The Europe Fatty Alcohols Market would witness market growth of 5.2% CAGR during the forecast period (2024-2031). In the year 2021, the Europe market's volume surged to 549.9 kilo tonnes, showcasing a growth of 22.7% (2020-2024).

Pure Cut fatty alcohols typically consist of a single, well-defined chain length, such as C12 (lauryl alcohol) or C16 (cetyl alcohol). These are widely used in personal care products like shampoos, lotions, and creams due to their excellent emollient, emulsifying, and moisturizing properties. Pure Cut fatty alcohols are also preferred in pharmaceuticals and cosmetics for their consistent performance and high purity. Hence, in Russia, 45.53 kilo tonnes of Pure Cut fatty alcohols is expected to be utilized by the year 2031.

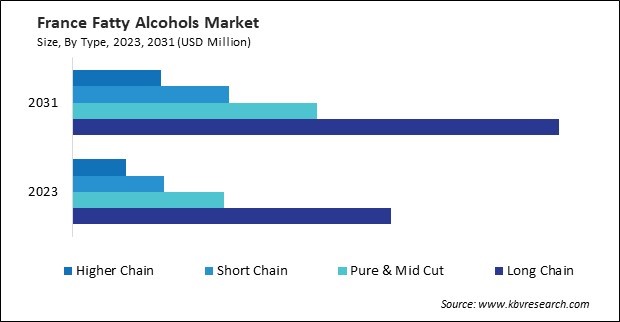

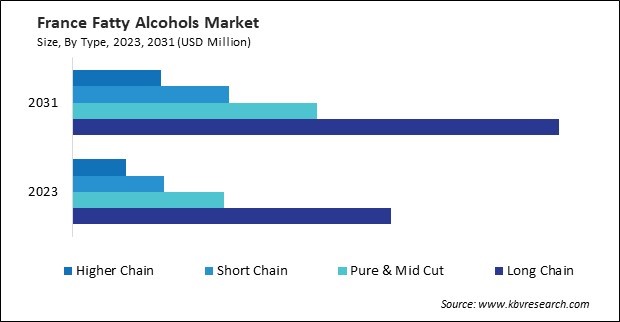

The Germany market dominated the Europe Fatty Alcohols Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $419 million by 2031. The UK market is experiencing a CAGR of 4.6% during (2024 - 2031). Additionally, The France market would exhibit a CAGR of 6.1% during (2024 - 2031).

In the industrial sector, fatty alcohols find applications in producing various chemicals, lubricants, and coatings. As lubricant additives, fatty alcohols help to improve lubricity, reduce friction, and enhance the performance of oils and greases in automotive, industrial, and marine applications. Specific fatty alcohols are also used as food additives and emulsifiers in the food and beverage industry. Examples of these include sorbitan esters and glycerol monostearate (GMS). These ingredients help to stabilize emulsions, prevent ingredient separation, and improve texture and mouthfeel in processed foods, confectionery, bakery products, and dairy alternatives. Fatty alcohols also carry flavors, colors, and nutrients, enhancing their dispersion and retention in food formulations.

The adoption of fatty alcohols within the market is influenced by many factors, encompassing economic conditions, consumer preferences, regulatory frameworks, and technological advancements. Understanding these dynamics provides insight into the growth trajectory and prospects of the fatty alcohols market. Changing consumer preferences towards natural, sustainable, and ethically sourced ingredients have fueled the adoption of fatty alcohols derived from renewable sources. Consumers increasingly seek products that align with their values, driving demand for eco-friendly formulations across various industries. Moreover, heightened health and wellness awareness has led to a preference for products free from harsh chemicals, further bolstering the demand for fatty alcohols in natural and organic formulations.

The popularity of plant-based and organic cleaning products is on the rise in Europe. Fatty alcohols, derived from renewable sources, are essential for creating formulations that appeal to consumers seeking environmentally friendly options. The trend towards liquid detergents over powder formulations is impacting the fatty alcohols market. Liquid products often require specific emulsifying agents, where fatty alcohols serve as effective surfactants that enhance the performance of liquid detergents.

As competition intensifies within the detergent sector, manufacturers are investing in high-performance formulations. Fatty alcohols contribute to superior foaming, wetting, and cleaning properties, allowing brands to differentiate their products in the market. Detergent companies in Europe are increasingly collaborating with chemical manufacturers to innovate and develop sustainable products. These partnerships enhance the utilization of fatty alcohols, enabling the creation of formulations that are both effective and environmentally responsible. Therefore, the growing detergent industry in the region is propelling the market's growth.

