Europe Food Acidulants Market Size, Share & Trends Analysis Report By Application, By Type (Citric Acid, Acetic Acid, Lactic Acid, Phosphoric Acid, Malic Acid and Others), By Country and Growth Forecast, 2024 - 2031

Published Date : 04-Jul-2024 |

Pages: 120 |

Formats: PDF |

COVID-19 Impact on the Europe Food Acidulants Market

The Europe Food Acidulants Market would witness market growth of 4.7% CAGR during the forecast period (2024-2031). In the year 2021, the Europe market's volume surged to 1,496.1 tonnes, showcasing a growth of 15.6% (2020-2023).

Acetic acid, a staple in the food acidulants market, serves multiple purposes in the food and beverage industry. Its primary use lies in enhancing flavors, acting as a preservative, and regulating pH levels in various products. This clear, colorless liquid, commonly found in condiments like vinegar, pickles, and salad dressings, imparts a tangy taste while extending shelf life. Its natural preservative properties inhibit bacterial and fungal growth, ensuring food safety and quality. Therefore, the Germany market consumed 40.63 tonnes of Acetic acid in 2023.

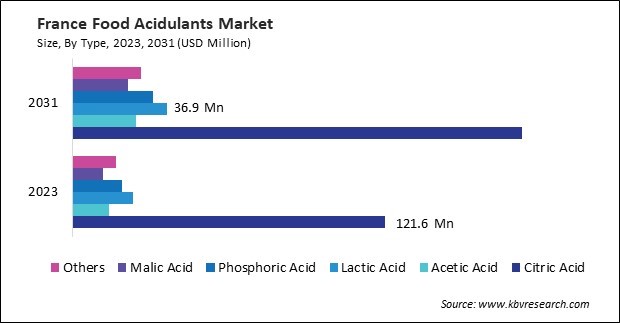

The Germany market dominated the Europe Food Acidulants Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $485.1 Million by 2031. The UK market is exhibiting a CAGR of 3.8% during (2024 - 2031). Additionally, The France market would experience a CAGR of 5.6% during (2024 - 2031).

The adoption of food acidulants has been widespread across the food and beverage industry, driven by several factors highlighting their importance and versatility. Food acidulants are integral to formulating various food and beverage products, ranging from carbonated beverages and confectionery to processed meats and dairy items. Their widespread usage across diverse food categories underscores their importance in modern food processing.

Acidulants play a crucial role in enhancing the flavor profiles of various food and beverage products by imparting tartness or sourness. This is particularly evident in carbonated beverages, where acidulants contribute to the characteristic tangy taste that consumers expect. Acidulants help regulate pH levels in food products, contributing to their stability and preservation. By creating an acidic environment, acidulants inhibit the growth of spoilage-causing microorganisms, extending the shelf life of processed foods such as canned fruits, sauces, and pickles.

The bakery sector requires acidulants for various purposes, including dough conditioning, flavor enhancement, and pH regulation. According to the Government of Poland, Poland is the 5th largest producer of bakery products in the European Union. Every fifth food company in Poland is involved in the production of bakery products. The bakery industry accounted for almost 5% of the domestic food production in 2022. Likewise, acidulants are used in various meat products, such as sausages, processed meats, marinades, and cured meats. As per the Eurostat, at the end of 2022, there were 134 million pigs, 75 million bovine animals, and 70 million sheep and goats in the EU. The EU’s pig meat production in 2022 was 1.3 million tons. The EU produced a provisional 6.6 million tons of bovine meat (beef and veal carcasses) in 2022. Therefore, the rising bakery industry and increasing regional meat sector drive the market's growth.

Free Valuable Insights: The Global Food Acidulants Market will Hit USD 8.6 Billion by 2031, at a CAGR of 5.1%

Based on Application, the market is segmented into Beverages, Bakery & Confectionery, Dairy & Frozen Desserts, Meat Industry and Others. Based on Type, the market is segmented into Citric Acid, Acetic Acid, Lactic Acid, Phosphoric Acid, Malic Acid and Others. Based on countries, the market is segmented into Germany, UK, France, Russia, Spain, Italy, and Rest of Europe.

