Europe Virtual Sensors Market Size, Share & Trends Analysis Report By Component (Solutions, and Services), By Deployment (On-Premise, and Cloud), By End Use, By Country and Growth Forecast, 2024 - 2031

Published Date : 26-Dec-2024 |

Pages: 129 |

Formats: PDF |

COVID-19 Impact on the Europe Virtual Sensors Market

The Europe Virtual Sensors Market would witness market growth of 28.8% CAGR during the forecast period (2024-2031).

The Germany market dominated the Europe Virtual Sensors Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $384.1 million by 2031. The UK market is registering a CAGR of 27.7% during (2024 - 2031). Additionally, The France market would witness a CAGR of 29.7% during (2024 - 2031).

Virtual sensors are crucial in enhancing vehicle performance and safety in the automotive industry. They are used to estimate tire pressure, engine temperature, and vehicle speed based on data from other vehicle systems. Virtual sensors are also being leveraged in developing autonomous driving technologies, which predict vehicle behaviour, track road conditions, and assist in collision avoidance by integrating data from cameras, LiDAR, radar, and other sensors. Additionally, in the context of electric vehicles (EVs), virtual sensors can estimate battery health, state of charge, and energy consumption, helping optimize charging cycles and improving the overall life cycle of EV batteries.

Furthermore, in healthcare, virtual sensors are revolutionizing patient monitoring and diagnostics. For instance, virtual sensors can estimate a patient’s vital signs, such as heart rate and blood pressure, based on data from wearable devices and other sensors. In clinical settings, they provide real-time patient monitoring, helping healthcare professionals make informed decisions without needing extensive physical sensor infrastructure.

The rise of advanced manufacturing in Europe also aligns with the region’s broader industrial strategy, emphasizing sustainability, innovation, and digital transformation. Virtual sensors are increasingly seen as a vital component in achieving these goals, as they contribute to reducing costs, energy consumption, and carbon emissions in manufacturing processes. By integrating virtual sensors, European manufacturers can optimize their operations, enhance production efficiency, and improve their environmental footprint. The combination of advanced manufacturing growth and the need for smarter, more sustainable technologies will create a strong demand for virtual sensors across various European industries, driving market expansion and technological innovation. In conclusion, the rapid growth of advanced manufacturing firms in the EU, especially in key manufacturing hubs, will significantly boost the demand for virtual sensors.

Free Valuable Insights: The Global Virtual Sensors Market will Hit USD 5.75 Billion by 2031, at a CAGR of 29.2%

Based on Component, the market is segmented into Solutions, and Services. Based on Deployment, the market is segmented into On-Premise, and Cloud. Based on End Use, the market is segmented into Manufacturing & Utilities, Automotive & Transportation, Aerospace & Defense, Oil & Gas, Healthcare, Electronics, and Other End Use. Based on countries, the market is segmented into Germany, UK, France, Russia, Spain, Italy, and Rest of Europe.

List of Key Companies Profiled

- Siemens AG

- General Electric Company

- Schneider Electric SE

- Rockwell Automation Inc.

- Honeywell International Inc.

- ABB Group

- Emerson Electric Co.

- Cisco Systems, Inc.

- Infineon Technologies AG

- MediaTek, Inc.

Europe Virtual Sensors Market Report Segmentation

By Component

- Solutions

- Services

By Deployment

- On-Premise

- Cloud

By End Use

- Manufacturing & Utilities

- Automotive & Transportation

- Aerospace & Defense

- Oil & Gas

- Healthcare

- Electronics

- Other End Use

By Country

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Europe Virtual Sensors Market, by Component