Free Valuable Insights: The Global Fatty Alcohols Market will Hit USD 7.5 Billion by 2031, at a CAGR of 5.5%

Based on Type, the market is segmented into Long Chain, Pure & Mid Cut, Short Chain, and Higher Chain. Based on Application, the market is segmented into Soaps & Detergents, Personal Care, Plasticizers, Lubricants, Pharmaceutical Formulation, Amines, and Other Applications. Based on countries, the market is segmented into Germany, UK, France, Russia, Spain, Italy, and Rest of Europe.

List of Key Companies Profiled

- Wilmar International Limited

- Kao Corporation

- Kuala Lumpur Kepong Berhad (Davos Life Science)

- Arkema S.A.

- The Procter & Gamble Company

- Sasol Limited

- Emery Oleochemicals LLC

- BASF SE

- Univar Solutions, Inc.

- Saudi Basic Industries Corporation (SABIC)

Europe Fatty Alcohols Market Report Segmentation

By Type (Volume, Kilo Tonnes, USD Billion, 2020-2031)

- Long Chain

- Pure & Mid Cut

- Short Chain

- Higher Chain

By Application (Volume, Kilo Tonnes, USD Billion, 2020-2031)

- Soaps & Detergents

- Personal Care

- Plasticizers

- Lubricants

- Pharmaceutical Formulation

- Amines

- Other Applications

By Country (Volume, Kilo Tonnes, USD Billion, 2020-2031)

