The Europe Digital Twin in Telecom Market would witness market growth of 21.8% CAGR during the forecast period (2024-2031).

The Germany market dominated the Europe Digital Twin in Telecom Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $108.9 Billion by 2031. The UK market is experiencing a CAGR of 20.7% during (2024 - 2031). Additionally, The France market would exhibit a CAGR of 22.8% during (2024 - 2031).

Digital twins have gained prominence across various industries, from manufacturing and automotive to healthcare, but their impact on the telecom industry is particularly profound. Telecom companies face unique challenges that digital twins are uniquely positioned to address. Networks are becoming more complex with the rise of 5G, edge computing, and IoT. Operators are no longer just managing centralized infrastructure but increasingly managing distributed networks that span geographic locations and support a wide range of applications, from high-speed internet access to critical real-time services such as autonomous driving and remote healthcare. The need for a robust, adaptable, and intelligent management system has never been more pressing, and this is where digital twins play a vital role.

As the rollout of 5G networks accelerates globally, telecom companies increasingly adopt digital twins to help manage these next-generation infrastructures' dynamic and complex nature. Unlike earlier generations, 5G networks rely heavily on software-based solutions, virtualized network functions (VNFs), and distributed architectures that require continuous monitoring and adaptive management. Digital twins can model this complexity and simulate how new technologies, such as network slicing and edge computing, will integrate into the network.

Germany is at the forefront of 5G deployment in Europe, driven by the government's vision of becoming a digital leader. The Digital Germany 2025 initiative, launched by the German government, is a key program to ensure 5G connectivity across urban and rural areas. In 2023, Germany invested significantly in expanding 5G infrastructure, supporting IoT applications across various sectors. The German regulator, Bundesnetzagentur (BNetzA), has announced a five-year extension for spectrum licenses and is working on auctioning these alongside spectrum in other bands where licenses are set to expire in 2033. The government’s proactive support and substantial financial backing for 5G deployment have helped Germany solidify its position as a major hub for 5G IoT technology in Europe, further strengthening its competitive edge in the global telecom landscape. Hence, this push for widespread 5G coverage, combined with strong public and private sector investments, is facilitating the market's growth in Europe.

Free Valuable Insights: The Global Digital Twin in Telecom Market will Hit USD 1.6 Trillion by 2031, at a CAGR of 22.0%

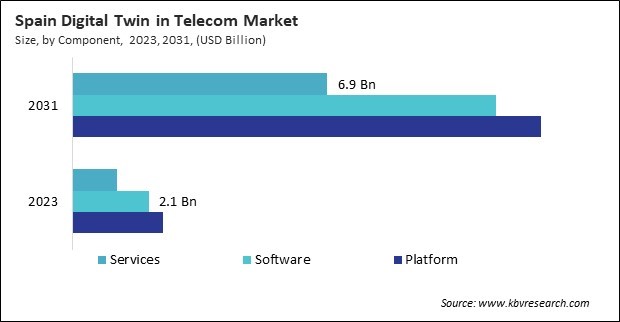

Based on Organization Size, the market is segmented into Large Enterprises and Small & Medium-Sized Enterprises (SMEs). Based on Component, the market is segmented into Platform, Software, and Services. Based on Technology, the market is segmented into Internet of Things (IoT), Artificial Intelligence (AI), Big Data Analytics, and Cloud Computing & Others. Based on End User, the market is segmented into Telecom Operators, Communication Service Providers (CSPs), Mobile Network Operators (MNOs), Internet Service Providers (ISPs), and Other End User. Based on Deployment Type, the market is segmented into Cloud-Based, On-Premise, and Hybrid. Based on countries, the market is segmented into Germany, UK, France, Russia, Spain, Italy, and Rest of Europe.

By Organization Size

By Component

By Technology

By End User

By Deployment Type

By Country

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.