1.4.2 Europe Virtual Sensors Market, by Deployment

1.4.3 Europe Virtual Sensors Market, by End Use

1.4.4 Europe Virtual Sensors Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

Chapter 4. Competition Analysis – Global

4.1 Market Share Analysis, 2023

4.2 Porter Five Forces Analysis

Chapter 5. Europe Virtual Sensors Market by Component

5.1 Europe Solutions Market by Country

5.2 Europe Services Market by Country

Chapter 6. Europe Virtual Sensors Market by Deployment

6.1 Europe On-Premise Market by Country

6.2 Europe Cloud Market by Country

Chapter 7. Europe Virtual Sensors Market by End Use

7.1 Europe Manufacturing & Utilities Market by Country

7.2 Europe Automotive & Transportation Market by Country

7.3 Europe Aerospace & Defense Market by Country

7.4 Europe Oil & Gas Market by Country

7.5 Europe Healthcare Market by Country

7.6 Europe Electronics Market by Country

7.7 Europe Other End Use Market by Country

Chapter 8. Europe Virtual Sensors Market by Country

8.1 Germany Virtual Sensors Market

8.1.1 Germany Virtual Sensors Market by Component

8.1.2 Germany Virtual Sensors Market by Deployment

8.1.3 Germany Virtual Sensors Market by End Use

8.2 UK Virtual Sensors Market

8.2.1 UK Virtual Sensors Market by Component

8.2.2 UK Virtual Sensors Market by Deployment

8.2.3 UK Virtual Sensors Market by End Use

8.3 France Virtual Sensors Market

8.3.1 France Virtual Sensors Market by Component

8.3.2 France Virtual Sensors Market by Deployment

8.3.3 France Virtual Sensors Market by End Use

8.4 Russia Virtual Sensors Market

8.4.1 Russia Virtual Sensors Market by Component

8.4.2 Russia Virtual Sensors Market by Deployment

8.4.3 Russia Virtual Sensors Market by End Use

8.5 Spain Virtual Sensors Market

8.5.1 Spain Virtual Sensors Market by Component

8.5.2 Spain Virtual Sensors Market by Deployment

8.5.3 Spain Virtual Sensors Market by End Use

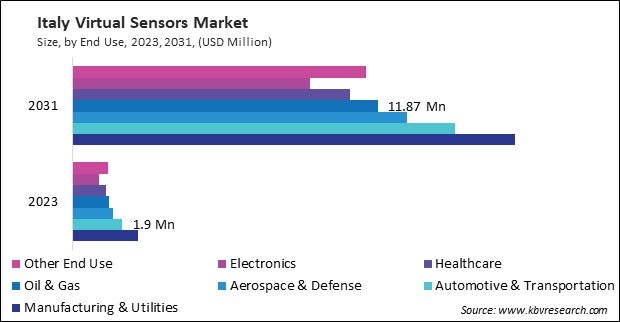

8.6 Italy Virtual Sensors Market

8.6.1 Italy Virtual Sensors Market by Component

8.6.2 Italy Virtual Sensors Market by Deployment

8.6.3 Italy Virtual Sensors Market by End Use

8.7 Rest of Europe Virtual Sensors Market

8.7.1 Rest of Europe Virtual Sensors Market by Component

8.7.2 Rest of Europe Virtual Sensors Market by Deployment

8.7.3 Rest of Europe Virtual Sensors Market by End Use

Chapter 9. Company Profiles

9.1 Siemens AG

9.1.1 Company Overview

9.1.2 Financial Analysis

9.1.3 Segmental and Regional Analysis

9.1.4 Research & Development Expense

9.1.5 SWOT Analysis

9.2 General Electric Company

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Segmental and Regional Analysis

9.2.4 Research & Development Expense

9.2.5 SWOT Analysis

9.3 Schneider Electric SE

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Segmental and Regional Analysis

9.3.4 Research & Development Expense

9.3.5 SWOT Analysis

9.4 Rockwell Automation, Inc.

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Segmental and Regional Analysis

9.4.4 Research & Development Expenses

9.4.5 SWOT Analysis

9.5 Honeywell International Inc.

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Segmental and Regional Analysis