List of Key Companies Profiled

- Tate & Lyle Plc

- Brenntag SE

- Univar Solutions, Inc.

- Archer Daniels Midland Company

- Jungbunzlauer Suisse AG

- Cargill, Incorporated

- Corbion N.V.

- Bartek Ingredients Inc. (TorQuest Partners)

- FBC Industries Inc.

- Hawkins Watts Limited

Europe Food Acidulants Market Report Segmentation

By Application< (Volume, Tonnes, USD Billion, 2020-2031)

- Beverages

- Bakery & Confectionery

- Dairy & Frozen Desserts

- Meat Industry

- Others

By Type (Volume, Tonnes, USD Billion, 2020-2031)

- Citric Acid

- Acetic Acid

- Lactic Acid

- Phosphoric Acid

- Malic Acid

- Others

By Country (Volume, Tonnes, USD Billion, 2020-2031)

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Europe Food Acidulants Market, by Application

1.4.2 Europe Food Acidulants Market, by Type

1.4.3 Europe Food Acidulants Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

3.3 Porter Five Forces Analysis

Chapter 4. Europe Food Acidulants Market by Application

4.1 Europe Beverages Market by Country

4.2 Europe Bakery & Confectionery Market by Country

4.3 Europe Dairy & Frozen Desserts Market by Country

4.4 Europe Meat Industry Market by Country

4.5 Europe Others Market by Country

Chapter 5. Europe Food Acidulants Market by Type

5.1 Europe Citric Acid Market by Country

5.2 Europe Acetic Acid Market by Country

5.3 Europe Lactic Acid Market by Country

5.4 Europe Phosphoric Acid Market by Country

5.5 Europe Malic Acid Market by Country

5.6 Europe Others Market by Country

Chapter 6. Europe Food Acidulants Market by Country

6.1 Germany Food Acidulants Market

6.1.1 Germany Food Acidulants Market by Application

6.1.2 Germany Food Acidulants Market by Type

6.2 UK Food Acidulants Market

6.2.1 UK Food Acidulants Market by Application

6.2.2 UK Food Acidulants Market by Type

6.3 France Food Acidulants Market

6.3.1 France Food Acidulants Market by Application

6.3.2 France Food Acidulants Market by Type

6.4 Russia Food Acidulants Market

6.4.1 Russia Food Acidulants Market by Application

6.4.2 Russia Food Acidulants Market by Type

6.5 Spain Food Acidulants Market

6.5.1 Spain Food Acidulants Market by Application

6.5.2 Spain Food Acidulants Market by Type

6.6 Italy Food Acidulants Market

6.6.1 Italy Food Acidulants Market by Application

6.6.2 Italy Food Acidulants Market by Type

6.7 Rest of Europe Food Acidulants Market

6.7.1 Rest of Europe Food Acidulants Market by Application

6.7.2 Rest of Europe Food Acidulants Market by Type

Chapter 7. Company Profiles

7.1 Tate & Lyle PLC

7.1.1 Company Overview

7.1.2 Financial Analysis

7.1.3 Segmental & Regional Analysis

7.1.4 Research & Development Expense

7.1.5 SWOT Analysis

7.2 Brenntag SE

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Segmental and Regional Analysis

7.2.4 SWOT Analysis

7.3 Univar Solutions, Inc.

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Segmental Analysis

7.3.4 SWOT Analysis

7.4 Archer Daniels Midland Company

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Segmental and Regional Analysis

7.4.4 Research & Development Expense

7.4.5 Recent strategies and developments:

7.4.5.1 Acquisition and Mergers:

7.4.6 SWOT Analysis

7.5 Jungbunzlauer Suisse AG

7.5.1 Company Overview

7.5.2 Recent strategies and developments:

7.5.2.1 Acquisition and Mergers:

7.5.3 SWOT Analysis

7.6 Cargill, Incorporated

7.6.1 Company Overview

7.6.2 SWOT Analysis

7.7 Corbion N.V.

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Segmental and Regional Analysis