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

TABLE 1 Europe Fatty Alcohols Market, 2020 - 2023, USD Million

TABLE 2 Europe Fatty Alcohols Market, 2024 - 2031, USD Million

TABLE 3 Europe Fatty Alcohols Market, 2020 - 2023, Kilo Tonnes

TABLE 4 Europe Fatty Alcohols Market, 2024 - 2031, Kilo Tonnes

TABLE 5 Europe Fatty Alcohols Market by Type, 2020 - 2023, USD Million

TABLE 6 Europe Fatty Alcohols Market by Type, 2024 - 2031, USD Million

TABLE 7 Europe Fatty Alcohols Market by Type, 2020 - 2023, Kilo Tonnes

TABLE 8 Europe Fatty Alcohols Market by Type, 2024 - 2031, Kilo Tonnes

TABLE 9 Europe Long Chain Market by Country, 2020 - 2023, USD Million

TABLE 10 Europe Long Chain Market by Country, 2024 - 2031, USD Million

TABLE 11 Europe Long Chain Market by Country, 2020 - 2023, Kilo Tonnes

TABLE 12 Europe Long Chain Market by Country, 2024 - 2031, Kilo Tonnes

TABLE 13 Europe Pure & Mid Cut Market by Country, 2020 - 2023, USD Million

TABLE 14 Europe Pure & Mid Cut Market by Country, 2024 - 2031, USD Million

TABLE 15 Europe Pure & Mid Cut Market by Country, 2020 - 2023, Kilo Tonnes

TABLE 16 Europe Pure & Mid Cut Market by Country, 2024 - 2031, Kilo Tonnes

TABLE 17 Europe Short Chain Market by Country, 2020 - 2023, USD Million

TABLE 18 Europe Short Chain Market by Country, 2024 - 2031, USD Million

TABLE 19 Europe Short Chain Market by Country, 2020 - 2023, Kilo Tonnes

TABLE 20 Europe Short Chain Market by Country, 2024 - 2031, Kilo Tonnes

TABLE 21 Europe Higher Chain Market by Country, 2020 - 2023, USD Million

TABLE 22 Europe Higher Chain Market by Country, 2024 - 2031, USD Million

TABLE 23 Europe Higher Chain Market by Country, 2020 - 2023, Kilo Tonnes

TABLE 24 Europe Higher Chain Market by Country, 2024 - 2031, Kilo Tonnes

TABLE 25 Europe Fatty Alcohols Market by Application, 2020 - 2023, USD Million

TABLE 26 Europe Fatty Alcohols Market by Application, 2024 - 2031, USD Million

TABLE 27 Europe Fatty Alcohols Market by Application, 2020 - 2023, Kilo Tonnes

TABLE 28 Europe Fatty Alcohols Market by Application, 2024 - 2031, Kilo Tonnes

TABLE 29 Europe Soaps & Detergents Market by Country, 2020 - 2023, USD Million

TABLE 30 Europe Soaps & Detergents Market by Country, 2024 - 2031, USD Million

TABLE 31 Europe Soaps & Detergents Market by Country, 2020 - 2023, Kilo Tonnes

TABLE 32 Europe Soaps & Detergents Market by Country, 2024 - 2031, Kilo Tonnes

TABLE 33 Europe Personal Care Market by Country, 2020 - 2023, USD Million

TABLE 34 Europe Personal Care Market by Country, 2024 - 2031, USD Million

TABLE 35 Europe Personal Care Market by Country, 2020 - 2023, Kilo Tonnes

TABLE 36 Europe Personal Care Market by Country, 2024 - 2031, Kilo Tonnes

TABLE 37 Europe Plasticizers Market by Country, 2020 - 2023, USD Million

TABLE 38 Europe Plasticizers Market by Country, 2024 - 2031, USD Million

TABLE 39 Europe Plasticizers Market by Country, 2020 - 2023, Kilo Tonnes

TABLE 40 Europe Plasticizers Market by Country, 2024 - 2031, Kilo Tonnes

TABLE 41 Europe Lubricants Market by Country, 2020 - 2023, USD Million

TABLE 42 Europe Lubricants Market by Country, 2024 - 2031, USD Million

TABLE 43 Europe Lubricants Market by Country, 2020 - 2023, Kilo Tonnes

TABLE 44 Europe Lubricants Market by Country, 2024 - 2031, Kilo Tonnes

TABLE 45 Europe Pharmaceutical Formulation Market by Country, 2020 - 2023, USD Million

TABLE 46 Europe Pharmaceutical Formulation Market by Country, 2024 - 2031, USD Million

TABLE 47 Europe Pharmaceutical Formulation Market by Country, 2020 - 2023, Kilo Tonnes

TABLE 48 Europe Pharmaceutical Formulation Market by Country, 2024 - 2031, Kilo Tonnes

