The Global Extremity Reconstruction Market size is expected to reach $5.5 billion by 2028, rising at a market growth of 6.5% CAGR during the forecast period.

Extremity reconstruction devices are utilized to cure, rebuild, substitute, or heal fractures or damage to the extremities. Implant devices for the elbow, shoulder, wrist, fingers, foot, and ankle joints are included in the extremities reconstruction market size. Outside articulated organs that perform various loco-motor functions are known as extremities. The human body is made up of four extremities: two lower limbs and two upper limbs. This surgery is used to correct flaws or deformities caused by trauma, cancer, and other medical problems. The procedures are important in improving the movement and appearance of damaged organs. Lower and Upper extremity operations are the two types of extremity surgery. Implants for the elbow, shoulder, ankle, wrist, and digits of the hands and feet are included in extremity reconstruction devices. It is because of the rising number of patients with malignancies, chronic diseases, and accidents that result in the amputation of limbs. This is becoming increasingly necessary for advancement in this sector to get more funding from the healthcare business. Plastic surgeons also utilize flaps or skin grafts to conceal wounds on the extremities, allowing patients to return to a more normal lifestyle more quickly.

The market for extremities reconstruction devices is primarily driven by a rise in the number of joint disorders like rheumatoid arthritis and osteoarthritis, as well as a quick rise in lifestyle-related disorders such as diabetes and obesity, which lead to joint disorders. In addition, a rising focus on aesthetic views is expected to improve the market for extremities reconstruction technologies. Moreover, rising patient awareness of the advantages of small joint reconstruction implants, as well as improved technology like the advancement of reverse shoulder implants that require fewer ankle reconstruction implants and shoulder implants that help patients regain ankle mobility, are expected to boost the extremity reconstruction market.

Although it has been a substantial decline in non-cancer associated major reconstructive surgeries, a large amount of work for other types of surgeries continues to increase throughout lockdown. As well as in this period, increasing number of fatal accidents and injuries have been recorded, also many region governments in meantime is investing heavily to provide smooth healthcare facilities to the patients. As a result, the breakout of COVID-19 has a beneficial impact on the market for extremities reconstruction. The healthcare infrastructure has been working actively enough since the beginning of the COVID-19 pandemic and has been engaged all throughout this period.

With an increase in instances noticed on a complete level, aesthetic medicine, cosmetic surgery, and minimally invasive procedures are reaching new heights. The leading countries for cosmetic surgery include many developed nations, which account for a significant portion of the comprehensive market for extremities tissue expanders. Such developed nation has appropriate healthcare infrastructure to assist the plastic surgery procedure. Also, people of these developed nations are financially sound enough to afford the costly cosmetic surgery.

Mass casualty occurrences (MCIs), whether planned or unintentional, continue to be a serious problem for multidisciplinary trauma teams and emergency medical resources. Geographic disasters, such as earthquakes and landslides, regularly emphasize multi-national relief operations in resource-constrained situations. In an age of international and domestic terrorism, planned acts of mass violence involving explosives and firearms have shattered social closeness and put regional care centers to the test. The crush injuries to the lower and upper limbs, whose etiologies are based on the variety of disaster types, are of special concern in MCIs.

Smoking has the potential to impair both circulation and healing. To decrease infection, nonunion, and wound healing issues, patients must abstain from smoking for at least few weeks before and after an electively planned operation. Patients who were existing smokers had a higher rate of infection, nonunion, and osteomyelitis in a prospective, multi-center investigation of limb trauma. It is because smoking cessation is often impossible following trauma, surgeons should continue with soft-tissue covering while encouraging postoperative cessation. The smokers and nonsmokers have similar rates of flap thrombosis after micro-surgical head and neck and breast reconstructions, however, the rate may be higher in individuals having lower extremity free flap reconstruction.

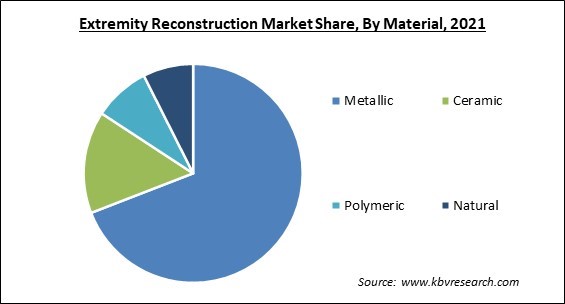

Based on Material, the market is segmented into Metallic, Ceramic, Polymeric, and Natural. The ceramic material segment procured a substantial revenue share in the extremity reconstruction market in 2021. The ceramics had no negative biological effects. Tissue ingrowth into ceramic pores was observed in all three types and both pore diameters, however, the density of penetrating tissue was much lower in calcium aluminate than in tricalcium phosphate or calcium hydroxyapatite. The soft tissue ingrowth was denser with bigger pore sizes and longer implantation times for each kind of ceramic. In most cases, bone ingrowth was not visible inside the pores of any ceramic. The histology findings in the rats and rabbits were identical.