7.7.4 Research & Development Expenses

7.7.5 SWOT Analysis

7.8 Bartek Ingredients Inc. (TorQuest Partners)

7.8.1 Company Overview

7.9 FBC Industries Inc.

7.9.1 Company Overview

7.10. Hawkins Watts New Zealand

7.10.1 Company Overview

TABLE 2 Europe Food Acidulants Market, 2024 - 2031, USD Million

TABLE 3 Europe Food Acidulants Market, 2020 - 2023, Tonnes

TABLE 4 Europe Food Acidulants Market, 2024 - 2031, Tonnes

TABLE 5 Europe Food Acidulants Market by Application, 2020 - 2023, USD Million

TABLE 6 Europe Food Acidulants Market by Application, 2024 - 2031, USD Million

TABLE 7 Europe Food Acidulants Market by Application, 2020 - 2023, Tonnes

TABLE 8 Europe Food Acidulants Market by Application, 2024 - 2031, Tonnes

TABLE 9 Europe Beverages Market by Country, 2020 - 2023, USD Million

TABLE 10 Europe Beverages Market by Country, 2024 - 2031, USD Million

TABLE 11 Europe Beverages Market by Country, 2020 - 2023, Tonnes

TABLE 12 Europe Beverages Market by Country, 2024 - 2031, Tonnes

TABLE 13 Europe Bakery & Confectionery Market by Country, 2020 - 2023, USD Million

TABLE 14 Europe Bakery & Confectionery Market by Country, 2024 - 2031, USD Million

TABLE 15 Europe Bakery & Confectionery Market by Country, 2020 - 2023, Tonnes

TABLE 16 Europe Bakery & Confectionery Market by Country, 2024 - 2031, Tonnes

TABLE 17 Europe Dairy & Frozen Desserts Market by Country, 2020 - 2023, USD Million

TABLE 18 Europe Dairy & Frozen Desserts Market by Country, 2024 - 2031, USD Million