TABLE 49 Europe Amines Market by Country, 2020 - 2023, USD Million

TABLE 50 Europe Amines Market by Country, 2024 - 2031, USD Million

TABLE 51 Europe Amines Market by Country, 2020 - 2023, Kilo Tonnes

TABLE 52 Europe Amines Market by Country, 2024 - 2031, Kilo Tonnes

TABLE 53 Europe Other Applications Market by Country, 2020 - 2023, USD Million

TABLE 54 Europe Other Applications Market by Country, 2024 - 2031, USD Million

TABLE 55 Europe Other Applications Market by Country, 2020 - 2023, Kilo Tonnes

TABLE 56 Europe Other Applications Market by Country, 2024 - 2031, Kilo Tonnes

TABLE 57 Europe Fatty Alcohols Market by Country, 2020 - 2023, USD Million

TABLE 58 Europe Fatty Alcohols Market by Country, 2024 - 2031, USD Million

TABLE 59 Europe Fatty Alcohols Market by Country, 2020 - 2023, Kilo Tonnes

TABLE 60 Europe Fatty Alcohols Market by Country, 2024 - 2031, Kilo Tonnes

TABLE 61 Germany Fatty Alcohols Market, 2020 - 2023, USD Million

TABLE 62 Germany Fatty Alcohols Market, 2024 - 2031, USD Million

TABLE 63 Germany Fatty Alcohols Market, 2020 - 2023, Kilo Tonnes

TABLE 64 Germany Fatty Alcohols Market, 2024 - 2031, Kilo Tonnes

TABLE 65 Germany Fatty Alcohols Market by Type, 2020 - 2023, USD Million

TABLE 66 Germany Fatty Alcohols Market by Type, 2024 - 2031, USD Million

TABLE 67 Germany Fatty Alcohols Market by Type, 2020 - 2023, Kilo Tonnes

TABLE 68 Germany Fatty Alcohols Market by Type, 2024 - 2031, Kilo Tonnes

TABLE 69 Germany Fatty Alcohols Market by Application, 2020 - 2023, USD Million

TABLE 70 Germany Fatty Alcohols Market by Application, 2024 - 2031, USD Million

TABLE 71 Germany Fatty Alcohols Market by Application, 2020 - 2023, Kilo Tonnes

TABLE 72 Germany Fatty Alcohols Market by Application, 2024 - 2031, Kilo Tonnes

TABLE 73 UK Fatty Alcohols Market, 2020 - 2023, USD Million

TABLE 74 UK Fatty Alcohols Market, 2024 - 2031, USD Million

TABLE 75 UK Fatty Alcohols Market, 2020 - 2023, Kilo Tonnes

TABLE 76 UK Fatty Alcohols Market, 2024 - 2031, Kilo Tonnes

TABLE 77 UK Fatty Alcohols Market by Type, 2020 - 2023, USD Million

TABLE 78 UK Fatty Alcohols Market by Type, 2024 - 2031, USD Million

TABLE 79 UK Fatty Alcohols Market by Type, 2020 - 2023, Kilo Tonnes

TABLE 80 UK Fatty Alcohols Market by Type, 2024 - 2031, Kilo Tonnes

TABLE 81 UK Fatty Alcohols Market by Application, 2020 - 2023, USD Million

TABLE 82 UK Fatty Alcohols Market by Application, 2024 - 2031, USD Million

TABLE 83 UK Fatty Alcohols Market by Application, 2020 - 2023, Kilo Tonnes

TABLE 84 UK Fatty Alcohols Market by Application, 2024 - 2031, Kilo Tonnes

TABLE 85 France Fatty Alcohols Market, 2020 - 2023, USD Million

TABLE 86 France Fatty Alcohols Market, 2024 - 2031, USD Million

TABLE 87 France Fatty Alcohols Market, 2020 - 2023, Kilo Tonnes

TABLE 88 France Fatty Alcohols Market, 2024 - 2031, Kilo Tonnes

TABLE 89 France Fatty Alcohols Market by Type, 2020 - 2023, USD Million

TABLE 90 France Fatty Alcohols Market by Type, 2024 - 2031, USD Million

TABLE 91 France Fatty Alcohols Market by Type, 2020 - 2023, Kilo Tonnes

TABLE 92 France Fatty Alcohols Market by Type, 2024 - 2031, Kilo Tonnes

TABLE 93 France Fatty Alcohols Market by Application, 2020 - 2023, USD Million

TABLE 94 France Fatty Alcohols Market by Application, 2024 - 2031, USD Million

TABLE 95 France Fatty Alcohols Market by Application, 2020 - 2023, Kilo Tonnes

TABLE 96 France Fatty Alcohols Market by Application, 2024 - 2031, Kilo Tonnes

TABLE 97 Russia Fatty Alcohols Market, 2020 - 2023, USD Million

TABLE 98 Russia Fatty Alcohols Market, 2024 - 2031, USD Million

TABLE 99 Russia Fatty Alcohols Market, 2020 - 2023, Kilo Tonnes

TABLE 100 Russia Fatty Alcohols Market, 2024 - 2031, Kilo Tonnes

TABLE 101 Russia Fatty Alcohols Market by Type, 2020 - 2023, USD Million

TABLE 102 Russia Fatty Alcohols Market by Type, 2024 - 2031, USD Million

TABLE 103 Russia Fatty Alcohols Market by Type, 2020 - 2023, Kilo Tonnes

TABLE 104 Russia Fatty Alcohols Market by Type, 2024 - 2031, Kilo Tonnes

TABLE 105 Russia Fatty Alcohols Market by Application, 2020 - 2023, USD Million

TABLE 106 Russia Fatty Alcohols Market by Application, 2024 - 2031, USD Million

TABLE 107 Russia Fatty Alcohols Market by Application, 2020 - 2023, Kilo Tonnes

TABLE 108 Russia Fatty Alcohols Market by Application, 2024 - 2031, Kilo Tonnes

TABLE 109 Spain Fatty Alcohols Market, 2020 - 2023, USD Million

