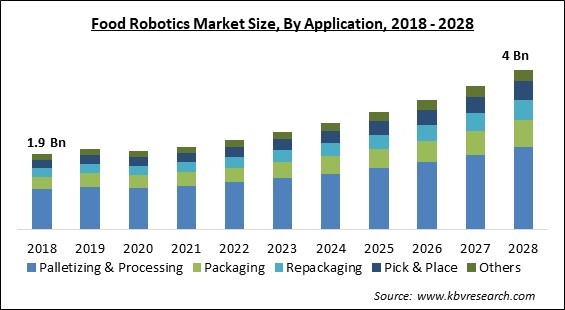

The Global Food Robotics Market size is expected to reach $4 billion by 2028, rising at a market growth of 10.2% CAGR during the forecast period.

Food robotics are referred to as robots employed in the food and beverage business to carry out intricate tasks like picking, packing, and palletizing. Robots from science fiction are already a reality owing to various technological developments. Furthermore, robots are becoming a crucial component of many sectors due to the rise in demand for increased productivity and the introduction of robots to job or task automation.

Automation and robotics play a significant role in the solution. The food manufacturing business has been particularly sluggish in incorporating robotics compared to other industries. Robotics, however, has begun to penetrate practically every stage of the food supply chain in the past few years, from the farm to the kitchen. Seedling planting, identification, and sorting are examples of robotic applications.

Additionally, self-driving tractors are also present nowadays along with robots for harvesting and weeding. Robotics are also being brought to the dairy, poultry, and cattle production sectors of non-plant agriculture. Applications include self-sufficient milking and feeding, egg gathering and sorting, and self-sufficient cleaning. Despite being originally developed to lift heavy metal components, modern technology can pick up delicate items like bread loaves, cheese, and fruits without causing any harm.

Manufacturers of food are now able to keep an eye on products as well as consumer demand, then use data analysis to tailor the output to this need. Robotics and the creation of AI software enable this. Companies can better monitor food quality and safety when they are better equipped to assess crucial processes like shipping, processing, and storage, as well as whether food is accidentally contaminated, where that food was shipped, and where that food was acquired from. Several large food service companies have recently invested in robots and artificial intelligence.

The COVID-19 pandemic brought on a significant economic depression. Several nations implemented strict lockdowns to contain the virus, which caused the closure of food & beverages (F&B) processing facilities and a brief disruption in the F&B supply chain. The absence of F&B products and necessities, panic buying by consumers worldwide, disruption of supply chains as a result of travel restrictions, and labor shortages had a substantial influence on the F&B supply chain. Major robot manufacturers reported lower revenue generation in the first half of 2020 due to lower sales brought on by an economic slowdown. This was brought on by quarantine and lockdown restrictions imposed by governments worldwide, as well as a temporary decrease in the demand for automation.

The need for ready-to-cook and ready-to-eat foods has increased in recent years, necessitating the packaging of food goods to extend their shelf life and meet consumer demand. The mass production of packaged food goods has pushed the market for food robotics, especially in nations such as the United States, Japan, France, and Italy. Most large-scale food manufacturing factories are automating their procedures to assure quality and consistency in the Stock Keeping Units (SKUs). Agriculture and food manufacturing tasks are more difficult to automate using robots, yet companies continue to implement them. As a result, the expansion of the packaged dairy products and baked goods industries is also driving the market for food robotics, as these products are mass-produced across regions.

Digitalization is the optimization of corporate operations by emerging digital technologies, such as IT/OT convergence, big data analytics, digital twin, 3D printing, artificial intelligence, and automation technologies. IoT and AI are assisting businesses in achieving high levels of food safety, enhancing food traceability, reducing food waste, and lowering food processing and packaging-related costs and risks. In recent years, digitalization has emerged as a crucial driver for automation, where artificial intelligence (AI) pushes operational productivity through enhancing workforce productivity. Hence, the growing adoption of digitalization across the F&B industry will propel the growth of the food robotics market in the coming years.

Due to the additional installation expense, most food and beverages businesses are unwilling to implement automated procedures. Market expansion is hindered by the extra cost of integrating individual robots into a comprehensive robotic system, including peripheral equipment such as safety barriers, sensors, programmable logic controllers (PLC), human-machine interface (HMI), and safety systems. In addition, engineering expenses include installation, programming, and commissioning. These increased expenses limit the growth of the market. Small and medium-sized manufacturers are hesitant to incur substantial installation expenditures at the outset since it could delay the payback period and further increase their operational cost.

Based on application, the food robotics market is divided into palletizing & processing, packaging, repackaging, pick & place, and others. In 2021, the palletizing & processing segment dominated the food robotics market with maximum revenue share. Robotic palletizing ensures quick and effective operations to increase throughput, improve quality, and improve working conditions for personnel. Robotics use grippers for either cases, bags, or crates and operate with people to increase production. They smoothly integrate into the current manufacturing line. Humans do not best perform numerous tasks involved in meat preparation.

