The Europe Cybersecurity for Critical Infrastructure in Financial Sector Market would witness market growth of 6.3% CAGR during the forecast period (2024-2031).

The Germany market dominated the Europe Cybersecurity for Critical Infrastructure in Financial Sector Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $878.2 Million by 2031. The UK market is exhibiting a CAGR of 5.5% during (2024 - 2031). Additionally, The France market would experience a CAGR of 7.1% during (2024 - 2031).

Protecting payment systems has become a critical application with the growth of digital payments and e-commerce. Cybersecurity safeguards ensure that online transactions, digital wallets, and electronic funds transfers are secure from interception, fraud, and cyberattacks. Encryption, tokenization, and multi-factor authentication (MFA) are commonly employed technologies to ensure the integrity of financial transactions.

Asset management platforms used by investment firms, portfolio managers, and pension funds are critical to properly managing financial assets. Cybersecurity ensures these platforms are protected from cyber intrusions, ensuring accurate and secure financial data management and transactions. One of the cornerstones of securing the financial sector is robust identity and authentication systems.

As reported by the European Banking Federation (EBF) for 2023, the evolving landscape of the banking sector in Europe reflects critical trends that impact the growth of cybersecurity for critical infrastructure in financial sector market. With a decrease in outstanding loans and an increase in deposits, particularly from households, the banking industry in Europe is becoming more digitized and interconnected. These changes, driven by technological adoption and shifting financial behaviors, necessitate enhanced cybersecurity measures to protect critical infrastructure, financial transactions, and sensitive data. The increased reliance on digital banking platforms, driven by rising household deposits, also extends to the growing use of online banking, digital wallets, and peer-to-peer (P2P) payment systems. As more customers engage with these digital services, the financial sector faces an expanding surface for potential cyberattacks. Cybercriminals may exploit weaknesses in the systems that store, transfer, and process large volumes of deposit-related data. Thus, decreasing loans and growing deposits in the EU financial sector have led to an increased reliance on digital banking services.

Free Valuable Insights: The Global Cybersecurity for Critical Infrastructure in Financial Sector Market will Hit USD 14.68 Billion by 2031, at a CAGR of 6.5%

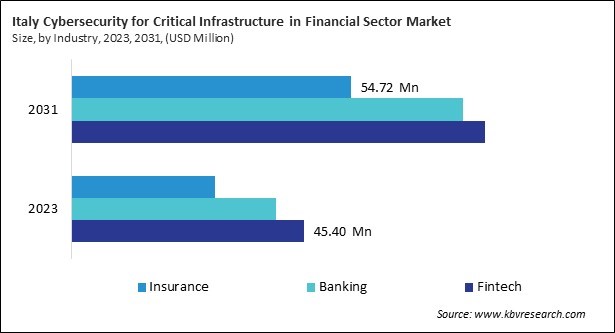

Based on Deployment Mode, the market is segmented into On-Premise, and Cloud. Based on Industry, the market is segmented into Fintech, Banking, and Insurance. Based on Component, the market is segmented into Solution, and Service. Based on countries, the market is segmented into Germany, UK, France, Russia, Spain, Italy, and Rest of Europe.

By Deployment Mode

By Industry

By Component

By Country

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.