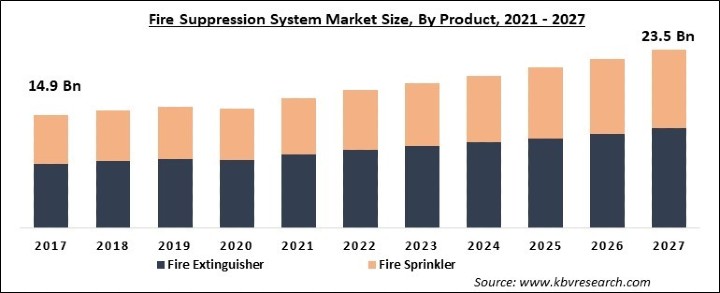

The Global Fire Suppression System Market size is expected to reach $23.5 billion by 2027, rising at a market growth of 5.4% CAGR during the forecast period. A fire suppression system refers to a set of units that are developed to extinguish the fire by the application of a substance. Mainly, it consists of built-in components that help in detecting fire at the early stage through various warning signals like smoke, heat, and others.

The system is connected with an alarm system that helps in alerting when there is a sudden outbreak of fire and starts taking immediate actions to avoid any kind of incident. After the detection of fire, the fire suppression system automatically starts releasing dry chemicals or wet agents to extinguish the fire. Whereas, various fire suppression systems start releasing on the manual command. Moreover, fire detection alarm systems include temperature detectors, flame detectors, optical detectors, and heat detectors.

The growing awareness about the modern fire protection systems and the increased focus on thwarting casualties and infrastructural damage because of sudden fire breakouts are some of the factors responsible for increasing the demand for fire suppression systems. A fire suppression system is among the safety-critical systems that are installed in buildings and infrastructures as a preventive measure. At the moment of a sudden fire outbreak, these fire suppression systems play a crucial role in protecting people and property.

Due to the outbreak of the COVID-19 pandemic, the consumer demand and the growth of the fire suppression systems decreased. Also, the manufacturing of these systems remained hampered, owing to the shutdown of the majority of product manufacturing facilities of fire suppression systems across the world. In addition, the supply chain was also disrupted as the governments across various nations-imposed lockdown due to the COVID-19 outbreak. Additionally, the demand for fire suppression systems has declined due to the discontinuation of various kinds of projects across the residential and commercial sectors.

Moreover, the growing awareness regarding fire safety systems that are integrated with the latest technology and the rising population in several countries are anticipated to boost the demand for the fire suppression system, thereby increasing the growth of the market in the coming years across the globe. Further, government across the various nations has mandated the installation of fire suppression systems in order to protect people, infrastructure and properties from getting harmed and damaged from the sudden outbreak of fire. These aspects would offer lucrative opportunities for the growth of the fire suppression system market over the forecasting period around the world.

The rise in industrialization is also increasing the number of fire-related accidents, which led to a huge loss of lives and damage of property and assets. Moreover, to reduce human losses and protect infrastructure and buildings from fire breakouts, several companies around the world are heavily investing in the deployment of fire suppression systems. Companies are depending on some devices like fire sprinklers, fire extinguishers, sensors and detectors, and other equipment to deploy fire suppression systems within their premises.

The best results of fire suppression systems can be obtained by the adoption of fixed human-machine interface solutions. In addition, to manage devices and systems in fire suppression, electromechanical equipment like pointing devices, keyboards, keypads, switches, and other elements like alarms and indicators are integrated with human-machine interfaces.

Companies need to invest a huge amount for the installation of fire suppression systems, owing to the complex networks and requirement of sophisticated tools to handle a fire situation. Due to the increasing fire incidents, solution vendors are expected to make continuous advancements in their existing solutions and introduce new technologies.

Based on Product, the market is segmented into Fire Extinguisher and Fire Sprinkler. Fire Extinguisher segment is further bifurcated across Dry Chemical Powder, Water, Gas, and Others. The fire extinguisher segment acquired the maximum revenue share in 2020. The huge investment in the installation of fire safety systems in industrial establishments and the advancements in technology that are used in fire safety systems and devices are accountable for augmenting the demand for fire suppression systems.

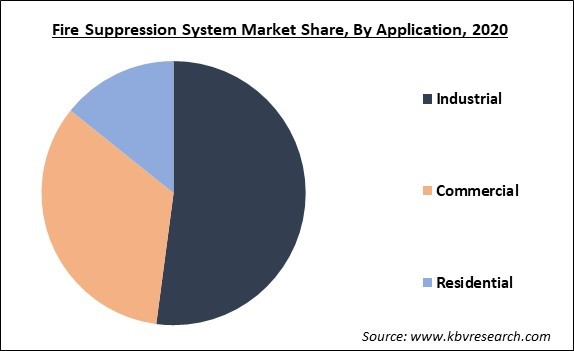

Based on Application, the market is segmented into Industrial, Commercial and Residential. The residential segment is projected to acquire the largest growth rate during the forecasting period. In the residential sector, the implementation of fire sprinkler systems has gained considerable traction in the past few years. In addition, some of the determinants like rising awareness among the end-users to ensure fire safety, the growing number of campaigns by several public safety associations, and leading manufacturers of fire safety equipment are estimated to spur the growth of the residential segment during the forecasting period.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 15.7 Billion |

| Market size forecast in 2027 | USD 23.5 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 5.4% from 2021 to 2027 |

| Number of Pages | 223 |

| Number of Tables | 353 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Product, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. North America procured the largest market share in 2020. As per the rules and regulations outlined by several governments existing in North America, the installation of fire suppression systems in buildings is mandatory. For example, in the US, the installation of a fire suppression system is mandatory for all buildings depending upon the type of occupancy and the usage of the building.

Free Valuable Insights: Global Fire Suppression System Market size to reach USD 23.5 Billion by 2027

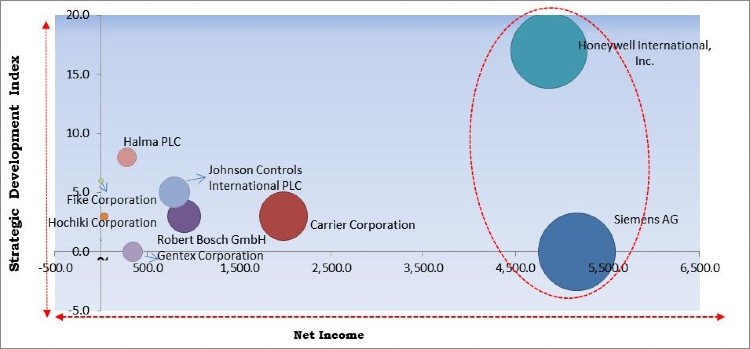

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Honeywell International, Inc. and Siemens AG are the forerunners in the Fire Suppression System Market. Companies such as Johnson Controls International PLC, Carrier Corporation., and Robert Bosch GmbH are some of the key innovators in the market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Robert Bosch GmbH, Honeywell International, Inc., Siemens AG, Carrier Corporation, Johnson Controls International PLC, Hochiki Corporation, Gentex Corporation, Halma PLC, Minimax Viking GmbH, and Fike Corporation.

By Product

By Application

By Geography

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.