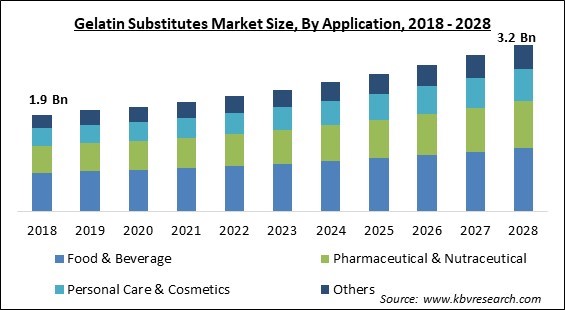

The Global Gelatin Substitutes Market size is expected to reach $3.2 billion by 2028, rising at a market growth of 6.3% CAGR during the forecast period.

Gelatin alternatives as a better option are rapidly replacing gelatin products made from non-plant sources. Gelatin is traditionally made by boiling animal bones and tissues until they solidify into a gel-like consistency. As a result, the presence of gelatin in many products that appear to be vegetarian renders them non-vegetarian.

Examples are gel capsules, marshmallows, yogurt, candy, and desserts. As a result, many companies discovered gelatin substitutes as preferable alternatives to use in their products as the number of vegan and vegetarian consumers increases globally. Some of the most common gelatin substitutes available presently in the market are agar-agar, corn starch, pectin, guar gum, xanthan gum, and modified starch. Agar-agar is one of the most common natural alternatives to gelatin.

When marketed in containers cleaned and dried in strips or powder form, it is white and translucent. It can be utilized to create custards, puddings, and jellies. Agar-agar can act as a gastrointestinal regulator because it contains about 80% dietary fiber. Its bulking properties have been the driving force behind popular diets in many regions, particularly in the Asia Pacific, such as the kanten diet. Agar triples in size after consumption and takes up water, and the consumers experience a fuller stomach as a result.

Additionally, a naturally occurring linear sulfated polysaccharide known as carrageenan is extracted from edible red seaweeds. Carrageenan is frequently employed in the food business due to its ability to stabilize, thicken, and gel. Due to their high affinity to dietary proteins, their primary use is in meat and dairy products. In addition, due to their resemblance to natural glycosaminoglycans (GAGs), carrageenan has recently become an attractive choice in regenerative medicine applications and tissue engineering.

They have primarily been utilized for medicine delivery, tissue engineering, and covering wounds. Chondrus crispus (Irish moss), a dark red plant that grows over rock structures, is the most well-known and significant red seaweed utilized to produce hydrophilic colloids to manufacture carrageenan. Presently, its use in place of gelatin to create vegetarian and vegan products is increasing rapidly.

The gelatin substitutes market was moderately impacted by COVID-19. Trade restrictions and lockdowns enforced by many governments around the world caused the production of gelatin substitutes to stop. Due to the shortage of raw materials and the resulting supply chain disruption, output as a whole was significantly impacted. When examining the food supply chain, it has been seen that COVID-19 had a negative impact on every step of the process, from the field to the customer. The spending power of consumers fell dramatically as a result of job losses and business closures, particularly in low- and middle-income countries. The food markets collapsed as a result of supply shortages and demand shocks.

Due to the desire of many customers to modify their lifestyles significantly, especially with regard to their eating habits by switching to plant-based food & beverage items, plant-based food constituents are in high demand. The rising body of data on the health benefits of plant-based diets, which is being promoted by public health organizations all over the world, is one of the driving forces behind such a significant dietary change. In addition, perceptions of the harmful impacts of animal-based meals on both environment and health, as well as growing knowledge regarding animal welfare, are driving the demand for plant-based components. As a result, it is projected that the use of plant-based and organic food ingredients will positively impact plant-based gelatin substitutes.

The industry for confectionery and bakery products is developing as a result of rising customer demand for convenient foods and their desire for appealing and tasty treats. Their low cost, ease of accessibility, and nutrition are the key factors determining their survival in the modern market. As a result, many individuals consider bakery goods to be essential. Due to this, demand for a wide range of baking ingredients that are used to make bread goods with a rich flavor and texture has surged. The population of lower- and middle-income groups is also predicted to rise dramatically throughout developing countries, which will enhance demand for bakery and confectionery products.