TABLE 19 Europe Dairy & Frozen Desserts Market by Country, 2020 - 2023, Tonnes

TABLE 20 Europe Dairy & Frozen Desserts Market by Country, 2024 - 2031, Tonnes

TABLE 21 Europe Meat Industry Market by Country, 2020 - 2023, USD Million

TABLE 22 Europe Meat Industry Market by Country, 2024 - 2031, USD Million

TABLE 23 Europe Meat Industry Market by Country, 2020 - 2023, Tonnes

TABLE 24 Europe Meat Industry Market by Country, 2024 - 2031, Tonnes

TABLE 25 Europe Others Market by Country, 2020 - 2023, USD Million

TABLE 26 Europe Others Market by Country, 2024 - 2031, USD Million

TABLE 27 Europe Others Market by Country, 2020 - 2023, Tonnes

TABLE 28 Europe Others Market by Country, 2024 - 2031, Tonnes

TABLE 29 Europe Food Acidulants Market by Type, 2020 - 2023, USD Million

TABLE 30 Europe Food Acidulants Market by Type, 2024 - 2031, USD Million

TABLE 31 Europe Food Acidulants Market by Type, 2020 - 2023, Tonnes

TABLE 32 Europe Food Acidulants Market by Type, 2024 - 2031, Tonnes

TABLE 33 Europe Citric Acid Market by Country, 2020 - 2023, USD Million

TABLE 34 Europe Citric Acid Market by Country, 2024 - 2031, USD Million

TABLE 35 Europe Citric Acid Market by Country, 2020 - 2023, Tonnes

TABLE 36 Europe Citric Acid Market by Country, 2024 - 2031, Tonnes

TABLE 37 Europe Acetic Acid Market by Country, 2020 - 2023, USD Million

TABLE 38 Europe Acetic Acid Market by Country, 2024 - 2031, USD Million

TABLE 39 Europe Acetic Acid Market by Country, 2020 - 2023, Tonnes

TABLE 40 Europe Acetic Acid Market by Country, 2024 - 2031, Tonnes

TABLE 41 Europe Lactic Acid Market by Country, 2020 - 2023, USD Million

TABLE 42 Europe Lactic Acid Market by Country, 2024 - 2031, USD Million

TABLE 43 Europe Lactic Acid Market by Country, 2020 - 2023, Tonnes

TABLE 44 Europe Lactic Acid Market by Country, 2024 - 2031, Tonnes

TABLE 45 Europe Phosphoric Acid Market by Country, 2020 - 2023, USD Million

TABLE 46 Europe Phosphoric Acid Market by Country, 2024 - 2031, USD Million

TABLE 47 Europe Phosphoric Acid Market by Country, 2020 - 2023, Tonnes

TABLE 48 Europe Phosphoric Acid Market by Country, 2024 - 2031, Tonnes

TABLE 49 Europe Malic Acid Market by Country, 2020 - 2023, USD Million

TABLE 50 Europe Malic Acid Market by Country, 2024 - 2031, USD Million

TABLE 51 Europe Malic Acid Market by Country, 2020 - 2023, Tonnes

TABLE 52 Europe Malic Acid Market by Country, 2024 - 2031, Tonnes

TABLE 53 Europe Others Market by Country, 2020 - 2023, USD Million

TABLE 54 Europe Others Market by Country, 2024 - 2031, USD Million

TABLE 55 Europe Others Market by Country, 2020 - 2023, Tonnes

TABLE 56 Europe Others Market by Country, 2024 - 2031, Tonnes

TABLE 57 Europe Food Acidulants Market by Country, 2020 - 2023, USD Million

TABLE 58 Europe Food Acidulants Market by Country, 2024 - 2031, USD Million

TABLE 59 Europe Food Acidulants Market by Country, 2020 - 2023, Tonnes

TABLE 60 Europe Food Acidulants Market by Country, 2024 - 2031, Tonnes

TABLE 61 Germany Food Acidulants Market, 2020 - 2023, USD Million

TABLE 62 Germany Food Acidulants Market, 2024 - 2031, USD Million

TABLE 63 Germany Food Acidulants Market, 2020 - 2023, Tonnes

TABLE 64 Germany Food Acidulants Market, 2024 - 2031, Tonnes

TABLE 65 Germany Food Acidulants Market by Application, 2020 - 2023, USD Million

TABLE 66 Germany Food Acidulants Market by Application, 2024 - 2031, USD Million

TABLE 67 Germany Food Acidulants Market by Application, 2020 - 2023, Tonnes

TABLE 68 Germany Food Acidulants Market by Application, 2024 - 2031, Tonnes