TABLE 110 Spain Fatty Alcohols Market, 2024 - 2031, USD Million

TABLE 111 Spain Fatty Alcohols Market, 2020 - 2023, Kilo Tonnes

TABLE 112 Spain Fatty Alcohols Market, 2024 - 2031, Kilo Tonnes

TABLE 113 Spain Fatty Alcohols Market by Type, 2020 - 2023, USD Million

TABLE 114 Spain Fatty Alcohols Market by Type, 2024 - 2031, USD Million

TABLE 115 Spain Fatty Alcohols Market by Type, 2020 - 2023, Kilo Tonnes

TABLE 116 Spain Fatty Alcohols Market by Type, 2024 - 2031, Kilo Tonnes

TABLE 117 Spain Fatty Alcohols Market by Application, 2020 - 2023, USD Million

TABLE 118 Spain Fatty Alcohols Market by Application, 2024 - 2031, USD Million

TABLE 119 Spain Fatty Alcohols Market by Application, 2020 - 2023, Kilo Tonnes

TABLE 120 Spain Fatty Alcohols Market by Application, 2024 - 2031, Kilo Tonnes

TABLE 121 Italy Fatty Alcohols Market, 2020 - 2023, USD Million

TABLE 122 Italy Fatty Alcohols Market, 2024 - 2031, USD Million

TABLE 123 Italy Fatty Alcohols Market, 2020 - 2023, Kilo Tonnes

TABLE 124 Italy Fatty Alcohols Market, 2024 - 2031, Kilo Tonnes

TABLE 125 Italy Fatty Alcohols Market by Type, 2020 - 2023, USD Million

TABLE 126 Italy Fatty Alcohols Market by Type, 2024 - 2031, USD Million

TABLE 127 Italy Fatty Alcohols Market by Type, 2020 - 2023, Kilo Tonnes

TABLE 128 Italy Fatty Alcohols Market by Type, 2024 - 2031, Kilo Tonnes

TABLE 129 Italy Fatty Alcohols Market by Application, 2020 - 2023, USD Million

TABLE 130 Italy Fatty Alcohols Market by Application, 2024 - 2031, USD Million

TABLE 131 Italy Fatty Alcohols Market by Application, 2020 - 2023, Kilo Tonnes

TABLE 132 Italy Fatty Alcohols Market by Application, 2024 - 2031, Kilo Tonnes

TABLE 133 Rest of Europe Fatty Alcohols Market, 2020 - 2023, USD Million

TABLE 134 Rest of Europe Fatty Alcohols Market, 2024 - 2031, USD Million

TABLE 135 Rest of Europe Fatty Alcohols Market, 2020 - 2023, Kilo Tonnes

TABLE 136 Rest of Europe Fatty Alcohols Market, 2024 - 2031, Kilo Tonnes

TABLE 137 Rest of Europe Fatty Alcohols Market by Type, 2020 - 2023, USD Million

TABLE 138 Rest of Europe Fatty Alcohols Market by Type, 2024 - 2031, USD Million

TABLE 139 Rest of Europe Fatty Alcohols Market by Type, 2020 - 2023, Kilo Tonnes

TABLE 140 Rest of Europe Fatty Alcohols Market by Type, 2024 - 2031, Kilo Tonnes

TABLE 141 Rest of Europe Fatty Alcohols Market by Application, 2020 - 2023, USD Million

TABLE 142 Rest of Europe Fatty Alcohols Market by Application, 2024 - 2031, USD Million

TABLE 143 Rest of Europe Fatty Alcohols Market by Application, 2020 - 2023, Kilo Tonnes

TABLE 144 Rest of Europe Fatty Alcohols Market by Application, 2024 - 2031, Kilo Tonnes

TABLE 145 Key Information – Wilmar International Limited

TABLE 146 Key Information – Kao Corporation

TABLE 147 Key Information – Kuala Lumpur Kepong Berhad

TABLE 148 Key information – Arkema S.A.

TABLE 149 Key Information – The Procter & Gamble Company

TABLE 150 Key Information – Sasol Limited

TABLE 151 Key Information – Emery Oleochemicals LLC

TABLE 152 Key Information – BASF SE

TABLE 153 Key Information – Univar Solutions, Inc.

TABLE 154 Key Information – SABIC

List of Figures

FIG 1 Methodology for the research

FIG 2 Europe Fatty Alcohols Market, 2020 - 2031, USD Million

FIG 3 Key Factors Impacting Fatty Alcohols Market

FIG 4 Porter’s Five Forces Analysis – Fatty Alcohols Market

FIG 5 Europe Fatty Alcohols Market share by Type, 2023

FIG 6 Europe Fatty Alcohols Market share by Type, 2031

FIG 7 Europe Fatty Alcohols Market by Type, 2020 - 2031, USD Million

FIG 8 Europe Fatty Alcohols Market share by Application, 2023

FIG 9 Europe Fatty Alcohols Market share by Application, 2031

FIG 10 Europe Fatty Alcohols Market by Application, 2020 - 2031, USD Million

FIG 11 Europe Fatty Alcohols Market share by Country, 2023

FIG 12 Europe Fatty Alcohols Market share by Country, 2031

FIG 13 Europe Fatty Alcohols Market by Country, 2020 - 2031, USD Million

FIG 14 SWOT Analysis: WILMAR INTERNATIONAL LIMITED

FIG 15 SWOT Analysis: Kao Corporation

FIG 16 Swot Analysis: Kuala Lumpur Kepong Berhad

FIG 17 SWOT Analysis: Arkema S.A.

FIG 18 SWOT Analysis: The Procter & Gamble Company

FIG 19 SWOT Analysis: Sasol Limited

FIG 20 SWOT Analysis: Emery Oleochemicals LLC

FIG 21 SWOT Analysis: BASF SE

FIG 22 Swot Analysis: Univar Solutions, Inc.

FIG 23 SWOT Analysis: SABIC