Pectin is present in most plants and is primarily found in fruits like apples and Plums as well as citrus fruit's peels & pulp. Since the natural form of pectin is indigestible to humans, most products available in the market use modified citrus pectin (MCP), a different variety of pectin which has the ability to be digested. This component is known to decrease the body's absorption capacity for a vital nutrient, beta-carotene. Pectin can also hinder the body's capacity to absorb several medications, such as digoxin (a cardiac medicine), lovastatin (a cholesterol-lowering prescription), and tetracycline antibiotics. As a result, these gelatin substitutes attract some negative reviews from customers, which lowers their usage and hamper the market's growth.

Based on product, the gelatin substitutes market is categorized into agar-agar, pectin, cornstarch, guar gum, carrageenan, xanthan gum, and others. The corn starch segment acquired a promising growth rate in the gelatin substitutes market in 2021. Steeping, wet milling, drying, grinding, and purifying, are the steps used to extract corn starch from the grain. Corn starch is a common food preparation ingredient across the world. The packaged and processed food sectors also frequently employ it. Corn starch enhances a range of food products' viscosity, texture, and other crucial qualities, including frozen and canned extruded snacks, microwaveable foods, and dry mixes.

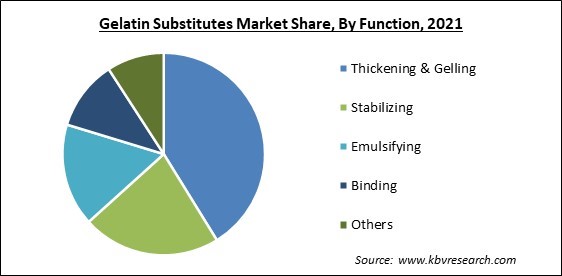

On the basis of function, the gelatin substitutes market is divided into thickening & gelling, stabilizing, emulsifying, binding, and others. The thickening and gelling segment witnessed the largest revenue share in the gelatin substitutes market in 2021. The use of these products in a variety of food and beverage applications as a thickening & gelling ingredient is the primary factor propelling the growth of the segment. They are employed as gelling agents in jam, jelly, marmalade, low-calorie/sugar gels, and restructured meals. In addition, as thickening agents, these are used in gravies, soups, salad dressings, sauces, and toppings.

Based on application, the gelatin substitutes market is segmented into food & beverage, pharmaceutical & nutraceutical, personal care & cosmetics, and others. The pharmaceutical and nutraceutical segment recorded a substantial revenue share in the gelatin substitutes market in 2021. When making tablets, emulsions, syrups, and capsules, gelatin substitutes are utilized for thermos-reversible binding, gelling, and adhesives. In addition, during the COVID-19 outbreak, there was a substantial increase in demand for immunity-boosting supplements, which is likely to persist in the years to come.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 2.1 Billion |

| Market size forecast in 2028 | USD 3.2 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 6.3% from 2022 to 2028 |

| Number of Pages | 225 |

| Number of Tables | 420 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Product, Application, Function, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

On the basis of region, the gelatin substitutes market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Europe region witnessed the largest revenue share in the gelatin substitutes market in 2021. This is due to the product's rising demand across a range of end-use industries, such as personal care and cosmetics, food & beverage, pharmaceutical & nutraceutical. In the UK, gelatin substitutes are frequently used to create low-calorie treats and non-starchy bread. Agar also gained popularity and is regarded as one of the safest hydrocolloids. In addition, the European Food Safety Authority (EFSA) has also given it the status of a safe food additive. These elements are anticipated to support regional expansion.

Free Valuable Insights: Global Gelatin Substitutes Market size to reach USD 3.2 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include NOW Foods, Inc., Cargill, Incorporated, Gelita AG, B&V S.r.l, Agarmex, S.A. DE C.V., Java Biocolloid (Hakiki Group), Great American Spice Company, Special Ingredients Ltd, Brova Limited, and A.F. Suter and Co. Ltd.

By Product

By Application

By Function

By Geography

The global Gelatin Substitutes Market size is expected to reach $3.2 billion by 2028.

Increasing demand for plant-based ingredients for meal preparation are driving the market in coming years, however, Speculations regarding the side effects of some gelatin substitutes restraints the growth of the market.

NOW Foods, Inc., Cargill, Incorporated, Gelita AG, B&V S.r.l, Agarmex, S.A. DE C.V., Java Biocolloid (Hakiki Group), Great American Spice Company, Special Ingredients Ltd, Brova Limited, and A.F. Suter and Co. Ltd.

The expected CAGR of the Gelatin Substitutes Market is 6.3% from 2022 to 2028.

The Food & Beverage segment acquired maximum revenue share in the Global Gelatin Substitutes Market by Application in 2021 thereby, achieving a market value of $1.2 billion by 2028.

The North America market dominated the Global Gelatin Substitutes Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $1.1 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.