control and Data Acquisition (SCADA)

- Human Machine Interaction (HMI)

- Advanced Process Control (APC)

- Manufacturing Execution System (MES)

By Country

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

Chapter 1. Market Scope & Methodology

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Europe Automation and Instrumentation In Power Market, by Instrument

1.4.2 Europe Automation and Instrumentation In Power Market, by Solution

1.4.3 Europe Automation and Instrumentation In Power Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Scenario and Composition

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

Chapter 4. Competition Analysis - Global

4.1 KBV Cardinal Matrix

4.2 Recent Industry Wide Strategic Developments

4.2.1 Partnerships, Collaborations and Agreements

4.2.2 Product Launches and Product Expansions

4.2.3 Acquisition and Mergers

4.2.4 Geographical Expansion

4.3 Market Share Analysis, 2023

4.4 Top Winning Strategies

4.4.1 Key Leading Strategies: Percentage Distribution (2020-2024)

4.4.2 Key Strategic Move: (Partnerships, Collaborations & Agreements: 2022, Feb – 2024, Jun) Leading Players

4.5 Porter Five Forces Analysis

Chapter 5. Europe Automation and Instrumentation In Power Market by Instrument

5.1 Europe Field Instruments Market by Country

5.2 Europe Process Analyzers Market by Country

Chapter 6. Europe Automation and Instrumentation In Power Market by Solution

6.1 Europe Programmable Logic Controller (PLC) Market by Country

6.2 Europe Distributed Control System (DCS) Market by Country

6.3 Europe Safety Automation Supervisory Control and Data Acquisition (SCADA) Market by Country

6.4 Europe Human Machine Interaction (HMI) Market by Country

6.5 Europe Advanced Process Control (APC) Market by Country

6.6 Europe Manufacturing Execution System (MES) Market by Country

Chapter 7. Europe Automation and Instrumentation In Power Market by Country

7.1 Germany Automation and Instrumentation In Power Market

7.1.1 Germany Automation and Instrumentation In Power Market by Instrument

7.1.2 Germany Automation and Instrumentation In Power Market by Solution

7.2 UK Automation and Instrumentation In Power Market

7.2.1 UK Automation and Instrumentation In Power Market by Instrument

7.2.2 UK Automation and Instrumentation In Power Market by Solution

7.3 France Automation and Instrumentation In Power Market

7.3.1 France Automation and Instrumentation In Power Market by Instrument

7.3.2 France Automation and Instrumentation In Power Market by Solution

7.4 Russia Automation and Instrumentation In Power Market

7.4.1 Russia Automation and Instrumentation In Power Market by Instrument

7.4.2 Russia Automation and Instrumentation In Power Market by Solution

7.5 Spain Automation and Instrumentation In Power Market

7.5.1 Spain Automation and Instrumentation In Power Market by Instrument

7.5.2 Spain Automation and Instrumentation In Power Market by Solution

7.6 Italy Automation and Instrumentation In Power Market

7.6.1 Italy Automation and Instrumentation In Power Market by Instrument

7.6.2 Italy Automation and Instrumentation In Power Market by Solution

7.7 Rest of Europe Automation and Instrumentation In Power Market

7.7.1 Rest of Europe Automation and Instrumentation In Power Market by Instrument

7.7.2 Rest of Europe Automation and Instrumentation In Power Market by Solution

Chapter 8. Company Profiles

8.1 Siemens AG

8.1.1 Company Overview

8.1.2 Financial Analysis

8.1.3 Segmental and Regional Analysis

8.1.4 Research & Development Expense

8.1.5 Recent strategies and developments:

8.1.5.1 Partnerships, Collaborations, and Agreements:

8.1.5.2 Product Launches and Product Expansions:

8.1.5.3 Acquisition and Mergers:

8.1.6 SWOT Analysis

8.2 ABB Group

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Segmental and Regional Analysis

8.2.4 Research & Development Expense

8.2.5 Recent strategies and developments:

8.2.5.1 Partnerships, Collaborations, and Agreements:

8.2.5.2 Acquisition and Mergers:

8.2.6 SWOT Analysis

8.3 Emerson Electric Co.

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Segmental and Regional Analysis