9.5.4 Research & Development Expenses

9.5.5 Recent strategies and developments:

9.5.5.1 Product Launches and Product Expansions:

9.5.6 SWOT Analysis

9.6 ABB Group

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Segmental and Regional Analysis

9.6.4 Research & Development Expense

9.6.5 SWOT Analysis

9.7 Emerson Electric Co.

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Segmental and Regional Analysis

9.7.4 Research & Development Expense

9.7.5 SWOT Analysis

9.8 Cisco Systems, Inc.

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Regional Analysis

9.8.4 Research & Development Expense

9.8.5 SWOT Analysis

9.9 Infineon Technologies AG

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Segmental and Regional Analysis

9.9.4 Research & Development Expense

9.9.5 Recent strategies and developments:

9.9.5.1 Partnerships, Collaborations, and Agreements:

9.9.5.2 Product Launches and Product Expansions:

9.9.6 SWOT Analysis

9.10. MediaTek, Inc.

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Regional Analysis

9.10.4 Research & Development Expenses

9.10.5 SWOT Analysis

TABLE 2 Europe Virtual Sensors Market, 2024 - 2031, USD Million

TABLE 3 Europe Virtual Sensors Market by Component, 2020 - 2023, USD Million

TABLE 4 Europe Virtual Sensors Market by Component, 2024 - 2031, USD Million

TABLE 5 Europe Solutions Market by Country, 2020 - 2023, USD Million

TABLE 6 Europe Solutions Market by Country, 2024 - 2031, USD Million

TABLE 7 Europe Services Market by Country, 2020 - 2023, USD Million

TABLE 8 Europe Services Market by Country, 2024 - 2031, USD Million

TABLE 9 Europe Virtual Sensors Market by Deployment, 2020 - 2023, USD Million

TABLE 10 Europe Virtual Sensors Market by Deployment, 2024 - 2031, USD Million

TABLE 11 Europe On-Premise Market by Country, 2020 - 2023, USD Million

TABLE 12 Europe On-Premise Market by Country, 2024 - 2031, USD Million

TABLE 13 Europe Cloud Market by Country, 2020 - 2023, USD Million

TABLE 14 Europe Cloud Market by Country, 2024 - 2031, USD Million

TABLE 15 Europe Virtual Sensors Market by End Use, 2020 - 2023, USD Million

TABLE 16 Europe Virtual Sensors Market by End Use, 2024 - 2031, USD Million

TABLE 17 Europe Manufacturing & Utilities Market by Country, 2020 - 2023, USD Million

TABLE 18 Europe Manufacturing & Utilities Market by Country, 2024 - 2031, USD Million

TABLE 19 Europe Automotive & Transportation Market by Country, 2020 - 2023, USD Million

TABLE 20 Europe Automotive & Transportation Market by Country, 2024 - 2031, USD Million

