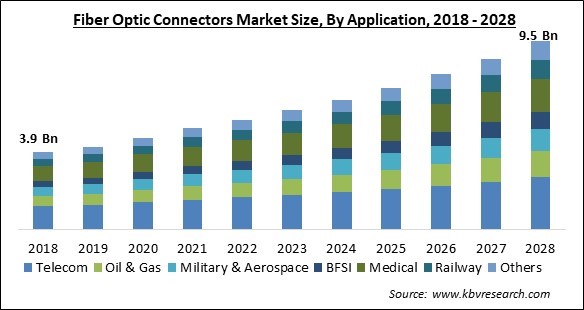

The Global Fiber Optic Connectors Market size is expected to reach $9.5 billion by 2028, rising at a market growth of 9.4% CAGR during the forecast period.

The joining of optical fibers using an optical fiber connector allows for quick connection as well as disconnection than splicing. Data centers, telecommunications, inter-, and intra-building applications, security systems, and high-density connectivity are just a few of the applications that use fiber optic connections. The market is primarily driven by the steadily rising demand for high bandwidth services from end users.

As a result of applications like video services, TV-on-demand, and online gaming, there is a greater need for high-speed data. The demand for 4G services, rising security and safety concerns and other factors are all propelling this business ahead. Consumers are moving toward more compact, effective, and multi-fiber connections for improved performance output.

The market for fiber optic connectors is expanding as a result of rising demand for high bandwidth, growing safety concerns, and expanding uses of fiber optic connectors. Additionally, FTTH (Fiber to the Home) usage and mobile device adoption is growing across the region. Comparing optical fiber to other transmission media, the former has a relatively large bandwidth. Compared to conventional media, this enables far greater signal speeds and longer transmission distances. For instance, all long-distance undersea communications cable is fiber-optic.

Worldwide communications (phone, video, and data) are now widely accessible because of this technology. VCSEL transmitters, parallel optics, and wavelength division multiplexing (WDM) are examples of new technology that will soon make services like video-on-demand and video conferencing accessible to most homes.

The COVID-19 widespread had a positive effect on the development of the fiber optic connector market because of the increase in funding from governments around the world for network infrastructure improvements to improve connectivity and the expanding demand for higher bandwidth connectivity throughout developing countries. The need for fiber optic connectors is expected to suddenly increase because of the COVID-19 pandemic, despite the market has experienced significant development in recent years. Furthermore, the majority of businesses already have business continuity strategies, but they might not fully cover the mutable and erratic aspects of a pandemic like COVID-19.

When compared to the technologies currently employed in most places, the demand for FTTH considerably boosts the connection speeds accessible to computer users. FTTH claims connection rates of up to 100 megabits per second (Mbps). Compared to standard cable modems or Digital Subscriber Line) connections, these speeds are 20 to 100 times faster. Because it necessitates the installation of new cable sets across the "last links" from existing optical fiber cables to individual users, FTTH implementation on a broad scale would be expensive. Additionally, FTTH offers several advantages in terms of speed and capacity, which is why outdated copper-based networks are now being replaced by Fiber to the X networks (FTTx).

The internet penetration rate has been increasing exponentially over the world. Social media services, Voice over IP (VoIP), online entertainment, and mobile payments have all grown widespread due to the rise in internet usage. As a result of the widespread use of tablets, smartphones, laptops, and other wireless devices, traffic related to data services, online gaming, and the internet has significantly increased. To get to its destination, wireless traffic uses a fiber optic wireline network. As a result, landline networks like front haul and backhaul are largely responsible for the rise of mobile communications.

Backbone cabling for local area networks (LANs) commonly uses fiber optics. Desktop cabling, which links individual workstations to the network, is a common use for this technology. Even yet, a PC does not require the high bandwidth characteristic offered by fiber optics. However, as bandwidth-hungry applications proliferate, they are showing promise for the desktop. Also, transmission losses could occur with the pricey, brittle, and fragile fiber optic components. Although fiber optics have a physical arc of wires that is physically constrained and can be utilized on the ground, they are advantageous for data transfer.

