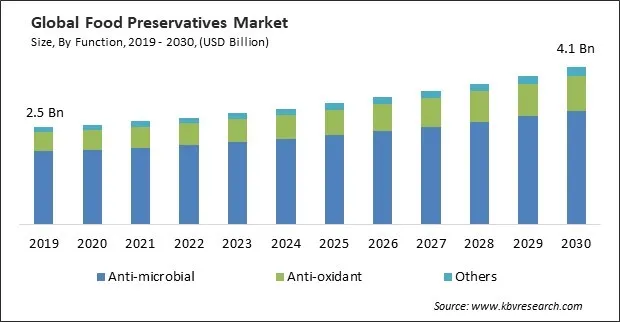

The Global Food Preservatives Market size is expected to reach $4.1 billion by 2030, rising at a market growth of 5.1% CAGR during the forecast period. In the year 2022, the market attained a volume of 1,92,466.9 Kilo Tonnes, experiencing a growth of 4.3% (2019-2022).

Vinegar, particularly apple cider vinegar, is associated with potential health benefits. The demand for artisanal and specialty food products has grown, and vinegar fits well into this trend. Therefore, the Vinegar segment captured $192.8 million revenue in the market in 2022. The ongoing influence of health and wellness trends on consumer decision-making has led to the recognition of vinegar as both a preservative and a functional constituent in food products. Specialty vinegar, such as balsamic or flavored vinegar, is used for its unique taste profiles and natural preservative properties.

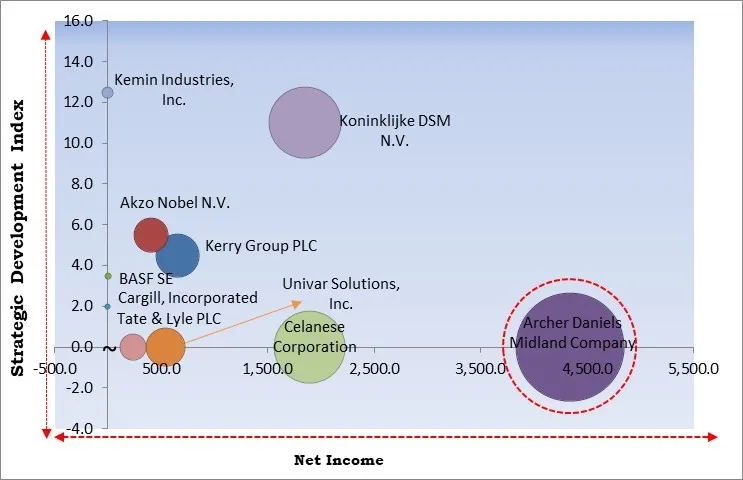

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In May, 2023, Akzo Nobel N.V. introduced Accelshield 700, a BPA-NI inner coating for beverage can lids, specifically designed for food and liquids with stringent storage requirements, catering to acidic or high-temperature sterilization needs, such as yogurt, milk, coffee, soft drinks, and beer. Additionally, In December, 2021, BASF SE introduced Natupulse TS, a non-starch polysaccharide (NSP) enzyme for animal feed. Functioning as an endo-1,4-ß-D-mannanase, it hydrolyzes ß-mannans into smaller components, such as manno-oligosaccharides (MOS).

Based on the Analysis presented in the KBV Cardinal matrix; Archer Daniels Midland Company are the forerunners in the Market. Companies such as Koninklijke DSM N.V., Kerry Group PLC, Akzo Nobel N.V. are some of the key innovators in the Market. For Instance, In October, 2019, Kemin Industries, Inc., introduced two new product ranges in its Ruminant Essentialities portfolio for animal nutrition and health. The offerings comprised Kessent, featuring rumen-protected Methionine developed by Kemin for precise feeding in ruminant diets, and CholiGem, a Choline nutrition product also developed and produced by Kemin, completing the Ruminant Essentialities portfolio.

Fast-paced routines, with limited time available for meal preparation, often characterize urban lifestyles. Convenience foods, which include ready-to-eat meals, snacks, and pre-packaged items, offer a quick and time-saving solution for individuals with busy schedules. Increased income levels and purchasing power often accompany urbanization. Urbanization brings challenges related to food distribution and storage, as products need to travel longer distances and be stored for extended periods. Food preservatives are essential for preventing spoilage, maintaining freshness, and extending the shelf life of products in the supply chain. Likewise, the growth of convenience stores, fast-food outlets, and online food delivery services in urban areas further supports the demand for processed and convenience foods. These factors will drive the demand in the market.

Globalization often leads to longer and more complex food supply chains involving transporting raw materials and finished products across different countries and regions. The extended transit times and distances need effective preservation methods, with as essential tools to prevent spoilage and maintain product quality. Global supply chains are susceptible to various risks, including fluctuations in climate, political instability, and unforeseen events such as natural disasters. Preservatives help mitigate these risks by ensuring that food products remain viable and safe even in challenging conditions, reducing potential financial losses due to spoilage. These factors are expected to help expand the market.

Modified atmosphere packaging (MAP) involves altering the composition of the air surrounding a food product within the package to slow deterioration. By adjusting the oxygen, carbon dioxide, and nitrogen levels, MAP can create an atmosphere that inhibits the growth of spoilage microorganisms and oxidative reactions. The controlled environments created by MAP and vacuum packaging reduce the need for certain preservatives traditionally used to inhibit microbial growth and prevent oxidation. This aligns with consumer preferences for minimally processed and additive-free foods. MAP and vacuum packaging help maintain the freshness of products by minimizing exposure to air and preventing the development of off-flavors or off-odors. This is particularly important for products sensitive to oxidation or microbial contamination. The use of MAP and vacuum packaging provides an alternative approach to preserving food products, reducing the reliance on synthetic preservatives that consumers may perceive negatively. These factors will lead to reduced demand in the market.