TABLE 21 Europe Aerospace & Defense Market by Country, 2020 - 2023, USD Million

TABLE 22 Europe Aerospace & Defense Market by Country, 2024 - 2031, USD Million

TABLE 23 Europe Oil & Gas Market by Country, 2020 - 2023, USD Million

TABLE 24 Europe Oil & Gas Market by Country, 2024 - 2031, USD Million

TABLE 25 Europe Healthcare Market by Country, 2020 - 2023, USD Million

TABLE 26 Europe Healthcare Market by Country, 2024 - 2031, USD Million

TABLE 27 Europe Electronics Market by Country, 2020 - 2023, USD Million

TABLE 28 Europe Electronics Market by Country, 2024 - 2031, USD Million

TABLE 29 Europe Other End Use Market by Country, 2020 - 2023, USD Million

TABLE 30 Europe Other End Use Market by Country, 2024 - 2031, USD Million

TABLE 31 Europe Virtual Sensors Market by Country, 2020 - 2023, USD Million

TABLE 32 Europe Virtual Sensors Market by Country, 2024 - 2031, USD Million

TABLE 33 Germany Virtual Sensors Market, 2020 - 2023, USD Million

TABLE 34 Germany Virtual Sensors Market, 2024 - 2031, USD Million

TABLE 35 Germany Virtual Sensors Market by Component, 2020 - 2023, USD Million

TABLE 36 Germany Virtual Sensors Market by Component, 2024 - 2031, USD Million

TABLE 37 Germany Virtual Sensors Market by Deployment, 2020 - 2023, USD Million

TABLE 38 Germany Virtual Sensors Market by Deployment, 2024 - 2031, USD Million

TABLE 39 Germany Virtual Sensors Market by End Use, 2020 - 2023, USD Million

TABLE 40 Germany Virtual Sensors Market by End Use, 2024 - 2031, USD Million

TABLE 41 UK Virtual Sensors Market, 2020 - 2023, USD Million

TABLE 42 UK Virtual Sensors Market, 2024 - 2031, USD Million

TABLE 43 UK Virtual Sensors Market by Component, 2020 - 2023, USD Million

TABLE 44 UK Virtual Sensors Market by Component, 2024 - 2031, USD Million

TABLE 45 UK Virtual Sensors Market by Deployment, 2020 - 2023, USD Million

TABLE 46 UK Virtual Sensors Market by Deployment, 2024 - 2031, USD Million

TABLE 47 UK Virtual Sensors Market by End Use, 2020 - 2023, USD Million

TABLE 48 UK Virtual Sensors Market by End Use, 2024 - 2031, USD Million

TABLE 49 France Virtual Sensors Market, 2020 - 2023, USD Million

TABLE 50 France Virtual Sensors Market, 2024 - 2031, USD Million

TABLE 51 France Virtual Sensors Market by Component, 2020 - 2023, USD Million

TABLE 52 France Virtual Sensors Market by Component, 2024 - 2031, USD Million

TABLE 53 France Virtual Sensors Market by Deployment, 2020 - 2023, USD Million

TABLE 54 France Virtual Sensors Market by Deployment, 2024 - 2031, USD Million

TABLE 55 France Virtual Sensors Market by End Use, 2020 - 2023, USD Million

TABLE 56 France Virtual Sensors Market by End Use, 2024 - 2031, USD Million

TABLE 57 Russia Virtual Sensors Market, 2020 - 2023, USD Million

TABLE 58 Russia Virtual Sensors Market, 2024 - 2031, USD Million

TABLE 59 Russia Virtual Sensors Market by Component, 2020 - 2023, USD Million

TABLE 60 Russia Virtual Sensors Market by Component, 2024 - 2031, USD Million

TABLE 61 Russia Virtual Sensors Market by Deployment, 2020 - 2023, USD Million

TABLE 62 Russia Virtual Sensors Market by Deployment, 2024 - 2031, USD Million

TABLE 63 Russia Virtual Sensors Market by End Use, 2020 - 2023, USD Million

TABLE 64 Russia Virtual Sensors Market by End Use, 2024 - 2031, USD Million

TABLE 65 Spain Virtual Sensors Market, 2020 - 2023, USD Million

TABLE 66 Spain Virtual Sensors Market, 2024 - 2031, USD Million

TABLE 67 Spain Virtual Sensors Market by Component, 2020 - 2023, USD Million

TABLE 68 Spain Virtual Sensors Market by Component, 2024 - 2031, USD Million