TABLE 69 Germany Food Acidulants Market by Type, 2020 - 2023, USD Million

TABLE 70 Germany Food Acidulants Market by Type, 2024 - 2031, USD Million

TABLE 71 Germany Food Acidulants Market by Type, 2020 - 2023, Tonnes

TABLE 72 Germany Food Acidulants Market by Type, 2024 - 2031, Tonnes

TABLE 73 UK Food Acidulants Market, 2020 - 2023, USD Million

TABLE 74 UK Food Acidulants Market, 2024 - 2031, USD Million

TABLE 75 UK Food Acidulants Market, 2020 - 2023, Tonnes

TABLE 76 UK Food Acidulants Market, 2024 - 2031, Tonnes

TABLE 77 UK Food Acidulants Market by Application, 2020 - 2023, USD Million

TABLE 78 UK Food Acidulants Market by Application, 2024 - 2031, USD Million

TABLE 79 UK Food Acidulants Market by Application, 2020 - 2023, Tonnes

TABLE 80 UK Food Acidulants Market by Application, 2024 - 2031, Tonnes

TABLE 81 UK Food Acidulants Market by Type, 2020 - 2023, USD Million

TABLE 82 UK Food Acidulants Market by Type, 2024 - 2031, USD Million

TABLE 83 UK Food Acidulants Market by Type, 2020 - 2023, Tonnes

TABLE 84 UK Food Acidulants Market by Type, 2024 - 2031, Tonnes

TABLE 85 France Food Acidulants Market, 2020 - 2023, USD Million

TABLE 86 France Food Acidulants Market, 2024 - 2031, USD Million

TABLE 87 France Food Acidulants Market, 2020 - 2023, Tonnes

TABLE 88 France Food Acidulants Market, 2024 - 2031, Tonnes

TABLE 89 France Food Acidulants Market by Application, 2020 - 2023, USD Million

TABLE 90 France Food Acidulants Market by Application, 2024 - 2031, USD Million

TABLE 91 France Food Acidulants Market by Application, 2020 - 2023, Tonnes

TABLE 92 France Food Acidulants Market by Application, 2024 - 2031, Tonnes

TABLE 93 France Food Acidulants Market by Type, 2020 - 2023, USD Million

TABLE 94 France Food Acidulants Market by Type, 2024 - 2031, USD Million

TABLE 95 France Food Acidulants Market by Type, 2020 - 2023, Tonnes

TABLE 96 France Food Acidulants Market by Type, 2024 - 2031, Tonnes

TABLE 97 Russia Food Acidulants Market, 2020 - 2023, USD Million

TABLE 98 Russia Food Acidulants Market, 2024 - 2031, USD Million

TABLE 99 Russia Food Acidulants Market, 2020 - 2023, Tonnes

TABLE 100 Russia Food Acidulants Market, 2024 - 2031, Tonnes

TABLE 101 Russia Food Acidulants Market by Application, 2020 - 2023, USD Million

TABLE 102 Russia Food Acidulants Market by Application, 2024 - 2031, USD Million

TABLE 103 Russia Food Acidulants Market by Application, 2020 - 2023, Tonnes

TABLE 104 Russia Food Acidulants Market by Application, 2024 - 2031, Tonnes

TABLE 105 Russia Food Acidulants Market by Type, 2020 - 2023, USD Million

TABLE 106 Russia Food Acidulants Market by Type, 2024 - 2031, USD Million

TABLE 107 Russia Food Acidulants Market by Type, 2020 - 2023, Tonnes

TABLE 108 Russia Food Acidulants Market by Type, 2024 - 2031, Tonnes

TABLE 109 Spain Food Acidulants Market, 2020 - 2023, USD Million

TABLE 110 Spain Food Acidulants Market, 2024 - 2031, USD Million

TABLE 111 Spain Food Acidulants Market, 2020 - 2023, Tonnes

TABLE 112 Spain Food Acidulants Market, 2024 - 2031, Tonnes

TABLE 113 Spain Food Acidulants Market by Application, 2020 - 2023, USD Million

TABLE 114 Spain Food Acidulants Market by Application, 2024 - 2031, USD Million

TABLE 115 Spain Food Acidulants Market by Application, 2020 - 2023, Tonnes

TABLE 116 Spain Food Acidulants Market by Application, 2024 - 2031, Tonnes

TABLE 117 Spain Food Acidulants Market by Type, 2020 - 2023, USD Million

TABLE 118 Spain Food Acidulants Market by Type, 2024 - 2031, USD Million