Based on Product, the market is segmented into Upper Extremity and Lower Extremity. The upper extremity segment procured the highest revenue share in the extremity reconstruction market in 2021. Elbow reconstruction, Shoulder reconstruction, and wrist and hand reconstruction are the three types of upper extremity reconstruction devices. Ankle fusion, ankle reconstruction, and foot fusion are the three types of lower extremity reconstruction. It is because of the increasing number of patients choosing technological advances in shoulder implants, shoulder reconstruction surgery, and positive clinical outcomes of shoulder reconstruction surgeries. Stemless shoulder replacement is linked to less discomfort and blood loss, as well as a quicker recovery time.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 3.6 Billion |

| Market size forecast in 2028 | USD 5.5 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 6.5% from 2022 to 2028 |

| Number of Pages | 163 |

| Number of Tables | 264 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Product, Material, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. North America emerged as the leading region in the extremity reconstruction market in 2021. This is due to an increase in the prevalence of joint problems, as well as a rise in the older population. As an outcome, the region is on track to become one of the world’s oldest in the coming decades, due to abundant growth potential in terms of non-treated medical requirements for the treatment of minor joint problems, expanding awareness, and growing acceptance of new technologies.

Free Valuable Insights: Global Extremity Reconstruction Market size to reach USD 5.5 Billion by 2028

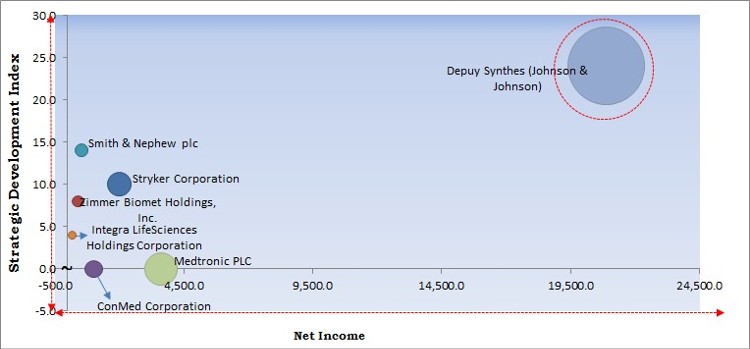

The major strategies followed by the market participants are Acquisitions. Based on the Analysis presented in the Cardinal matrix; Johnson & Johnson is the forerunner in the Extremity Reconstruction Market. Companies such as Smith & Nephew plc, Stryker Corporation and Zimmer Biomet Holdings, Inc. are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Smith & Nephew PLC, Stryker Corporation, Zimmer Biomet Holdings, Inc., Johnson & Johnson (DePuy Synthes), Integra LifeSciences Holdings Corporation, Medtronic PLC, ConMed Corporation, Acumed LLC, Skeletal Dynamics, LLC, Arthrex, Inc., and IDS GeoRadar s.r.l.(Hexagon AB).

By Material

By Product

By Geography

The extremity reconstruction market size is projected to reach USD 5.5 billion by 2028.

Increasing prevalence of natural attacks and calamities are driving the market in coming years, however, risk factors for serious side effects growth of the market.

Smith & Nephew PLC, Stryker Corporation, Zimmer Biomet Holdings, Inc., Johnson & Johnson (DePuy Synthes), Integra LifeSciences Holdings Corporation, Medtronic PLC, ConMed Corporation, Acumed LLC, Skeletal Dynamics, LLC, Arthrex, Inc., and IDS GeoRadar s.r.l.(Hexagon AB).

The expected CAGR of the extremity reconstruction market is 6.5% from 2022 to 2028.

The Metallic segment acquired maximum revenue share in the Global Extremity Reconstruction Market by Material in 2021; thereby, achieving a market value of $3.7 billion by 2028.

The North America is the fastest growing region in the Global Extremity Reconstruction Market by Region in 2021.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.