TABLE 69 Spain Virtual Sensors Market by Deployment, 2020 - 2023, USD Million

TABLE 70 Spain Virtual Sensors Market by Deployment, 2024 - 2031, USD Million

TABLE 71 Spain Virtual Sensors Market by End Use, 2020 - 2023, USD Million

TABLE 72 Spain Virtual Sensors Market by End Use, 2024 - 2031, USD Million

TABLE 73 Italy Virtual Sensors Market, 2020 - 2023, USD Million

TABLE 74 Italy Virtual Sensors Market, 2024 - 2031, USD Million

TABLE 75 Italy Virtual Sensors Market by Component, 2020 - 2023, USD Million

TABLE 76 Italy Virtual Sensors Market by Component, 2024 - 2031, USD Million

TABLE 77 Italy Virtual Sensors Market by Deployment, 2020 - 2023, USD Million

TABLE 78 Italy Virtual Sensors Market by Deployment, 2024 - 2031, USD Million

TABLE 79 Italy Virtual Sensors Market by End Use, 2020 - 2023, USD Million

TABLE 80 Italy Virtual Sensors Market by End Use, 2024 - 2031, USD Million

TABLE 81 Rest of Europe Virtual Sensors Market, 2020 - 2023, USD Million

TABLE 82 Rest of Europe Virtual Sensors Market, 2024 - 2031, USD Million

TABLE 83 Rest of Europe Virtual Sensors Market by Component, 2020 - 2023, USD Million

TABLE 84 Rest of Europe Virtual Sensors Market by Component, 2024 - 2031, USD Million

TABLE 85 Rest of Europe Virtual Sensors Market by Deployment, 2020 - 2023, USD Million

TABLE 86 Rest of Europe Virtual Sensors Market by Deployment, 2024 - 2031, USD Million

TABLE 87 Rest of Europe Virtual Sensors Market by End Use, 2020 - 2023, USD Million

TABLE 88 Rest of Europe Virtual Sensors Market by End Use, 2024 - 2031, USD Million

TABLE 89 Key Information – Siemens AG

TABLE 90 Key Information – General Electric Company

TABLE 91 Key Information – Schneider Electric SE

TABLE 92 Key Information – Rockwell Automation, Inc.

TABLE 93 Key Information – Honeywell International, Inc.

TABLE 94 Key Information – ABB Group

TABLE 95 Key Information – Emerson Electric Co.

TABLE 96 Key Information – Cisco Systems, Inc.

TABLE 97 Key Information – Infineon Technologies AG

TABLE 98 Key Information – MediaTek, Inc.

List of Figures

FIG 1 Methodology for the research

FIG 2 Europe Virtual Sensors Market, 2020 - 2031, USD Million

FIG 3 Key Factors Impacting Virtual Sensors Market

FIG 4 Market Share Analysis, 2023

FIG 5 Porter’s Five Forces Analysis – Virtual Sensors Market

FIG 6 Europe Virtual Sensors Market share by Component, 2023

FIG 7 Europe Virtual Sensors Market share by Component, 2031

FIG 8 Europe Virtual Sensors Market by Component, 2020 - 2031, USD Million

FIG 9 Europe Virtual Sensors Market share by Deployment, 2023

FIG 10 Europe Virtual Sensors Market share by Deployment, 2031

FIG 11 Europe Virtual Sensors Market by Deployment, 2020 - 2031, USD Million

FIG 12 Europe Virtual Sensors Market share by End Use, 2023

FIG 13 Europe Virtual Sensors Market share by End Use, 2031

FIG 14 Europe Virtual Sensors Market by End Use, 2020 - 2031, USD Million

FIG 15 Europe Virtual Sensors Market share by Country, 2023

FIG 16 Europe Virtual Sensors Market share by Country, 2031

FIG 17 Europe Virtual Sensors Market by Country, 2020 - 2031, USD Million

FIG 18 SWOT Analysis: Siemens AG

FIG 19 SWOT Analysis: General electric Company

FIG 20 SWOT Analysis: Schneider Electric SE

FIG 21 SWOT Analysis: Rockwell Automation, Inc.

FIG 22 SWOT Analysis: Honeywell international, inc.

FIG 23 SWOT Analysis: ABB GROUP

FIG 24 Swot Analysis: EMERSON ELECTRIC CO.

FIG 25 SWOT Analysis: Cisco Systems, Inc.

FIG 26 Recent strategies and developments: Infineon Technologies AG

FIG 27 SWOT Analysis: Infineon Technologies AG

FIG 28 SWOT Analysis: MediaTek, Inc.