The Europe Oat Milk Market would witness market growth of 13.0% CAGR during the forecast period (2024-2031). In the year 2021, the Europe market's volume surged to 187.29 kilo tonnes, showcasing a growth of 10.8% (2020-2024).

Organic oat milk is produced using oats grown without synthetic pesticides, herbicides, or fertilizers. This type of oat milk appeals to health-conscious and environmentally aware consumers who prioritize organic and sustainably sourced products. Organic certification ensures the product meets strict environmental and quality standards. Although organic oat milk tends to be more expensive than its conventional counterpart, demand is increasing due to the growing preference for clean-label products free from harmful chemicals. Hence, in UK, it is expected that 17.41 kilo tonnes of organic oat milk is expected to be utilized by the year 2031.

The Germany market dominated the Europe Oat Milk Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $572.1 million by 2031. The UK market is exhibiting a CAGR of 12.1% during (2024 - 2031). Additionally, The France market would witness a CAGR of 14.1% during (2024 - 2031).

Oat milk can be blended into smoothies and protein shakes, adding a creamy base while enhancing the nutritional profile with fiber and vitamins. Its mild flavour allows it to pair well with various fruits, vegetables, and protein powders, making it an excellent choice for health-conscious consumers. Oat milk can replace traditional dairy in various recipes, from béchamel sauce to curry bases, adding creaminess without the lactose. It serves as an excellent base for vegan cheeses and creamy dressings, providing a dairy-like texture that can satisfy those transitioning to plant-based diets.

Increased focus on health and wellness through social media and influencers has led to greater consumer awareness of the benefits of oat milk, including its lower environmental impact compared to dairy milk. Consumers are increasingly seeking transparency in food products. Brands that label their oat milk as organic, non-GMO, or fortified with vitamins have gained traction among health-conscious shoppers. The growing prevalence of lactose intolerance in various populations has fuelled demand for lactose-free alternatives like oat milk, leading to wider acceptance among those with dietary restrictions. Oat milk caters to lactose-intolerant individuals and those with dairy allergies, expanding its market reach among diverse consumer groups.

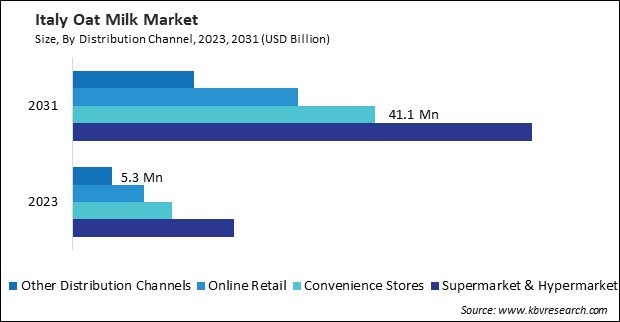

The rising food retail industry in Italy is significantly impacting the growth of the oat milk market, driven by increased sales across various retail formats and evolving consumer preferences. According to the International Trade Administration (ITA), Italy’s retail food sales reached $170.4 billion in 2022, reflecting a 2.1% increase over 2021. This robust growth across various channels presents a valuable opportunity for oat milk producers to tap into a larger consumer base. Furthermore, the notable increases in sales at discount stores (4.1%), supermarkets (2.8%), hypermarkets (2.7%), and small local grocers (1%) demonstrate a shifting landscape in the Italian retail sector. As consumers increasingly seek healthier, plant-based alternatives to traditional dairy products, oat milk is becoming more popular. Moreover, the rise in consumer food service value sales by 19% over 2021 indicates a flourishing food service industry increasingly catering to health-conscious consumers. Thus, the rising food retail industry in the region is driving the market's growth.

Free Valuable Insights: The Global Oat Milk Market will Hit USD 6.8 Billion by 2031, at a CAGR of 13.7%

Based on Source, the market is segmented into Conventional and Organic. Based on Product, the market is segmented into Plain and Flavored. Based on Distribution Channel, the market is segmented into Supermarket & Hypermarket, Convenience Stores, Online Retail, and Other Distribution Channels. Based on Packaging, the market is segmented into Cartons, Bottle, and Other Packaging. Based on countries, the market is segmented into Germany, UK, France, Russia, Spain, Italy, and Rest of Europe.

By Source (Volume, Kilo Tonnes, USD Billion, 2020-2031)

By Product (Volume, Kilo Tonnes, USD Billion, 2020-2031)

By Distribution Channel (Volume, Kilo Tonnes, USD Billion, 2020-2031)

By Packaging (Volume, Kilo Tonnes, USD Billion, 2020-2031)

By Country (Volume, Kilo Tonnes, USD Billion, 2020-2031)

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.