TABLE 119 Spain Food Acidulants Market by Type, 2020 - 2023, Tonnes

TABLE 120 Spain Food Acidulants Market by Type, 2024 - 2031, Tonnes

TABLE 121 Italy Food Acidulants Market, 2020 - 2023, USD Million

TABLE 122 Italy Food Acidulants Market, 2024 - 2031, USD Million

TABLE 123 Italy Food Acidulants Market, 2020 - 2023, Tonnes

TABLE 124 Italy Food Acidulants Market, 2024 - 2031, Tonnes

TABLE 125 Italy Food Acidulants Market by Application, 2020 - 2023, USD Million

TABLE 126 Italy Food Acidulants Market by Application, 2024 - 2031, USD Million

TABLE 127 Italy Food Acidulants Market by Application, 2020 - 2023, Tonnes

TABLE 128 Italy Food Acidulants Market by Application, 2024 - 2031, Tonnes

TABLE 129 Italy Food Acidulants Market by Type, 2020 - 2023, USD Million

TABLE 130 Italy Food Acidulants Market by Type, 2024 - 2031, USD Million

TABLE 131 Italy Food Acidulants Market by Type, 2020 - 2023, Tonnes

TABLE 132 Italy Food Acidulants Market by Type, 2024 - 2031, Tonnes

TABLE 133 Rest of Europe Food Acidulants Market, 2020 - 2023, USD Million

TABLE 134 Rest of Europe Food Acidulants Market, 2024 - 2031, USD Million

TABLE 135 Rest of Europe Food Acidulants Market, 2020 - 2023, Tonnes

TABLE 136 Rest of Europe Food Acidulants Market, 2024 - 2031, Tonnes

TABLE 137 Rest of Europe Food Acidulants Market by Application, 2020 - 2023, USD Million

TABLE 138 Rest of Europe Food Acidulants Market by Application, 2024 - 2031, USD Million

TABLE 139 Rest of Europe Food Acidulants Market by Application, 2020 - 2023, Tonnes

TABLE 140 Rest of Europe Food Acidulants Market by Application, 2024 - 2031, Tonnes

TABLE 141 Rest of Europe Food Acidulants Market by Type, 2020 - 2023, USD Million

TABLE 142 Rest of Europe Food Acidulants Market by Type, 2024 - 2031, USD Million

TABLE 143 Rest of Europe Food Acidulants Market by Type, 2020 - 2023, Tonnes

TABLE 144 Rest of Europe Food Acidulants Market by Type, 2024 - 2031, Tonnes

TABLE 145 Key Information – Tate & Lyle PLC

TABLE 146 Key Information – Brenntag SE

TABLE 147 Key Information – Univar Solutions, Inc.

TABLE 148 Key Information – Archer Daniels Midland Company

TABLE 149 Key Information – jungbunzlauer suisse ag

TABLE 150 Key Information – Cargill, Incorporated

TABLE 151 Key Information – Corbion N.V.

TABLE 152 Key Information – Bartek Ingredients Inc.

TABLE 153 Key Information – FBC Industries Inc.

TABLE 154 Key Information – Hawkins Watts New Zealand

List of Figures

FIG 1 Methodology for the research

FIG 2 Europe Food Acidulants Market, 2020 - 2031, USD Million

FIG 3 Key Factors Impacting Food Acidulants Market

FIG 4 Porter’s Five Forces Analysis – Food Acidulants Market

FIG 5 Europe Food Acidulants Market share by Application, 2023

FIG 6 Europe Food Acidulants Market share by Application, 2031

FIG 7 Europe Food Acidulants Market by Application, 2020 - 2031, USD Million

FIG 8 Europe Food Acidulants Market share by Type, 2023

FIG 9 Europe Food Acidulants Market share by Type, 2031

FIG 10 Europe Food Acidulants Market by Type, 2020 - 2031, USD Million

FIG 11 Europe Food Acidulants Market share by Country, 2023

FIG 12 Europe Food Acidulants Market share by Country, 2031

FIG 13 Europe Food Acidulants Market by Country, 2020 - 2031, USD Million

FIG 14 Swot Analysis: Tate & Lyle PLC

FIG 15 Swot Analysis: Brenntag SE

FIG 16 Swot Analysis: Univar Solutions, Inc.

FIG 17 SWOT Analysis: Archer Daniels Midland Company

FIG 18 Swot Analysis: Jungbunzlauer Suisse AG

FIG 19 SWOT Analysis: Cargill, Incorporated

FIG 20 SWOT Analysis: Corbion N.V.