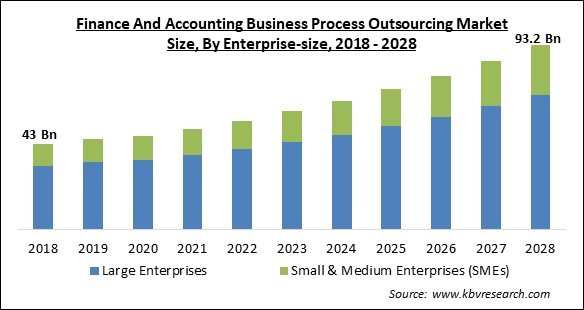

The Global Finance and Accounting Business Process Outsourcing Market size is expected to reach $93.2 billion by 2028, rising at a market growth of 9.2% CAGR during the forecast period.

Financing and accounting business process outsourcing is tasking the finance and accounting activities to a third-party service provider. This service allows financial organizations to get finance process improvement expertise, transformation methodologies, and hyper-automation technology solutions, assisting the digital optimization of finance operations. Operational and infrastructure capabilities are set up by service providers basis contractual agreements.

In the finance & accounting business process outsourcing, the supplier is usually from a developing nation where the services or the business operations are conducted, and the buyer belongs to a developed economy. Finance & accounting BPO services usually standardize processes to decrease fixed operational expenses like insurance claim processing, account & booking services, and record to report. Also, knowledge Process Outsourcing (KPO) enables businesses to expand operations by assisting at a strategic level; market intelligence services, consulting services, and legal services are among the others to aid in making strategic business decisions.

Various businesses are trying to find ways to manage cash flows and save costs. One way to do that is by hiring someone with the foundational knowledge to perform finance and accounting tasks offshore. Finance and accounting work together in business.It is about keeping track of financial statements, financial reporting, and transactions. Such financial transaction is recorded in a balance sheet utilizing generally accepted accounting principles.

The financial information is where all the transactions can be found and then presented to the cline tor management team for financial reporting. These all are important in any corporate finance reports about financial accounting because they will measure the return on investment, income statement, financial assets, liabilities of the company, and the analysis of cash flow. These are the key reasons most organizations outsource finance and accounting. It is now amongst the best digital resources expanding online to manage an organization’s finances.

The changes brought to the business activities because of these disruptions are anticipated to ultimately give momentum to the market. Finance and accounting business process outsourcing service providers have altered their business models by restructuring their business continuity plans to a distributed workforce. Businesses have understood the importance of continuous operations planning and disaster recovery to create a more reliable business model that can overcome an unprecedented disruption like the pandemic. Such business models aided the finance and accounting business process outsourcing market in recovering from the pandemic and showcase growth.

A worker might spend around half of their workweek handling repetitive digital tasks. But when these repetitive tasks are outsourced, the organization can free up many hours on these processes. Outsourcing these works allows the company to allocate more time towards other things that are essential for the company and create a variety of responsibilities for the employees. The finance and accounting business process outsource the organization to free up their workforce from completing non-core work and better utilize them, which is expected to increase their usage and thereby propel the market growth.

Organizations often risk losing clients to a competitor with such lapses in business continuity. However, with outsourced accounting, the work with the providers is generally equipped with cloud-based systems and automation capabilities that offer uninterrupted services. Also, the organizations can get time-bound service from the service provider by having a business continuity plan in their service agreement. The flexibility and the business continuity assurance provided by the outsourcing service provider are anticipated to surge the finance and accounting business process outsourcing market’s expansion.

This lack of communication can lead to a lack of management and human error. The financial process outsourcing provider sometimes lacks the management skills to carry out the given task, and due to the lack of communication, the organization cannot guide the outsourcing company properly. This also leads to increased errors, which can harm the organization’s status and reputation. The issues caused due to the limited control and lack of communication will hinder the adoption of the finance and accounting business process outsourcing market growth.

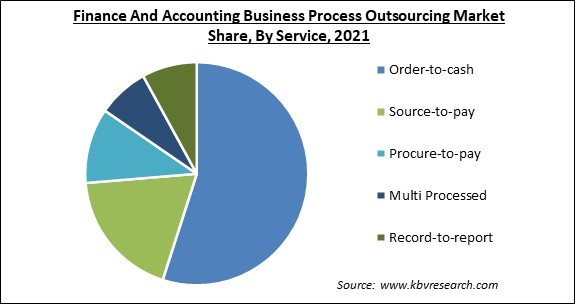

Based on service, the finance and accounting business process outsourcing market is segmented into order-to-cash, procure-to-pay, record-to-report, source-to-pay, and multi processed. The order-to-cash segment dominated the finance and accounting business process outsourcing market with the maximum revenue share in 2021. This is because order-to-cash is a collection of business activities and operations that includes receiving customer requests for services and goods. The order-to-cash function determines the company's cash inflow and working capital. In addition, it aids in cost savings, enhanced customer experience, and revenue generation. Therefore, these factors are expected to drive the segment’s growth.

On the basis of enterprise-size, the finance and accounting business process outsourcing market is divided into small & medium enterprises (SMEs) and large enterprises. The large enterprises segment held the highest revenue share in the finance and accounting business process outsourcing market in 2021. This is because large institutions are collaborating with numerous BPO service providers for enhanced cost efficiency and ease of customer management across multiple regions. Finance and accounting BPO allow large organizations to refocus on their core business activities to provide incremental value to their customers. These services benefit organizations for cost optimization and enhance business functions.

By industry, the finance and accounting business process outsourcing market is classified into BFSI, healthcare & life sciences, manufacturing, energy & utilities, travel & logistics, telecom & IT, media & entertainment, retail and others. The telecom & IT segment recorded a prominent revenue share in the finance and accounting business process outsourcing market in 2021. This is because BPO companies offer various services to the telecom & IT sector based on their requirement. In addition, the finance and accounting services include record-to-report, source-to-pay, order-to-cash, and procure-to-pay. Hence, the specialized services offered to the telecom & IT sector will propel the segment’s expansion in the forecasted period.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 50.6 Billion |

| Market size forecast in 2028 | USD 93.2 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 9.2% from 2022 to 2028 |

| Number of Pages | 286 |

| Number of Table | 420 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Enterprise-size, Service, Industry, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the finance and accounting business process outsourcing market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region registered the highest revenue share in the finance and accounting business process outsourcing market in 2021. This is because of the increasing requirement for business process outsourcing services due to their lower costs, focus on core business functions, and high efficiency. In addition, the customization of these service better meet with the individuals' needs, and there is a rising demand for cloud computing. These factors are expected to boost the market growth in the region.

Free Valuable Insights: Global Finance And Accounting Business Process Outsourcing Market size to reach USD 93.2 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Accenture PLC, Wipro Limited, Fiserv, Inc., Infosys Limited, Tata Consultancy Services Ltd., IBM Corporation, HCL Technologies Ltd. (HCL Enterprises), Genpact Limited, Capgemini SE, and Sutherland Global Services, Inc.

By Enterprise-size

By Industry

By Service

By Geography

The global Finance And Accounting Business Process Outsourcing Market size is expected to reach $93.2 billion by 2028.

The ability to save organization’s time are driving the market in coming years, however, Limited control and communication restraints the growth of the market.

Accenture PLC, Wipro Limited, Fiserv, Inc., Infosys Limited, Tata Consultancy Services Ltd., IBM Corporation, HCL Technologies Ltd. (HCL Enterprises), Genpact Limited, Capgemini SE, and Sutherland Global Services, Inc.

The BFSI segment acquired maximum revenue share in the Global Finance And Accounting Business Process Outsourcing Market by Industry in 2021 thereby, achieving a market value of $20.6 billion by 2028.

The North America market dominated the Global Finance And Accounting Business Process Outsourcing Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $34.6 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.