8.3.4 Research & Development Expense

8.3.5 Recent strategies and developments:

8.3.5.1 Partnerships, Collaborations, and Agreements:

8.3.5.2 Acquisition and Mergers:

8.3.6 SWOT Analysis

8.4 Rockwell Automation, Inc.

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Segmental and Regional Analysis

8.4.4 Research & Development Expenses

8.4.5 Recent strategies and developments:

8.4.5.1 Acquisition and Mergers:

8.4.5.2 Geographical Expansions:

8.4.6 SWOT Analysis

8.5 Omron Corporation

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Segmental and Regional Analysis

8.5.4 Research & Development Expenses

8.5.5 Recent strategies and developments:

8.5.5.1 Partnerships, Collaborations, and Agreements:

8.5.5.2 Product Launches and Product Expansions:

8.5.6 SWOT Analysis

8.6 Honeywell International, Inc.

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Segmental and Regional Analysis

8.6.4 Research & Development Expenses

8.6.5 Recent strategies and developments:

8.6.5.1 Partnerships, Collaborations, and Agreements:

8.6.6 SWOT Analysis

8.7 Schneider Electric SE

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Segmental and Regional Analysis

8.7.4 Research & Development Expense

8.7.5 SWOT Analysis

8.8 Mitsubishi Electric Corporation

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Segmental and Regional Analysis

8.8.4 Research & Development Expense

8.8.5 Recent strategies and developments:

8.8.5.1 Partnerships, Collaborations, and Agreements:

8.8.6 SWOT Analysis

8.9 Yokogawa Electric Corporation

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Segmental and Regional Analysis

8.9.4 Research & Development Expenses

8.9.5 Recent strategies and developments:

8.9.5.1 Partnerships, Collaborations, and Agreements:

8.9.5.2 Product Launches and Product Expansions:

8.9.5.3 Acquisition and Mergers:

8.9.6 SWOT Analysis

8.10. Danaher Corporation (Beckman Coulter, Inc.)

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Segmental and Regional Analysis

8.10.4 Research & Development Expense

8.10.5 SWOT Analysis

TABLE 1 Europe Automation and Instrumentation In Power Market, 2020 - 2023, USD Million

TABLE 2 Europe Automation and Instrumentation In Power Market, 2024 - 2031, USD Million

TABLE 3 Partnerships, Collaborations and Agreements– Automation and Instrumentation In Power Market

TABLE 4 Product Launches And Product Expansions– Automation and Instrumentation In Power Market

TABLE 5 Acquisition and Mergers– Automation and Instrumentation In Power Market

TABLE 6 Geographical Expansion– Automation and Instrumentation In Power Market

TABLE 7 Europe Automation and Instrumentation In Power Market by Instrument, 2020 - 2023, USD Million

TABLE 8 Europe Automation and Instrumentation In Power Market by Instrument, 2024 - 2031, USD Million

TABLE 9 Europe Field Instruments Market by Country, 2020 - 2023, USD Million

TABLE 10 Europe Field Instruments Market by Country, 2024 - 2031, USD Million

TABLE 11 Europe Process Analyzers Market by Country, 2020 - 2023, USD Million

TABLE 12 Europe Process Analyzers Market by Country, 2024 - 2031, USD Million

TABLE 13 Europe Automation and Instrumentation In Power Market by Solution, 2020 - 2023, USD Million

TABLE 14 Europe Automation and Instrumentation In Power Market by Solution, 2024 - 2031, USD Million

TABLE 15 Europe Programmable Logic Controller (PLC) Market by Country, 2020 - 2023, USD Million

TABLE 16 Europe Programmable Logic Controller (PLC) Market by Country, 2024 - 2031, USD Million

TABLE 17 Europe Distributed Control System (DCS) Market by Country, 2020 - 2023, USD Million

TABLE 18 Europe Distributed Control System (DCS) Market by Country, 2024 - 2031, USD Million

TABLE 19 Europe Safety Automation Supervisory Control and Data Acquisition (SCADA) Market by Country, 2020 - 2023, USD Million

TABLE 20 Europe Safety Automation Supervisory Control and Data Acquisition (SCADA) Market by Country, 2024 - 2031, USD Million

TABLE 21 Europe Human Machine Interaction (HMI) Market by Country, 2020 - 2023, USD Million

