The Europe Automotive Dealer Management System Market would witness market growth of 9.4% CAGR during the forecast period (2024-2031).

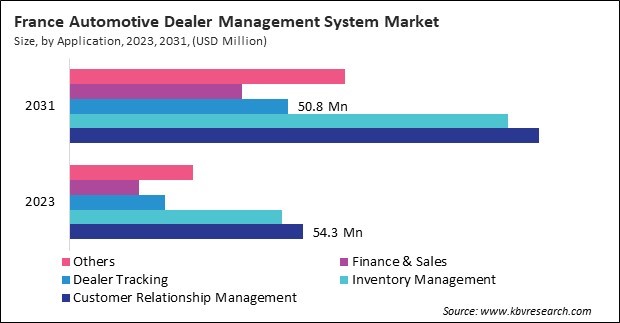

The Germany market dominated the Europe Automotive Dealer Management System Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $575.7 million by 2031. The UK market is exhibiting a CAGR of 8.4% during (2024 - 2031). Additionally, The France market would experience a CAGR of 10.2% during (2024 - 2031).

Service management is another critical function within dealership operations, and ADMS platforms offer comprehensive tools to streamline service scheduling, workflow management, and customer communication. Service management modules typically include features such as appointment scheduling, technician dispatching, parts ordering, service history tracking, and warranty management. By optimizing service operations, dealerships can enhance customer satisfaction, increase service revenue, and improve overall efficiency in the service department.

The adoption of ADMS is influenced by various market dynamics, including industry trends, technological advancements, regulatory requirements, and changing customer expectations. Understanding the factors driving adoption rates provides valuable insights into the automotive dealer management systems market’s current and future trajectory. For instance, the automotive industry is undergoing a significant transformation with the increasing digitalization and automation of dealership operations. As dealerships strive to improve efficiency, reduce costs, and enhance customer experiences, there is a growing recognition of the importance of adopting advanced DMS solutions. ADMS platforms enable dealerships to streamline processes, automate routine tasks, and leverage data-driven insights to drive growth and profitability.

As automotive production increases in Italy, there is a corresponding increase in the number of vehicles distributed and sold through dealer networks. This surge in activity drives the demand for DMS solutions, which are essential for managing inventory, sales, and customer interactions efficiently. According to the International Trade Administration (ITA), the automotive sector is one of Italy’s main industries. In 2022, the automotive sector’s turnover was €92.7 billion, 9.3% of Italy’s manufacturing turnover and 5.2% of Italy’s GDP. As the number of EV registrations rises in Poland, dealerships will need specialized inventory management capabilities within their DMS to handle the unique requirements of EVs. According to the ITA, at the end of February 2020, 9,803 electric cars were registered in Poland. 1,166 all-electric and plug-in hybrid vehicles were registered in the first two months of 2020, an increase of 181% over the same period in 2019. In conclusion, increasing automotive production and rising EV registration in the region drive the market’s growth.

Free Valuable Insights: The Global Automotive Dealer Management System Market will Hit USD 9.6 Billion by 2031, at a CAGR of 9.8%

Based on Component, the market is segmented into Hardware, and Software & Services. Based on Application, the market is segmented into Customer Relationship Management, Inventory Management, Dealer Tracking, Finance & Sales, and Others. Based on Deployment, the market is segmented into On-Premise, and On-Cloud. Based on countries, the market is segmented into Germany, UK, France, Russia, Spain, Italy, and Rest of Europe.

By Component

By Application

By Deployment

By Country

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.