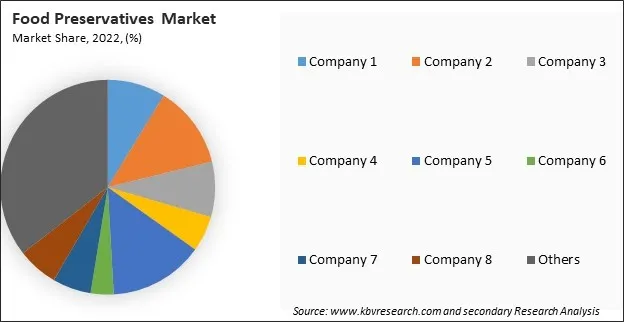

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

Based on function, the market is divided into anti-microbial, anti-oxidant, and others. The anti-microbial segment held the largest revenue share in the market in 2022. Growing consumer awareness about foodborne illnesses and the importance of food safety has driven the demand for preservatives with antimicrobial properties. Consumers seek products that remain safe and fresh for an extended period. Antimicrobial preservatives effectively prevent spoilage caused by bacteria, molds, and yeasts. As consumers increasingly prioritize longer shelf life and reduced food waste, the demand for preservatives with antimicrobial properties has surged. These factors will pose lucrative growth prospects for the segment.

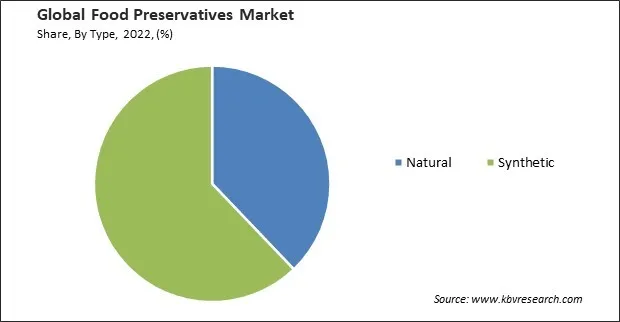

Based on type, the market is bifurcated into natural and synthetic. The natural segment held a significant revenue share in the market in 2022. Growing awareness of health and wellness, coupled with concerns about the potential health impacts of synthetic additives, has influenced consumers to choose products with natural preservatives. Natural preservatives are often associated with a healthier and more wholesome image. These factors will boost the demand in the segment.

On the basis of application, the market is divided into meat & poultry product, bakery products, dairy product, beverages, snacks, and others. The meat and poultry product segment recorded the maximum revenue share in the market in 2022. The susceptibility of meat and poultry products to microbial contamination makes effective preservation essential. Foodborne pathogens and spoilage microorganisms can compromise the safety and quality of these products. Preservatives help inhibit the growth of bacteria, molds, and yeasts, contributing to the microbiological safety and shelf-life extension of meat and poultry. These aspects will boost the demand in the segment.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 2.8 Billion |

| Market size forecast in 2030 | USD 4.1 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 5.1% from 2023 to 2030 |

| Number of Pages | 566 |

| Number of Tables | 1154 |

| Quantitative Data | Volume in Tonnes, Revenue in USD Billion, and CAGR from 2019 to 2030 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Type, Function, Application, Region |

| Country scope |

|

| Companies Included | Archer Daniels Midland Company, Cargill, Incorporated, Kerry Group, Plc., Akzo Nobel N.V., Kemin Industries, Inc., Univar Solutions, Inc., Koninklijke DSM N.V., Tate & Lyle Plc., BASF SE, Celanese Corporation |

| Growth Drivers |

|

| Restraints |

|

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. In 2022, the Europe segment acquired a considerable revenue share in the market. Europe has robust regulatory frameworks governing food safety. Stringent regulations related to food preservation and additives drive the demand for approved and safe preservatives, fostering growth in the market. Growing consumer awareness about food safety, shelf-life extension, and the impact of preservatives on health has influenced purchasing decisions. This has led to a demand for preservatives that align with clean label and natural food trends. Therefore, the segment will expand rapidly in the future.

Free Valuable Insights: Global Food Preservatives Market size to reach USD 4.1 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Archer Daniels Midland Company, Cargill, Incorporated, Kerry Group, Plc., Akzo Nobel N.V., Kemin Industries, Inc., Univar Solutions, Inc., Koninklijke DSM N.V., Tate & Lyle Plc., BASF SE, Celanese Corporation.

By Function (Volume, Kilo Tonnes, USD Billion, 2019-2030)

By Type (Volume, Kilo Tonnes, USD Billion, 2019-2030)

By Application (Volume, Kilo Tonnes, USD Billion, 2019-2030)

By Geography (Volume, Kilo Tonnes, USD Billion, 2019-2030)

This Market size is expected to reach $4.1 billion by 2030.

Increasing demand for processed and convenience foods are driving the Market in coming years, however, Technological advancements in packaging restraints the growth of the Market.

Archer Daniels Midland Company, Cargill, Incorporated, Kerry Group, Plc., Akzo Nobel N.V., Kemin Industries, Inc., Univar Solutions, Inc., Koninklijke DSM N.V., Tate & Lyle Plc., BASF SE, Celanese Corporation.

In the year 2022, the market attained a volume of 1,92,466.9 Kilo Tonnes, experiencing a growth of 4.3% (2019-2022).

The Synthetic segment is leading the Market by Type in 2022; thereby, achieving a market value of $2.6 billion by 2030.

The North America region dominated the Market by Region in 2022 and would continue to be a dominant market till 2030; thereby, achieving a market value of $1.4 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.