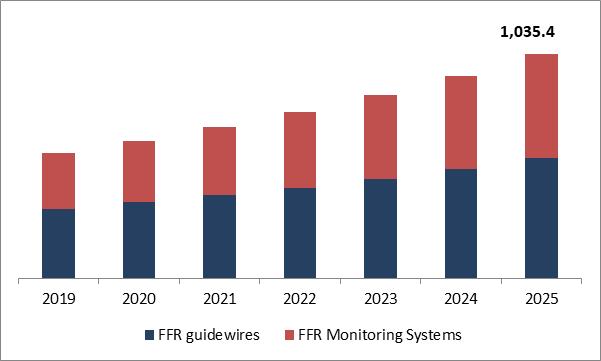

The Global Fractional Flow Reserve Market is expected to reach $1,035.4 million by 2025, growing at a CAGR of 10.2% during 2019-2025. Fractional flow reserve (FFR) is a procedure used in coronary catheterization to calculate variations in pressure across coronary artery stenosis. This process helps to determine the likelihood of stenosis which impedes the supply of oxygen to the heart muscle (myocardial ischemia).

FFR is a novel mathematical model for estimating stenotic coronary artery atherosclerosis and is potentially useful in medical settings. In a proprietary race that claims risk-based cardiac mathematics for ischemic cardiac disease, the measure of reliability (easily reproducible) between competing laboratories to test this critical metric remains in conflict.

FFR has some benefits over other methods for testing narrowed coronary arteries, like coronary angiography, intravascular ultrasound, and coronary angiography through CT. For example, FFR takes collateral flow into consideration, which can make a technically unimportant anatomical blockage. Standard angiography may also underestimate or overestimate narrowing because it visualizes contrast within a vessel.

Global Fractional Flow Reserve Market Size (USD Million)

FFR guide wires accounted for a dominant market share in 2018 due to their widespread use in diagnostic cardiovascular procedures. This segment is expected to have a stable CAGR over the forecast period due to the increased use of coronary artery disease diagnosis worldwide. For example, according to the Centers for Disease Control and Prevention (CDC), in 2015, nearly 370,000 people died of coronary artery disease in the United States. In addition, elderly people are more prone to heart disorders. The growing population of geriatrics, therefore, supports the development of the segment.

Fractional flow reserve (FFR) is an invasive method for managing coronary artery disease. This method has proven to be a very useful addition to the toolbox of a doctor, resulting in better patient outcomes and reducing healthcare costs. Despite heart stents being overused in the healthcare industry, a debate has surrounded the fact that while evaluating stents the doctors are being more selective.

In contrast, there has been a slight decrease in stenting cases with the introduction of new treatments in the industry. These developments have increased the use of FFR technology to help clinicians assess the need for stents among each patient. The ability to distinguish between lesions that can cause myocardial ischemia and physiologically insignificant lesions are one of the major challenges faced by cardiologists. Here, FFR tests help to avoid excessive placements of the cardiac stent and further reduce the risk of myocardial ischemia or infarction.

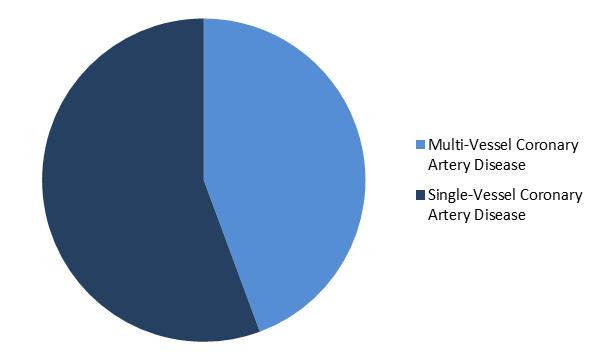

Global Fractional Flow Reserve Market Share

In 2018, single-vessel coronary artery disease (CAD) dominated the market for fractional flow reserves. This dominance can be associated with the wide use of the system in CAD, combined with the rise in the geriatric population. In addition, increasing partnerships between key players to improve market penetration, such as GE Healthcare and Medis collaboration in 2017, the overall market position is set to grow.

Free Valuable Insights: Global Fractional Flow Reserve Market to reach a market size of $1,035.4 million by 2025

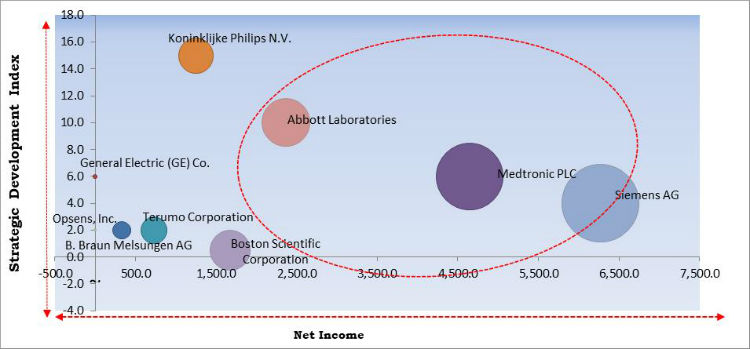

Fractional Flow Reserve Market Cardinal Matrix

The major strategies followed by the market participants are Product launches and Partnerships & Collaborations. Based on the Analysis presented in the Cardinal matrix, Siemens AG, Medtronic PLC, Abbott Laboratories are some of the forerunners in the Fractional Flow Reserve Market.

Companies such as Koninklijke Philips N.V., General Electric (GE) Co., Terumo Corporation, Boston Scientific Corporation, Opsens, Inc., B. Braun Melsungen AG, and Bracco S.p.A. are some of the key innovators in Fractional Flow Reserve Market.

Based on Product, the market is segmented into FFR guidewires and FFR Monitoring Systems. Based on Application, the market is segmented into Multi-Vessel Coronary Artery Disease and Single-Vessel Coronary Artery Disease. The report also covers geographical segmentation of Fractional Flow Reserve market. The geographies included in the report are North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. For the better analysis, the geographies are segmented into countries.

Key companies profiled in the report include Medtronic PLC, Terumo Corporation, B. Braun Melsungen AG, General Electric (GE) Co, Siemens AG (Siemens Healthineers), Koninklijke Philips N.V., Boston Scientific Corporation, Abbott Laboratories, Bracco S.p.A. and Opsens, Inc.

» Collaborations, Partnerships and Agreements:

» Acquisition and Mergers:

» Product Launches:

Market Segmentation:

By Product

By Application

By Geography

Companies Profiled

The global Fractional Flow Reserve market size is expected to reach $1,035.4 million by 2025.

The major factors that are anticipated to drive the Fractional Flow Reserve industry include FFR guided PCI improves patient outcomes, rise in geriatric population, and ffr examinations prevents unimportant cardiac stent placements.

Some of the key industry players are Medtronic PLC, Terumo Corporation, B. Braun Melsungen AG, General Electric (GE) Co, Siemens AG (Siemens Healthineers), Koninklijke Philips N.V., Boston Scientific Corporation, Abbott Laboratories, Bracco S.p.A. and Opsens, Inc.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.