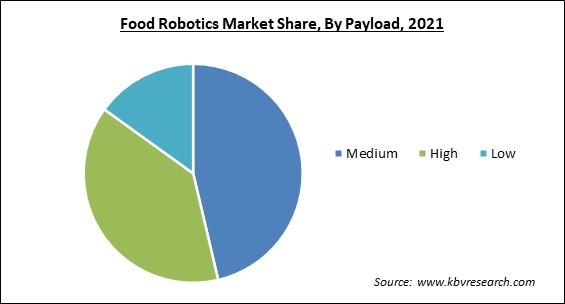

On the basis of payload, the food robotics market is fragmented into low, medium and high. The low segment covered a remarkable revenue share in the food robotics market in 2021. Many of the available SCARA food robots fall under the low payload category as picking objects is considered a rather simplistic task. The expertise in food handling, pick-and-place, packaging & palletizing, sealing, labeling, and spraying, among many other things, is largely responsible for the segment's explosive expansion.

By type, the food robotics market is segmented into articulated, cartesian, SCARA, cylindrical, collaborative and others. The SCARA segment generated the prominent revenue share in the food robotics market in 2021. A selective compliance articulated robot arm (SCARA) robot is intended for pick-and-place applications and has a relatively high speed and a high degree of precision. SCARA robots can easily and adaptably solve a number of automated assembling applications. Demand is rising with the expanding use of food robotics in this industry.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 2.1 Billion |

| Market size forecast in 2028 | USD 4 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 10.2% from 2022 to 2028 |

| Number of Pages | 239 |

| Number of Tables | 404 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Payload, Type, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the food robotics market is analyzed across North America, Europe, Asia Pacific and LAMEA. In 2021, the Asia Pacific region held the highest revenue share in the food robotics market. The rapid expansion of the food robotics market in this region is ascribed to the population's shift toward prepared and packaged foods as a result of growing concerns about food safety and lifestyle. The region's desire for high-tech packaged foods and beverages has been spurred by the rise in consumer income. In Asia Pacific, China is well-known as the nation that sets the standard for food robot adoption.

Free Valuable Insights: Global Food Robotics Market size to reach USD 4 Billion by 2028

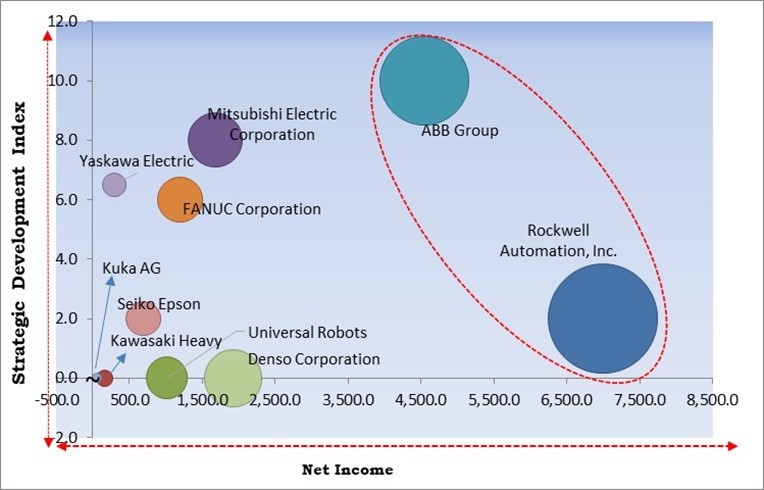

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Rockwell Automation, Inc. and ABB Group are the forerunners in the Food Robotics Market. Companies such as Mitsubishi Electric Corporation, FANUC Corporation, and Denso Corporation are some of the key innovators in Food Robotics Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Mitsubishi Electric Corporation, ABB Group, Rockwell Automation, Inc., Kawasaki Heavy Industries, Ltd., Kuka AG (Midea Investment Holding Co., Ltd.), FANUC Corporation, Yaskawa Electric Corporation, Seiko Epson Corporation, Teradyne, Inc. (Universal Robots A/S) and Denso Corporation

By Application

By Payload

By Type

By Geography

The global Food Robotics Market size is expected to reach $4 billion by 2028.

Demand for packaged foods is increasing are driving the market in coming years, however, High cost of robotic system installation restraints the growth of the market.

Mitsubishi Electric Corporation, ABB Group, Rockwell Automation, Inc., Kawasaki Heavy Industries, Ltd., Kuka AG (Midea Investment Holding Co., Ltd.), FANUC Corporation, Yaskawa Electric Corporation, Seiko Epson Corporation, Teradyne, Inc. (Universal Robots A/S) and Denso Corporation

The expected CAGR of the Food Robotics Market is 10.2% from 2022 to 2028.

The Medium market is leading the segment in the Global Food Robotics Market by Payload in 2021; thereby, achieving a market value of $1.8 billion by 2028.

The Asia Pacific market dominated the Global Food Robotics Market by Region in 2021; thereby, achieving a market value of $1.6 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.