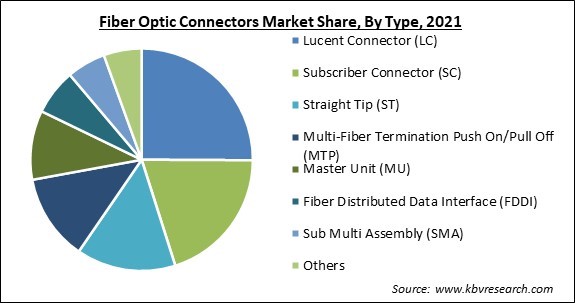

Based on type, the fiber optics connector market is segmented into lucent connector (LC), subscriber connector (SC), straight tip (ST), multi-fiber termination push on/ pull off (MTP), master unit (MU), fiber distributed data interface (FDDI), sub multi assembly (SMA) and others. In 2021, the subscriber connectors (SC) segment acquired a significant revenue share in the fiber optic connectors market. SC connectors have a push-pull design but lock the cable in place with a locking tab. The SC fiber optic connector is the most popular one in use today and is frequently used in datacom and telecom applications. This would contribute to the market growth in fiber optic connectors in the near future.

On the basis of application, the fiber optics connector market is fragmented into telecom, oil and gas, military and aerospace, BFSI, medical, railway and others. In 2021, the telecom segment dominated the fiber optic connectors market by generating the largest revenue share. This is explained by the potential for low-cost services like IPTV, broadband, and IP video calls. Furthermore, as the telecommunication industry is growing all over the world demand for high-speed networks option is rising due to which the fiber optic component demand is expanding. Thus, the market would grow in this segment.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 3.9 Billion |

| Market size forecast in 2028 | USD 9.5 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 9.4% from 2022 to 2028 |

| Number of Pages | 248 |

| Number of Tables | 354 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the fiber optic connectors market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2021, the Asia Pacific region held the largest revenue share in the fiber optic connectors market. This is due to the presence of several prominent businesses, academic institutions, governmental agencies, and banks. Additionally, there is a rising need for fiber optic connectors due to the rising need for connectivity among businesses, governmental agencies, and educational institutions.

Free Valuable Insights: Global Fiber Optic Connectors Market size to reach USD 9.5 Billion by 2028

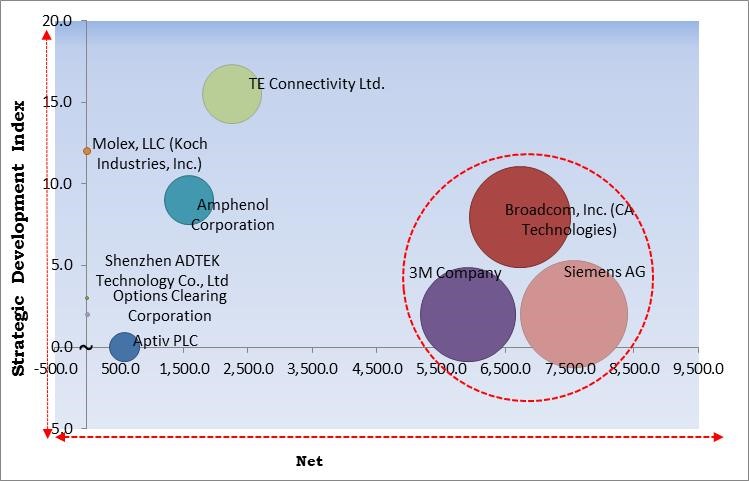

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Siemens AG, 3M Company and Broadcom, Inc. are the forerunners in the Fiber Optic Connectors Market. Companies such as Amphenol Corporation, TE Connectivity Ltd. and Aptiv PLC are some of the key innovators in Fiber Optic Connectors Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include 3M Company, Broadcom, Inc. (CA Technologies, Inc.), Siemens AG, TE Connectivity Ltd., Amphenol Corporation, Aptiv PLC, Optical Cable Corporation, Shenzhen ADTEK Technology Co., Ltd, Molex, LLC (Koch Industries, Inc.) and Extron Electronics.

By Type

By Application

By Geography

The Fiber Optic Connectors Market size is projected to reach USD 9.5 billion by 2028.

Increasing the use of FTTH are driving the market in coming years, however, Transmission loss & physical damage risk restraints the growth of the market.

3M Company, Broadcom, Inc. (CA Technologies, Inc.), Siemens AG, TE Connectivity Ltd., Amphenol Corporation, Aptiv PLC, Optical Cable Corporation, Shenzhen ADTEK Technology Co., Ltd, Molex, LLC (Koch Industries, Inc.) and Extron Electronics.

The expected CAGR of the Fiber Optic Connectors Market is 9.4% from 2022 to 2028.

The Lucent Connector (LC) market is leading the Global Fiber Optic Connectors Market by Type in 2021; thereby, achieving a market value of $2.1 billion by 2028.

The Asia Pacific market dominated the Global Fiber Optic Connectors Market by Region in 2021; thereby, achieving a market value of $3.5 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.