TABLE 22 Europe Human Machine Interaction (HMI) Market by Country, 2024 - 2031, USD Million

TABLE 23 Europe Advanced Process Control (APC) Market by Country, 2020 - 2023, USD Million

TABLE 24 Europe Advanced Process Control (APC) Market by Country, 2024 - 2031, USD Million

TABLE 25 Europe Manufacturing Execution System (MES) Market by Country, 2020 - 2023, USD Million

TABLE 26 Europe Manufacturing Execution System (MES) Market by Country, 2024 - 2031, USD Million

TABLE 27 Europe Automation and Instrumentation In Power Market by Country, 2020 - 2023, USD Million

TABLE 28 Europe Automation and Instrumentation In Power Market by Country, 2024 - 2031, USD Million

TABLE 29 Germany Automation and Instrumentation In Power Market, 2020 - 2023, USD Million

TABLE 30 Germany Automation and Instrumentation In Power Market, 2024 - 2031, USD Million

TABLE 31 Germany Automation and Instrumentation In Power Market by Instrument, 2020 - 2023, USD Million

TABLE 32 Germany Automation and Instrumentation In Power Market by Instrument, 2024 - 2031, USD Million

TABLE 33 Germany Automation and Instrumentation In Power Market by Solution, 2020 - 2023, USD Million

TABLE 34 Germany Automation and Instrumentation In Power Market by Solution, 2024 - 2031, USD Million

TABLE 35 UK Automation and Instrumentation In Power Market, 2020 - 2023, USD Million

TABLE 36 UK Automation and Instrumentation In Power Market, 2024 - 2031, USD Million

TABLE 37 UK Automation and Instrumentation In Power Market by Instrument, 2020 - 2023, USD Million

TABLE 38 UK Automation and Instrumentation In Power Market by Instrument, 2024 - 2031, USD Million

TABLE 39 UK Automation and Instrumentation In Power Market by Solution, 2020 - 2023, USD Million

TABLE 40 UK Automation and Instrumentation In Power Market by Solution, 2024 - 2031, USD Million

TABLE 41 France Automation and Instrumentation In Power Market, 2020 - 2023, USD Million

TABLE 42 France Automation and Instrumentation In Power Market, 2024 - 2031, USD Million

TABLE 43 France Automation and Instrumentation In Power Market by Instrument, 2020 - 2023, USD Million

TABLE 44 France Automation and Instrumentation In Power Market by Instrument, 2024 - 2031, USD Million

TABLE 45 France Automation and Instrumentation In Power Market by Solution, 2020 - 2023, USD Million

TABLE 46 France Automation and Instrumentation In Power Market by Solution, 2024 - 2031, USD Million

TABLE 47 Russia Automation and Instrumentation In Power Market, 2020 - 2023, USD Million

TABLE 48 Russia Automation and Instrumentation In Power Market, 2024 - 2031, USD Million

TABLE 49 Russia Automation and Instrumentation In Power Market by Instrument, 2020 - 2023, USD Million

TABLE 50 Russia Automation and Instrumentation In Power Market by Instrument, 2024 - 2031, USD Million

TABLE 51 Russia Automation and Instrumentation In Power Market by Solution, 2020 - 2023, USD Million

TABLE 52 Russia Automation and Instrumentation In Power Market by Solution, 2024 - 2031, USD Million

TABLE 53 Spain Automation and Instrumentation In Power Market, 2020 - 2023, USD Million

TABLE 54 Spain Automation and Instrumentation In Power Market, 2024 - 2031, USD Million

TABLE 55 Spain Automation and Instrumentation In Power Market by Instrument, 2020 - 2023, USD Million

TABLE 56 Spain Automation and Instrumentation In Power Market by Instrument, 2024 - 2031, USD Million

TABLE 57 Spain Automation and Instrumentation In Power Market by Solution, 2020 - 2023, USD Million

TABLE 58 Spain Automation and Instrumentation In Power Market by Solution, 2024 - 2031, USD Million

TABLE 59 Italy Automation and Instrumentation In Power Market, 2020 - 2023, USD Million

TABLE 60 Italy Automation and Instrumentation In Power Market, 2024 - 2031, USD Million

TABLE 61 Italy Automation and Instrumentation In Power Market by Instrument, 2020 - 2023, USD Million

TABLE 62 Italy Automation and Instrumentation In Power Market by Instrument, 2024 - 2031, USD Million

TABLE 63 Italy Automation and Instrumentation In Power Market by Solution, 2020 - 2023, USD Million

TABLE 64 Italy Automation and Instrumentation In Power Market by Solution, 2024 - 2031, USD Million

TABLE 65 Rest of Europe Automation and Instrumentation In Power Market, 2020 - 2023, USD Million

TABLE 66 Rest of Europe Automation and Instrumentation In Power Market, 2024 - 2031, USD Million

TABLE 67 Rest of Europe Automation and Instrumentation In Power Market by Instrument, 2020 - 2023, USD Million

TABLE 68 Rest of Europe Automation and Instrumentation In Power Market by Instrument, 2024 - 2031, USD Million

TABLE 69 Rest of Europe Automation and Instrumentation In Power Market by Solution, 2020 - 2023, USD Million

TABLE 70 Rest of Europe Automation and Instrumentation In Power Market by Solution, 2024 - 2031, USD Million

TABLE 71 Key Information – Siemens AG

TABLE 72 Key Information – ABB Group

TABLE 73 Key Information – Emerson Electric Co.

TABLE 74 Key Information – Rockwell Automation, Inc.

TABLE 75 Key Information – Omron Corporation

TABLE 76 Key Information – Honeywell International, Inc.

TABLE 77 Key Information – Schneider Electric SE

TABLE 78 Key Information – Mitsubishi Electric Corporation

TABLE 79 Key Information – Yokogawa Electric Corporation

TABLE 80 Key Information – Danaher Corporation

List of Figures

FIG 1 Methodology for the research

FIG 2 Europe Automation and Instrumentation In Power Market, 2020 - 2031, USD Million

FIG 3 Key Factors Impacting Automation and Instrumentation In Power Market

FIG 4 KBV Cardinal Matrix

FIG 5 Market Share Analysis, 2023

FIG 6 Key Leading Strategies: Percentage Distribution (2020-2024)

FIG 7 Key Strategic Move: (Product Launches and Product Expansions : 2022, Feb – 2024, Jun) Leading Players

FIG 8 Porter’s Five Forces Analysis – Automation and Instrumentation In Power Market

FIG 9 Europe Automation and Instrumentation In Power Market share by Instrument, 2023

FIG 10 Europe Automation and Instrumentation In Power Market share by Instrument, 2031

FIG 11 Europe Automation and Instrumentation In Power Market by Instrument, 2020 - 2031, USD Million

FIG 12 Europe Automation and Instrumentation In Power Market share by Solution, 2023

FIG 13 Europe Automation and Instrumentation In Power Market share by Solution, 2031

FIG 14 Europe Automation and Instrumentation In Power Market by Solution, 2020 - 2031, USD Million

FIG 15 Europe Automation and Instrumentation In Power Market share by Country, 2023

FIG 16 Europe Automation and Instrumentation In Power Market share by Country, 2031

FIG 17 Europe Automation and Instrumentation In Power Market by Country, 2020 - 2031, USD Million

FIG 18 Recent strategies and developments: Siemens AG

FIG 19 SWOT Analysis: Siemens AG

FIG 20 Recent strategies and developments: ABB GROUP

FIG 21 SWOT Analysis: ABB GROUP

FIG 22 Recent strategies and developments: EMERSON ELECTRIC CO.

FIG 23 Swot Analysis: EMERSON ELECTRIC CO.

FIG 24 Recent strategies and developments: Rockwell Automation, Inc.

FIG 25 SWOT Analysis: Rockwell Automation, Inc.

FIG 26 Recent strategies and developments: Omron Corporation

FIG 27 SWOT Analysis: Omron Corporation

FIG 28 Swot analysis: Honeywell international, inc.

FIG 29 SWOT Analysis: Schneider Electric SE

FIG 30 SWOT Analysis: Mitsubishi Electric Corporation

FIG 31 Recent strategies and developments: Yokogawa Electric CorporatioN

FIG 32 Swot Analysis: Yokogawa Electric CorporatioN

FIG 33 SWOT Analysis: Danaher Corporation