The Europe Wealth Management Software Market would witness market growth of 13.2% CAGR during the forecast period (2025-2032).

The Germany market dominated the Europe Wealth Management Software Market by Country in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $714.8 million by 2032. The UK market is exhibiting a CAGR of 12.1% during (2025 - 2032). Additionally, The France market would experience a CAGR of 14.1% during (2025 - 2032).

Stricter regulations and emphasis on financial transparency are key factors propelling the demand for wealth management platforms. These platforms assist financial advisors in adhering to regulations such as MiFID II, GDPR, and Dodd-Frank, while ensuring data security and client privacy. Automated compliance features enable better reporting, risk management, and auditing processes, reducing operational risks for wealth management firms and fostering greater trust and accountability between advisors and clients.

The European market is undergoing significant transformation, driven by technological advancements, regulatory changes, and evolving client expectations. A key driver of this growth is the increasing demand for digital solutions among high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs). Europe accounts for about 30% of the world's millionaire population, and the rising number of millionaires enhances the wealth management market.

Technological advancements, particularly in artificial intelligence (AI), are reshaping the wealth management landscape. A survey by Celent revealed that 70% of wealth management firms in Europe prioritize streamlining and automating advisor workflows, with 60% actively exploring or implementing generative AI solutions . These technologies enhance client service by providing deeper insights and more personalized advice. Cloud-based deployments are becoming increasingly prevalent, offering scalability and flexibility to wealth management firms. Approximately 48% of firms in the U.S. are now integrating technologies like blockchain, machine learning, and digital process automation to enhance service delivery and client engagement. Regulatory changes are also influencing the adoption of wealth management software. Stricter compliance requirements, such as MiFID II and GDPR, are prompting firms to invest in solutions that ensure transparency and risk mitigation. This regulatory environment, coupled with technological innovation, is solidifying Europe's position in the global market. In summary, Europe's market is poised for continued expansion, driven by demographic shifts, technological advancements, and a dynamic regulatory landscape. Firms that leverage these trends to offer innovative, client-centric solutions will be well-positioned to thrive in this evolving market.

Free Valuable Insights: The Global Wealth Management Software Market will Hit USD 14.52 Billion by 2032, at a CAGR of 13.6%

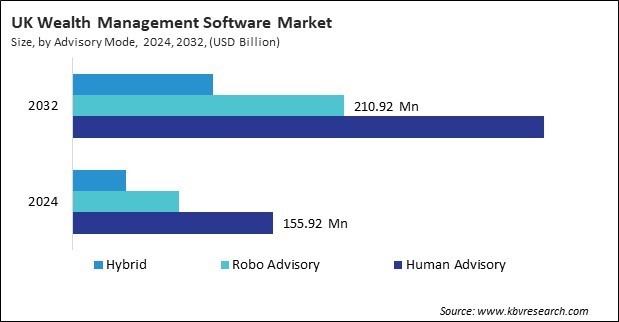

Based on Enterprise Size, the market is segmented into Large Enterprises, and Small and Medium Enterprises (SMEs). Based on Advisory Mode, the market is segmented into Human Advisory, Robo Advisory, and Hybrid. Based on Deployment, the market is segmented into Cloud, and On-premise. Based on End-use, the market is segmented into Banks, Investment Management Firms, Trading & Exchange Firms, Brokerage Firms, and Other End-use. Based on Application, the market is segmented into Portfolio, Accounting, & Trading Management, Financial Advice & Management, Performance Management, Risk & Compliance Management, Reporting, and Other Application. Based on countries, the market is segmented into Germany, UK, France, Russia, Spain, Italy, and Rest of Europe.

By Enterprise Size

By Advisory Mode

By Deployment

By End-use

By Application

By Country

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.