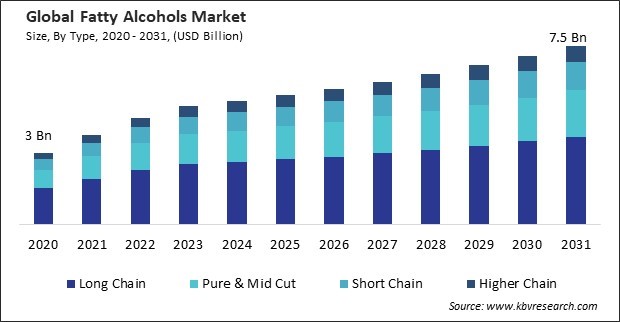

“Global Fatty Alcohols Market to reach a market value of USD 7.5 Billion by 2031 growing at a CAGR of 5.5%”

The Global Fatty Alcohols Market size is expected to reach $7.5 billion by 2031, rising at a market growth of 5.5% CAGR during the forecast period. In the year 2023, the market attained a volume of 3,352.8 kilo tonnes, experiencing a growth of 22.9% (2020-2023).

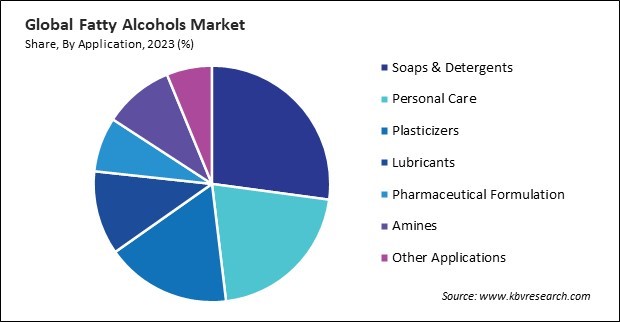

Fatty alcohols such as cetyl alcohol, stearyl alcohol, and cetostearyl alcohol possess emollient properties that help moisturize, soften, and condition the skin. Therefore, the personal care segment procured 21% revenue share in the market in 2023. In terms of volume, 1,034.5 kilo tonnes of fatty alcohol is expected to be utilized in personal care by the year 2031. These fatty alcohols form a protective barrier on the skin's surface, preventing moisture loss and improving skin texture. Consumers increasingly prioritize hydration and skin health, so the demand for personal care products containing fatty alcohols has risen.

The pharmaceutical industry's adoption of fatty alcohols for various applications, such as excipients, emulsifiers, and penetration enhancers, leads to an increased demand for these compounds as pharmaceutical companies develop new drug formulations and delivery systems, the need for fatty alcohols as key ingredients grow, driving market demand. As the pharmaceutical sector expands globally and introduces novel therapies and treatments, the demand for fatty alcohols as essential ingredients in pharmaceutical formulations is expected to persist, contributing to the sustained growth of the fatty alcohols market. Thus, emerging applications in the pharmaceutical industry are propelling the market's growth.

Additionally, Fatty alcohols, such as glycerol monostearate (GMS) and sorbitan esters, act as emulsifiers and stabilizers in food and beverage formulations. They help to create stable emulsions, prevent separation of ingredients, and improve the texture and mouthfeel of products such as dairy, bakery, confectionery, and processed foods. Fatty alcohols contribute to the texture and consistency of food products, especially in applications where smoothness, creaminess, or viscosity are desired. They are used in ice creams, margarines, spreads, and sauces to enhance their sensory properties and consumer appeal. Therefore, expansion of the food and beverage industry is driving the growth of the market.

However, Fatty alcohols are primarily derived from natural sources such as palm, coconut, and other vegetable oils. These sources are subject to price fluctuations due to various factors, including weather conditions, agricultural yields, geopolitical stability, and supply chain disruptions. Adverse weather conditions can drastically reduce crop yields, leading to supply shortages and increased prices for these raw materials. Any disruptions in transportation networks can lead to delays and increased costs, further contributing to price volatility. Thus, raw material price volatility is hampering the growth of the market.

Based on type, the market is divided into short chain, pure & mid cut, long chain, and higher chain. In 2023, the long chain segment held 51% revenue share in the market. In terms of volume, 2,157.5 kilo tonnes of Long-chain fatty alcohols is expected to be utilized by the year 2031. Long-chain fatty alcohols, typically those with carbon chain lengths of C16 and above, offer enhanced performance compared to their shorter-chain counterparts. They exhibit superior emollient, moisturizing, and conditioning properties, making them ideal ingredients for personal care products such as creams, lotions, and hair care formulations.

On the basis of application, the market is segmented into soaps & detergents, personal care, plasticizers, lubricants, pharmaceutical formulation, and amines. In 2023, the lubricants segment acquired 11% revenue share in the fatty alcohols market. In terms of volume, 541.1 kilo tonnes of Fatty alcohols is expected to be utilized in lubricants by the year 2031. Fatty alcohols possess lubricating properties that make them suitable additives in lubricant formulations. They help reduce friction between moving surfaces, preventing wear and tear and extending the lifespan of machinery and equipment. Fatty alcohols improve the lubricity of oils and greases, enhancing their performance in various industrial applications.

Free Valuable Insights: Global Fatty Alcohols Market size to reach USD 7.5 Billion by 2031

Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The Asia Pacific region attained 40% revenue share in the market in 2023. In terms of volume, 2,076.5 kilo tonnes of fatty alcohols is expected to be utilized by thi9s region in 2031. The Asia-Pacific region is home to some of the world's largest personal care industries, including China, Japan, South Korea, and India. The demand for skincare, haircare, and cosmetic products is fueled by a growing population, increasing urbanization, and changing beauty trends.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 4.9 Billion |

| Market size forecast in 2031 | USD 7.5 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 5.5% from 2024 to 2031 |

| Quantitative Data | Volume in Kilo Tonnes, Revenue in USD Billion, and CAGR from 2020 to 2031 |

| Number of Pages | 314 |

| Number of Tables | 526 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Type, Application, Region |

| Country scope |

|

| Companies Included | Wilmar International Limited, Kao Corporation, Kuala Lumpur Kepong Berhad (Davos Life Science), Arkema S.A., The Procter & Gamble company, Sasol Limited, Emery Oleochemicals LLC, BASF SE, Univar Solutions, Inc., Saudi Basic Industries Corporation (SABIC) |

By Type (Volume, Kilo Tonnes, USD Billion, 2020-2031)

By Application (Volume, Kilo Tonnes, USD Billion, 2020-2031)

By Geography (Volume, Kilo Tonnes, USD Billion, 2020-2031)

This Market size is expected to reach $7.5 billion by 2031.

Emerging Applications in Pharmaceutical Industry are driving the Market in coming years, however, Raw Material Price Volatility restraints the growth of the Market.

Wilmar International Limited, Kao Corporation, Kuala Lumpur Kepong Berhad (Davos Life Science), Arkema S.A., The Procter & Gamble company, Sasol Limited, Emery Oleochemicals LLC, BASF SE, Univar Solutions, Inc., Saudi Basic Industries Corporation (SABIC)

In the year 2023, the market attained a volume of 3,352.8 kilo tonnes, experiencing a growth of 22.9% (2020-2023).

The Soaps & Detergents segment is leading the Market by Application in 2023; thereby, achieving a market value of $1.8 billion by 2031.

The Asia Pacific region dominated the Market by Region in 2023; thereby, achieving a market value of $3.0 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges