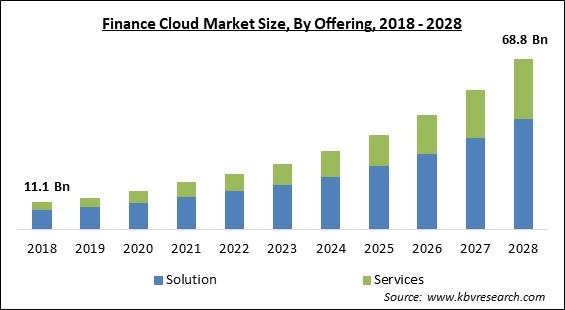

The Global Finance Cloud Market size is expected to reach $68.8 billion by 2028, rising at a market growth of 20.5% CAGR during the forecast period.

An integrated platform is a Financial Services Cloud that was created to foster deeper client relationships that endure for generations. Financial Services Cloud, which is powered by Lightning, makes it simple for advisors to provide the tailored, proactive advice clients demand at a concierge level of service. Advisors can spend more time doing what they do best—providing comprehensive, goal-based advice that puts their customers at the center of everything they do—instead of spending more time gathering client information with the help of an improved set of productivity and engagement tools.

Any expanding business's modern finance staff is equipped with a range of potent software alternatives to handle the business's finances. They use a range of financial management tools to develop budgets, produce invoices, monitor all expenditures, approve purchase requests, and manage payments. Often, they are all separate on-premises systems that don't talk to one another.

A disjointed system results in severe team miscommunication, catastrophic time and resource waste, and a cumbersome procedure with lots of room for human mistakes. The management of an organization's financial planning via the cloud is known as cloud financial management. It provides organizations and finance teams with an ecosystem of interconnected solutions for account management, financial report creation, payment processing, payroll administration, and budget management.

The data can be viewed from anywhere at any time because it is available online. Comparatively speaking, on-premise ERP systems are more expensive than cloud financial management software. There are no setup fees, ongoing costs, or support costs. Users can anticipate costs because of the subscription-based pricing model, which makes it easier for the user to manage their cash flow.

The COVID-19 pandemic had a favorable effect on the cloud-finance sector. The financial industry has fundamentally altered its current business strategy, upgrading the current product lines and adjusting company performance with a more economical and efficient approach. Banks and other financial institutions have adopted the cloud much more widely to maintain efficient internal operations in the event of a pandemic. As a result, amid the health crisis, there has been a considerable surge in demand for finance cloud.

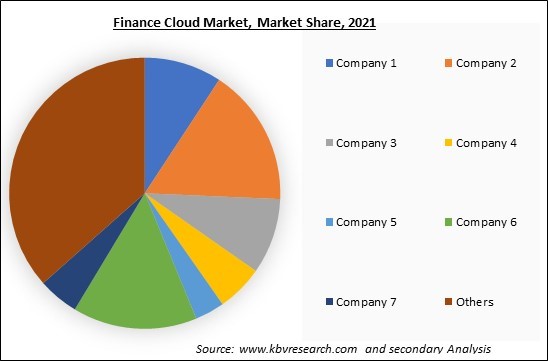

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The below illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

The majority of organizations traditionally devote time and energy to making decisions and delivering company information. Successful organizations are always looking for new systems to better serve their customers and boost their profit margins. Cloud solutions are currently key platforms that provide financial companies with a strong foundation and informational backbone. Many financial institutions handle back-office tasks and essential business activities like payments and credit risk monitoring utilizing a mixed blend of public and private clouds.

The market for cloud computing services has great potential to grow in emerging economies like India, China, Brazil, and Africa. For instance, the monitoring and analytics software provider ITRS Group Ltd. Since these nations are developing and have limited financial resources, they require cost-effective solutions, which increase demand for cloud technology and lower IT costs. After all, businesses can be sure that files, programs, and other data are protected if they are not housed securely onsite.

The cost of acquiring and implementing a cloud system is high at first. International software providers including IBM Corp., SAP, Oracle, and Microsoft demand exorbitant prices for their products. Additionally, the maintenance and support services provided by these software companies are very expensive. The overall annual cost of upkeep and updating the cloud system consists of internal expenses (user training, IT wages, and project management), external expenses (IT vendors and contractors), and annual maintenance and support fees paid to cloud suppliers.

By offering, the Finance Cloud Market is bifurcated into Solution and Services. The solution segment acquired the highest revenue share in the finance cloud market in 2021. It is because the user can build a single client database and begin automating billing, revenue management, and other essential financial procedures using a cloud financing system. It is the most effective technique to carry out profitable and predictable operations and wins loyal customers.

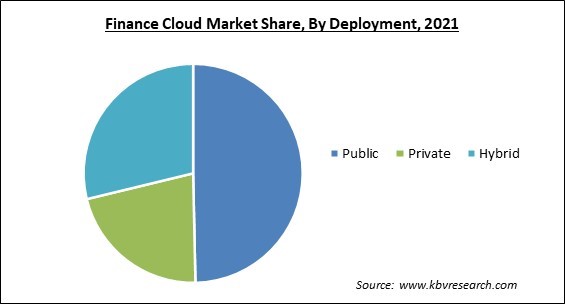

By Functionality, the Finance Cloud Market is classified into Public, Private, and Hybrid. The private cloud segment registered a significant revenue share in the finance cloud market in 2021. The private cloud offers users low-cost management tools and services for cloud applications, including data storage, security, and monitoring. Organizations can take advantage of numerous cloud computing advantages while maintaining control, security, and customization by utilizing the private cloud.

Based on the Organization Size, the Finance Cloud Market is bifurcated into Large Enterprises and Small & Medium Enterprises (SMEs). The small & medium enterprise (SMEs) segment witnessed a substantial revenue share in the finance cloud market in 2021. Due to factors like strict regulatory compliance, lower IT infrastructure costs, and fraud detection and prevention tools, this market is expected to increase. Infrastructure as a service, platform as a service, and software as a service are examples of noisy computing services.

On the basis of Application, the Finance Cloud Market is divided into Revenue Management, Wealth Management, Account Management, Customer Relationship Management, Asset Management, and Others. The wealth management segment procured the highest revenue share in the finance cloud market in 2021. Regulation requirements, shifting generational wealth, and rising demand for cloud technologies from wealth and investment companies are all contributing to the market expansion of this sector.

By End-use, the Finance Cloud Market is classified into Banking & Financial Services, and Insurance. The banking & financial services segment garnered the largest revenue share in the finance cloud market in 2021. Reduced client acquisition costs, growing security concerns, and the necessity for disaster recovery are a few reasons for this market segment's rise. For the adoption of the cloud, banks and other financial institutions are working with finance cloud providers.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 19 Billion |

| Market size forecast in 2028 | USD 68.8 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 20.5% from 2022 to 2028 |

| Number of Pages | 377 |

| Number of Tables | 644 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Companies Strategic Developments, Company Profiling |

| Segments covered | Offering, Deployment, Organization Size, End-use, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the Finance Cloud Market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The north America segment acquired the highest revenue share in the finance cloud market in 2021. Due to the region's strong economy and increased internet penetration rates, isolated infrastructure has been migrated to the cloud in North America. The growth of the North American finance cloud market is also largely attributed to increased security and agility, decreased capital expenditure (CapEx), and simplified IT administration.

Free Valuable Insights: Global Finance Cloud Market size to reach USD 68.8 Billion by 2028

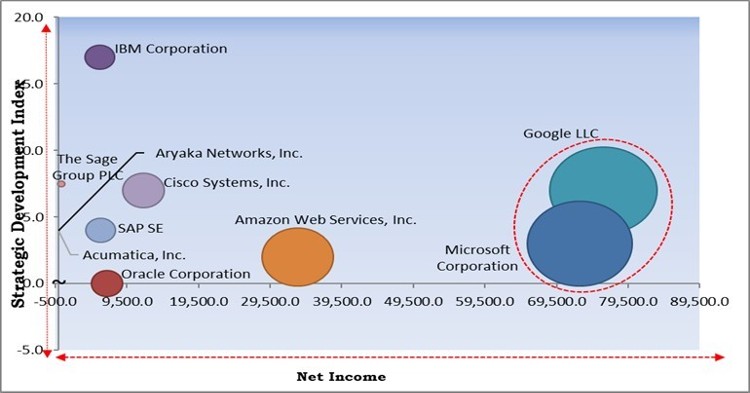

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Microsoft Corporation and Google LLC are the forerunners in the Finance Cloud Market. Companies such Amazon Web Services, IBM Corporation, SAP SE are some of the key innovators in Finance Cloud Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include IBM Corporation, Google LLC, Microsoft Corporation, Oracle Corporation, SAP SE, Amazon Web Services, Inc., Cisco Systems, Inc., The Sage Group PLC, Acumatica, Inc., and Aryaka Networks, Inc.

By Offering

By Deployment

By End-use

By Organization Size

By Application

By Geography

The global Finance Cloud Market size is expected to reach $68.8 billion by 2028.

The Growing Demand For Operational Efficiency And Transparency are driving the market in coming years, however, Increased Maintenance & Investment Costs restraints the growth of the market.

IBM Corporation, Google LLC, Microsoft Corporation, Oracle Corporation, SAP SE, Amazon Web Services, Inc., Cisco Systems, Inc., The Sage Group PLC, Acumatica, Inc., and Aryaka Networks, Inc.

The Public segment acquired maximum revenue share in the Global Finance Cloud Market by Deployment in 2021 thereby, achieving a market value of $33.2 billion by 2028.

The Large Enterprises segment is leading the Global Finance Cloud Market by Organization Size in 2021 thereby, achieving a market value of $47.4 billion by 2028.

The North America market dominated the Global Finance Cloud Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $23.3 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.